How Much Money Does Taxes Take Out Of Your Check

So, I was at the coffee shop the other day, you know, the usual spot where the barista knows my order before I even open my mouth (bless them). I’m just scrolling through my banking app, feeling pretty good about the weekend ahead, when I spot it. That little chunk of cash, already missing. My paycheck had just hit, and poof, a good chunk of it was already gone. Like a magic trick, but way less entertaining and a lot more… frustrating. And I swear, for a second there, I felt like I was talking to my bank account, asking, “Where did it all go, man? Where did it all go?”

And that, my friends, is the age-old question, isn't it? The one that pops into your head every single time you look at your pay stub. “How much money does taxes really take out of your check?” It’s like a phantom limb, you know that money should be there, but it’s just… vanished. Poof! Gone to the land of government services and… well, let’s not even get into the debates about what it all goes towards. The point is, it’s a significant chunk, and understanding why and how much can feel like cracking the Da Vinci Code, sometimes.

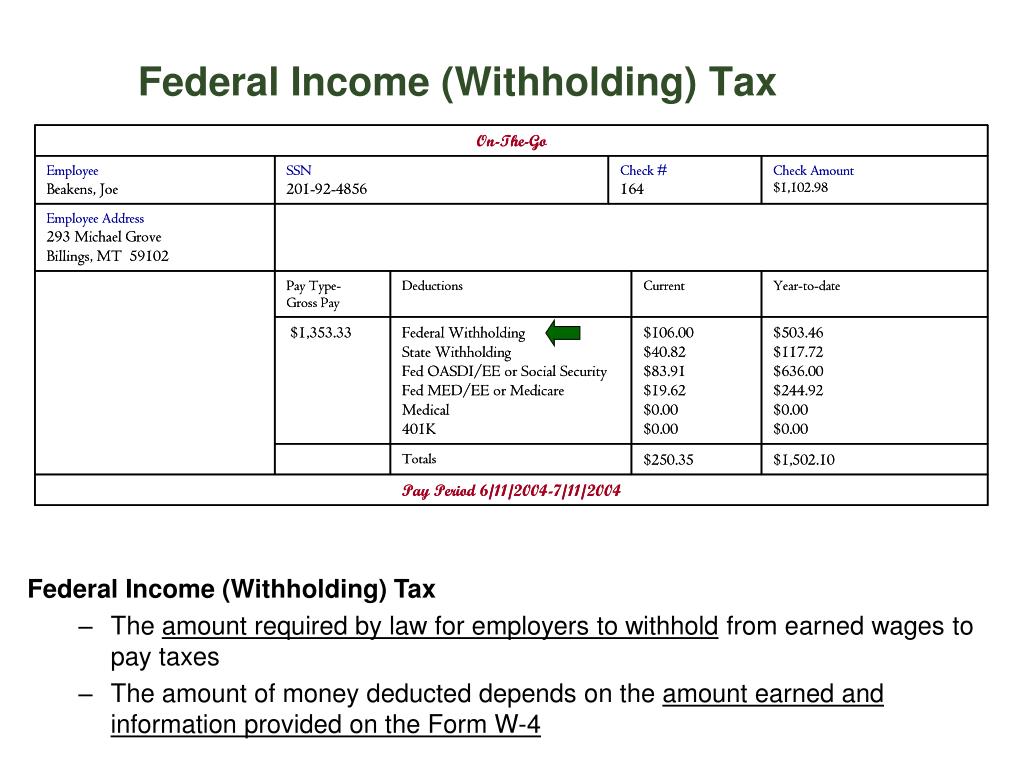

Let’s be honest, staring at a pay stub can feel like deciphering an ancient scroll written in hieroglyphics. You’ve got your gross pay, your net pay, and then all these mysterious deductions in between. It’s enough to make you want to go back to bartering for goods and services, right? No taxes, just a good ol’ fashioned trade of chickens for bread. Simpler times, maybe.

But since we’re living in the 21st century and bartering is generally frowned upon at your local supermarket, we’ve got to deal with the tax man. And the first thing to understand is that it’s not just one tax. Oh no, that would be far too simple. We’re talking about a whole buffet of taxes, each with its own little bite out of your hard-earned dough.

The Big Kahunas: Federal and State Income Taxes

These are usually the biggest hitters on your pay stub. Think of them as the main course. You’ve got your federal income tax, which is determined by the IRS (Internal Revenue Service). This is where things get… progressive. Basically, the more you earn, the higher percentage you pay. This is based on a system of tax brackets, which, let me tell you, can feel like navigating a maze designed by a committee.

Your tax bracket is determined by your taxable income, which isn’t just your gross pay. It’s your gross pay minus certain deductions and adjustments. So, if you’re contributing to a traditional IRA, paying for health insurance premiums through work, or have certain other pre-tax deductions, those can lower your taxable income. It’s like a little bit of good news in the tax world, right?

