How Is The Dow Industrial Average Calculated

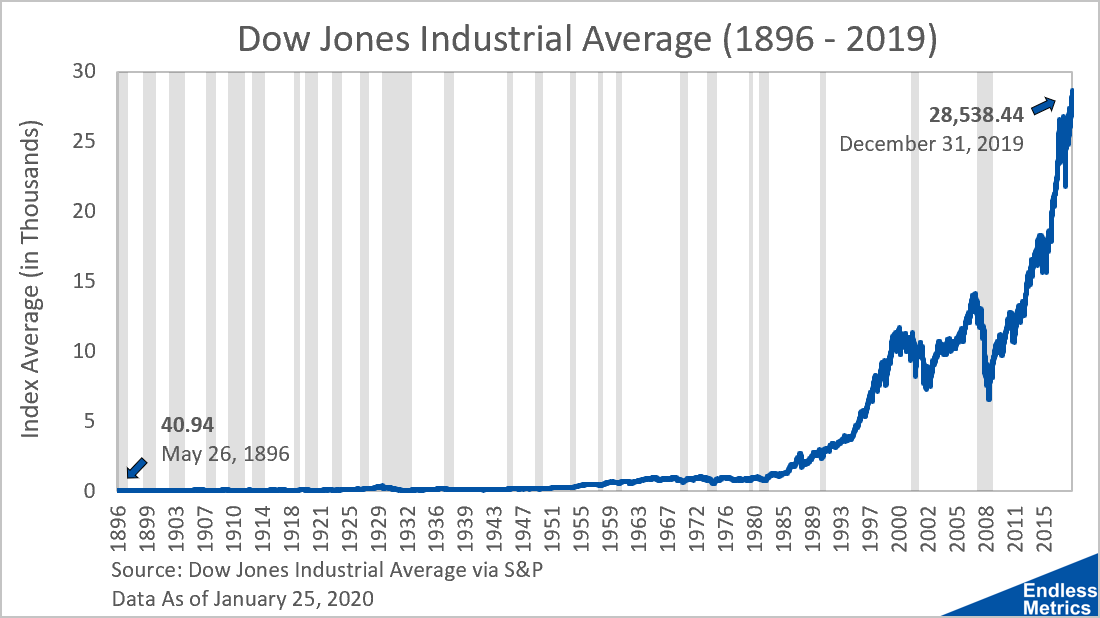

Picture this: It’s the late 1890s, a time when horse-drawn carriages were still king and the internet was, well, about as likely as a flying car. Two guys, Charles Dow and Edward Jones, were sitting around, probably nursing some strong coffee and wondering, "How are we supposed to know if the stock market is doing, you know, good or bad?" They were financial journalists, and frankly, the whole thing was a bit of a wild west. There wasn't some handy-dandy ticker tape spitting out a single number representing the entire market's mood. So, they decided to do something about it.

Their initial idea was pretty simple, actually. They picked a handful of companies – the big, important ones of their day, the ones everyone was talking about. Think railroads, manufacturing giants. They’d then take the stock prices of these companies, add them up, and divide by the number of companies. Voilà! Instant market snapshot. A bit like asking your friends how their day is going by just adding up their mood ratings and dividing. Pretty straightforward, right? But as you’ll see, the market, much like teenagers, can be a bit… complicated. And the way we track it has had to evolve to keep up.

Fast forward a century or so, and that little brainstorm has morphed into something we all hear about: the Dow Jones Industrial Average, or the DJIA for short. It’s this seemingly magical number that supposedly tells us whether the economy is pumping iron or hitting the snooze button. But how on earth do they get that number? Does it involve a secret handshake with a Wall Street wizard? A crystal ball? Nope, it’s actually a bit more… mathematical. And it’s evolved, believe it or not, from that original simple addition and division.

