How To Get A Vat Number Uk (step-by-step Guide)

Hey there, you savvy entrepreneur! So, you're ready to take your business to the next level and get yourself a VAT number here in the UK, eh? Awesome! It might sound a bit daunting, like wrestling a badger in a suit, but honestly, it's more like following a really clear recipe. And guess what? This recipe is going to be super easy and, dare I say, even a little bit fun!

Let's ditch the jargon and get down to brass tacks. Think of a VAT number as your business's official badge of honour for dealing with Value Added Tax. It's basically a unique identifier that HMRC (Her Majesty's Revenue and Customs – the folks who keep the country running, and also the ones you'll be dealing with for this) uses to track your VAT activities.

So, why would you even want one? Well, if your business's taxable turnover (that's the money you make from selling things and services that are subject to VAT) goes over a certain threshold – which is currently £90,000 per year as of April 2024 – you have to register for VAT. It's the law, and we don't want to be on the wrong side of the law, do we? Besides, even if you're not quite at that magic number yet, registering voluntarily can sometimes be a good move. More on that later, perhaps!

So, You Think You Might Need One? Let's Figure It Out!

First things first, let's have a little chat about that magical number: £90,000. Keep a running tally of all the sales you make that aren't VAT exempt. If that total creeps over £90,000 in any rolling 12-month period, then ding ding ding! It's time to register.

Now, this isn't just a "once a year" check-in. It's a rolling 12 months. So, if at the end of January you're thinking "Hmm, my turnover for February last year up to this January was X," and then at the end of February you're thinking "Okay, now my turnover from March last year up to this February is Y," and Y is over £90,000, you've hit the mark. It’s like a sneaky treadmill, always moving!

What if you’re just starting out and you know you’ll hit that threshold pretty quickly? You can actually register in anticipation. You just need to be able to show HMRC that you’re going to go over the limit. It’s like telling your parents you’re going to get a gold star before you even sit the exam – you’ve got to have faith (and a solid business plan!).

There are also some specific types of businesses or situations where you might need to register regardless of your turnover. For example, if you're selling goods from overseas into the UK, or if you're in certain industries. But for most of us just getting our little businesses off the ground, the turnover threshold is the main thing to keep an eye on.

The Voluntary Shuffle: To Register or Not to Register?

Okay, so your turnover is under £90,000. Does that mean you should just forget all about VAT? Not necessarily! Sometimes, it’s actually a smart move to register for VAT voluntarily. Why, you ask?

Well, think about it: when you're VAT registered, you can reclaim the VAT you've paid on most of your business expenses. So, if you’re buying supplies, equipment, or paying for services, and the VAT on those things adds up, you can claim it back from HMRC. This can be a nice little cash injection for your business.

This is especially useful if you sell a lot of things to other VAT-registered businesses. They can also reclaim the VAT you charge them, so it doesn't really cost them more. But if you sell mainly to the general public (who can't reclaim VAT), then charging VAT might make your prices less competitive. It's a bit of a strategic decision, like choosing the right emoji for a crucial text message.

So, weigh it up! If the VAT you pay on your expenses is likely to be more than the VAT you collect from your sales, voluntary registration could be a winner. If it’s the other way around, or if your customers will balk at paying more, maybe hold off.

Step-by-Step: Let's Get This VAT Number!

Right, you've decided you need to register, or you're going to do it voluntarily. Hooray for proactive business ownership! Now, let's break down the actual process. It's surprisingly straightforward.

Step 1: Gather Your Business Intel

Before you even think about clicking anything, have your ducks in a row. HMRC loves a bit of organised information. You'll need things like:

- Your Unique Taxpayer Reference (UTR). This is the 10-digit number you get when you register for Self Assessment. If you haven't done that yet, you'll need to do that first. It’s like getting your passport before your holiday!

- Your business name and address. Obvious, I know, but double-check it's all correct.

- Details about your business structure (sole trader, partnership, limited company, etc.).

- Your estimated taxable turnover for the next 12 months. Be realistic here!

- Details of any VAT you've already paid on purchases if you're registering late or have specific circumstances.

Having all this ready will make the online form a breeze. You don’t want to be fumbling around for your UTR while a spinning wheel of doom taunts you.