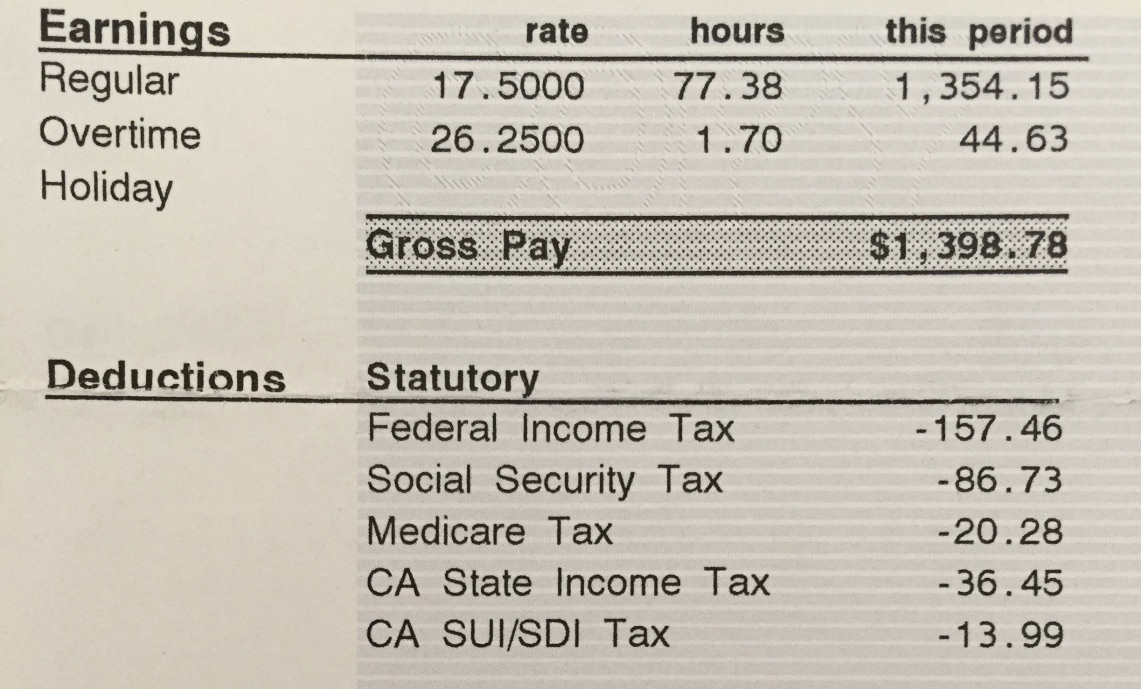

Then there are your state income taxes. This is where things get even more interesting, and by interesting, I mean wildly inconsistent. Some states, like Florida, Texas, and Washington, have no state income tax at all. Lucky them, right? Others, like California and New York, have some of the highest state income tax rates in the country. So, even if you’re making the exact same salary, what you keep in your pocket can vary dramatically depending on where you live.

It’s kind of like a geographical lottery. You’re either in a state that’s collecting a hefty chunk for its own services, or you’re in a state that’s relying more heavily on sales tax or property tax. Fascinating, and also, again, a little bit frustrating if you’re in one of those high-tax states.

The actual percentage taken out for federal and state income tax depends on a few key things:

- Your Gross Income: The more you earn, the higher your tax bracket. Simple (but sometimes painful) math.

- Your Filing Status: Are you single? Married filing jointly? Head of household? These all have different tax implications. It’s like choosing your avatar in a video game, but with real-world financial consequences.

- Your Withholding Allowances (W-4): This is a form you fill out when you start a new job. It tells your employer how much to withhold for federal income tax. If you have a lot of dependents or anticipate a lot of deductions, you might claim more allowances, which means less tax withheld from each paycheck. On the flip side, if you claim too few, you might end up owing money at tax time. Oops.

- State-Specific Laws: As we discussed, every state does its own thing.

So, when you see that line item for “Federal Income Tax” or “State Income Tax,” remember it’s not a flat rate. It’s a calculation based on your individual circumstances. And that’s why your friend who makes the same as you might have a slightly different amount taken out. Sneaky, right?

The Not-So-Optional Add-Ons: FICA Taxes

Now, let’s talk about FICA. The Federal Insurance Contributions Act. This one is pretty standard across the board for most employees. It’s essentially funding for two major programs: Social Security and Medicare.

Social Security is that program that’s supposed to provide you with a retirement income, as well as benefits for disabled workers and survivors. Medicare is our national health insurance program for people aged 65 and older, and for younger people with certain disabilities. You’ve probably heard people talk about “maxing out” their Social Security contributions for the year. That means you’ve paid into it enough that you won’t have any more Social Security tax taken out for the rest of the year. It’s a little glimmer of light in the deductions landscape.

Here’s the breakdown for FICA:

- Social Security Tax: This is currently set at 6.2% of your income. However, there’s an annual limit on how much income is subject to Social Security tax. For 2023, that limit was $160,200. So, if you earn more than that, you won’t have Social Security tax taken out on the amount exceeding the limit. This is a big one to remember!