The “Average” in Dow Jones Industrial Average

Okay, so let’s break down this whole "average" thing. Remember our friends Dow and Jones picking a few stocks and adding them up? That was the foundational idea. But here's where it gets interesting, and where things start to feel a little less like adding up your friends’ moods and more like… well, something a bit more involved.

The DJIA doesn’t include all the stocks on the market. That would be a lot of numbers to crunch, even for our super-smart computers today. Instead, it’s a carefully curated list of 30 large, publicly traded companies. These aren't just random companies, mind you. They're supposed to represent the big players, the titans of American industry. Think names you've definitely heard of, like Apple, Microsoft, Coca-Cola, maybe even McDonald’s. They’re chosen because they're considered leaders in their respective sectors.

So, you’ve got your 30 companies. What’s the first step? You might think it’s just adding up the stock prices of all 30 companies. And you’d be… sort of right, for the original calculation. But that’s where the story gets a bit twisty.

The Original Simple Average (and why it’s not the whole story anymore)

Back in the day, when they first created the index, it was genuinely a simple average. If you had, say, 12 stocks, you’d add their prices together and then divide by 12. Easy peasy. The idea was that if the average price of these 30 big companies went up, the market was generally doing well. If it went down, things were looking a bit grim.

Let’s imagine a super-simplified, hypothetical Dow with just three stocks: Company A at $10, Company B at $20, and Company C at $30. The sum is $60. Divide by 3, and your Dow is 20. If Company A goes up to $15, Company B stays at $20, and Company C stays at $30, the new sum is $65. Divide by 3, and your Dow is now 21.67. See? It went up, mirroring the rise of one of its components.

But here's the kicker: a simple average has a problem. If one of those stocks splits its shares (you know, where one share magically becomes two, but the total value of your holding stays the same), or if a company pays out a big dividend, the stock price can change significantly without the underlying value of the company actually changing in a way that reflects broader market sentiment. This would mess up the "average" and give a false impression of market movement.

So, our intrepid financial wizards had to come up with a better way. And that’s where the Dow Divisor enters the picture. It’s not just dividing by the number of companies anymore. Nope.

Enter the Dow Divisor: The Secret Sauce (or is it?)

This is where things get a little more technical, but stick with me! The Dow Divisor is a number that’s adjusted over time to ensure that events like stock splits, stock dividends, and component changes don’t artificially distort the average. It’s the secret sauce that keeps the Dow from going haywire.

Think of it like this: imagine you have a recipe for a cake. If you suddenly double the amount of flour, the cake will be a mess, right? The Dow Divisor is like a magical ingredient that you tweak to keep the proportions of your "market cake" just right, even when some ingredients (stocks) change their size or get swapped out.

Here’s the magic formula, so to speak: Dow Jones Industrial Average = Sum of the prices of the 30 DJIA stocks / Dow Divisor.

So, instead of just dividing by 30, they divide by this much smaller, constantly changing number. This way, a $1 change in one stock has the same impact on the DJIA regardless of that stock's price. Pretty neat, huh?

How Does the Dow Divisor Change?

The Dow Divisor is adjusted whenever there's a stock split, a stock dividend, or when a company is added or removed from the index. Let's say a stock splits 2-for-1. Its price is halved. Without adjusting the divisor, the Dow would suddenly drop, making it look like the market tanked, when in reality, nothing fundamental has changed for that company. To prevent this, the divisor is adjusted downwards. The goal is to keep the value of the Dow the same immediately before and immediately after the event.

Imagine our super-simplified 3-stock Dow again: A=$10, B=$20, C=$30. Sum = $60. Let’s say the initial divisor was 3 (just for simplicity’s sake). Dow = 20. Now, Company A, which was $10, announces a 2-for-1 stock split. Its price becomes $5. The sum of prices is now $5 + $20 + $30 = $55.

