How Much On Average Does A Lyft Driver Make

Hey there, future ride-sharing guru! So, you’re curious about how much dough a Lyft driver can actually rake in, huh? It’s like wondering what’s in the secret sauce – everyone wants to know, but the exact recipe can be a bit of a mystery. Well, pull up a virtual chair, grab a virtual coffee (or something stronger, no judgment!), because we’re about to spill the beans. No fancy financial jargon here, just the real, honest-to-goodness scoop from your friendly neighborhood explainer. Let’s dive in!

First things first, the big question: "How much does a Lyft driver make on average?" The honest answer is… it’s complicated! Think of it like asking how much a chef makes. It depends on the restaurant, their skill, the day of the week, and whether they’re serving Michelin-star meals or… well, let’s just say more casual fare. Lyft driving is kind of the same. There’s no single magic number that applies to everyone. However, we can definitely give you a solid ballpark figure and break down what makes that number wiggle and jiggle.

The Nitty-Gritty: What’s the Average Take-Home?

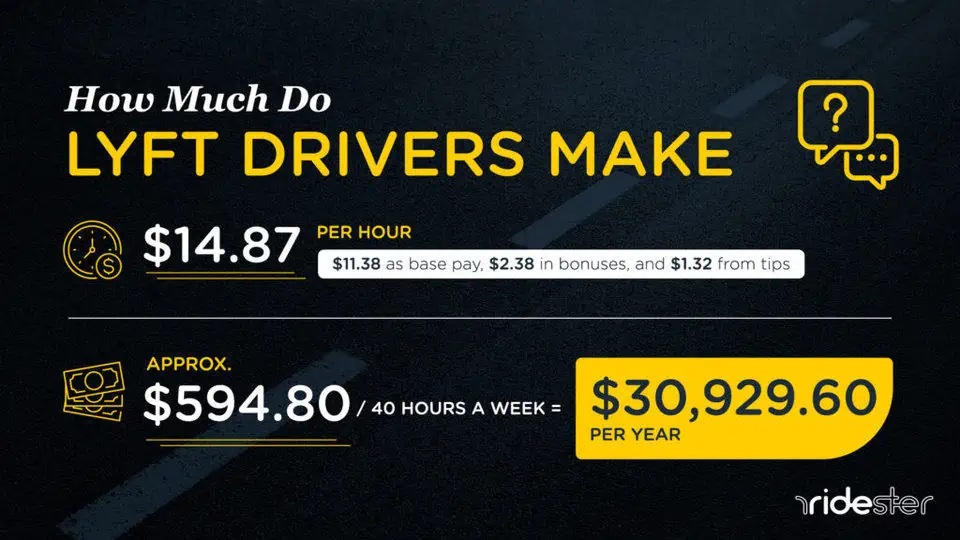

Alright, let’s get to the numbers. Most reports and driver surveys tend to land in the ballpark of $17 to $25 per hour before expenses. Yeah, you read that right. That sounds pretty decent, doesn't it? Think about it – that’s more than minimum wage in a lot of places, and you’re your own boss! High five!

But, hold your horses there, Captain Cash. That’s the gross earnings. What you actually get to put in your pocket after all the dust settles is a whole different story. And that’s where things get really interesting, and sometimes a little less glamorous. We’re talking about the things that eat into that hourly rate like a hungry bear at a picnic. Don’t worry, we’ll get into those juicy details in a sec!

Some sources might quote higher, some lower. For example, if you’re in a super busy city during peak hours, you might be flirting with the upper end of that range, or even a bit beyond. But if you’re in a smaller town, or driving during the dreaded “off-peak” hours (you know, like Tuesday mornings at 3 AM – anyone?), your earnings might be on the lower side. It’s all about supply and demand, baby!

Factors That Make or Break Your Earnings

Okay, so what influences this magical hourly rate? Imagine you’re a detective, and these are your clues. Each one is a piece of the puzzle that shapes your paycheck.

