How Do I Get A Vat Certificate? Simple Steps That Work

Hey there, coffee-sipping buddy! So, you’re looking to get your hands on a VAT certificate, huh? Sounds super official, right? Maybe a little bit daunting? Don't sweat it! It's not like you're trying to negotiate a peace treaty or anything. Honestly, it's way simpler than you're probably imagining. Think of it as just another step in the grand adventure of running your own thing, or perhaps dealing with those glorious tax people. We’ll break it down, nice and easy. Like, really easy.

First things first, let's get one thing straight. What is a VAT certificate, anyway? It's basically your official "yay, you're registered for Value Added Tax!" card. It’s proof to the world (or at least to the taxman and your business partners) that you’re playing by the VAT rules. You know, that tax thing that gets added to most goods and services? Yep, that one. Without it, you might find yourself in a bit of a pickle. So, consider this your golden ticket to VAT compliance. Pretty cool, huh?

Now, before you even think about clicking around on government websites until your eyes glaze over, let's figure out if you even need one. Are you selling stuff? Are you providing services? And, more importantly, are you making enough money doing it to trigger the VAT threshold? This is like the pre-game warm-up. You wouldn't go to a fancy gala in flip-flops, would you? Same vibe here. Check those rules! Every country has its own little quirks and numbers. So, a quick Google search for "VAT registration threshold [your country]" is your best friend right now. Seriously, save yourself the headache.

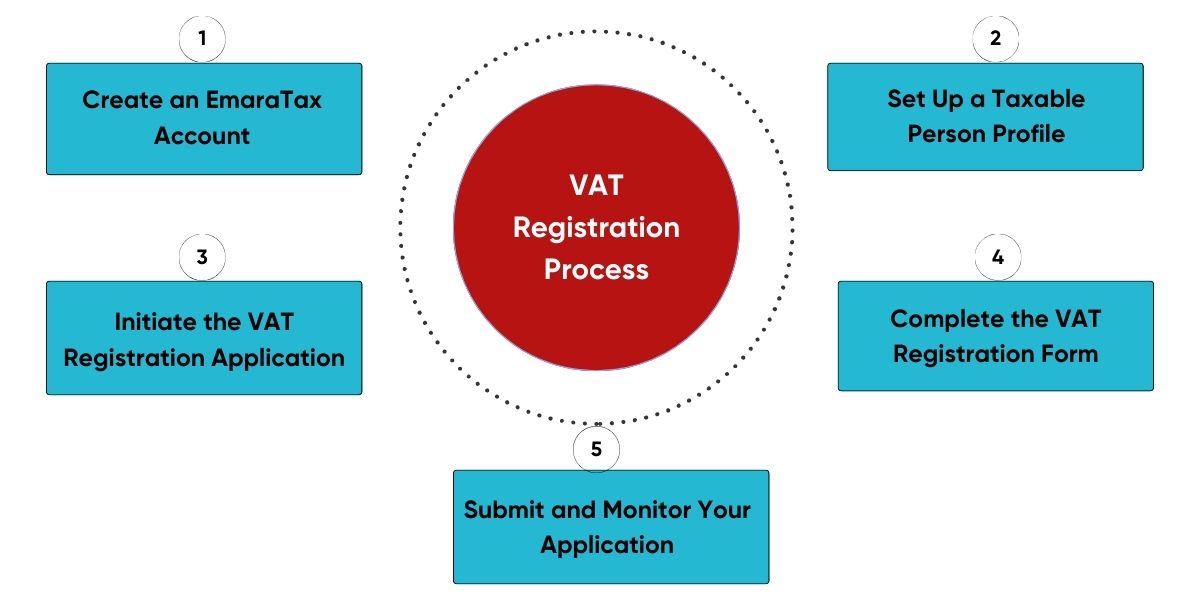

Okay, so you’ve done your detective work and confirmed you’re definitely in VAT territory. Awesome! You’re already ahead of the game. Most countries have an online portal for this stuff these days. It’s like the digital post office for all things tax-related. You’ll need to find the official government tax authority website for your region. Don’t go clicking on random ads that promise you a "super-fast VAT certificate delivered by unicorn!" Stick to the official stuff. It’s usually something like "HMRC" in the UK, "Bundeszentralamt für Steuern" in Germany, or similar for wherever you hang your hat. It might sound a bit dry, but that’s where the magic happens. Or, you know, the administrative process.

Once you've landed on the right website, it’s time to put on your thinking cap. You’ll likely need to find a section related to "VAT registration" or "registering for tax". It’s usually pretty clearly marked. Think of it like finding the "checkout" button on an online store, but instead of buying something, you're… well, registering. Sometimes it's buried a little, so don’t be afraid to poke around. Maybe have another sip of that coffee. Deep breaths.

