How Do You Fill In A Cheque? Step-by-step Answer

Remember those beautifully printed pieces of paper that used to flood our mailboxes, promising everything from birthday cash to thank-you notes? Yep, we're talking about cheques. While digital payments and instant transfers have definitely taken centre stage, there's still a certain charm and undeniable practicality to a good old-fashioned cheque. And if you've found yourself staring at a blank one, perhaps inherited from a generous aunt or needed for that quirky independent bookstore, you might be wondering, "So, how do I fill in this thing?" Fear not, fellow modern mover-and-shaker! We're about to demystify the cheque-writing process, making it as breezy as a Sunday brunch. Think of this as your chill guide to navigating the wonderfully analogue world of cheques.

The Art of the Cheque: More Than Just Paper

Before we dive into the nitty-gritty, let's appreciate the cheque for what it is. It's a promise. A tangible, verifiable promise that your bank will transfer a specific sum of money from your account to someone else's. It's like a mini I.O.U. with official bank backing. In a world of fleeting digital interactions, there's a satisfying finality to it, don't you think? Plus, for certain transactions, like paying for a vintage vinyl collection at a flea market or contributing to a local charity that prefers the old ways, a cheque can be surprisingly relevant. It’s also a fantastic way to teach younger generations about financial responsibility – a hands-on lesson in value and exchange.

Think of it as a bit of financial calligraphy. While it might seem daunting, once you get the hang of it, it becomes second nature. We're not talking about mastering Renaissance script here, just a few key pieces of information. So, grab that pen (a good one, please! No leaky biros allowed in cheque-writing etiquette), and let's get started.

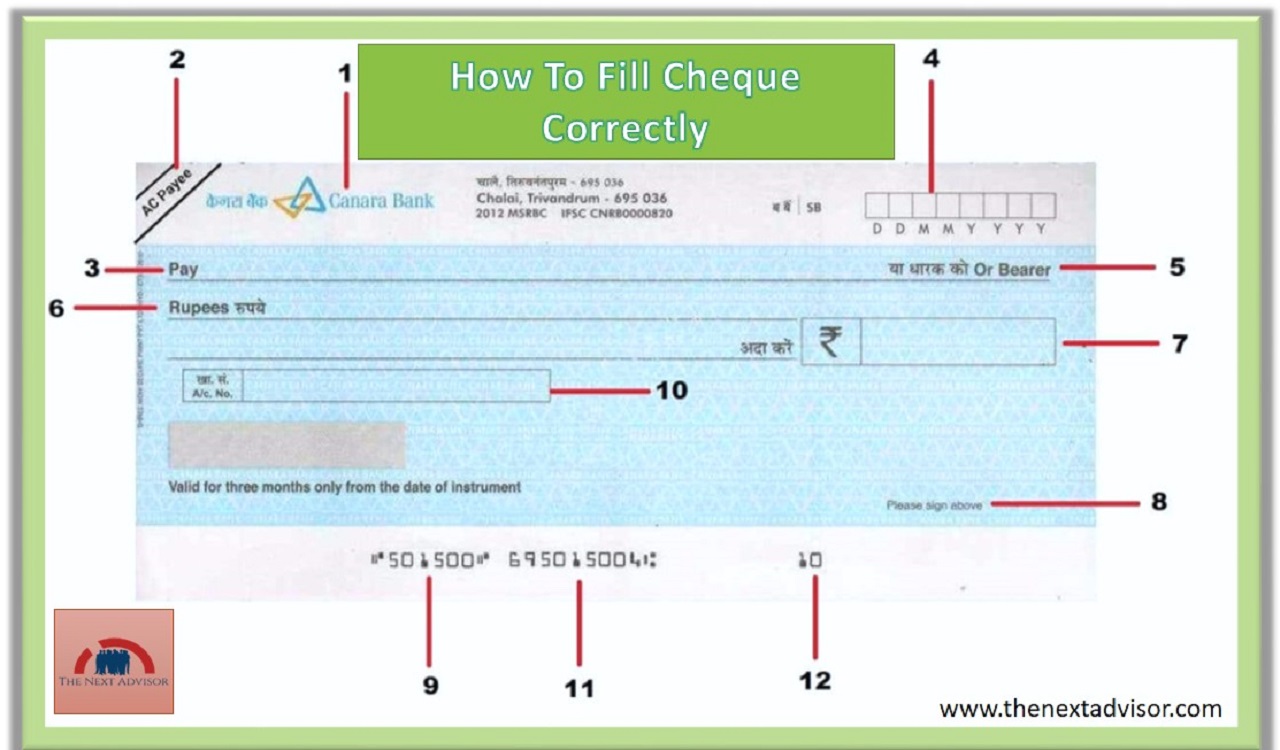

Part 1: The "Pay to the Order of" Line – Who Gets the Goodies?