- Medicare Tax: This is currently 1.45% of your income. Unlike Social Security, there’s generally no income limit for Medicare tax. So, it’s taken out of every dollar you earn. However, if you’re a high earner, there’s an additional Medicare tax of 0.9% that kicks in for individuals earning over $200,000 ($250,000 for married couples filing jointly). So, for those earning a lot, the Medicare bite can get a little bigger.

Combined, FICA taxes are a significant chunk, typically around 7.65% of your gross pay (up to the Social Security limit). Your employer also matches this amount, which is a nice little bonus for the government, I guess. But from your perspective, it’s a consistent deduction that’s hard to avoid.

It's important to remember that these are not optional deductions in the same way that you might choose to contribute to a 401(k). They are mandated by law. So, while you might grumble about it, it’s a necessary part of the system.

The Local Flavor: Local Taxes

This is where things get really localized. Some cities, counties, or even school districts have their own income taxes or wage taxes. These are less common than federal and state income taxes, but they can definitely add up if you live in one of those areas. Think of it as an extra topping on your tax pizza, and sometimes, that topping is pretty hefty.

For example, some cities in Ohio and Pennsylvania have local income taxes. If you work in one of these areas, you’ll see another deduction on your pay stub for that specific municipality. It’s another layer of complexity, and another reason why your take-home pay might differ from someone earning the same gross salary in a different town.

It's always a good idea to check with your local government or HR department to see if any local taxes apply to you. You might be surprised! And by surprised, I mean a little bit dismayed, but at least you’ll know where that money is going.

Beyond the Basics: Other Deductions

While income and FICA taxes are the main players, there can be other tax-related deductions on your pay stub. These are often voluntary, but they can impact your taxable income, which is a good thing!

Health Insurance Premiums: If you get your health insurance through your employer, the premiums are often deducted before federal and state income taxes are calculated. This is called a pre-tax deduction. It means that the amount you pay for health insurance effectively lowers your taxable income. Score! So, that premium you’re paying? It’s doing double duty – providing you with coverage and reducing your tax bill. Pretty neat, huh?

Retirement Contributions (401(k), etc.): Similar to health insurance, contributions to a traditional 401(k) or other pre-tax retirement plans are also deducted before income taxes are calculated. This is a fantastic way to lower your current tax burden while saving for the future. The money you contribute isn’t taxed now; it’s taxed when you withdraw it in retirement. It’s a win-win for your wallet and your future self.

Flexible Spending Accounts (FSAs) and Health Savings Accounts (HSAs): These are also typically pre-tax deductions and can significantly reduce your taxable income. They allow you to set aside money for healthcare or dependent care expenses on a pre-tax basis.

It’s these pre-tax deductions that can sometimes make the difference between what your gross pay is and what your actual taxable income is. And that, my friends, is where understanding your pay stub becomes less of a mystery and more of a superpower.

So, What’s the Damage? The Average Take-Home Pay

Putting a single, universal number on “how much money taxes take out of your check” is impossible because, as we’ve seen, it’s so personalized. However, we can look at averages and general estimates.

For a typical W-2 employee in the United States, you can expect somewhere in the range of 20% to 35% of your gross pay to be withheld for federal and state income taxes, FICA taxes, and any applicable local taxes. This is a broad range, and it can go higher or lower depending on your specific circumstances.

For example, someone in a high tax bracket in a state with a high income tax, who doesn’t have many pre-tax deductions, might see closer to 35% or more of their pay go towards taxes. On the other hand, someone in a low tax bracket in a no-income-tax state, with significant 401(k) contributions, might see closer to 20% or less of their gross pay go to taxes.

This is why it’s so important to look at your actual pay stub. Those numbers are specific to you. They’re not just some abstract concept; they are the direct result of your income, your location, and your choices regarding benefits and savings.

The Irony of It All

And here’s where the irony really kicks in. We work hard, we earn money, and then a significant portion of it gets taken out before we even see it. We might grumble about it, we might curse the system, but in many ways, we’re also paying for the roads we drive on, the schools our kids might attend, the national parks we visit, and the safety nets that exist for those in need. It’s a complex relationship, our relationship with taxes.

It’s easy to feel like you’re just handing over money with no tangible return, especially when you’re struggling to make ends meet. But when you zoom out, you realize it’s the price of living in a society that provides a certain level of infrastructure and social services. Whether we always agree with how that money is spent is a whole other conversation, one that could fill several more articles (and probably a few heated debates over coffee).

The next time you get your paycheck, instead of just sighing and moving on, take a moment to look at those deductions. Try to understand what each one is for. It might not make the number any smaller, but it can make the process feel a little less like a mystery and a little more like an informed part of your financial life. And who knows, you might even feel a tiny bit of pride knowing you’re contributing to… well, everything. It’s a thought, anyway.