How Much Is It To Do Your Taxes On Turbotax

Hey there, fellow tax-season warrior! So, you're staring down the barrel of tax season and wondering, "How much is this TurboTax thing actually going to cost me?" I totally get it. It feels like every year, taxes get a little more complicated, and we're all just trying to find the least painful way to get it done. And let's be honest, the word "taxes" itself can sometimes make us want to crawl back under the covers. But fear not! We're going to break down the TurboTax pricing like we're deciphering a secret code, but way more fun (promise!).

First things first, let's acknowledge the elephant in the room. You're not going to find a single, flat price for TurboTax. Nope. It's kind of like going to a buffet – there are different options, and you pay for what you pile on your plate. And just like that buffet, sometimes you think you're grabbing the basic salad, and then oops, a little detour for the prime rib and lobster tail happens. We've all been there, right?

The good news? TurboTax actually does a pretty good job of guiding you through the different versions, so you don't accidentally end up with the "deluxe everything" package when all you need is the "basic beans and rice." They’re pretty transparent about what each version offers, which is a breath of fresh air in the often-murky world of tax software.

The TurboTax Menu: What's on Offer?

Alright, let's dive into the different TurboTax flavors. Think of them as your tax-filing spirit animals, each suited for a different kind of taxpayer.

TurboTax Free Edition: The "I Just Want to Get This Over With" Special

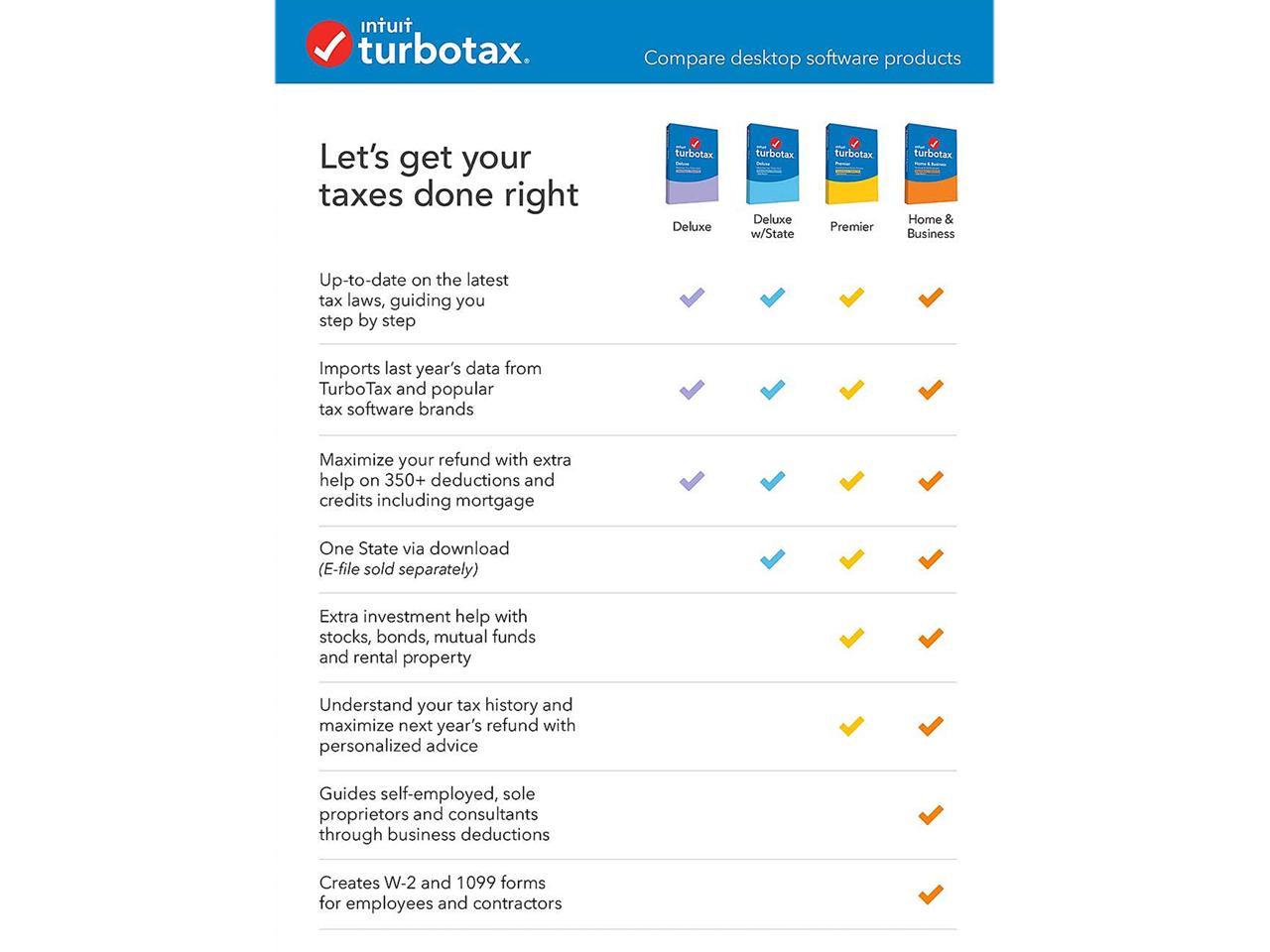

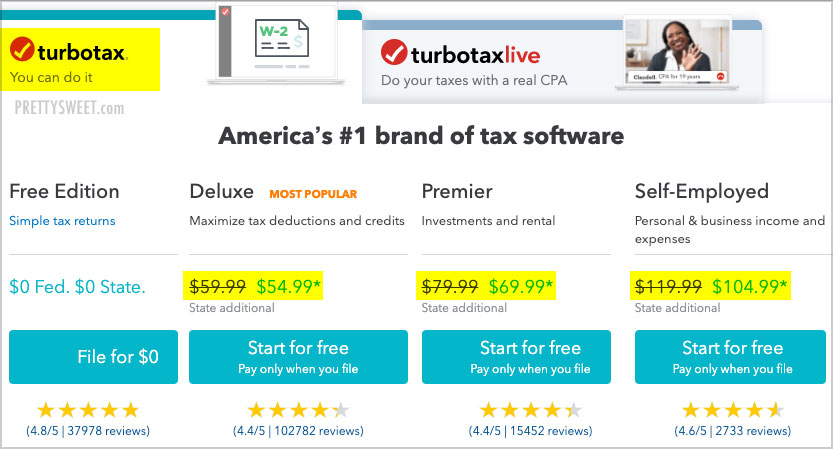

This is the superstar for a lot of people, and for good reason! If your tax situation is relatively simple, like you have W-2 income and not much else going on, then the TurboTax Free Edition might be your new best friend. Think of it as the "pay-as-you-go, no frills, but gets the job done" option.

What kind of "simple" are we talking about? Basically, if you're filing the standard Form 1040 and don't have a ton of deductions or credits to claim, this is usually your golden ticket. It's perfect for students, young professionals just starting out, or anyone who’s managed to keep their financial life… well, uncomplicated. And the best part? It's actually free. Like, $0. Nada. Zilch. Revolutionary, I know!

However, and this is a tiny but important caveat, sometimes your tax situation might start simple and then… poof… a wild crypto transaction appears! Or maybe you received a 1099-NEC for a little side hustle. In those cases, the Free Edition might tap out and say, "Whoa there, partner, you've crossed into TurboTax Deluxe territory!" But if you stick to the basics, this free version is a lifesaver.

TurboTax Deluxe: The "Slightly More Stuff, But Still Not Crazy" Choice

Okay, so your financial life isn't exactly a minimalist masterpiece. Maybe you have some common deductions or credits you want to claim. This is where TurboTax Deluxe often shines. Think of it as the "it’s getting a little interesting, but I still got this" option.