This is arguably the most crucial part. This is where you clearly state who you want to receive the money. Be precise!

For Individuals: Write the full legal name of the person. If it’s your friend Sarah Miller, write "Sarah Miller". Avoid nicknames like "Sazzy" or "Sal," unless you're absolutely certain that's how they've registered their account (which is highly unlikely!).

For Businesses: Use the exact legal business name. This might be "The Coffee Bean Cafe LLC" or "Acme Corporation." If you're unsure, ask for their official business name. It’s better to be a little too formal than to have your cheque bounced because of a name mismatch.

For Organisations/Charities: Again, use their official registered name. "Friends of the Park Foundation" is better than "The Park People."

Pro-Tip: If you're paying a business and you only know their trade name (e.g., "Pizza Palace"), but their official legal name is "Global Food Services Inc.," you can often write "Pizza Palace (a division of Global Food Services Inc.)". However, for maximum clarity, the legal name is always best. It’s like knowing someone’s full name versus their handle on social media – one is more official!

Fun Fact: In the early days of banking, cheques were sometimes used to pay for extravagant purchases like racehorses or even small parcels of land. The principle remains the same: a clear instruction for payment!

Part 2: The Memo Line – Your Personal Note

This little box, often labelled "Memo," "For," or "Re," is your personal note-taking space. It's not legally binding, but it's incredibly useful for your own record-keeping.

What to Write: This is where you can be specific about the purpose of the cheque. Examples include:

- "Rent - May 2024"

- "Birthday Gift for Mom"

- "Invoice #12345"

- "Reimbursement for Dinner"

- "Donation to Animal Shelter"

Why It Matters: When you eventually receive your bank statement (or check it online), this memo will help you remember what that outgoing payment was for. It’s like a mini diary entry for your finances, helping you track your spending effortlessly. Imagine trying to recall every single payment from months ago without these little reminders!

Cultural Nugget: In some cultures, particularly in Asia, it's common to write auspicious phrases or good luck wishes in the memo line when giving a cheque as a gift for occasions like weddings or birthdays. It adds a layer of personal blessing to the financial transaction.

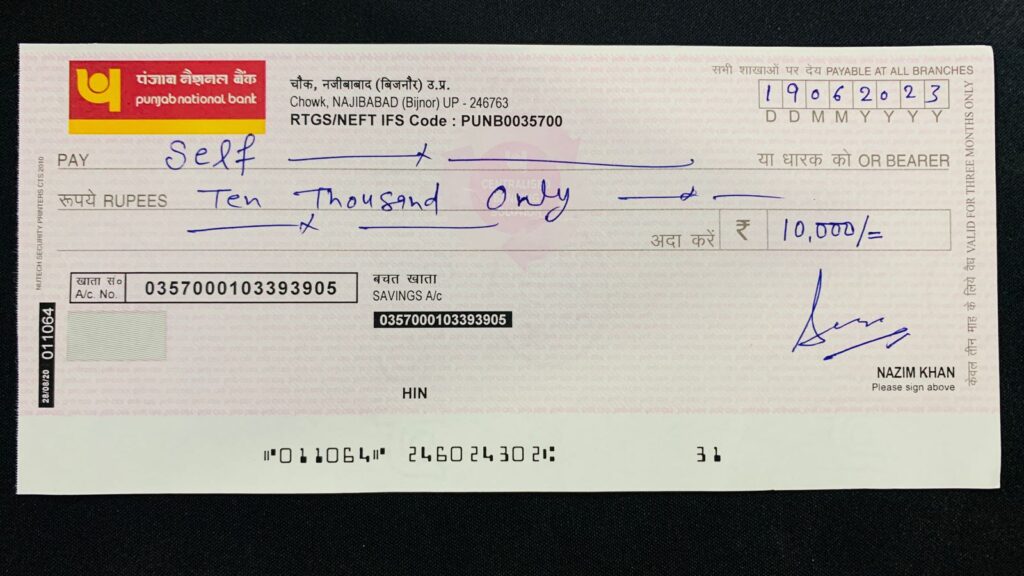

Part 3: The Numeric Amount – The Dollar Signs!

This box, usually located in the top right corner, is for writing the amount of the cheque in numbers. This is where you'll use those familiar digits.

How to Do It: Write the dollar amount clearly, using a decimal point for cents. For example, if you're paying $50.75, you'd write "50.75". If it's a whole dollar amount, like $100, you can write "100." or "100.00".

Important: Make sure the number here exactly matches the amount you write out in words on the next line. Any discrepancy can cause issues or even lead to the cheque being rejected. It's a double-check system, really.

Tip: Draw a line through any unused space after the numbers to prevent someone from adding extra digits and altering the amount. So, if you write "50.75", extend a line through to the edge of the box: "50.75------".