Now for the nitty-gritty: the application form. This is where they ask you to spill the beans about your business. What’s your business name? What’s your address? What kind of magical things do you sell or do? They’ll want your business registration details, your national insurance number or equivalent, and probably some info about your projected turnover. Be honest, be thorough. It’s like filling out a college application, but way less stressful (hopefully!). Have all your business documents handy. You know, the ones that prove you’re a legitimate, tax-paying entity. Birth certificate for your business, basically.

One thing to keep in mind is that some countries might have different application processes depending on your business structure. Are you a sole trader? A limited company? A partnership? Each might have a slightly different path. So, if you get to a point where you're staring at the screen thinking, "Uh oh, this doesn't look like my business," double-check which category you fall into. It's like choosing the right door at a choose-your-own-adventure book. Pick wisely!

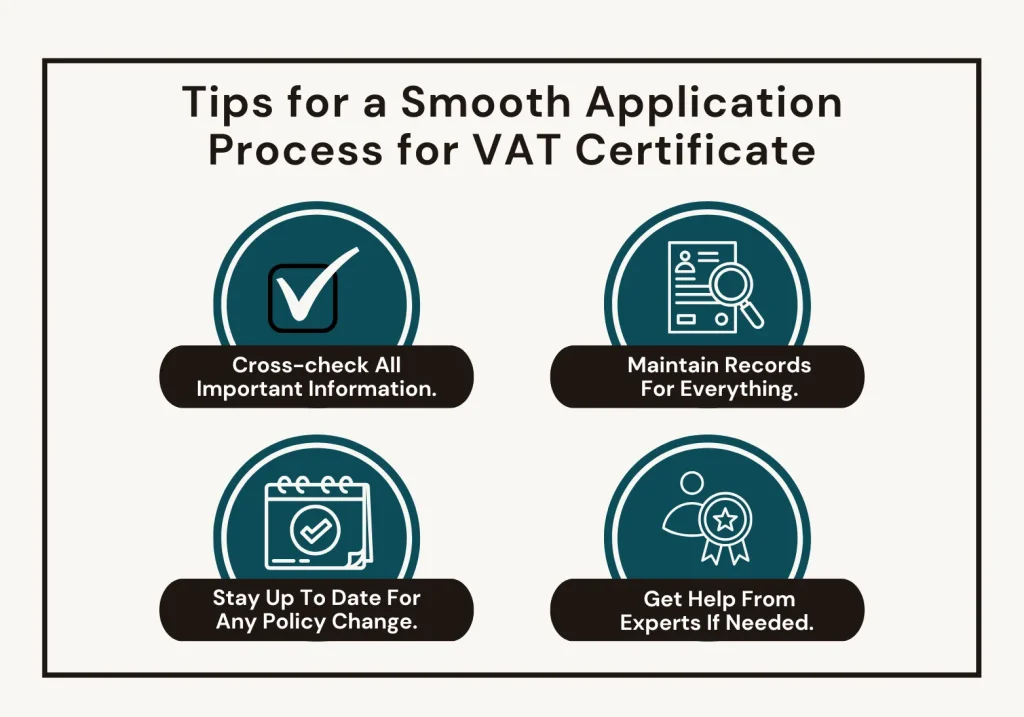

You might also need to provide some supporting documents. This could include things like your business bank statements, proof of address, or even a copy of your business plan if you're a newer venture. They just want to make sure you're on the level. It's like showing your ID at a bar, but for your business. So, gather up those important papers. Don't go hunting for them at the last minute when the system is about to time out. Been there, done that. It's not fun.

Once you’ve filled out the form and uploaded all your supporting documents (if needed), you’ll hit that glorious "submit" button. Hooray! You’ve done it. You’ve officially entered the VAT world. Now, the waiting game begins. This is where you channel your inner Zen master. The tax authorities have to process your application, and that can take a little while. How long? Well, it varies. It could be a few days, a few weeks, or maybe even a month or two if they’re particularly busy. So, don't start checking your inbox every five minutes like you're expecting a love letter. Give them some breathing room.

They might contact you if they need more information. This is usually a good sign, meaning they’re actively reviewing your application. Don't panic if they ask for clarification. Just provide what they need as quickly and accurately as possible. It’s like a little dance, and you just need to follow the steps. Think of it as a friendly follow-up from your new tax buddies.

And then, poof! Your VAT certificate arrives. It could be sent to you by post, or it might be available to download from your online portal. Keep it somewhere safe! This is your official document, your badge of honor. Frame it! Put it on your fridge! (Okay, maybe just keep it in a secure digital folder or a well-organized filing cabinet). It’s important, so treat it with respect. You earned it!

So, what happens after you get your certificate? Well, now you have a VAT number. You'll need to put this on your invoices, your website, and any other official business communications. This tells your customers and suppliers that you're a VAT-registered business. It's like wearing a uniform – it identifies you!

