How Much Can You Make And Still Get Eic

Ah, the age-old question that sparks a little thrill and a whole lot of relief: "How much can I actually earn and still snag that sweet Earned Income Tax Credit (EIC)?" It's like a fun little financial puzzle, isn't it? You're working hard, bringing home the bacon, but you also want to take advantage of every bit of help the government offers. The EIC is a fantastic way for hardworking individuals and families to get a bit of a boost, especially if you're just starting out, raising a family, or navigating the ups and downs of the economy. Understanding the income limits is key to unlocking this valuable credit. Think of it as a secret handshake with the tax system – know the code, and you're in!

The Earned Income Tax Credit, or EIC, is a refundable tax credit designed to help low-to-moderate income workers and families. What does "refundable" mean? It means that if the credit is more than the taxes you owe, you get the difference back as a refund. It's not just about reducing your tax bill; it's about putting money back in your pocket! The primary purpose of the EIC is to offset the burden of payroll taxes and encourage work. It's a way to make working more financially rewarding for those who need it most. The benefits are pretty straightforward and incredibly impactful: it can significantly boost your annual income, help pay for essential expenses like rent, groceries, and childcare, and even allow for savings or investments in your future.

Understanding the EIC income limits is like having a superpower for your tax return!

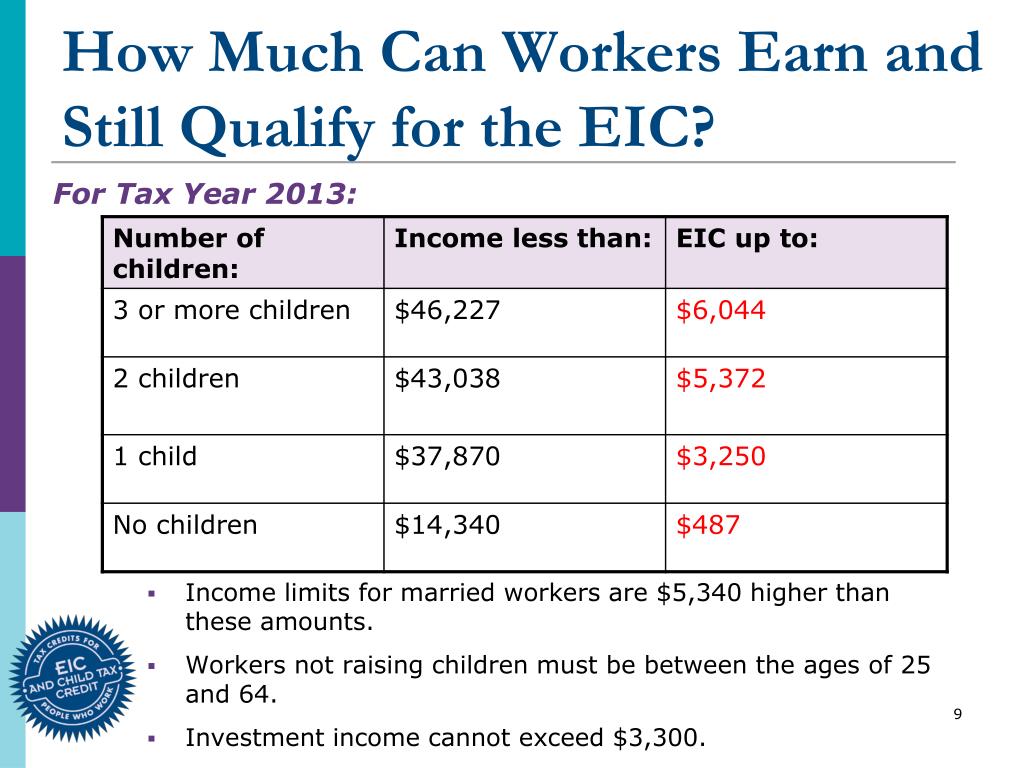

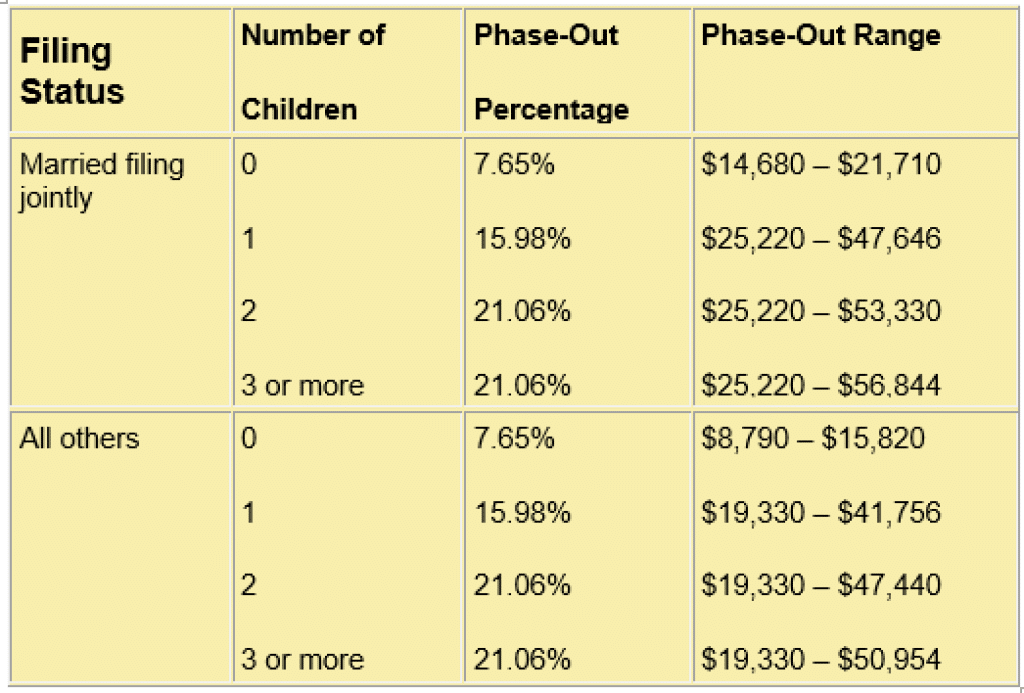

So, let's dive into the juicy part: the income numbers! The exact amounts you can earn and still qualify for the EIC change each year due to inflation adjustments. It's crucial to check the most up-to-date figures for the tax year you're filing. However, we can talk about the general framework. The EIC has two main income considerations: your earned income and your adjusted gross income (AGI). Generally, both of these need to be below a certain threshold to qualify.