Fun Fact: Before the widespread adoption of Arabic numerals, amounts were sometimes written out in Roman numerals. Imagine deciphering an “LXXV” for seventy-five on a cheque!

Part 4: The Written Amount – The Words Matter!

This is the line where you write out the amount of the cheque in words. This is considered the more legally binding amount, should there be a dispute. So, pay close attention here!

How to Do It:

- Write out the dollar amount. For example, "Fifty and 75/100".

- The word "and" separates the dollars from the cents.

- The cents are written as a fraction over 100. So, 75 cents becomes "75/100".

Let's break it down with an example: If the numeric amount is $123.45, you would write: "One Hundred Twenty-Three and 45/100".

If it’s a whole dollar amount, like $200: You can write "Two Hundred and 00/100" or simply "Two Hundred". Many banks accept "Two Hundred Only." For extra clarity and to prevent any funny business, writing "Two Hundred Dollars Only" is a good practice.

Pro-Tip: Use a pen and write neatly. Once you write this out, draw a line from the last word to the end of the line. This ensures no one can add words to increase the amount. For instance, if you wrote "Fifty and 75/100", you'd draw a line like this: "Fifty and 75/100--------------------".

Cultural Observation: In some countries, the format for writing the amount in words might differ slightly. For instance, in the UK, you might write "Fifty pounds and seventy-five pence." Always stick to the conventions of the currency and country your cheque is drawn from.

Part 5: The Date – When Was This Promise Made?

This is straightforward. In the top right corner, next to the numeric amount (or sometimes in its own dedicated box), you'll find a space for the date. Fill it in with the current date when you are writing the cheque.

Format: The most common formats are MM/DD/YYYY (e.g., 05/15/2024) or DD/MM/YYYY (e.g., 15/05/2024). Your chequebook or bank will usually indicate the preferred format. If not, be consistent. Writing out the month name (e.g., May 15, 2024) is also perfectly acceptable and often clearer.

Post-Dated Cheques: You might sometimes hear about "post-dated cheques." This is when you write a date in the future. While legally valid in some contexts, many banks prefer not to process post-dated cheques until the date arrives. It's generally best practice to issue cheques with the current date unless you have a specific agreement with the recipient.

Fun Fact: The concept of dating cheques is to provide a record of when the transaction was initiated, which can be important for accounting and legal purposes. It’s a historical timestamp of your financial commitment.

Part 6: The Signature – Your Seal of Approval!

This is the final, and arguably most important, step. In the bottom right corner, you'll find a line for your signature. This is your official confirmation that the cheque is valid and you authorize the payment.

Sign It: Use the same signature you would use on other important documents, like your driver's license or passport. It doesn't have to be an elaborate flourish; it just needs to be recognizable as yours.

Don't Forget: This is the one place where you absolutely cannot skip. An unsigned cheque is essentially a blank piece of paper and cannot be cashed.

What if You Mess Up? If you make a mistake on a cheque, don't try to scribble it out or use correction fluid. It can invalidate the cheque. The best approach is to write "VOID" clearly across the front of the cheque and start a new one. Keep the voided cheque for your records.

Part 7: The Cheeky Bits – Routing and Account Numbers

At the bottom of the cheque, you'll see a series of numbers. These are crucial for the banking system to process your cheque. You don't need to fill these in; they are pre-printed by your bank.

Routing Number: This is typically a 9-digit number that identifies your bank. It's like the bank's social security number. It's usually on the left side.

Account Number: This is your personal bank account number. It's usually longer than the routing number and is on the right side.

Check Number: Often, there's a third, shorter number on the far right. This is the cheque number itself, part of your chequebook sequence.

Keep Them Safe: Treat your chequebook and the information on it like you would your debit card. Don't leave them lying around where others can access them.

A Modern Cheque: Still a Useful Tool

So there you have it! Filling out a cheque is not some arcane ritual reserved for a bygone era. It's a simple, methodical process that, once mastered, can be incredibly useful. Whether it’s for a specific purchase, a gift, or a vendor who still prefers the tangible, cheques have their place in our increasingly digital lives.

Think of it this way: in a world of infinite scrolling and ephemeral messages, there’s something grounding about a piece of paper that represents a concrete financial commitment. It’s a moment of focused intent in a fast-paced world. And when you hand over that perfectly filled cheque, you can feel a sense of accomplishment, a little nod to financial tradition. It’s a small act of control in a universe of variables, a tangible promise delivered. So next time you’re faced with a cheque, don’t sweat it. Just follow these simple steps, and you'll be a cheque-writing pro in no time. It's a small skill, but one that adds a touch of sophistication to your financial repertoire, proving that sometimes, the old ways still have a lot to offer.