Step 2: Head Over to the HMRC Website

This is where the magic happens, folks! Go to the official GOV.UK website. Seriously, make sure it's GOV.UK. You don't want to end up on a dodgy site promising you a VAT number for a fiver and a pack of slightly-used biscuits.

Search for "register for VAT" or navigate to the business section. You'll be looking for the online registration service. It's usually pretty easy to find. Think of it as finding the hidden treasure chest on a pirate map.

Step 3: Fill Out the Online Application Form

This is the main event! The form is pretty comprehensive, but it guides you through it. You’ll be asked questions about your business, your turnover projections, and your reasons for registering.

Important Tip: Be honest and accurate with your information. HMRC has ways of finding out if you're fibbing, and nobody wants a stern letter from them. It's like telling your boss you're sick when you're actually at the beach – you might get away with it for a bit, but eventually, the truth will out!

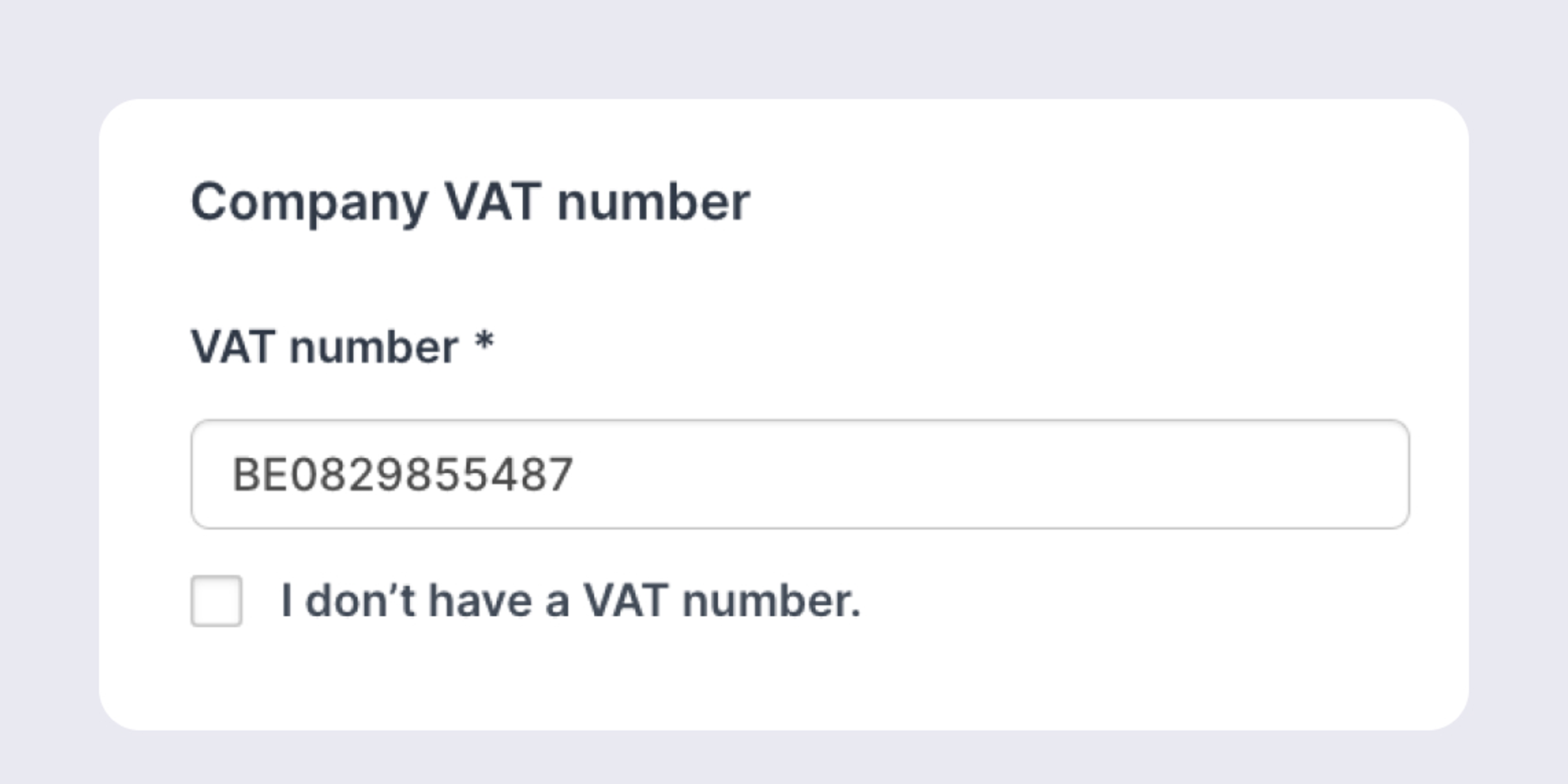

You'll need to create a Government Gateway user ID and password if you don't already have one. This is your digital key to the HMRC kingdom. Keep it safe!

The form will ask you about your business activities. Be as specific as possible. If you sell artisanal cheese and also offer cheese-tasting workshops, mention both! The more detail, the better.

You'll also be asked about your estimated turnover for the next 12 months. This is crucial. If you’re registering because you've gone over the threshold, you'll need to state when that happened. If you’re registering voluntarily, you’ll be projecting your future turnover.

Don't rush through this part. Take your time, read the questions carefully, and if you're unsure about anything, there's usually a "help" button or a link to more information.

Step 4: Submit Your Application and Wait (Patiently!)

Once you've filled everything in and double-checked it all, hit that submit button! You'll usually get a confirmation message on screen, and you should also receive an email.

Now comes the waiting game. HMRC will review your application. This can take a few weeks. Try not to refresh your inbox every five minutes, although I know it's tempting! Think of it as waiting for a pizza to arrive – it's always the longest wait, but oh so worth it.

If they need more information, they'll contact you. So, keep an eye on your email (and your spam folder, just in case!).

Step 5: You've Got Your VAT Number! (Hooray!)

Eventually, you'll receive a letter (yes, a real, physical letter – how retro!) from HMRC confirming your VAT registration. This letter will contain your 9-digit VAT number. Keep this safe, as you'll need it for all your VAT-related business.

