How To Decide To File Jointly Or Separately

Hey there, coffee buddy! So, tax season is creeping up, right? Ugh, I know. And one of those big decisions we have to make is whether to file our taxes jointly or separately. It sounds so official, doesn't it? Like we're adulting with a capital 'A'.

But seriously, it’s a pretty important choice. And honestly, it can be a real head-scratcher. I mean, who knew picking a checkbox could have such financial implications? It's like a financial choose-your-own-adventure, but with less dragons and more… deductions. Fun!

So, let's dive in, shall we? Grab another sip of that latte, because we're about to break down this whole filing thing.

The Joint vs. Separate Showdown

Okay, so the default for married folks is usually filing jointly. It's the path of least resistance, the easy button. And for a lot of couples, it's the best option. More on that in a sec. But then there's the option to go solo, to file separately. Why would you even do that, you ask? Great question!

Think of it like this: filing jointly is like a big, warm hug for your tax return. Everything’s blended together. Filing separately is more like… two separate, perfectly organized filing cabinets. Each has its own stuff, its own system. Sometimes, that separation can actually be beneficial. Who knew!

When Filing Jointly is Your BFF

Let's start with the popular kid on the block: filing jointly. For most couples, this is the sweet spot. Why? Because the U.S. tax code loves married couples who file together. It's almost like a reward!

One of the biggest perks is the marriage penalty relief. This sounds fancy, but it's basically the government saying, "Hey, we don't want to penalize you for being married!" Sometimes, if two people with similar incomes get married and file separately, their combined tax bill can be higher than if they were single. Filing jointly often wipes that out and can even lead to a lower tax bill overall. See? Love wins… at tax time, at least.

Then there are those awesome tax credits and deductions. Many of these have higher income limits or are simply unavailable if you file separately. Think about things like the Earned Income Tax Credit (EITC), the education credits, or even certain IRA deductions. Filing jointly often opens the door to claiming these goodies, which can seriously shave money off your tax bill. It’s like finding an extra twenty bucks in your old jeans, but way more substantial!

And let's not forget the simplicity. One return, one refund (or one payment, if you're on the less fortunate side of that equation). It's less paperwork, less to keep track of. If you're both pretty organized and your financial lives are pretty intertwined, this can be a huge relief. No need for two separate spreadsheets battling it out!

Plus, if one of you has significant medical expenses, you can combine those. That’s a biggie! The medical expense deduction is based on a percentage of your Adjusted Gross Income (AGI). When you file jointly, you combine your incomes, meaning a higher AGI. BUT, you also combine your expenses. So, if one spouse has a boatload of medical bills, combining them with the other spouse's lower medical bills might still push you over that AGI threshold to claim the deduction. It's a bit of a puzzle, but sometimes the pieces fit perfectly.

So, When Does Separate Shine?

Now, let's talk about the underdog: filing separately. It's not as common, but there are definitely situations where it makes more sense. Think of it as a strategic move, like playing chess with your tax return.

The most common reason couples choose to file separately is if one spouse has a lot of itemized deductions that are specifically tied to them. We're talking about things like significant unreimbursed medical expenses, or maybe state and local taxes (SALT) that are really high for one person. Remember that AGI threshold for medical expenses? If one spouse has a very low income but very high medical bills, filing separately might allow them to deduct those expenses because their AGI is lower. It’s a niche situation, but it happens!

Another scenario? Debt. If one of you has a mountain of debt, or if one spouse has a history of tax issues (like unpaid taxes or penalties), filing separately can protect the "clean" spouse from being on the hook for the other's financial mess. It’s a way to wall off your finances, tax-wise. Like putting up a little financial fence. Smart, right?

This is also where the term "innocent spouse relief" comes in. If you discover your spouse didn't report income or made a significant error, filing jointly could make you both responsible. Filing separately can offer some protection, although Innocent Spouse Relief is a separate process you can apply for even if you filed jointly. But hey, an ounce of prevention is worth a pound of… tax forms.

