How To Protect Your Assets From Divorce

Let's talk about your treasures. We're not just talking about gold bars and diamond necklaces, though those are certainly shiny. We're talking about the things that make your heart sing, the stuff that tells your story. Think of your prized comic collection, that ridiculously comfortable armchair your dog adores, or even your secret stash of gourmet chocolate. These are the everyday heroes of your life, and it's smart to give them a little hug of protection, especially when life throws a curveball like a divorce.

Now, divorce can sound like a stormy sea, and sometimes it feels like the waves are going to crash over everything you hold dear. But just like a good sailor knows how to navigate the roughest waters, you can learn to steer your belongings safely to shore. It’s all about being a little bit prepared and a little bit clever, not about being a grumpy pirate hoarding his loot.

Imagine your stuff as a quirky cast of characters in a play. You've got the dependable old family heirloom, the slightly silly but beloved quirky lamp you found at a flea market, and maybe even that slightly embarrassing but hilarious karaoke machine from your college days. Each item has a story, and you want to make sure those stories continue, unmarred by any dramatic legal reenactments.

One of the best ways to start this treasure-guarding adventure is by getting to know your own hoard. What exactly do you have? It sounds obvious, but sometimes we forget about the little things. That vintage record player? That collection of first edition books? They’re all part of your unique tapestry.

So, grab a cup of your favorite tea (or coffee, we don't judge!), and let's make a list. It doesn't have to be fancy, a simple notebook will do. Think of it as your personal inventory of awesomeness. This is where you can really have some fun, reminiscing about how you acquired each special item.

Did you snag that amazing retro video game console at a yard sale for a steal? Or maybe that handmade quilt was a gift from your grandma that warms your heart as much as it does your bed. Jot down the details, the stories, the memories. This isn't just a list; it's a love letter to your possessions.

Now, for the slightly more serious, but still important part: understanding what belongs to whom. Sometimes, during a marriage, things get a little blended. Think of it like a potluck dinner where everyone brings their best dish. It's all delicious, but sometimes it’s hard to remember who brought what.

This is where the concept of "separate property" comes in. It sounds a bit formal, but it’s really just about things that were yours before you got married, or gifts and inheritances that were specifically for you. Your childhood teddy bear, for instance, probably predates your relationship and is firmly in the "you're stuck with it" category. Even if your partner secretly loved cuddling with it, it's still yours.

Consider that vintage motorcycle you’ve been lovingly restoring. If you bought it with your own savings before you said "I do," it’s likely to be considered your separate property. It's a testament to your passion and your pre-marital prowess. Similarly, if your Aunt Mildred left you a hefty sum in her will that you used to buy that impressive art collection, that's probably yours to keep.

What about things acquired during the marriage? This is where things can get a bit more like a friendly tug-of-war, but with rules. These are often considered "marital property," and in the eyes of the law, they’re like a shared prize that needs to be divided fairly. Think of that fantastic home theater system you both picked out together. You probably both have a claim to enjoying those movie nights.

But here’s a fun twist: sometimes, even if something was bought during the marriage, it can still be kept separate if you can prove it was purchased with funds that were also separate. It's like having a special piggy bank for your own personal treats. If you had a separate account from before the marriage and used those funds to buy something, it might just stay yours.

