How To Have Money Work For You (step-by-step Guide)

Hey there! Ever feel like money just… disappears? Like you earn it, spend it, and then poof it's gone, leaving you wondering where it all went? Yeah, most of us have been there. It's like having a magic money tree that only drops leaves, never actual fruit. But what if I told you there's a way to make your money do the heavy lifting for you? Like, instead of just sitting there, it actually goes out and works to make more money? Sounds pretty cool, right? Let's dive into how you can get your money to join the team and start working for you.

So, What Does It Mean to Have Money Work For You?

Think of it like this: you hire a bunch of tiny, super-efficient employees. These employees are your money, and their job is to go out there, find opportunities, and bring back more money. It’s not about working harder, it's about working smarter. It’s about setting up systems so that your money can grow all on its own, even when you’re binge-watching your favorite show or sleeping. Pretty sweet deal, huh?

This isn't some get-rich-quick scheme, mind you. It's more like planting a garden. You put in a little effort upfront, tend to it, and then watch it grow over time. The results are usually much more sustainable and way more satisfying.

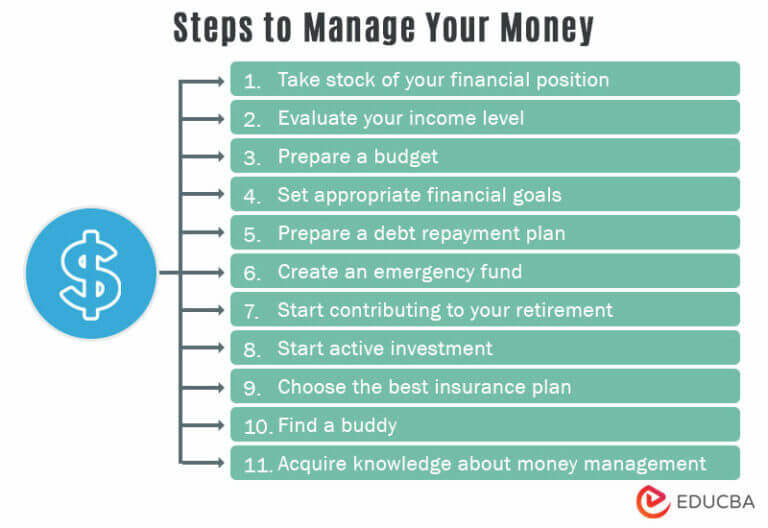

Step 1: Get Your Financial House in Order (The Foundation!)

Before we can get our money working, we gotta make sure it’s not running away on us. This means understanding where your money is going. You know, those little sneaky expenses that add up? Like that daily fancy coffee or that streaming service you never use?

Track your spending. Seriously. Grab an app, a spreadsheet, or even a trusty old notebook. For a month, just write down everything you spend money on. It’s a little tedious, but trust me, the insights are wild. You’ll probably be surprised at what you find. It’s like looking in the mirror for your finances.

Next up: make a budget. This isn't about restriction; it's about direction. A budget is your roadmap. It tells your money where to go, instead of you wondering where it went. Allocate money for essentials, for fun, and, most importantly, for saving and investing.

And hey, if you have any debt, especially high-interest debt like credit cards, that’s your money’s biggest saboteur! It's like a leaky bucket; you're pouring money in, but it's draining out super fast. Tackle that debt head-on. It’s one of the most powerful ways to free up your money to actually work for you.

Step 2: Build an Emergency Fund (Your Financial Safety Net)

Life happens, right? Your car breaks down, you have an unexpected medical bill, or maybe you just need a little breathing room. That’s where your emergency fund comes in. Think of it as your financial superhero cape, ready to swoop in when things get a bit wild.

Aim to save about 3 to 6 months of your living expenses. This fund should be easily accessible, like in a separate savings account. It’s not for investing; it’s for emergencies only. This way, you won't have to dip into your investments or go into debt when the unexpected pops up. It’s the peace of mind money.

Step 3: Start Investing (Letting Your Money Get to Work!)

Okay, this is where the magic really starts. Investing is essentially putting your money into assets that have the potential to grow in value over time. It’s like planting seeds and watching them turn into a thriving garden.

Don't get intimidated! Investing doesn't have to be complicated. You don't need a fancy finance degree or a massive amount of money to get started.

What Can You Invest In?

There are tons of options, but let's keep it simple for now. Two of the most common and accessible ways are:

- Stocks: When you buy stock, you're buying a tiny piece of ownership in a company. If the company does well, the value of your stock can go up. It's like owning a sliver of a successful business.

- Bonds: Think of bonds as a loan you give to a government or a corporation. They pay you back with interest over time. They're generally considered a bit less risky than stocks.

For beginners, often the easiest way to start is through index funds or ETFs (Exchange Traded Funds). These are like baskets that hold a variety of stocks or bonds, giving you instant diversification. It’s like buying a pre-made healthy meal instead of trying to source all the ingredients yourself.

Robo-advisors are also super popular. They use algorithms to build and manage a diversified portfolio for you based on your goals and risk tolerance. It's like having a very patient, data-driven friend managing your money.

Step 4: Automate Your Savings and Investments (Set It and Forget It!)

This is a game-changer. Seriously. Once you've figured out your budget and decided how much you want to save and invest, set up automatic transfers from your checking account to your savings and investment accounts. Do this right after you get paid.

This way, your money is saved and invested before you even have a chance to spend it. It's like giving your money a head start on its workday. You won’t even miss it, and your future self will thank you profusely.

Think of it as pre-paying for your future happiness. Why wait for future-you to be happy when you can start building that happiness today?

Step 5: Be Patient and Stay Consistent (The Long Game)

This is where that garden analogy really shines. You don't plant a seed and expect a full-grown tree the next day, right? Investing is a marathon, not a sprint.

The power of compound interest is your best friend here. It's when your earnings start earning their own earnings. It's like a snowball rolling down a hill, getting bigger and bigger with every turn. The longer your money is invested, the more time compound interest has to work its magic.

Don't get discouraged by market ups and downs. The stock market will go up and down; that’s just its nature. Stay the course. Resist the urge to panic sell when things look shaky. Historically, the market has always recovered and gone on to new heights.

Regularly revisiting your budget and investment strategy is a good idea, maybe once a year or so, just to make sure you're still on track. But for the most part, consistency and patience are key.

Step 6: Keep Learning and Growing (Your Money's Education!)

The world of finance can seem a bit daunting, but it doesn't have to be. The more you learn, the more comfortable you'll become with making your money work for you.

Read books, listen to podcasts, follow reputable financial blogs. Educate yourself about different investment options, financial planning, and tax strategies. It’s like giving your money a continuous education, so it’s always learning new ways to earn.

And as your income grows, and your confidence builds, you can explore more advanced strategies. But start simple, and build from there. The goal is to create a financial system that supports your life and helps you reach your goals, whatever they may be.

So, there you have it! Making your money work for you isn't about having a ton of cash to begin with; it's about making smart choices and letting time and consistency do the heavy lifting. It's about turning your money from a passive observer into an active participant in building your future. Pretty neat, huh?