1. Location, Location, Location! This is probably the biggest one. Driving in a bustling metropolis like New York City, Los Angeles, or Chicago is going to be vastly different from driving in a sleepy suburb. Big cities mean more people, more demand, and more potential for fares. Plus, surge pricing (more on that later!) is more common and often more significant in high-demand areas. Think of it as prime real estate for your car!

2. Time is Money (Literally!) When you choose to drive makes a huge difference. Peak hours, like morning and evening commutes, Friday and Saturday nights, and holidays, are your goldmines. People are out and about, going to work, going out for dinner, coming home from parties – and they need rides! Outside of these times? It can be a bit like crickets chirping. So, being strategic about your driving schedule is key. Become a master of the rush hour!

3. Your Driving Style and Efficiency. This might sound a bit cheeky, but how you drive can impact your earnings. Are you picking up rides efficiently, minimizing downtime between fares, and taking the most logical routes? Or are you taking a scenic tour of the city on every trip? While no one wants a driver who speeds or drives recklessly, being smart about navigation and minimizing wasted time is crucial. Think of yourself as a finely tuned, fare-generating machine!

4. The Magic of Surge Pricing. Ah, surge pricing! This is Lyft’s way of saying, "Hey, there are a lot of people who want rides right now, and not enough drivers! So, prices are going up!" When demand is high (think rainy nights, major events, or during holidays), you’ll see the map light up with “surge zones.” Driving in these areas can significantly boost your earnings per ride. It’s like finding a hidden treasure chest!

5. Bonuses and Promotions. Lyft loves to keep drivers happy (and driving!), so they often offer bonuses and promotions. These can be for completing a certain number of rides in a week, driving during specific times, or hitting certain mileage goals. Keep an eye on your Lyft app for these opportunities – they’re like free money if you can snag them!

6. Tips! This is the cherry on top, the sprinkles on the ice cream, the… well, you get the idea. While tips aren't guaranteed, they can definitely add up. Some passengers are incredibly generous, while others… well, let’s just say they’re still working on their tipping etiquette. A friendly demeanor, a clean car, and a smooth ride can definitely increase your chances of a nice tip. So, be the driver everyone wants to tip!

The Not-So-Glamorous Side: Expenses to Consider

Now, let’s get real. That $17-$25 per hour? That’s before you account for all the money that goes out. And in the ride-sharing world, there are a few significant expenses that can trim down your take-home pay quite a bit. It’s like having a birthday cake – you love it, but you have to buy the ingredients, bake it, and then there’s the frosting… and that frosting costs money!

1. Gas. This is a big one. You’re burning fuel every single mile you drive, and gas prices can fluctuate like a roller coaster. If you’re driving a gas-guzzler, your fuel costs will be higher. If you’ve got a fuel-efficient car or an electric vehicle, you’re in luck! It’s a good idea to track your gas expenses diligently. Think of it as a love-hate relationship with your gas pedal.

2. Vehicle Maintenance. Your car is your livelihood. Oil changes, tire rotations, brake replacements, unexpected repairs – they all add up. The more miles you put on your car, the more frequently it will need servicing. It’s like a never-ending spa day for your vehicle, but you’re footing the bill. Regular maintenance can prevent bigger, more costly problems down the line, so it’s worth investing in.

3. Insurance. This is a critical one. Your personal auto insurance policy likely doesn’t cover you when you’re driving for ride-sharing services. You’ll need to get specific rideshare insurance, which can be more expensive than standard coverage. Don't skip this! It’s your safety net in case of an accident while you’re working.

4. Depreciation. Every mile you drive reduces the resale value of your car. This is a hard cost to quantify, but it's real. If you plan on selling your car after a year or two of ride-sharing, its value will be significantly lower than if you’d only used it for personal errands. It’s like watching your car get older in fast-forward.

5. Taxes. As an independent contractor, you’re responsible for paying your own taxes. This includes income tax and self-employment tax (which covers Social Security and Medicare). Lyft doesn’t withhold taxes for you, so you’ll need to set aside a portion of your earnings for taxes and potentially make quarterly estimated tax payments. Consult with a tax professional to make sure you’re doing it right!