What about student loan payments? If you have different incomes and one spouse has income-driven repayment plans, filing separately might be beneficial. These plans often calculate payments based on your individual income, not your joint income. So, if you file separately, your loan payments might be lower. This is a big one for many younger couples!

And then there's the "just in case" factor. Sometimes, couples file separately if they're going through a rough patch in their marriage and want to keep their financial lives as separate as possible. It's a personal choice, for sure. It’s like saying, "Let’s just keep our tax lives independent for now, thanks."

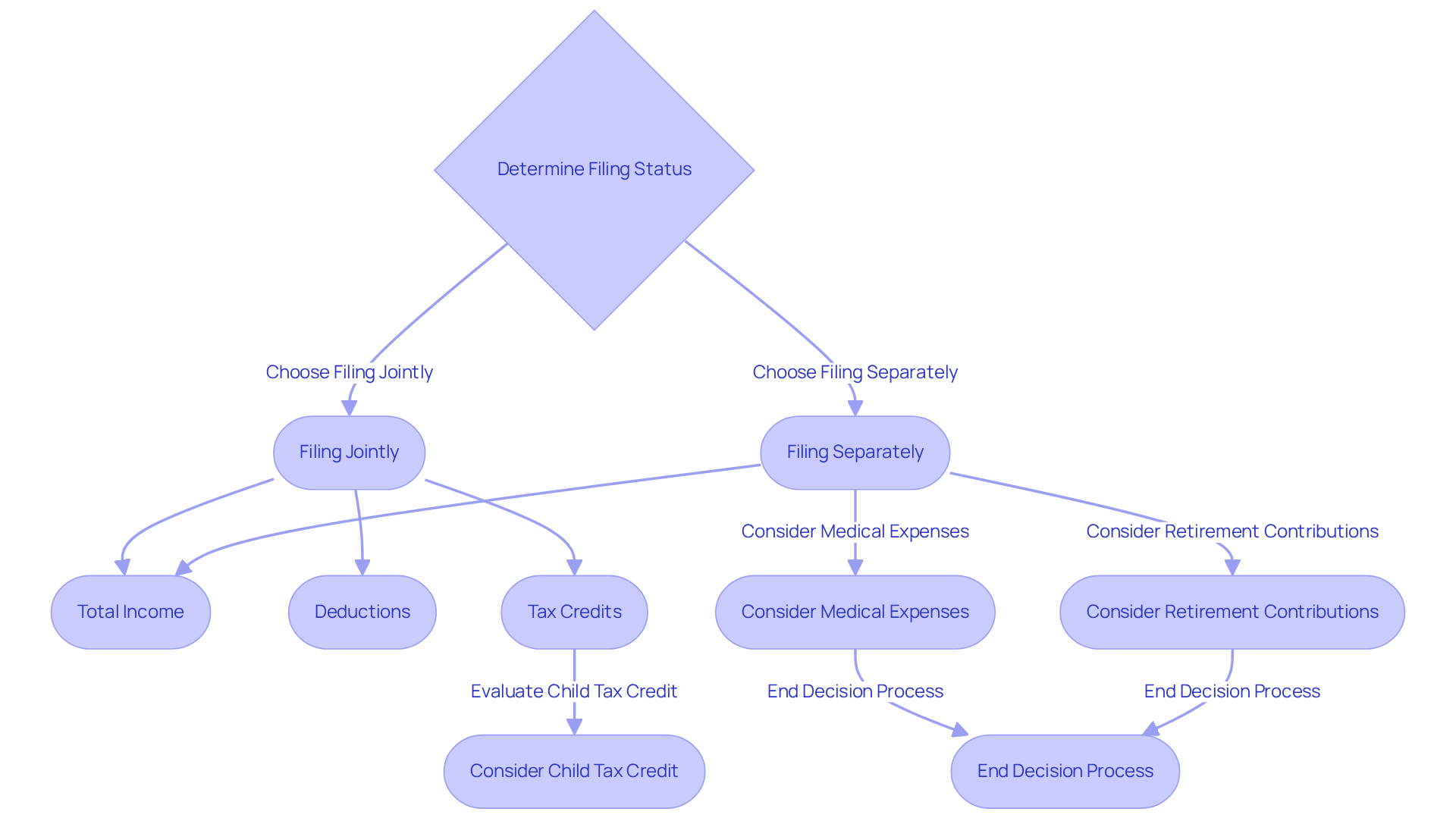

The Nitty-Gritty: How to Decide

Okay, so how do you actually make this decision? It's not usually a gut feeling thing. It’s more like… crunching some numbers. And maybe a little bit of math wizardry.

The absolute best way is to run the numbers both ways. Get your tax software or your friendly neighborhood tax preparer to calculate your tax bill as if you're filing jointly, and then calculate it again as if you're filing separately. Seriously, do this! It’s the only way to know for sure.

When you’re running the numbers, pay attention to a few key things:

- Which filing status gives you the lowest total tax liability? This is the big one.

- Are you eligible for certain credits or deductions when filing jointly that you lose when filing separately? As we discussed, this is often a dealbreaker for jointly filing.

- Do you have significant itemized deductions that would be better utilized if you file separately? Again, think medical expenses.

- What are your individual incomes and tax situations? If your incomes are very different, it might lean towards one option or the other.

Don't forget about state taxes! Some states follow federal filing statuses, while others have their own rules. Make sure you check your state’s requirements too. It's a whole tax ecosystem out there!

And here's a little secret: you can't go back easily. Once you file, that's it for the year. So, make sure you're confident in your choice. It’s like picking a wedding venue – once you book it, you’re pretty committed!

The "What Ifs" and Caveats

Let's throw in a few more thoughts, because taxes are rarely straightforward, are they?

