How To Calculate Student Loan Interest Paid

Alright, gather ‘round, my fellow graduates (and soon-to-be grads who are already sweating bullets about this stuff). Let’s talk about the elephant in the room. No, not that questionable roommate you had in college. I’m talking about student loan interest. It’s that sneaky little extra cost that makes your dream of student loan freedom feel as far away as a decent Wi-Fi signal in a library basement. But fear not, brave borrowers! Today, we’re going to demystify this financial beast and figure out just how much of your hard-earned cash is vanishing into the interest abyss. Think of me as your friendly neighborhood loan guru, armed with coffee, a calculator (probably an app on my phone), and a healthy dose of sarcasm.

So, you’ve got that student loan. It was a lifeline, a magical portal to knowledge, a passport to your future! And then, BAM! The payments start. And with those payments comes… interest. It’s like that extra topping you didn’t ask for on your pizza, but you have to pay for it anyway. And sometimes, it feels like that topping is actually a small, hungry gremlin that eats your money.

Let’s get down to brass tacks. Calculating student loan interest paid isn't rocket science. In fact, it's probably easier than understanding that one professor’s lecture on quantum physics. You just need a few key ingredients, a sprinkle of math, and a willingness to confront your financial reality. No judgment here – we’ve all been there, staring at our loan statements with the same bewildered expression we had on the first day of calculus.

The Magical Numbers You Need (Don’t Freak Out!)

First things first, you need to know your principal loan amount. This is the OG amount you borrowed. Think of it as the principal dancer in the grand ballroom of your debt. It’s the original sum, before any of those pesky interest charges decided to crash the party.

Next up is your interest rate. This is usually expressed as a percentage. It’s the gremlin’s hourly wage, basically. Higher interest rate? More gremlin power! Keep in mind, if you have multiple loans, each might have a different interest rate. It’s like a bizarre interest rate buffet, and you’re stuck paying for all of it.

Finally, you need to know your loan term. This is the length of time you have to repay the loan. It’s usually in years. Think of it as the duration of the gremlin’s employment. A longer term means the gremlin gets to munch on your money for longer. So, a 10-year loan term is like a decade-long gremlin rave.

:max_bytes(150000):strip_icc()/how-to-calculate-student-loan-interest-4772208_final-39fc8391e4e2462e91d1632c7f8abe72.png)

The Super-Duper Simple (Okay, Maybe Just Simple) Calculation

Here’s the basic idea: your loan payment is split between paying off the principal and paying off the interest. At the beginning of your loan, a HUGE chunk of your payment goes towards interest. It’s like you’re paying rent for borrowing the money, and then a tiny bit is actually buying the house. As you pay down the principal, the amount of interest you owe each month decreases. It’s a beautiful, albeit slow, process.

Method 1: The “Honest, It’s Not That Bad” Way (For Quick Estimates)

Want a ballpark figure without diving into the deep end of amortization schedules? Here’s a quick cheat code. This isn't perfectly accurate, but it’ll give you a general idea. Grab your calculator (or your phone’s calculator, no shame).

