How To Invest In S & P 500 (step-by-step Guide)

Alright, let's talk about money. Specifically, your money and how to make it do a little happy dance. We're diving into the world of the S&P 500.

Now, I know what you're thinking. "Investing? That sounds complicated!" Or maybe, "Isn't that for super rich people with fancy degrees?" Nope. Not today, friend.

My unpopular opinion? Investing in the S&P 500 is surprisingly… well, easy. And maybe even a little bit fun. Like collecting stickers, but instead of shiny cartoons, you're collecting little pieces of big companies.

So, how do you actually get your hands on these company pieces? It's simpler than deciphering your teenager's text messages. We're talking baby steps, folks. Easy peasy lemon squeezy.

Step 1: Open a Special Account

First things first, you need a place to put your investing money. Think of it like a special piggy bank, but way more sophisticated. This is called a brokerage account.

You can't just shove cash under your mattress and expect it to grow. Unless you have a very magical mattress, which I doubt. So, find a brokerage. There are tons out there.

Some are big and old, like your grandma's favorite armchair. Others are newer and slicker, like a brand-new smartphone. Do a quick search for "online stock broker."

Picking Your Brokerage Buddy

Think about what you want. Low fees? A super-easy app? Educational stuff to learn more? Most of them are pretty user-friendly these days. Seriously, if you can navigate social media, you can handle this.

Popular choices include names you've probably heard of: Fidelity, Charles Schwab, or newer players like Robinhood or Webull. They all have their quirks and perks.

Don't get bogged down in analysis paralysis. Pick one that feels right and get started. You can always switch later if you have a change of heart.

Step 2: Fund Your Account (The Money Part)

Okay, you've got your special account. Now, you need to put some money in it. This is the exciting part! You're feeding the money monster.

You can usually link your regular bank account to your brokerage. Think of it like transferring money between your checking and savings accounts, but for investing.

How much? Whatever you can afford. Seriously. It doesn't have to be a fortune. A dollar a day is still a dollar growing.

Small Amounts, Big Dreams

Don't feel pressured to deposit your life savings. Start small. Maybe $50? $100? Whatever feels comfortable and won't keep you up at night.

The beauty of investing is that it can be done with small, regular contributions. It's like planting tiny seeds and watching them grow into a mighty oak.

And hey, if you just got paid and have a little extra jingle in your pocket, that's a perfect time to top up. Treat yourself to a future-you present.

Step 3: Find That Magical S&P 500 Thingy

Now, the main event. You're looking for something that tracks the S&P 500. It’s not a single stock you buy, but a collection. Imagine a basket holding 500 of the biggest companies in America.

You're not buying all 500 individual stocks. That would be a nightmare. Instead, you buy a fund that owns them all. It’s like buying a pre-made smoothie instead of buying all the fruits and veggies separately.

These funds are typically called Index Funds or Exchange-Traded Funds (ETFs). They are designed to mirror the performance of an index, like, you guessed it, the S&P 500.

ETFs vs. Mutual Funds: Don't Overthink It

For the S&P 500, you'll likely see S&P 500 ETFs. These trade like stocks during the day. There are also S&P 500 Index Mutual Funds, which are bought and sold at the end of the trading day.

For simplicity, many people opt for ETFs. They’re usually low-cost and easy to buy. Just search for "S&P 500 ETF" on your brokerage platform.

You'll see ticker symbols like VOO, IVV, or SPY. These are the secret codes for S&P 500 ETFs. Pick one that has low fees. The lower the fees, the more money stays in your pocket.

Step 4: Hit That "Buy" Button (Don't Be Scared!)

This is it. The moment of truth. You've found your S&P 500 ETF. You've got money in your account. Time to press the button.

On your brokerage platform, you’ll search for the ETF's ticker symbol. Then, you’ll click "buy." It’s like clicking "add to cart" on your favorite online store.

You'll specify how many shares you want to buy, or how much money you want to invest. For example, you might say, "Buy $100 worth of VOO."

It's Just a Click Away

Don't let the jargon scare you. "Market order" means you buy at the current price. "Limit order" means you set a price you’re willing to pay.

