How Much Is Renters Insurance In California

California dreamin', right? Sunshine, beaches, and maybe even a celebrity sighting if you're lucky! But let's be real, living in the Golden State can sometimes feel like you're paying a small fortune for a closet with a view. And when it comes to your cozy California pad, you might be wondering, "How much is renters insurance in this land of avocado toast and endless summer?"

Spoiler alert: It's probably a lot less than you think! We're talking about a super affordable way to protect your precious belongings from life's little (or not-so-little) curveballs. Think of it like a superhero cape for your stuff, minus the awkward spandex.

The Price Tag: Is It Shockingly High?

Let's get down to brass tacks. The truth is, renters insurance in California is surprisingly budget-friendly. Most of the time, you'll be looking at a monthly cost that's less than your fancy coffee habit or that impulse purchase of a novelty pineapple ice cube tray. We're talking about amounts that won't make you want to sell a kidney to make rent.

On average, for a decent amount of coverage, you're probably looking at somewhere in the ballpark of $15 to $30 per month. Yes, you read that right! That's less than a few lattes from your favorite trendy cafe. Imagine, for the price of a couple of fancy coffees, you can have peace of mind!

What's Driving the Cost (Besides the Price of Avocados)?

Now, you might be thinking, "Okay, but why that much and not less?" Great question, Sherlock! Several factors play a role in determining your exact premium. It's not just a random number pulled out of a hat by a team of squirrels wearing tiny business suits.

One of the biggest players is the coverage amount you choose. This is basically how much protection you want for your stuff. If you're rocking a minimalist lifestyle with only a toothbrush and a dream, you'll likely pay less than someone with a collection of rare comic books and a home theater system that rivals a Hollywood premiere.

Your location within California also matters. Living in a bustling city with a higher chance of, say, a rogue skateboarder deciding your window is a perfect ramp might mean a slightly higher premium than living in a quiet, serene mountain town. We're not saying bad things will happen, but some areas are just statistically a little more... exciting!

The type of dwelling you rent can also be a factor. A charming bungalow might have different considerations than a high-rise apartment building. Think about things like shared walls and the overall structure of the building. It all adds up to the insurance puzzle!

Basically, the insurance company is trying to figure out how much risk they're taking on. The more valuable your stuff and the more potential there is for something to go wrong, the more they'll need to charge. It's like calculating the odds of winning the lottery, but way less exciting and much more practical.