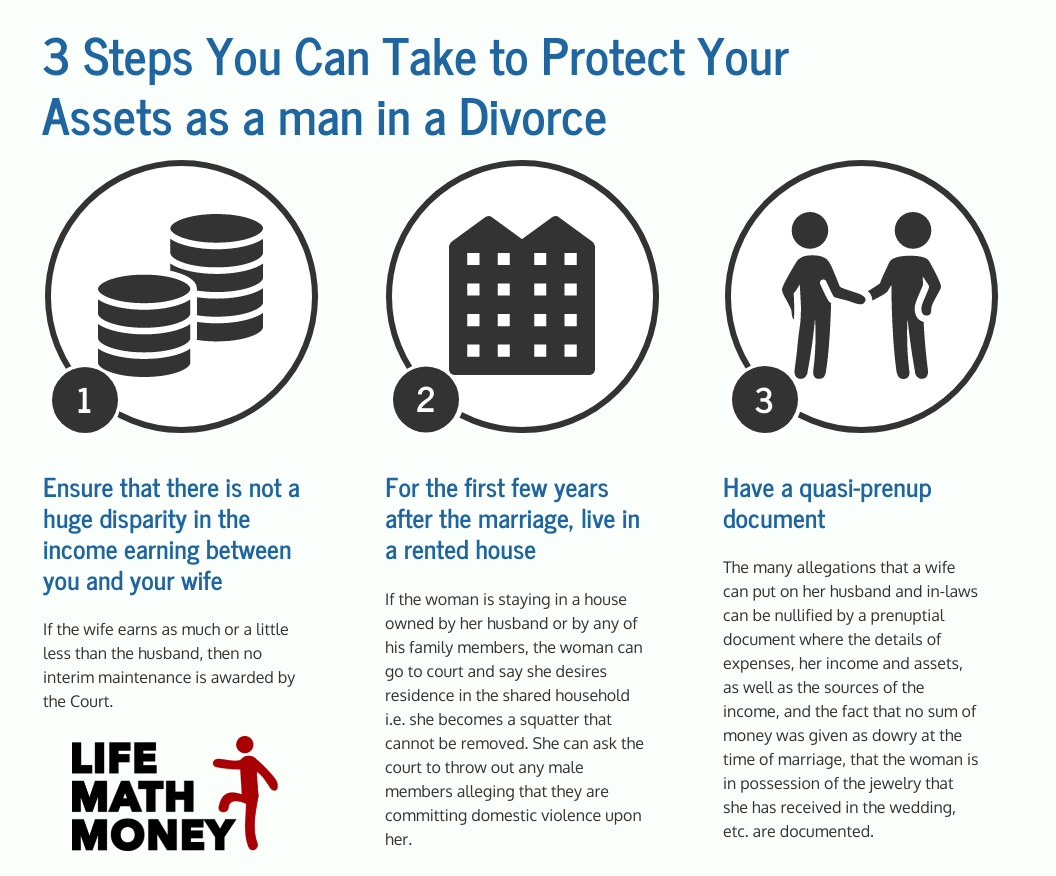

The Power of the Prenup (Yes, Really!)

Now, I know what you're thinking. Prenuptial agreements? That sounds about as romantic as a root canal. But hear me out! Think of a prenup not as a sign of distrust, but as a clear roadmap for your financial journey together. It’s like having a detailed instruction manual for your shared life, just in case.

A prenup can outline how your assets would be divided if, heaven forbid, your marriage were to end. It’s a way to have those sometimes-awkward conversations about money and possessions before you're in the middle of a storm. It can protect your individual treasures, your family legacies, and even your future earnings.

Imagine sitting down with a cup of that delicious gourmet chocolate we mentioned, and calmly discussing who gets to keep the rare wine collection. It’s much more pleasant than arguing about it later when emotions are running high. A prenup allows you to be proactive and set clear expectations. It's about respecting each other's financial independence and setting clear boundaries, even when you're madly in love.

And it's not just for the super-rich! Even if you're not a millionaire, a prenup can be incredibly useful. It can protect a family business, a valuable piece of art, or even intellectual property. It's a way to ensure that your personal endeavors are safe, no matter what happens down the road.

The Gift of Documentation

Let's talk about evidence. Not in a courtroom drama kind of way, but in a "happily ever after, but just in case" kind of way. Having good records is like having a superhero sidekick for your assets. It’s the unsung hero of financial peace of mind.

Think of all those receipts for that amazing vintage car parts collection. Or the appraisals for your grandmother's exquisite antique jewelry. These documents are your proof. They whisper, "This is mine, and here's why!"

Keep copies of bank statements, property deeds, investment account statements, and anything that shows ownership or value of your assets. Digital copies are great too, stored securely in the cloud. It’s like building a fortress around your financial life, one document at a time.

And if you received a significant gift or inheritance, make sure you have the paperwork to prove it. A thank-you note from the giver along with the documentation can be incredibly helpful. It's a tangible reminder of your good fortune and a solid defense if questions arise later.

The Trust Factor (and How to Use It)

This might sound a little more advanced, but trusts can be incredibly powerful tools for asset protection. Don't let the word "trust" scare you; think of it as a special box where you can place your treasures for safekeeping.

You can set up a trust to hold your assets, and it can be structured in various ways to protect them from future claims, including those that might arise from a divorce. It’s like giving your valuables a VIP pass to a secure, private club. The assets are owned by the trust, not directly by you, which can offer a layer of separation.

There are different types of trusts, like revocable and irrevocable, each with its own set of rules and benefits. An irrevocable trust, for instance, is harder to change once it's set up, making it a very strong form of protection. It’s like locking away your valuables in a vault with a key you don’t have easy access to.

Consulting with an attorney who specializes in estate planning and asset protection is crucial here. They can help you understand which type of trust, if any, is right for your situation and your precious rare stamp collection. They are the wizards who can make the magic happen.

Beyond the Tangible: Protecting Your Dreams

It's not just about the physical things. What about your future? Your career? Your passions? Divorce can impact those too, and it's worth thinking about how to shield those aspects of your life.

For instance, if you're a budding entrepreneur with a brilliant business idea, consider how you can protect that venture. Maybe it's by keeping it separate from joint marital finances from the outset. Or perhaps by having a clear agreement on ownership and future involvement.

Your personal blog, that novel you're writing, your innovative app idea – these are all valuable intangible assets. While they might not be listed on a stock exchange, they represent your creativity and your potential for future income. Protecting them involves clear documentation of ownership and, sometimes, strategic legal structures.

Think of it like this: you've nurtured a beautiful garden. You've watered it, you've weeded it, and now it's starting to bloom. You want to ensure that even if the weather turns rough, your garden continues to thrive. That’s what asset protection is all about – safeguarding the fruits of your labor and the seeds of your future success.

Ultimately, protecting your assets from divorce is about being informed, being proactive, and sometimes, just being a little bit clever. It’s about ensuring that the things you love, the things that tell your unique story, continue to be a part of your life, no matter what twists and turns life may bring. So go forth, protect your treasures, and keep that dog happy in his favorite armchair!