How Do I Open A Trust Fund? Simple Steps That Work

Ever dreamt of a magic money tree that grows for your loved ones long after you've, well, gone? Or maybe you're thinking about setting up a sweet little nest egg for your future grandkids, or even for a cause you're super passionate about? Well, guess what? You don't need a wizard's wand or a pirate's treasure map to make that happen. Opening a trust fund might sound a bit fancy, but it's actually a super accessible and incredibly smart way to manage your assets and ensure they go exactly where you want them to, when you want them to. It's like giving your money superpowers, allowing it to do good and continue your legacy on its own terms. Plus, in the world of financial planning, it's a popular and powerful tool, offering flexibility and control that other methods just can't match.

So, What Exactly is a Trust Fund, Anyway?

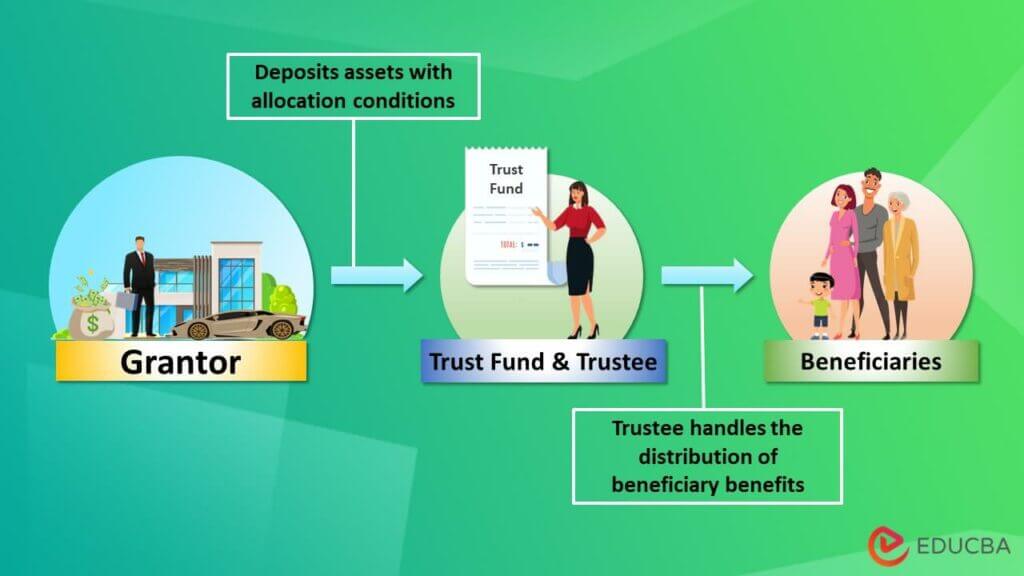

Think of a trust fund as a special legal arrangement. You (the grantor or settlor) transfer ownership of your assets – like money, property, or investments – to a trustee. This trustee then manages those assets according to the rules you've set out in a trust document, for the benefit of designated beneficiaries. It's like appointing a responsible friend to look after your prized possessions and give them out to specific people when the time is right. Simple, right?

Why Bother? The Awesome Benefits of Trusts

The benefits of setting up a trust fund are pretty compelling, and they go way beyond just passing down wealth. Here are some of the highlights:

- Privacy: Unlike a will, which becomes a public document after your death, a trust is generally private. Your family's financial details and your wishes remain confidential. Sneaky good, right?