The Magic Numbers: Coverage Levels

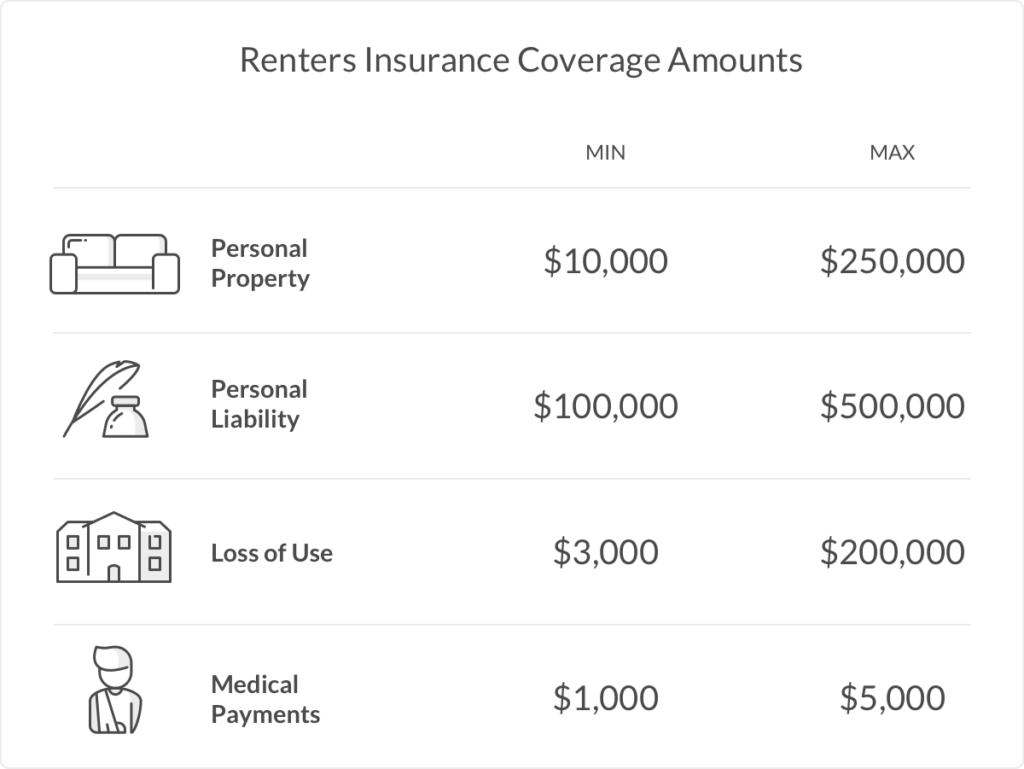

Let's dive deeper into that "coverage amount" thing. This is where you decide what your stuff is worth to you. Think about everything you own: your couch that’s seen better days but is still your beloved throne, your impressive collection of board games, that slightly chipped but sentimental coffee mug, your laptop that’s basically an extension of your brain.

Most renters insurance policies have two main parts: personal property coverage and liability coverage. Personal property is all about your stuff. It protects you if your belongings are damaged or stolen due to covered events like fire, theft, or certain types of water damage.

Liability coverage is like your trusty bodyguard if someone gets hurt in your rental. If, heaven forbid, a guest slips on a rogue banana peel (you know, the kind that just appears in California) and breaks their arm, liability coverage can help with their medical bills and legal expenses. Phew!

How Much is Enough? The Crystal Ball Approach

So, how much personal property coverage do you actually need? This is where a little bit of detective work comes in. Grab a notepad (or your phone's notes app) and do a quick sweep of your place. What's the value of your TV? That fancy espresso machine? Your entire wardrobe?

If you have a lot of high-value items, like expensive electronics, designer clothes, or musical instruments, you'll want a higher coverage limit. If you're more of a "Netflix and chill with a good book" kind of person, a lower limit might suffice. It's all about matching your insurance to your lifestyle, not your fantasy life!

For liability coverage, a common amount is $100,000. This sounds like a lot, but in the world of potential lawsuits, it's a good safety net. It’s like having a giant umbrella in case of a sudden downpour of legal troubles. You can usually increase this if you have particularly valuable assets to protect.

The Perks: Beyond Just Stuff Protection

Renters insurance is more than just a "break-glass-in-case-of-fire" policy. Many policies include additional living expenses (ALE) coverage. This is a lifesaver if your rental becomes uninhabitable due to a covered event.

Imagine your apartment suddenly becomes a makeshift water park because of a burst pipe. ALE coverage can help pay for hotel stays, meals out, and other temporary living costs while your place is being repaired. It’s like having a mini-vacation funded by your insurance, but a much less fun, forced kind of vacation.

Another cool perk can be loss of use coverage, which is very similar to ALE. It ensures you're not left out in the cold (or in this case, the warm California sun with nowhere to sleep!) if you can't live in your rental. It’s your safety net for unforeseen housing adventures.

The Deductible Deal: Your Share of the Pie

Now, let's talk about the deductible. This is the amount you pay out-of-pocket before your insurance kicks in. Think of it as your contribution to the "oh no!" fund.

You'll usually have a choice of deductibles, often ranging from $500 to $1,000 or even higher. A higher deductible typically means a lower monthly premium. It's a trade-off, like choosing between a slightly more expensive but delicious pastry and a cheaper, okay-ish one.

If you have a larger emergency fund and feel confident you can cover a higher deductible if needed, you might opt for one to save on your monthly payments. If you prefer smaller, more frequent payments and want a lower out-of-pocket cost in an emergency, a lower deductible might be your jam.

Saving Money: California Style!

Want to keep that renters insurance cost as low as a surfer's tan? There are a few tricks up your sleeve! Many insurance companies offer discounts for bundling your renters insurance with other policies, like your car insurance. It’s like getting a loyalty card for being a responsible adult!

Some companies might also offer discounts for things like having a good credit score, installing safety features in your rental (like a smoke detector that actually works!), or being claim-free for a certain period. So, keep those smoke detectors chirping and your credit score shining bright!

Finally, don't be afraid to shop around! Get quotes from multiple insurance providers. Prices can vary significantly, and you might be surprised by how much you can save by simply comparing offers. It’s like finding the best deal on a vintage surfboard – a little effort for a big reward!

So, to wrap it all up, renters insurance in California is your secret weapon against financial headaches. It’s an investment in your peace of mind that costs less than a fancy brunch. Don't let the fear of the unknown leave you unprepared. Protect your pad, protect your possessions, and keep on dreamin' that California dream!