How Do You Estimate Closing Costs On A House

So, you've found the one. That house with the perfect kitchen for your sourdough experiments, the backyard begging for string lights and impromptu dance parties, or maybe just a roof that doesn't leak like a sieve. It’s exciting, right? The dream is practically within reach. But then, like a sudden rain shower on your picnic, the topic of closing costs pops up. Cue the slight furrow of the brow. What exactly are these mysterious fees, and how do you even begin to estimate them without needing a calculator the size of a pizza box?

Don't worry, we’re not talking about deciphering ancient hieroglyphs here. Think of closing costs as the final, friendly handshake you give to all the people who helped make your homeownership dream a reality. It's a bundle of fees that covers everything from the paperwork to the property survey. And while it might seem like a lot, breaking it down makes it way less daunting. Consider this your gentle guide, your chill companion, as we navigate the waters of home-buying finances.

The "Before You Even Get There" Prep

Before we dive deep into the nitty-gritty, let's set the stage. The estimate you receive upfront, often called the Loan Estimate, is your best friend in this initial phase. It's a standardized document, so all lenders have to present it in a similar format, making it easier to compare apples to apples. Think of it like a menu at your favorite restaurant; it lays out all the potential dishes (costs) you'll be ordering.

This Loan Estimate will typically come your way within three business days of officially applying for your mortgage. It’s crucial to review it carefully. Don't just skim! Highlight anything that seems unclear or high. Remember, this is a negotiable process, and your lender is there to answer your questions, not to baffle you with jargon.

A fun fact: the Loan Estimate was a result of regulatory changes aimed at making the closing process more transparent. Before this, buyers often received a confusing pile of papers, leading to more than a few "wait, what am I paying for?" moments. So, be grateful for this organized breakdown!

The Big Players: What's Actually In Those Costs?

Alright, let's get down to business. Closing costs generally fall into a few main categories. We’re talking about fees for the lender, fees for the title company, government recording fees, and prepaid items. Let’s break them down, like a perfectly layered trifle.

Lender Fees: The Gatekeepers of Your Loan

These are the fees your mortgage lender charges for originating and processing your loan. They're essentially getting paid for the service of lending you a significant chunk of change.

Origination Fee: This is a fee charged by the lender for processing the loan application. It’s usually a percentage of the loan amount, often around 0.5% to 1%. Think of it as the "thank you for letting us handle this" fee.

Underwriting Fee: Lenders have to assess your financial stability to make sure you’re a good bet. This fee covers the cost of that assessment. It’s like the detective work that goes into ensuring you're ready for this big step.

Discount Points: This is an interesting one. You can choose to pay for discount points upfront to lower your interest rate over the life of the loan. Each point typically costs 1% of the loan amount. This is a strategic move, and whether it’s worth it depends on how long you plan to stay in the home. If you're a mover-and-shaker, it might not be the best bet. If you're planning to nest for decades, it could save you a fortune. It's like buying a bulk discount on your future happiness!

Appraisal Fee: Your lender needs to know the fair market value of the home. An appraiser will assess the property and provide a report. This ensures that the loan amount is in line with the home’s worth. It's a crucial step to protect both you and the lender.

Credit Report Fee: They need to check your credit history, and that costs money. Simple as that.

Title Company Fees: The Guardians of Ownership

The title company plays a vital role in ensuring that the property you're buying is free and clear of any liens or ownership disputes. They're the unsung heroes making sure your ownership is solid.

Title Search Fee: The title company searches public records to verify the seller’s legal ownership and to uncover any existing claims or encumbrances on the property. It’s like a deep dive into the home’s past to make sure there are no skeletons in the closet. Remember that time you found an old photo album and realized your grandma had a secret poodle phase? This is kind of like that, but for deeds and mortgages.

Title Insurance: This is a biggie. You’ll typically need two types: lender’s title insurance (to protect the lender) and owner’s title insurance (to protect you). This insurance protects against future claims on your property that may have been missed during the title search. It’s a one-time premium paid at closing, and it provides peace of mind for years to come. Think of it as a superhero cape for your ownership.

Settlement or Closing Fee: This is the fee the title company or closing attorney charges for coordinating the entire closing process, from handling paperwork to disbursing funds. They are the conductors of your financial orchestra.

Government Fees: The Price of Officialdom

These are fees charged by local or state governments for recording the new ownership and mortgage documents.

Recording Fees: When you buy a house, the deed and mortgage documents need to be officially recorded with the local government. This fee covers that administrative task. It’s the government's way of saying, “Yep, this is official now!”

