How Do You Find The Time In Simple Interest

Ever found yourself staring at a loan statement or a savings account summary and wondering, "Where does this extra bit of money come from?" Or maybe you've seen those investment ads promising a nice, steady growth and thought, "Is it really that simple?" Well, often, the magic behind those numbers boils down to a concept that's surprisingly straightforward and quite handy to understand: simple interest. It’s not just for mathematicians or bankers; it's a fundamental idea that helps us navigate our financial world, making it a little less mysterious and a lot more empowering.

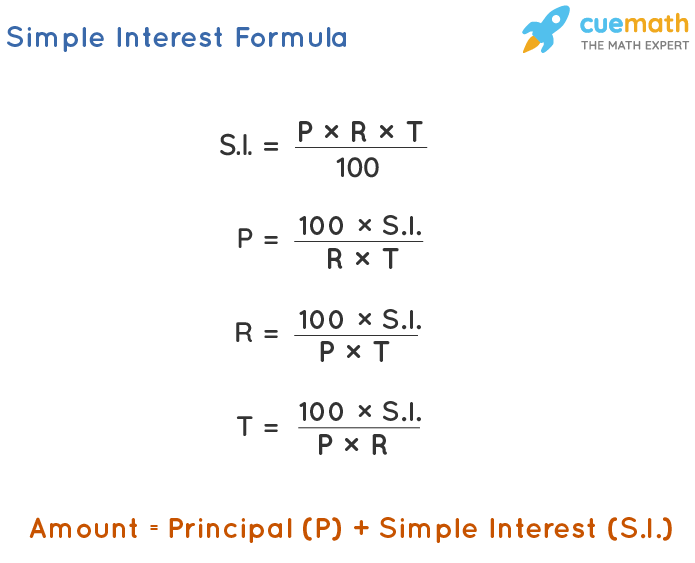

The beauty of simple interest lies in its name – it’s simple. Unlike its more complex cousin, compound interest, which often feels like a snowball rolling downhill, simple interest is a consistent, predictable growth. Its core purpose is to calculate the interest earned or paid on the initial amount of money, known as the principal, over a specific period. Think of it as a straightforward reward for lending your money, or a clear cost for borrowing it. This clarity is its biggest benefit, making it easy to grasp and apply.

So, where might you encounter this helpful little concept? In education, it’s a staple in middle and high school math classes, teaching students the basics of financial literacy. Imagine calculating how much interest you’d earn on a small savings bond your grandparents gave you – that's simple interest at play. In daily life, it pops up more often than you might think. When you take out a short-term loan, like a payday loan or a car loan, the interest is often calculated using a simple interest model. Even understanding the basic growth of a Certificate of Deposit (CD) often starts with the concept of simple interest before you consider compounding.

Let's look at a quick example. Say you deposit $1,000 into a savings account that offers a 5% simple interest rate per year. After one year, the interest earned would be 5% of $1,000, which is $50. So, your total would be $1,050. The next year? You earn another $50, bringing your total to $1,100. It’s a steady increase, always based on that original $1,000 principal. This predictable pattern makes it easy to budget and plan.

Curious to explore this further? You don't need a fancy calculator or a finance degree. Grab a piece of paper and a pen! Try calculating the interest on hypothetical amounts for different time periods. You can easily find simple interest calculators online with a quick search, which are great for double-checking your work or experimenting with different scenarios. Think about situations like lending a friend a small sum of money – you could agree on a simple interest rate to be fair. Or consider how much you might save by paying off a credit card balance quickly to avoid accumulating more interest. The more you play around with these numbers, the more intuitive understanding you'll develop. It’s a skill that can genuinely help you make smarter financial decisions throughout your life, and honestly, it’s not nearly as daunting as it might sound!