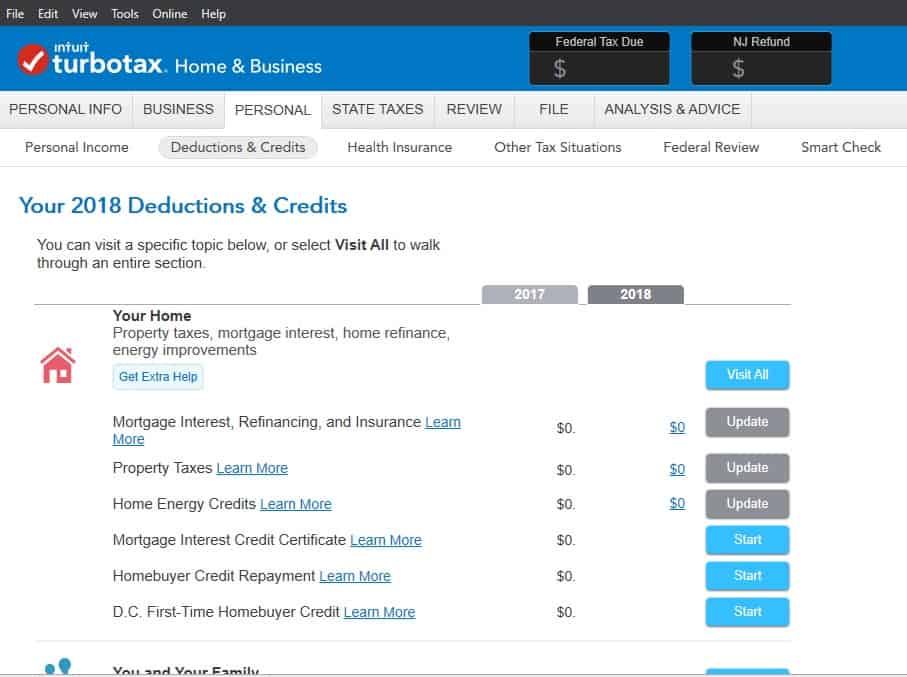

What does Deluxe usually cover? A lot of the everyday stuff that makes tax filing a tad more involved. This includes things like:

- Deductions for homeownership (hello, mortgage interest and property taxes!)

- Charitable contributions (feeling good about giving back and getting a tax break? Yes, please!)

- Education expenses (students, parents of students, anyone who’s ever paid for textbooks – this is for you!)

- Certain credits that can really knock down your tax bill.

If you're itemizing deductions, Deluxe is typically the minimum you'll need. And the price? It’s usually in the ballpark of $50-$70, depending on sales and whether you’re filing jointly or as an individual. So, still a pretty reasonable investment for peace of mind, wouldn't you say?

One of the cool things about TurboTax Deluxe is that it helps you figure out if itemizing is actually better for you than taking the standard deduction. It’ll crunch the numbers and say, "Yep, you’re saving X dollars by doing it this way!" It's like having a friendly accountant whispering helpful tips in your ear, but without the awkward small talk about the weather.

TurboTax Premier: The "Investment Savvy, Real Estate Mogul (or Aspiring One!)" Tier

Now we're moving into the territory of people with a bit more… financial flair. If you've got investments, like stocks and mutual funds, or you own rental properties, then TurboTax Premier is probably calling your name.

This version is built for taxpayers who are dealing with:

- Investment income (dividends, interest, capital gains from selling stocks – the whole shebang)

- Rental property income and expenses (got tenants? Got repairs? Premier helps you navigate that labyrinth!)

- Investing in cryptocurrency (yes, even your Bitcoin gains and losses get special attention here. TurboTax has gotten pretty good at this!)

The price for Premier usually hovers around the $70-$90 mark. It's a step up, but if you're tracking a lot of investment activity, the software's specialized features are invaluable. It makes importing your investment data a breeze and helps you uncover all those potential deductions and credits related to your financial endeavors. It's like giving your investments a little tax spa treatment.

Think of it this way: if your investments are doing well, you want to make sure you're not leaving any money on the table when it comes to taxes. Premier helps you do just that. It’s for the person who’s not afraid of a few more tax forms, because they know it means potentially more money back in their pocket (or less owed, which is also a win!).

TurboTax Self-Employed: The "Boss Babe/Hustle King/Queen" Version

Alright, independent contractors, freelancers, side-hustlers, small business owners – this one's for you! If you're earning income as an independent contractor, gig worker, or small business owner, you're going to want TurboTax Self-Employed.

This version is designed to handle the unique tax challenges of being your own boss. It’s built to help you:

- Track income from freelance work and side gigs (all those 1099s add up!)

- Deduct business expenses (home office, supplies, travel – the things that make your hustle happen!)

- Calculate and pay estimated taxes (this is a HUGE one to avoid penalties!)

- Understand self-employment taxes (hello, Social Security and Medicare contributions!)

The price for the Self-Employed version is typically the highest, often in the range of $90-$120. And why so much? Because the tax implications of self-employment are significantly more complex than a standard W-2 job. You're not just filing a personal tax return; you're also dealing with business expenses, deductions that can be tricky to navigate, and the whole shebang of self-employment taxes.

But here's the thing: if you are self-employed, this version is often worth every penny. It's not just about filing your taxes; it’s about maximizing your deductions and avoiding costly mistakes that could end up costing you way more than the software itself. It's like having a turbocharged business accountant at your fingertips.

The Sneaky Stuff: State Taxes and Extra Fees

Now, before you get too excited about the prices I’ve thrown around, there’s a little more to the story. Remember that buffet analogy? We're about to talk about the "add-ons" and the "oops, I didn't realize that cost extra" moments.

State Tax Returns: The Double Whammy (Usually)

Most of the time, when you buy a federal version of TurboTax (Deluxe, Premier, Self-Employed), it only covers your federal tax return. If you live in a state that has state income tax (and most do!), you'll likely need to file a state tax return as well. And guess what? That usually comes with an extra charge.