If we kept the divisor at 3, the Dow would be $55 / 3 = $18.33. That’s a big drop! To prevent this, the divisor needs to be adjusted. The new divisor would be calculated so that the Dow remains the same immediately before and after the split. So, you’d take the new sum ($55) and divide it by the new divisor to get the old Dow value (20). So, $55 / New Divisor = 20. Therefore, New Divisor = $55 / 20 = 2.75.

Now, if Company A’s price goes back up to $10 (which it effectively is, considering you now have twice as many shares), the sum is $10 + $20 + $30 = $60. The Dow is $60 / 2.75 = $21.82. Notice how the divisor change kept the Dow from plummeting and then reflecting the true value?

.jpg)

It’s a bit like a seesaw. When the sum of the stock prices goes down (due to a split, etc.), the divisor gets smaller, lifting the Dow back up. When the sum of prices goes up (due to adding a higher-priced stock, for example), the divisor gets larger, bringing the Dow back down to a more manageable level.

Why Price Matters (and why it’s a bit weird)

Here’s where a lot of people get a bit confused. The Dow is a price-weighted index. This means that stocks with higher share prices have a greater influence on the index's movement than stocks with lower share prices. This is different from most other major stock market indexes, like the S&P 500, which are market-cap weighted.

What's market cap? It's simply the total value of a company's outstanding shares (stock price multiplied by the number of shares). In a market-cap weighted index, the biggest companies (by market cap) have the biggest say.

In the Dow, however, a $1 move in a $200 stock has twice the impact on the index as a $1 move in a $100 stock. So, if a company like, say, UnitedHealth Group (which historically has a higher stock price) moves up $5, it will push the Dow up more than if a company like, say, Boeing (which might have a lower stock price on that particular day) moves up $5.

Is this the most "accurate" way to represent the market? That's a debate for the economists! But it's how the Dow has always worked, and it's a key characteristic that sets it apart. It’s like saying the opinion of the loudest person in the room matters more, even if they don't have the most followers. It’s a feature, not a bug, of the Dow.

:max_bytes(150000):strip_icc()/DowJonesIndustrialAverage-af0c386c72c74e05b1ccc563b4a0ea06.jpg)

The Impact of Component Changes

And what about when a company gets swapped out? Say, Company X is replaced by Company Y. If Company Y has a much higher stock price than Company X, the sum of the 30 stocks will increase, and the divisor will be adjusted to compensate. The goal is to make the transition as seamless as possible, so the Dow doesn't suddenly jump or plummet just because a different company is now on the list.

It’s all about trying to create a continuous, relatively smooth line that represents the general trend of these 30 heavyweight companies. The divisor is the unsung hero, the behind-the-scenes magic that makes it all work. Without it, the Dow would be a chaotic mess of numbers, bouncing around based on every stock split or dividend payment.

So, What Does it All Mean?

At its core, the Dow Jones Industrial Average is a snapshot. It’s a way to quickly gauge the performance of 30 of the most influential companies in the U.S. economy. When you hear on the news that "the Dow is up 100 points," it’s telling you that, on average, the prices of those 30 stocks, adjusted for the divisor, have gone up.

It's not a perfect measure of the entire stock market, and it’s certainly not a perfect measure of the overall economy. It’s a specific, price-weighted index of 30 large companies. But it’s been around for a long time, and it’s become a widely recognized and understood benchmark. People look to it for a quick sense of market direction.

Think of it as your grandpa telling you how the weather is. He might not have a fancy weather app, but he’s seen a lot of storms and sunshine, and his general sense of things is usually pretty good. The Dow, with its history and its established methodology, is a bit like that – a seasoned observer giving us a temperature check.

And the calculation? It’s a bit more sophisticated than a simple average, thanks to that clever Dow Divisor. It’s designed to filter out the noise of stock splits and dividends, so you’re seeing a more consistent reflection of the underlying movement of these giant companies. It’s a testament to how financial tools have evolved to try and make sense of a constantly changing world. So next time you hear about the Dow, you'll know it's not just magic – it's math, with a little bit of historical evolution thrown in for good measure!