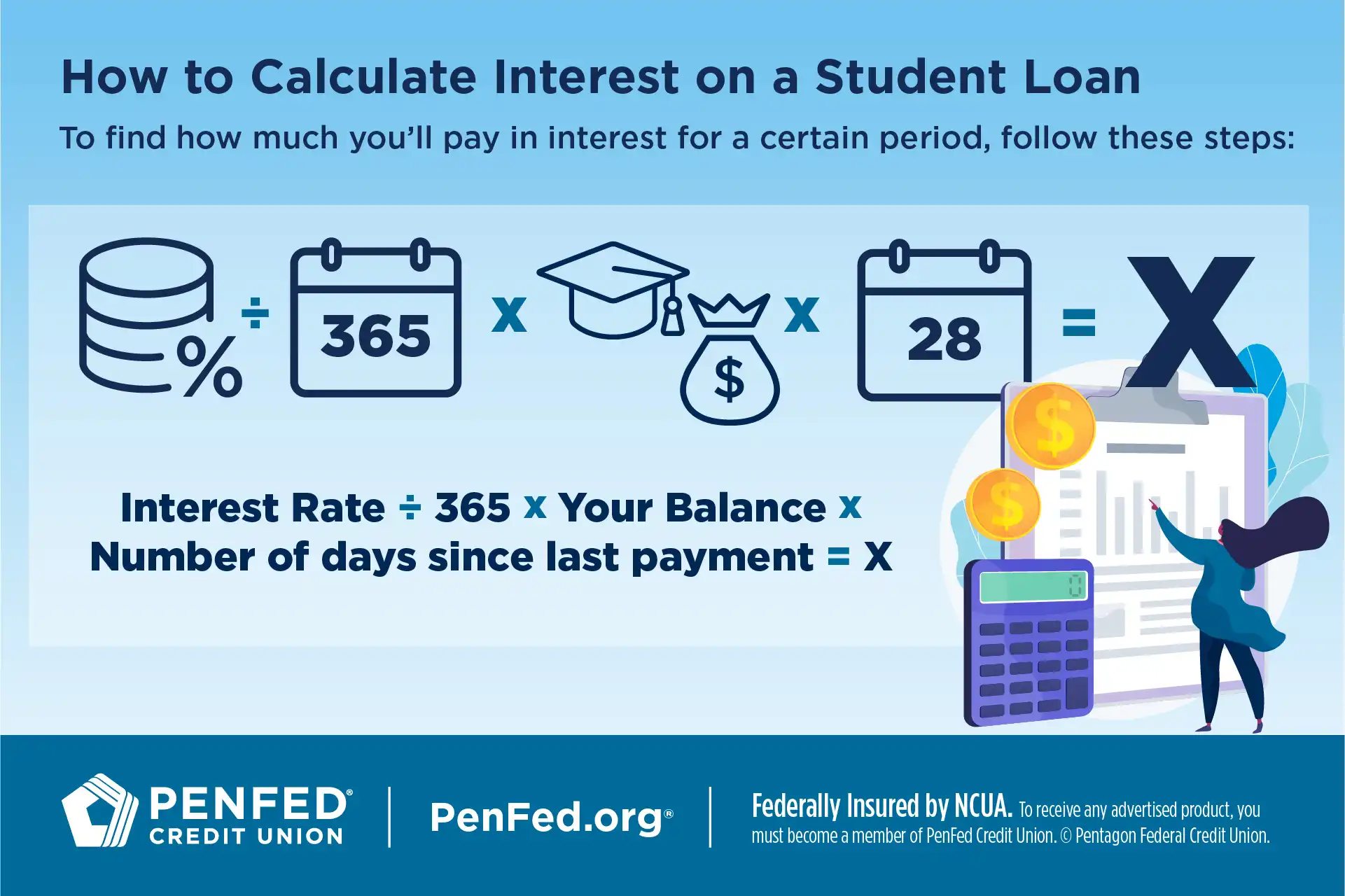

Step 1: Find your monthly interest amount. Take your outstanding principal balance and multiply it by your annual interest rate (as a decimal). Then, divide that by 12 (for the 12 months in a year).

Example: You owe $30,000. Your interest rate is 5% (which is 0.05 as a decimal). So, $30,000 * 0.05 = $1,500 (this is your annual interest if you only paid interest). Then, $1,500 / 12 = $125. This is roughly the interest portion of your first payment. See? That gremlin is hungry!

Step 2: Estimate your total interest paid over the loan’s life. Now, this is where it gets a little fuzzy with this method, but we can make a guess. Multiply your approximate monthly interest by the total number of payments.

Example continued: If your loan term is 10 years, that’s 120 payments. So, $125 (monthly interest) * 120 (payments) = $15,000. This means you’d pay roughly $15,000 in interest over 10 years. That’s a whole lot of gremlin snacks!

Surprising Fact Time! Did you know that some people end up paying almost as much in interest as they originally borrowed? It’s like buying a $10,000 car and paying $8,000 in interest. Ouch. This is why understanding your interest is CRUCIAL.

Method 2: The “Let’s Get Real” Way (Using an Amortization Schedule)

This is the more accurate, the more detailed, and the slightly more intimidating method. But don’t worry, we’re going to break it down. An amortization schedule is basically a month-by-month breakdown of your loan payments. It shows you exactly how much goes to principal and how much goes to interest each time you pay.

Where to find this magical document?

- Your loan servicer’s website: Most loan servicers (the companies you actually pay) have online portals where you can access your loan details, including amortization schedules. This is your best bet!

- Online amortization calculators: A quick Google search for “student loan amortization calculator” will bring up tons of free tools. You plug in your loan details, and voilà!

- Spreadsheet wizardry: If you’re feeling particularly ambitious (or just really like spreadsheets), you can create your own amortization schedule in Excel or Google Sheets. There are plenty of templates online to help you.

How to read it:

Once you have your amortization schedule, look for a column labeled “Interest Paid” or something similar. You'll see the amount of interest you paid for each individual payment. To find your total interest paid, you just need to sum up all the values in that column for the entire life of the loan.

Example: Let’s say your schedule shows $115.50 in interest for month 1, $114.75 for month 2, and so on. You’d add all those numbers up. If you're using an online calculator, it usually spits out a grand total for you at the end. It’s like a financial report card!

Playful Exaggeration Alert! Some amortization schedules can be longer than a Tolkien novel. But the satisfaction of knowing exactly where your money is going? Priceless. (Or, well, the opposite of priceless, but you get the idea.)

Why Bother Doing This Anyway?

Good question! Besides the sheer joy of knowing where your money is going (or, you know, not going towards rent), calculating your total interest paid is super important for a few reasons:

- Budgeting: Knowing the total interest helps you plan your finances more effectively. You can see how much extra you’ll be paying and adjust your budget accordingly. Maybe that daily $7 latte isn’t so affordable when you realize it’s funding a gremlin’s summer vacation.

- Tax Deductions: Guess what? You can often deduct the interest you pay on student loans! Keeping track of your total interest paid is essential for claiming this deduction on your taxes. It’s like finding a hidden treasure chest in your financial paperwork.

- Refinancing Decisions: If you’re considering refinancing your student loans, knowing your current interest rate and the total interest you’ll pay is key to evaluating if a new loan will actually save you money. Is this new loan a fairy godmother or just a slightly shinier gremlin?

- Motivation! Seeing the total interest can be a powerful motivator to pay off your loans faster. Imagine crossing off that interest amount like a boss! It’s a psychological victory!

So, there you have it. While the concept of student loan interest might seem daunting, breaking it down with these methods makes it much more manageable. Grab that coffee, open up that loan statement (or that online calculator), and let’s get crunching. You’ve got this! And hey, if all else fails, just remember that you’re not alone in this financial jungle. We’re all in this gremlin-infested, interest-laden forest together, navigating our way to financial freedom, one payment at a time!