How Many Years Between Chapter 7 Bankruptcy

So, you’ve had a bit of a… financial adventure. Maybe a rogue unicorn ate your entire retirement fund, or your pet rock collection mysteriously developed a taste for designer handbags. Whatever the reason, you’re pondering the mystical number of years between Chapter 7 bankruptcies. And let me tell you, it’s not as simple as counting your lucky stars (unless those stars are currently being repossessed).

Imagine this: you’re at a fancy restaurant, right? And you’ve just finished your appetizer (your first bankruptcy). You’re eyeing that delicious second entree (your potential second bankruptcy). The waiter, a stern-looking fellow with a ledger as his bible, comes over and says, “Sir/Madam, for your next indulgence of debt erasure, you’ll need to wait a specific amount of time. No impulse bankruptcy orders here, folks!”

The magic number, my friends, is generally eight years. Yep, eight. That’s like waiting for a really, really long bus that’s perpetually stuck in traffic. You can’t just hop on the next bus after the first one leaves. The universe, or rather, the U.S. Bankruptcy Code, has rules. And these rules are about as flexible as a brick.

Why the Wait? It’s Not About Being Picky!

Now, you might be thinking, “Eight years? That’s practically an eternity! Can’t I just, you know, borrow some time from my future self?” Alas, no. The bankruptcy court isn’t a time-traveling pawn shop. The eight-year waiting period is designed to prevent people from treating bankruptcy like a revolving door at a casino. Imagine if you could just keep filing, getting a fresh slate, and then racking up debt again. It would be financial anarchy, and nobody wants that. Well, maybe a few people, but they’re usually the ones wearing tinfoil hats.

The law figures that after eight years, you’ve had a decent amount of time to, shall we say, recalibrate your financial trajectory. It’s like giving your budget a stern talking-to in the corner. It’s a chance to get your financial house in order, learn from your past spending sprees (did that solid gold toilet really come with a warranty?), and hopefully, build a more stable financial foundation.

But What If It’s Not Chapter 7?