6. Wear and Tear on Your Car. Beyond major repairs, there’s the general wear and tear. The constant starting and stopping, the bumps and jolts of the road, the interior getting scuffed up – it all contributes to the lifespan of your vehicle. It’s the little things that add up, like a thousand tiny paper cuts.

Estimating Your True Take-Home Pay

So, how do we combine the gross earnings with the expenses to get a more realistic picture? Let’s do some back-of-the-envelope math. If you’re making, say, $20 per hour gross, and you’re spending about $5-$7 per hour on gas, maintenance, and other immediate costs, your net earnings might be closer to $13-$15 per hour. This is still a respectable figure, especially if you’re working during peak times and in a good location. But it’s definitely not the $25-$30 per hour you might see advertised sometimes.

Remember, these are just estimates. Your actual costs will vary depending on your car, your driving habits, and where you live. The best thing you can do is track your income and expenses meticulously for a few weeks. Use a spreadsheet, an app, or even a trusty notebook. Knowledge is power, and in this case, knowledge is also money!

Maximizing Your Lyft Earnings

Okay, so we’ve talked about what makes your earnings fluctuate and what eats into them. Now, for the good stuff: how to make more money! It’s not about magic tricks; it’s about smart strategies.

1. Drive During Peak Hours: I know, I know, we keep saying it. But it’s true! Commute times, weekend evenings, and special events are your best friends. Be strategic about when you log on. Think of yourself as a savvy shopper, hitting the stores when the best deals are available.

2. Chase the Surges: Keep an eye on the Lyft app for those pulsating surge zones. If you can safely and efficiently get to a surge area, do it! It’s like following a breadcrumb trail to treasure.

3. Be a Top-Rated Driver: Those five-star ratings are gold! Passengers are more likely to tip and request you again (if that’s an option for them). Be polite, helpful, and maintain a clean, comfortable car. Go the extra mile (pun intended!) to provide a great experience.

4. Drive in High-Demand Cities (if possible): If you have the flexibility, consider driving in a larger city. The density of passengers and events often leads to higher earning potential.

5. Utilize Lyft Promotions: Always check the app for any current bonuses or challenges. These can provide a nice boost to your income. Don’t leave free money on the table!

6. Minimize Downtime: Try to accept rides as they come and avoid long stretches of inactivity. Plan your routes to minimize time spent driving without a passenger.

7. Be Smart About Fuel: Keep an eye on gas prices and look for the cheapest options. Consider using fuel-efficient driving techniques. Every dollar saved on gas is a dollar in your pocket.

8. Consider a Fuel-Efficient Vehicle: If you’re in the market for a new car or can switch your current one, a hybrid or electric vehicle can significantly reduce your fuel costs. It’s a long-term investment that can pay off.

9. Track Your Expenses for Tax Purposes: This isn’t directly about earning more, but it is about keeping more of what you earn. Keep meticulous records of all your business-related expenses. You can often deduct these, which reduces your taxable income.

10. Stay Informed: Follow Lyft driver forums, social media groups, and read articles about ride-sharing. The more you know about industry trends, new features, and best practices, the better equipped you’ll be to maximize your earnings.

The Bottom Line: Is it Worth It?

So, after all this talk of numbers and expenses, is driving for Lyft a good way to make money? The answer, as always, is a resounding… it depends! For some, it’s a fantastic way to earn extra cash, supplement their primary income, or even make a full-time living. For others, especially those who don’t factor in expenses or drive strategically, it might not be as lucrative as they’d hoped.

The key is to go into it with your eyes wide open. Understand the costs involved, be strategic about your driving hours and locations, and always strive to provide excellent customer service. When you do that, you’ll be well on your way to making Lyft driving a rewarding and profitable experience.

Think of it this way: you’re not just driving people around; you’re offering a service, you’re navigating your own business, and you’re in control of your own destiny. You’re the captain of your own ship (or, you know, car!). And that feeling of independence and flexibility? That’s pretty darn valuable. So, go forth, be smart, be friendly, and may your rides be plentiful and your tips be generous!