How To Put My House In A Trust (step-by-step Guide)

Let's dive into a topic that might sound a little… formal, but trust us, it’s actually super empowering and can even feel like a clever game of financial strategy! We're talking about putting your house into a trust. Now, before you picture dusty legal jargon and intimidating paperwork, think of it as giving your home a superhero cape, ready to protect it and make its future journey a whole lot smoother. It’s becoming incredibly popular because it offers peace of mind and a smart way to manage your most valuable asset, especially when thinking about your loved ones or the inevitable passage of time.

So, what exactly is this "trust" thing, and why would you want your precious house to be part of it? At its heart, a trust is like a special box where you put your assets (in this case, your home) to be managed by a designated person, called a trustee, for the benefit of specific people, known as beneficiaries. Think of yourself as the architect of this plan, deciding who gets what and when, all while you're still around to oversee things. It's a way to say, "Hey future me, and hey loved ones, here's a clear and organized path for my house!"

The benefits are pretty compelling. One of the biggest reasons people do this is to avoid probate. Probate is the court-supervised process of distributing a deceased person's assets. It can be lengthy, expensive, and quite public. When your house is in a trust, it typically bypasses probate altogether, meaning your beneficiaries can get access to it much faster and without those hefty court fees. Imagine your kids inheriting your home without the added stress of legal battles!

Another fantastic perk is privacy. Unlike wills, which become public record during probate, a trust is generally a private document. This means your financial affairs and who inherits your home remain confidential, away from prying eyes. It’s like keeping your family’s legacy a special secret.

Furthermore, trusts offer significant control. You can set specific conditions for how and when your beneficiaries receive the house, or proceeds from its sale. For example, you might want your children to inherit the house only after they reach a certain age, or you could stipulate that it must be sold and the money used for their education. This level of foresight is invaluable.

It can also be a great tool for asset protection. Depending on the type of trust you establish, it can offer a shield against creditors or potential lawsuits, protecting your home from being seized. This is especially relevant if you own a business or have other significant assets.

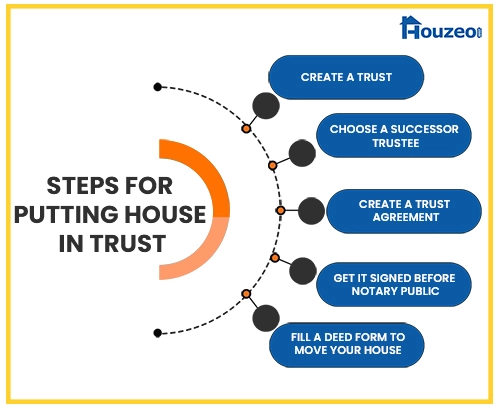

Ready to embark on this journey? Here's a step-by-step guide to help you navigate putting your house in a trust:

Step 1: Dream Big (and Get Informed!)

Before you even think about paperwork, the first step is to understand your options. There are different types of trusts, each with its own purpose. The most common for this scenario are a revocable living trust and an irrevocable trust. A revocable trust is flexible – you can change or cancel it anytime. An irrevocable trust is more permanent. Chatting with a qualified estate planning attorney is crucial here. They’ll help you understand which type best suits your goals, whether it's for avoiding probate, protecting assets, or simply making things easier for your heirs.

Step 2: Choose Your Trustee Wisely

The trustee is the rock of your trust, responsible for managing the assets according to your instructions. This could be yourself (while you're alive and well), a trusted family member, a friend, or even a professional trustee company. Think about who is responsible, organized, and trustworthy enough to handle such an important role. If you choose yourself as the initial trustee of a revocable trust, you'll also need to designate a successor trustee who will step in when you're no longer able to manage things.

Step 3: Draft the Trust Document

This is where the legal magic happens. Your attorney will draft the trust document, outlining all the specifics: who the beneficiaries are, how the house is to be managed and distributed, and who the trustee and successor trustees will be. This document is the blueprint for your entire plan, so ensure you and your attorney review it thoroughly to make sure it perfectly reflects your wishes.

Step 4: Fund the Trust (The Big Move!)

This is the exciting part – actually moving your house into the trust! This process is called funding the trust. It involves preparing and recording a new deed, typically a Quitclaim Deed or a Warranty Deed, that transfers ownership of your home from your name(s) to the name of the trust. For example, if your trust is named "The Smith Family Trust," the deed will transfer ownership from "John and Jane Smith" to "The Smith Family Trust." Your attorney will handle this crucial step, ensuring all legal requirements are met. This is what officially makes your house a trust asset.

Step 5: Update Beneficiary Designations

While your house is now in the trust, it's also a good idea to review any other accounts or assets that have beneficiary designations, such as life insurance policies or retirement accounts. Ensure these align with your overall estate plan. Sometimes, the trust itself can be named as the beneficiary for these accounts.

Putting your house in a trust is a proactive and incredibly smart move. It's an act of love and foresight, ensuring your home is managed and distributed according to your wishes, with minimal fuss for your loved ones.

And there you have it! By following these steps, you can successfully put your house in a trust, gaining peace of mind and a streamlined approach to your estate. It’s a powerful way to protect your legacy and ensure your home continues to be a source of comfort and security for generations to come.