Transfer Taxes: Some states and municipalities charge a tax when property ownership is transferred. This can be a significant cost, so it's important to know if your area has them and how they’re calculated.

Prepaid Items and Escrow: The Future-Proofing Fund

These are costs that cover services and taxes that will be due in the future, often paid upfront at closing to get you started.

Property Taxes: You’ll likely need to pay a portion of your upcoming property taxes at closing. Your lender wants to ensure these are covered, so they’ll often set up an escrow account to handle future payments.

Homeowners Insurance: Just like property taxes, your lender will require you to have homeowners insurance. You’ll typically need to pay the first year’s premium upfront. And if you have a mortgage, they’ll usually require you to have an escrow account for future insurance payments.

Private Mortgage Insurance (PMI): If your down payment is less than 20% of the home's purchase price, you'll likely have to pay for PMI. This protects the lender in case you default on the loan. PMI premiums are often paid monthly, but a portion might be due at closing.

Putting It All Together: The Estimation Game

So, how do you actually estimate all of this? The general rule of thumb is that closing costs can range from 2% to 5% of the loan amount. This is a broad range, and it can vary quite a bit depending on your location, the lender you choose, and the specifics of your loan.

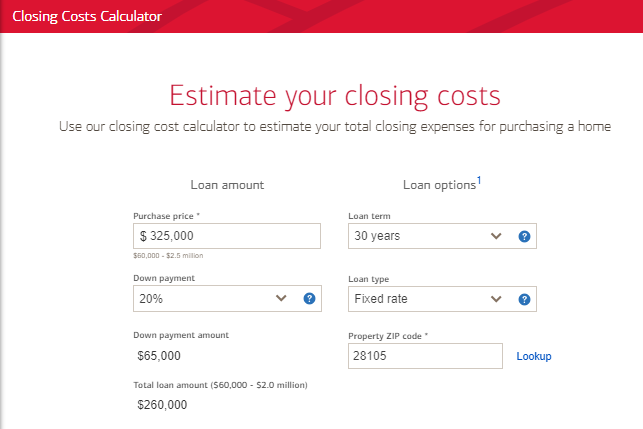

Your Best Tool: The Loan Estimate. Seriously, this document is designed for estimation. It breaks down each fee. You can also plug numbers into online closing cost calculators, but remember these are just estimates. The Loan Estimate from your lender is the most accurate representation you'll get at that stage.

Don't Forget Your Local Flavors. Some areas have higher title insurance costs, more robust recording fees, or specific local taxes. A quick Google search for "[your city/state] closing costs" can give you a general idea, but always rely on your lender's estimate for specifics.

Negotiation is Your Friend. While some fees are non-negotiable (like government recording fees), others, like origination fees or even title insurance, might have some wiggle room. Don’t be afraid to ask your lender if there’s any flexibility. You could also shop around with different lenders; their fees can vary.

Think of it like planning a trip. You know you'll need to budget for flights, accommodation, and food. But then there are the little extras: that souvenir you had to have, the fancy gelato, the unexpected taxi ride. Closing costs are similar. You have the big-ticket items, and then the smaller fees that add up.

A Little Fun Fact to Keep You Smiling

Did you know that the concept of a "down payment" has roots in ancient Babylonian law? While the specifics have changed dramatically, the idea of putting a portion of the price down to secure a purchase has been around for millennia. So, in a way, you’re participating in a very, very old tradition!

The Home Stretch: What to Expect on Your Final Closing Disclosure

A few days before your closing, you'll receive the Closing Disclosure. This is the final, itemized bill for your home purchase. It should be very similar to your Loan Estimate, with any last-minute adjustments clearly explained. This is your last chance to spot any major discrepancies before you sign on the dotted line.

It’s also important to note that some closing costs are tax-deductible. While this isn't an estimation tip, it's a nice little perk to keep in mind for tax season. Things like points you pay to get your mortgage can often be deducted.

A Moment of Reflection: Beyond the Numbers

Thinking about closing costs can feel a bit like staring at a giant to-do list. It’s a necessary step, but it can feel like a hurdle. But here’s the thing: every single one of those fees represents a service, a protection, or a necessary step in transferring ownership of what will likely be the biggest investment of your life. It’s the cost of entry into a whole new chapter.

Just like managing your weekly grocery budget or planning for that much-needed vacation, understanding and estimating closing costs is about being prepared and making informed decisions. It’s about taking control of your financial journey. And when you finally get those keys in your hand, and you’re standing in your new home, you'll know that every bit of that preparation was worth it. It’s the price of admission to your own slice of paradise, and that, my friends, is a pretty sweet deal.