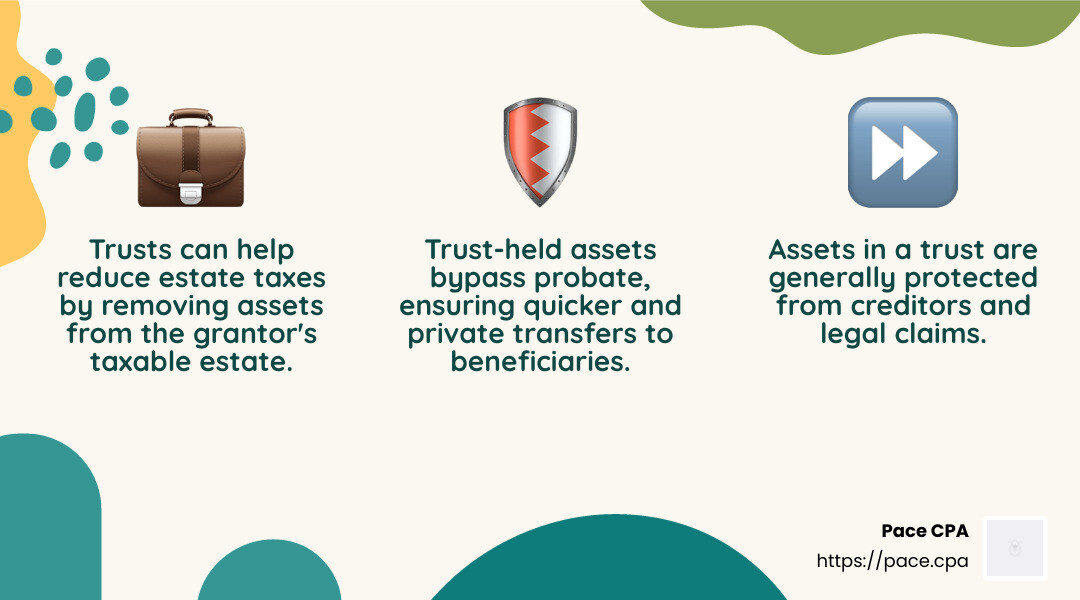

- Avoiding Probate: This is a big one! Assets in a trust typically bypass the often lengthy, expensive, and public process of probate court. This means your beneficiaries can get their inheritance much faster and with less hassle. Who wants to wait around for the legal system when there's fun stuff to do with that money?

- Control and Flexibility: You get to call the shots! You can specify exactly how, when, and for what purposes your beneficiaries receive funds. For example, you could set it up so a child only receives money for education or a down payment on a home, preventing it from being frittered away. It’s like having a remote control for your legacy!

- Protecting Beneficiaries: Trusts can be invaluable for beneficiaries who are minors, have special needs, or might not be the most financially savvy. The trustee ensures the funds are managed responsibly for their long-term well-being.

- Estate Tax Benefits: Certain types of trusts can help minimize estate taxes, preserving more of your wealth for your heirs.

- Charitable Giving: You can establish trusts specifically for charitable purposes, ensuring your philanthropic goals are met.

Let's Get Down to Business: Simple Steps to Opening Your Trust

Alright, ready to roll up your sleeves and make some financial magic happen? Here’s a simplified roadmap. Remember, while this is a guide, consulting with professionals is always a smart move!

Step 1: Figure Out Your "Why" and "What"

Before you even think about legal jargon, get clear on your goals. Who do you want to benefit? What assets will go into the trust? Do you want to protect someone? Do you want to control how the money is spent? Answering these questions will help you choose the right type of trust and ensure it's set up perfectly for your situation.

Step 2: Choose Your Trustee Wisely

This is a critical decision. Your trustee will be responsible for managing the trust assets and distributing them according to your wishes. They should be someone you trust implicitly, who is organized, responsible, and understands financial matters. This could be a family member, a friend, or even a professional trustee (like a bank or trust company). Think carefully – this person holds a lot of power!

Step 3: Decide on the Type of Trust

There are many types of trusts, but for most people starting out, the two main categories are:

Revocable Living Trusts: These are super popular because you can change, amend, or even cancel them during your lifetime. They're great for avoiding probate and managing assets while you're alive. Think of it as a flexible safety net.

Irrevocable Trusts: Once established, these are much harder to change or revoke. They often offer more significant tax benefits and asset protection but come with less flexibility. These are usually for more complex situations.

How Trust Fund Works? Definition, Costs, Benefits, Types

Your specific goals will dictate which type is best for you. Don't worry if this part feels a bit daunting; a good lawyer will guide you through it.

Step 4: Draft the Trust Document

This is where the official paperwork comes in. You'll need a legally sound document that outlines all the terms of your trust: who the grantor, trustee, and beneficiaries are, what assets are included, how they should be managed and distributed, and when distributions should occur. This is where hiring an experienced estate planning attorney is absolutely essential. They’ll make sure the document is legally valid and perfectly tailored to your needs. Trying to DIY this step is a recipe for disaster!

Step 5: Fund the Trust

This is the step where your trust actually comes to life! You'll need to officially transfer ownership of your assets into the name of the trust. For example, if you're transferring a bank account, you'll need to open a new account in the trust's name and deposit the funds. If it’s real estate, the deed needs to be re-titled to the trust. This process is called "funding the trust", and it’s crucial for the trust to function as intended.

Step 6: Manage and Review

Once funded, your trustee takes over. They'll manage the assets and make distributions according to the trust document. It’s also a good idea to review your trust periodically, especially after major life events (like a marriage, divorce, or birth of a child), to ensure it still aligns with your wishes.

Opening a trust fund is a proactive and thoughtful way to secure your legacy and take care of your loved ones. It’s a powerful tool that offers peace of mind, control, and protection. So, dive in, do your research, and consider taking these steps to build a brighter future for those you care about!