The amount of EIC you can receive also depends on your filing status and the number of qualifying children you have. For instance, if you're filing as single, head of household, or qualifying widow(er) with no children, your income limits will be different than if you are married filing jointly. And, of course, the more qualifying children you have, the higher your potential credit amount can be, but there are also higher income thresholds for larger families. This makes the credit particularly beneficial for parents who are working hard to support their children.

Let's look at some ballpark figures for the 2023 tax year (which you'll file in 2024). These are just estimates, and you should always refer to the official IRS guidelines for the precise numbers.

- For someone with no qualifying children: Your earned income and AGI generally need to be less than about $17,640 if filing single, or $23,260 if married filing jointly.

- For someone with one qualifying child: Your earned income and AGI generally need to be less than about $49,019 if filing single, or $54,639 if married filing jointly.

- For someone with two qualifying children: Your earned income and AGI generally need to be less than about $55,314 if filing single, or $60,934 if married filing jointly.

- For someone with three or more qualifying children: Your earned income and AGI generally need to be less than about $59,187 if filing single, or $64,807 if married filing jointly.

It's important to remember that these are the maximum income limits. The actual amount of EIC you get is calculated based on your specific income, filing status, and the number of qualifying children. The credit amount increases as your income rises, up to a certain point, and then it gradually phases out as your income continues to increase. This phase-out is precisely why knowing the upper limits is so helpful!

What counts as "earned income"? It's primarily wages, salaries, tips, and other taxable compensation from working. It generally does not include things like unemployment benefits, alimony, or investment income. Your adjusted gross income (AGI) is your gross income minus certain deductions. These are usually found on your W-2 or self-employment tax forms.

Navigating tax credits can sometimes feel a bit daunting, but the EIC is a real game-changer for so many people. By staying informed about the income thresholds, you can maximize your tax benefits and ensure you're getting every dollar you deserve. So, keep up the great work, and don't forget to explore the possibilities of the Earned Income Tax Credit!