What if you're married but living apart? This can get complicated. You might be able to file as Head of Household if you meet certain criteria. Definitely consult a tax pro on this one. It’s a whole other ballgame.

What if you have dependents? This usually makes filing jointly more advantageous, as it often allows for higher child tax credits and other dependent-related benefits. But again, run the numbers!

What about kids from previous marriages? This can also add layers of complexity, especially regarding who can claim the child tax credit or the dependent care credit. You might need to coordinate with your ex. Fun times!

The "convenience" factor. Even if filing separately saves you a few bucks, sometimes the peace of mind and simplicity of filing jointly is worth it. If the savings are minimal, and filing jointly makes your lives easier, maybe that's the way to go. It’s a personal cost-benefit analysis!

Don't forget the deadlines! Make sure you know the deadlines for filing and paying your taxes. Procrastination is a tax preparer's worst nightmare. And yours, probably!

My Personal Take (and a Disclaimer!)

Honestly, for most of my friends and for me, filing jointly has always been the way to go. My husband and I have pretty similar incomes, and we tend to benefit from the combined deductions and credits. It’s just… easier. Less math for me to do, which is always a win in my book!

But I've also seen friends who, for reasons like massive medical bills for one spouse or to avoid complications with a spouse’s past tax issues, have found significant savings by filing separately. It really does depend on your unique situation.

And this is super important: I am not a tax professional! This is just me chatting with you like we’re at our favorite coffee shop, sharing what I’ve learned and researched. The tax laws are complex and they can change. If you’re unsure, or if your situation is a bit… spicy, please, please, please talk to a qualified tax advisor or CPA. They’re the real MVPs of tax season. They can look at your exact numbers and give you personalized advice. It's an investment that can save you a lot of headaches, and potentially a lot of money!

So, there you have it! A little coffee-fueled chat about filing jointly versus separately. Hopefully, it’s demystified things a bit and given you some food for thought. Now go forth, crunch those numbers, and may your tax return be ever in your favor!