How To Determine Value Of Savings Bonds

Hey there, savers and dreamers! Ever stumble across a dusty old savings bond tucked away in a drawer, or maybe you're holding onto a few from a thoughtful grandparent? It’s like finding a little treasure map to your past! But then comes the big question: "What's this thing actually worth now?" It can feel a bit like trying to decipher an ancient scroll, can't it? Don't you worry your pretty little head about it. We’re going to break down how to figure out the value of those savings bonds in a way that’s as easy as making your morning coffee (or tea, if that’s your jam!).

Think of savings bonds as little time capsules of your money. You lent Uncle Sam some cash a while back, and he promised to pay you back with a little extra for being so patient. The tricky part is, that "little extra" isn't always straightforward. It’s not like a plain old savings account where you can peek at your balance every day and see it grow in predictable increments. Savings bonds have their own special rules, and understanding them is key to unlocking their full potential.

Why should you even bother caring about this? Well, imagine you’ve got a forgotten jar of change. You might think it’s just a few bucks, but when you finally cash it in, bam! You’ve got enough for a nice dinner out, or maybe that book you’ve been eyeing. Savings bonds can be like that, but often with a much bigger surprise! They’re essentially guaranteed by the U.S. government, which is a pretty solid promise. They've been a popular way for parents and grandparents to help fund education, or just to give a little boost to future generations. So, knowing their worth is like knowing exactly how much fun you can have with that found treasure!

The Big Secret: It's Not Just Face Value!

So, you've got a bond that says "$100" on it. Does that mean it's worth exactly $100 today? Nope! That's the face value, the amount Uncle Sam initially borrowed from you. The real value, what it's worth now, is called the current redemption value. And this is where things get a little more interesting.

Think of it like a plant. When you plant a tiny seed (the face value), it doesn't stay a tiny seed forever, right? With the right conditions – sunlight, water, and time – it grows into something bigger and more substantial. Savings bonds work a bit like that. They earn interest over time, and that interest gets added to the original amount. The longer you hold onto it, the more it grows!

Where to Find the Magic Numbers

The easiest and most reliable way to find out what your savings bonds are worth is to hop online. The U.S. Treasury has a super handy tool called the TreasuryDirect.gov website. Think of this as the official registry for all your government-backed goodies. It’s like having a direct line to the source!