You’ll also need to start charging VAT on your taxable sales and submitting regular VAT returns. This is where things get a bit more… ongoing. But don’t worry, that’s a whole other adventure for another day. For now, just focus on getting that certificate. It’s the first big hurdle.

Now, what if you’re a bit of a technophobe, or just feel like you’re drowning in jargon? Totally understandable! There’s no shame in asking for help. You can always enlist the services of an accountant or a tax advisor. They do this stuff for a living, so they can navigate the system like a pro. Think of them as your personal tax ninjas. They’ll handle the paperwork while you focus on, you know, running your amazing business. It might cost a little extra, but for some people, the peace of mind is totally worth it.

Some countries also offer helplines or support services for businesses. Don't be shy about calling them if you get stuck. They're there to help! They might not have a pot of gold waiting at the end of the rainbow, but they can certainly point you in the right direction.

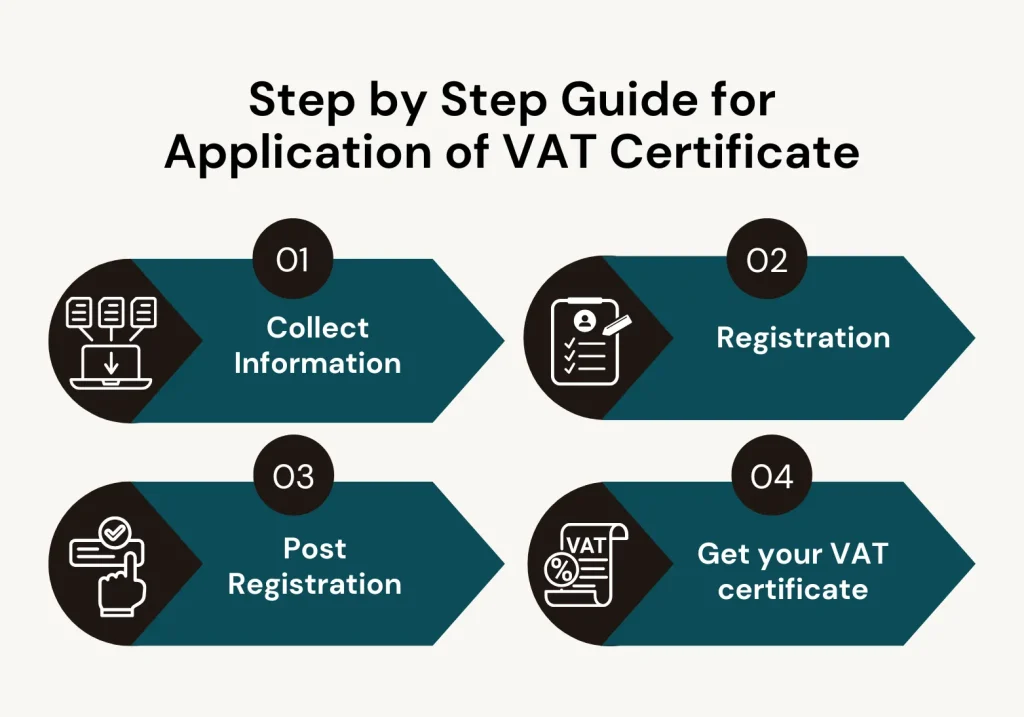

Let's recap, shall we? It’s like a mini-tutorial, but less boring. First, check if you even need to register. Then, find your country's official tax authority website. Next, locate the VAT registration section. Fill out the application form with all your business deets. Gather any necessary supporting documents. Hit submit and practice your patience. Finally, celebrate when your VAT certificate lands in your inbox or mailbox!

It really is that straightforward, for the most part. Sure, there might be a few hiccups along the way, a bit of paperwork that seems to multiply, or a form that makes you question your life choices. But hey, that’s business! You're learning, you're growing, and you're becoming a VAT-savvy entrepreneur. And who knows, maybe one day you'll be the one giving advice to someone else over coffee about how to get their VAT certificate. Wouldn't that be a laugh?

Remember, being VAT-registered is a good thing. It means your business is growing, and you're operating legitimately. It opens doors to working with bigger clients who might require their suppliers to be VAT registered. So, view this as a positive step. It’s not a punishment, it’s a promotion! To the next level of business seriousness, anyway. So, go forth, brave entrepreneur, and conquer the world of VAT registration!

And if all else fails, just remember the three magical words: "Ask for help." Seriously. It's not a sign of weakness, it's a sign of intelligence. Especially when dealing with tax laws. They’re written in a language that only accountants and tax lawyers seem to truly understand. So, embrace the support systems available to you. Your future, less-stressed self will thank you.

So there you have it! Getting your VAT certificate might seem like a big deal, but with these simple steps, you’ll be well on your way. Just be prepared, be patient, and don't be afraid to ask for a little guidance. Now, go get that certificate and show the world you mean business! And maybe treat yourself to another coffee. You deserve it!