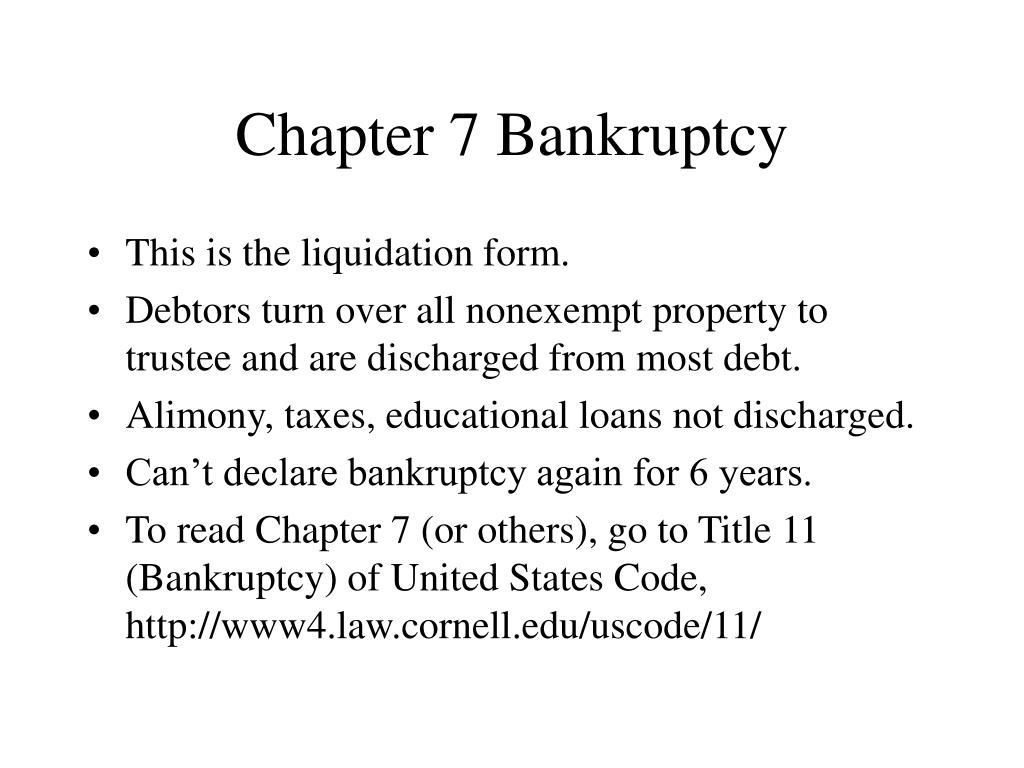

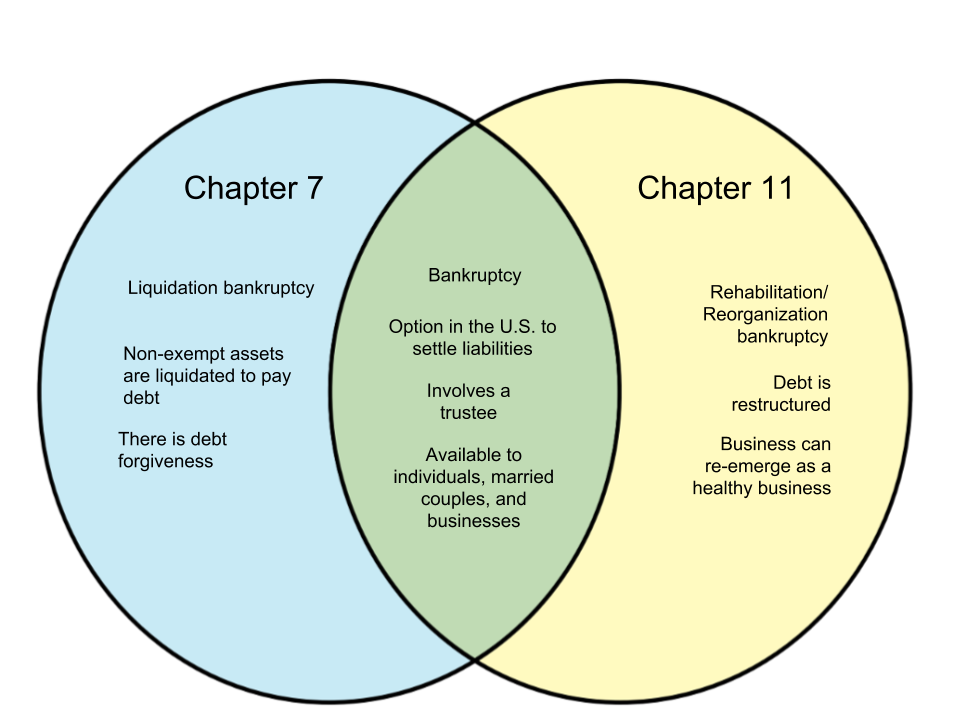

Ah, a keen observation! Because life, much like your credit score after a bankruptcy, is rarely that straightforward. While Chapter 7 is the one that wipes the slate clean (think of it as a cosmic “delete all” button for your debts), there are other types of bankruptcy. And these other types play nicely with the eight-year rule in different ways.

For instance, if you’ve previously filed for Chapter 13 bankruptcy, which is more like a payment plan for your debts, the waiting period is a bit more forgiving. If you successfully completed your Chapter 13 plan, you can usually file for Chapter 7 again after two years. That’s a much shorter wait, like swapping a leisurely stroll for a brisk walk. Two years feels more like a “oops, let’s try this again” than an “eight years in solitary confinement” situation.

But here’s the kicker: if your Chapter 13 was dismissed (meaning it didn’t go through properly, perhaps you forgot to pay your fairy godmother for her assistance) or converted to a Chapter 7, the clock might not even start ticking as favorably. It’s like going to a buffet, loading up your plate, and then realizing you forgot your wallet. You might not get a second helping anytime soon.

And for the truly daring (or desperate), if you filed for Chapter 7 bankruptcy twice within the eight-year window, the second filing might not discharge any debts. This means your debts from the first bankruptcy will still be hanging around like that one relative who never leaves after the holidays. It’s a grim thought, isn’t it? Like realizing your favorite ice cream flavor has been discontinued.

The “Subsequent Filing” Nuance: It’s Not Just About Time!

Now, let’s talk about the nitty-gritty. The law isn’t just looking at a calendar. It’s also looking at whether your previous bankruptcy was successful in discharging your debts. If your first Chapter 7 was somehow thrown out (maybe you tried to claim your pet rock collection as a dependent), that can mess with the timeline for your next one.

Think of it this way: if you didn’t actually get the full “debt-free” experience the first time around, the court is going to be extra cautious. They want to see that you’ve truly learned your lesson and aren’t just trying to play the system. It’s like trying to get a driver’s license after you’ve had your license revoked for joyriding on a unicycle. They’re going to make you do extra behind-the-wheel tests, and they’ll probably make you parallel park a minivan blindfolded.

The key phrase here is “subsequent filing.” If you file for Chapter 7, get your debts discharged, and then eight years later file for Chapter 7 again, the court will typically discharge the debts from your second filing. Hooray! You get to be debt-free again! It’s like winning the lottery, but instead of money, you get the sweet relief of not owing anyone anything. (Minus the taxes on that theoretical lottery win, of course.)

Surprising Facts You Didn’t Know (and Probably Didn’t Need to)

Here’s a fun little tidbit to chew on: the eight-year rule isn’t some ancient decree etched in stone by cavemen. It was actually established by the Bankruptcy Abuse Prevention and Consumer Protection Act of 2005. So, it’s a relatively modern concept, proving that even in the modern age, we still like to have rules about how people handle their money. Go figure!