The cost for state returns can vary, but you're typically looking at anywhere from $40 to $50 per state. So, if you live in a state with income tax, you'll need to factor that into your total cost. If you happen to live in one of the few states with no income tax (lucky you!), then you can skip this extra expense.

TurboTax does have a State Free Edition for some situations, just like the federal Free Edition, but its availability depends on your state and the complexity of your return. So, always double-check what applies to your specific location.

TurboTax Live and Expert Services: When You Need a Real Person

Okay, so sometimes you want to DIY, but you also want the safety net of knowing there's a human being who can swoop in if things get hairy. This is where TurboTax Live and their expert services come in.

TurboTax Live is a pretty cool option. It basically means you have access to tax experts who can review your return before you file, answer questions as you go, or even help you finish your return if you get stuck. They're real CPAs and EAs (Enrolled Agents) who are there to guide you.

The cost for TurboTax Live is usually an additional fee on top of the version you choose. So, if you're using TurboTax Deluxe with Live, you'll pay the Deluxe price plus the Live fee. These fees can range from an extra $50 to $150 or more, depending on the level of support you need.

Then there are options like TurboTax Full Service, where an expert does your entire tax return for you. This is the most expensive option, but it's essentially like hiring a tax professional without having to leave your couch. The price here can be significantly higher, often starting at $150-$200 and going up.

Is it worth it? If you have a complex tax situation, feel completely lost, or just want the ultimate peace of mind, then yes, these live services can be a lifesaver. Think of it as hiring your own personal tax superhero.

Other Add-Ons and Things to Watch For

Just like that buffet, there can be other little things that pop up. TurboTax might offer add-ons for things like identity theft protection or specialized tax forms. Sometimes these are bundled in, and sometimes they're optional extras.

Also, keep an eye out for pricing changes throughout the tax season. TurboTax often has sales and promotions, especially closer to the filing deadlines. So, if you're not in a rush, you might be able to snag a deal. Conversely, waiting too long can sometimes mean paying a premium.

So, How Much Is It Really? The Grand Total Breakdown

Alright, let's try and put this all together in a way that makes sense. The final cost of doing your taxes with TurboTax depends on a few key factors:

- Your Tax Situation: Are you super simple (Free Edition), do you own a home or have student loans (Deluxe), do you invest heavily (Premier), or are you running your own business (Self-Employed)?

- State Taxes: Do you live in a state with income tax? If so, add that cost.

- Level of Support: Do you want to do it all yourself, get a review from an expert, or have an expert do it all for you?

Here’s a rough idea of what you might expect:

- Absolute Cheapest: If your taxes are simple enough for the Free Edition and you live in a state with no income tax, you could pay $0. Yes, it’s possible!

- Most Common DIY: For someone with W-2 income, some deductions (like student loans or charitable donations), filing jointly, and living in a state with income tax, you might be looking at something in the range of $50 (federal Deluxe) + $40-$50 (state) = $90-$100.

- Investor DIY: For someone with investments and state taxes, you might be looking at $70-$90 (federal Premier) + $40-$50 (state) = $110-$140.

- Self-Employed DIY: For a freelancer or small business owner with state taxes, expect something like $90-$120 (federal Self-Employed) + $40-$50 (state) = $130-$170.

- With Live Expert Help: Add anywhere from $50 to $150+ to the above estimates for federal Live assistance, and potentially more for state.

- Full Service: This is where costs can easily reach $150-$300+ depending on complexity and what’s included.

Important Note: These are estimates! Prices can fluctuate, and TurboTax often has different tiers of their software within each category (e.g., "Deluxe Download" vs. "Deluxe Online"). Always check the TurboTax website directly for the most current and accurate pricing for your specific situation.

The Takeaway: Making Tax Time Less Terrifying

So, there you have it! Doing your taxes with TurboTax can range from completely free to a couple of hundred dollars, depending on your needs. The key is to be honest with yourself about your tax situation and what you’re comfortable doing yourself.

The beauty of TurboTax is that it’s designed to be user-friendly. It asks you questions in plain English, and it guides you through the process step-by-step. Even if you’re not a tax whiz (who is, really?), you can usually navigate it successfully. And if you get stuck, that’s when you can consider the Live options.

Ultimately, TurboTax is a tool. It’s a tool to help you conquer tax season, get your return filed accurately, and hopefully, snag that sweet, sweet refund. Think of the money you spend on tax software not as an expense, but as an investment in your peace of mind and potentially, in your financial well-being. You're taking control, you're getting it done, and that, my friend, is something to feel really, really good about. Now go forth and conquer those taxes! You’ve got this, and a little bit of tech magic will help you get there with a smile (or at least, without a grimace!).