For beginners, a market order is usually fine for ETFs. It’s the easiest way to get invested right away. Just double-check the amount you’re investing.

And then… you’re done! You’ve officially invested in the S&P 500. Give yourself a pat on the back. You just made your future self happy.

Step 5: Hold On Tight (And Maybe Add More!)

This is where patience comes in. Investing isn't a get-rich-quick scheme. It's more like a slow-cooker meal. You let it simmer and it gets better over time.

The stock market goes up and down. It’s like a roller coaster. Some days are thrilling, some are a bit scary. That's normal.

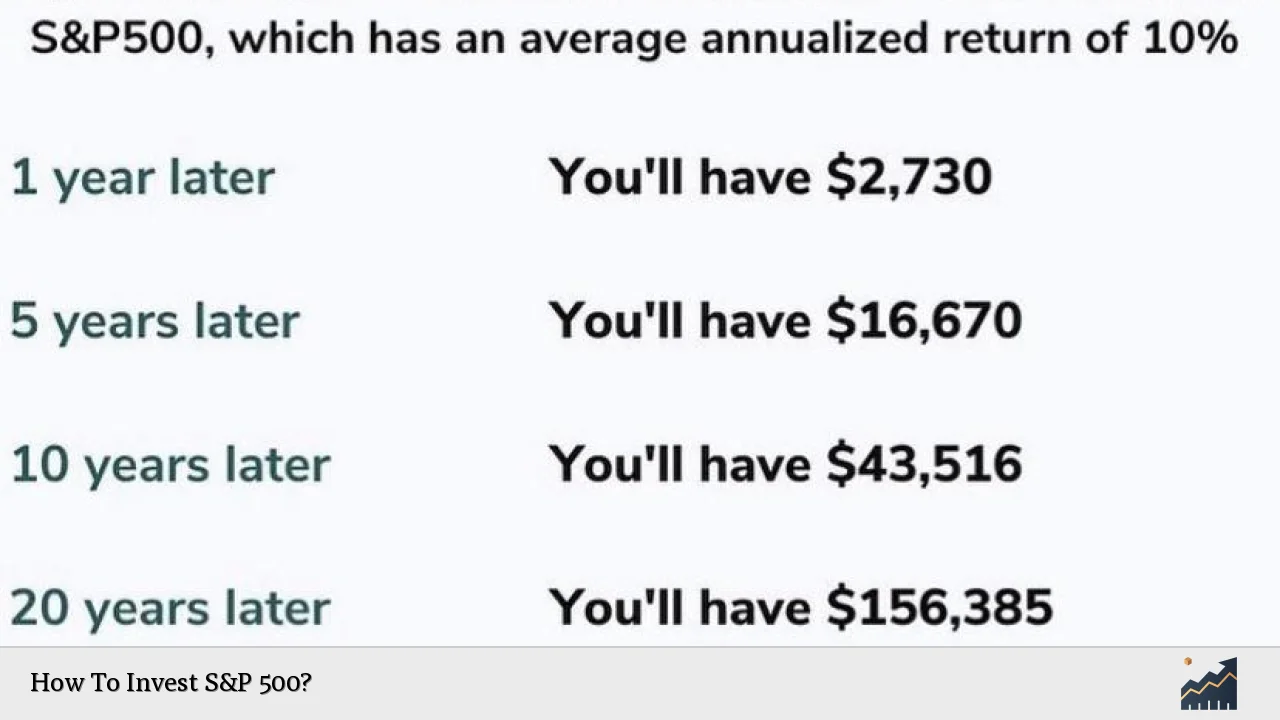

The S&P 500 has a history of growing over the long term. Think years, not days or weeks. So, resist the urge to panic sell when things get a little bumpy.

The Magic of Time and Consistency

The best thing you can do is keep adding money regularly. This is called dollar-cost averaging. You buy more shares when prices are low and fewer when prices are high.

It's a smart way to smooth out your investment returns. Plus, it makes investing a habit. Like brushing your teeth, but for your wealth.

So, there you have it. Open an account, add some cash, find an S&P 500 ETF, buy it, and hold on. You've just dipped your toes into the investing pool. Welcome!