Congratulations! You've officially joined the VAT club. You're now one step closer to looking like a fully-fledged, serious business entity. Time to pop some bubbly (or a cuppa tea, whatever floats your boat)!

What Happens Next? Don't Panic!

So, you've got the number. What now? Well, you'll need to start keeping proper VAT records. This includes all your sales invoices and purchase invoices. You'll need to declare your VAT to HMRC periodically.

The most common VAT scheme is the standard VAT accounting scheme. With this, you calculate the VAT you owe on your sales and subtract the VAT you can reclaim on your purchases. The difference is what you pay to HMRC.

You’ll usually need to submit a VAT return and pay any VAT due every three months (quarterly). The deadlines are usually set, so mark them in your calendar like you would a dentist appointment.

There are other VAT schemes available, like the Flat Rate Scheme, which can simplify things for smaller businesses. It’s worth looking into these to see if they’re a good fit for you. It's like choosing between a simple side salad or a full three-course meal – both are food, but one is more involved!

Don't be afraid to ask for help! If all this sounds a bit much, there are plenty of accountants and bookkeepers who specialise in VAT. They can help you with your registration and ongoing VAT returns. It might cost a little, but it can save you a lot of headaches (and potential fines!).

A Little Word on Late Registration Penalties

Okay, deep breaths. We’ve covered getting your number. But what if you’ve missed the boat and are supposed to be VAT registered but aren't? HMRC can charge you penalties for late registration. This is based on how much VAT you owe and how late you are.

So, if you realise you've gone over the threshold and haven't registered, it's best to do it as soon as possible. Contacting HMRC and explaining the situation might help mitigate any penalties. Honesty is, as they say, the best policy.

And So, You've Conquered VAT Registration!

There you have it! Getting your VAT number in the UK is totally achievable, and hopefully, this guide has made it feel like less of a mountain and more of a gentle hill. You’ve navigated the online forms, gathered your business intel, and are now ready to play in the bigger leagues of business.

Remember, this is a positive step. It shows your business is growing, thriving, and ready for whatever comes next. You've got this! So go forth, conquer your VAT obligations, and keep building that amazing business of yours. And when it all feels a bit much, just picture yourself holding that official VAT certificate with pride. You earned it!