How To Freeze Your Transunion Credit Report

Ever felt like your personal information might be a little too accessible in this vast digital landscape? You’re not alone! It’s a common thought, and thankfully, there are some pretty neat ways to gain a bit more control over it. One of those cool, maybe even slightly empowering, things you can do is freeze your TransUnion credit report. Think of it as putting a temporary, super-secure lock on a really important part of your financial identity. It’s not scary or overly technical, and understanding how it works can be surprisingly… well, fascinating!

So, what’s the big deal about freezing your credit report with TransUnion, one of the major credit bureaus? In a nutshell, a credit freeze (also known as a security freeze) is a security measure that restricts access to your credit file. This means that most lenders and other entities can’t pull your credit report to open new accounts in your name. Why would you want to do that? The primary benefit is fraud prevention. If someone tries to open a credit card, take out a loan, or even rent an apartment using your Social Security number, they won’t be able to, because the freeze will block the approval process. It’s like putting up a “Do Not Disturb” sign for your credit history.

Beyond just being a powerful shield against identity theft, a credit freeze offers peace of mind. Imagine going on vacation and knowing that even if a data breach happens while you're away, the chances of someone exploiting your credit are significantly reduced. It’s a proactive step that many people find incredibly reassuring. For students, it can be a valuable lesson in financial security. You can learn about credit bureaus and identity protection firsthand, perhaps even demonstrating its importance to parents or younger siblings. In daily life, if you’re not planning on applying for new credit anytime soon, a freeze offers an extra layer of security without much inconvenience.

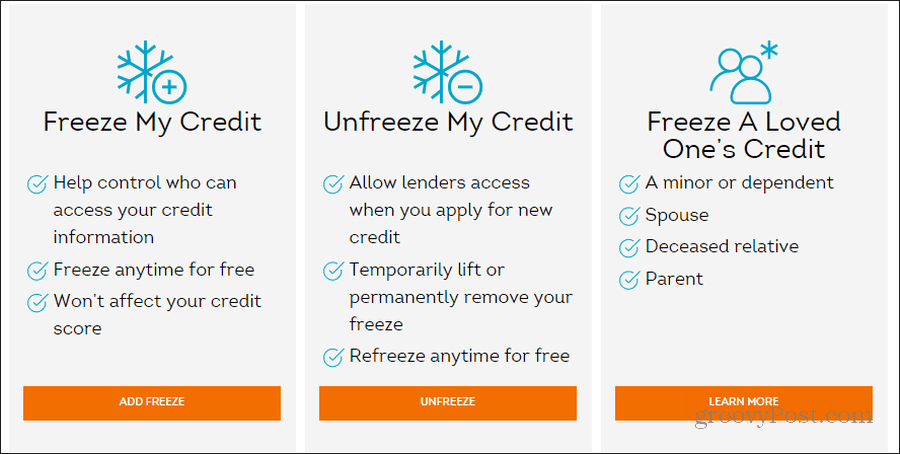

The process itself is often simpler than you might expect. TransUnion, like the other credit bureaus (Equifax and Experian), offers a way to initiate a freeze online, by mail, or over the phone. You'll typically need to verify your identity. Once frozen, if you do need to apply for credit – say, for a new mortgage or car loan – you can temporarily “unfreeze” your report. This is usually just as straightforward and can often be done instantly online or with a quick phone call. You can even choose to lift the freeze for a specific period or for a particular lender.

Exploring this feature is a great way to understand your rights and the mechanisms of financial security. You can visit the TransUnion website to learn more about their specific freezing process. Don't be afraid to poke around their FAQ sections – they’re often full of helpful, easy-to-understand information. You might also want to look into freezing your reports with Equifax and Experian as well, to create a comprehensive security net. It’s a proactive step that empowers you and can save you a lot of potential headaches down the line. So, why not get curious and explore how to put that lock on your credit report today?