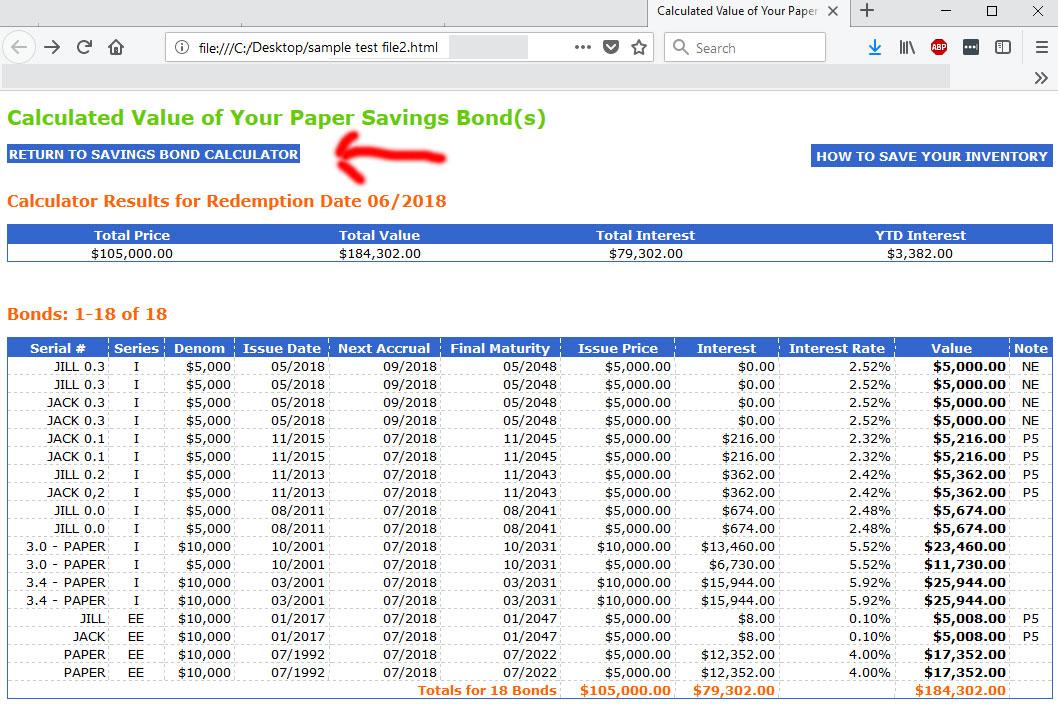

On TreasuryDirect, you can use their "Savings Bond Value Calculator". This is your trusty sidekick in this treasure hunt. You'll need a few pieces of information, but don't sweat it. They’re usually pretty simple:

- The Series of the Bond: This is super important. Bonds come in different flavors, like Series E, EE, I, etc. They each have their own unique rules about how they earn interest and when they stop earning. You'll usually find this printed right on the bond itself. It might look like a letter followed by another letter (e.g., "Series EE").

- The Issue Date: This is the date the bond was originally purchased or issued. Again, this is printed on the bond. It’s like the bond’s birthday!

- The Face Value: That "$100" we talked about earlier.

You just plug these details into the calculator, and voilà! It’ll tell you the current redemption value. It’s like magic, but it’s just good old-fashioned government accounting!

What if My Bonds Are Really Old?

Now, some of you might be thinking, "My bonds are ancient! Like, from before I was even born!" Well, that’s where the fun really starts. Most savings bonds have an original maturity, meaning they stop earning interest after a certain number of years. For older bonds, like Series E and EE, this can be 30 years.

But here’s the cool part: even after they stop earning interest, they might still be worth their face value! So, a $100 bond from 30 years ago might just be worth $100 today, even if it didn’t accrue much interest at the end. It’s like finding a vintage toy in good condition – it might not have gotten fancier over the years, but it still holds its original value.

For some newer bonds, like Series I bonds, they can continue to earn interest for up to 30 years. These are pretty neat because their interest rate adjusts with inflation, so they're designed to protect your purchasing power. It's like having a money-making plant that thrives even when the world gets a bit pricier!

What About Bonds I Can't Find the Info For?

Okay, picture this: You found a bond, but the print is faded, or maybe the paper is a bit crumbly. Life happens! If you can't find the issue date or the exact series number on the bond itself, don't despair. TreasuryDirect.gov has another helpful tool called the "Lost Savings Bond" search. You can enter some personal information, and they might be able to help you track down your bond's details if it was ever electronically registered.

If you can't find the information online, you can always reach out to the Bureau of the Fiscal Service, which is part of the U.S. Department of the Treasury. They have a dedicated team that can help you with these kinds of situations. Think of them as the seasoned detectives of the savings bond world!

When Should I Actually Cash Them In?

This is the million-dollar question, right? When is the perfect time to turn that piece of paper into cold, hard cash (or, more likely, a direct deposit)? Generally, you want to hold onto them until they’ve reached their full potential. For many older bonds, this means waiting the full 30 years to get the maximum interest. For newer bonds, it depends on the series and your financial goals.

However, life isn't always about maximizing every single penny. Sometimes, you might need that money sooner. If you need cash for an emergency, a down payment, or a dream vacation, cashing in a bond might be the right move for you, even if it’s not at its absolute peak value. It’s a trade-off between potential future gains and present needs. Think of it like deciding whether to hold onto a rare collectible or sell it now to fund a trip you've always wanted. Both are valid choices!

Remember, the most important thing is to know what you have. Even if you decide to hold onto your bonds for a while longer, knowing their current value helps you plan for the future. It’s like having a clear picture of your financial landscape, so you can navigate it with confidence and a smile. So go on, dust off those bonds, and discover the little treasures you've been holding onto!