![Chapter 7 vs Chapter 13 Bankruptcy [Infographic]](https://infographicjournal.com/wp-content/uploads/2020/07/Chapter-7-13-Comparison-feat.jpg)

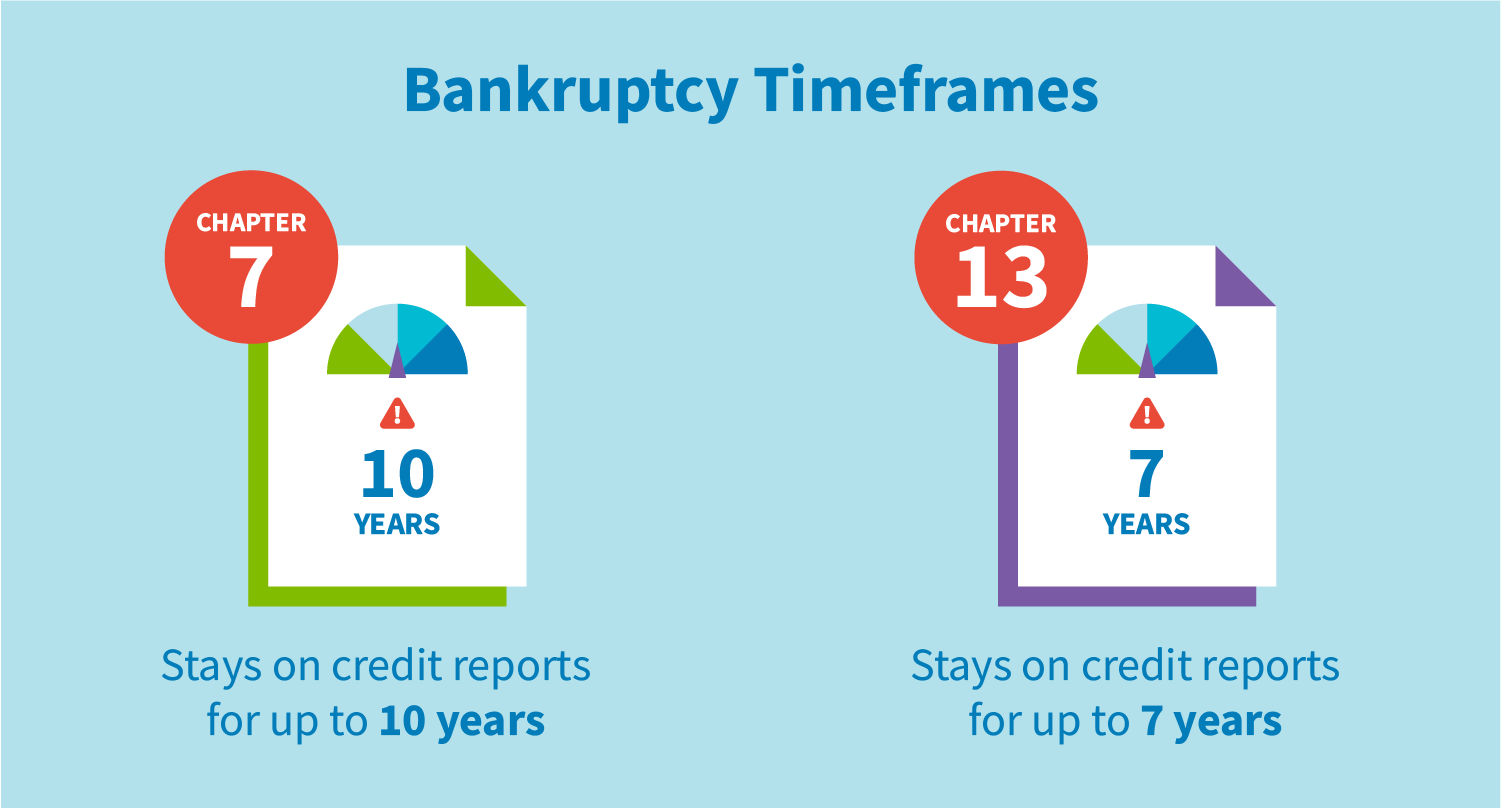

Another surprising fact is that the eight-year period is calculated from the date you filed your previous Chapter 7, not the date your case was discharged. So, don’t go around counting the days from when the judge finally said, “You’re free!” You need to look back at that initial filing date. It’s like trying to remember when you first started that ridiculously long Netflix binge – it’s the start date that matters!

Also, remember that this is a general guideline. There are always exceptions, and your specific situation might be unique. Consulting with a qualified bankruptcy attorney is like having a financial GPS that can navigate these tricky legal roads. They can tell you exactly when you can hit the “next bankruptcy” button without getting a ticket from the legal police.

So, the next time you’re contemplating a financial restart, remember the magic number: eight years for Chapter 7 after Chapter 7. It’s a long time, sure, but it’s also a chance to rebuild and come back stronger. Think of it as a financial hibernation. You emerge, refreshed, debt-free, and hopefully, with a newfound appreciation for the simple joy of having money in your wallet that actually belongs to you. Now, who wants to talk about budgeting for that solid gold toilet?