How Do I Get A Cheque Book? Simple Steps That Work

Remember the days when a crisp, new cheque book felt like a golden ticket? Maybe it was for a big purchase, a special gift, or just the thrill of writing out a payment with a flourish. While we're living in a world of instant transfers and digital wallets, the humble cheque still holds its ground, and sometimes, you just need one. Whether it's for a landlord who’s a bit old-school, a quirky small business, or a donation to a charity that prefers the tangible, figuring out how to get your hands on a cheque book can feel like unlocking a secret level in a video game. But fear not, fellow traveller on this modern-day journey! It’s actually way simpler than you might think. Let’s dive into the easy-peasy steps to get your own little book of blank cheques.

The "Why" Behind the Paper Trail

Before we get to the "how," let's touch on the "why." You might be asking yourself, "Seriously? Cheques in 2024?" And it's a valid question. We're all about efficiency and speed. But think of it this way: sometimes, the old ways have a certain charm, a tangible permanence that digital transactions, for all their convenience, can lack. It’s like choosing to send a handwritten letter instead of a text message – it shows a bit more thought, a bit more effort. Cheques can also be a great tool for budgeting, giving you a visual representation of your spending when you physically write them out. Plus, some folks just feel more comfortable with them, especially when dealing with larger sums or situations where immediate confirmation isn't the be-all and end-all. And let's not forget, they’re still the go-to for things like paying rent in some cities, or for those lovely independent shops that haven't quite embraced the latest tech wave.

Step 1: Your Friendly Neighbourhood Bank (The Cornerstone!)

The absolute, number one, non-negotiable first step is to connect with your bank. If you don't already have a bank account, well, that's your very first quest! But assuming you’re already a banking patron, this is where your cheque book journey begins. Most banks offer cheque books as a standard service for their checking or current accounts. Think of your bank as the gatekeeper to the cheque-book kingdom. They hold the keys, and they’re usually pretty happy to hand them over once they’ve confirmed you’re, well, you.

Choosing Your Account Wisely

Now, not all bank accounts are created equal when it comes to cheque book access. Generally, you'll need a checking account (or current account, depending on your neck of the woods). Savings accounts typically don't come with cheque-issuing privileges. So, if you're starting from scratch, or if your current account doesn't offer them, you might need to explore opening a new one. Don't worry, it's usually a straightforward process. Your bank will guide you through the options. Some accounts might even come with a complimentary set of starter cheques, which is a nice little bonus!

Step 2: The "I'm Here to Get a Cheque Book" Chat

Once you’ve identified your bank and your account type, it's time for a little face-to-face (or screen-to-screen) interaction. There are a few ways you can go about this:

In-Person Power!

The classic method: walk into your local bank branch. This is perhaps the most traditional and, for some, the most reassuring way to do it. Find your nearest branch, make sure you have your identification documents handy (more on that in a sec!), and head to the customer service desk or speak to a teller. They’ll likely ask you for your account number and verify your identity. It’s a good opportunity to ask any questions you might have about cheque book fees, delivery times, or even how to order more when you run out. Think of it as a mini-financial consultation!

The Digital Dive

Most banks today have a robust online banking portal and a mobile app. This is where modern convenience truly shines! Log in to your account online or through your phone. Navigate to the section for account services or cheque requests. You’ll usually find a clear option to order a new cheque book. It’s often just a few clicks away. This method is fantastic for speed and ease, especially if you’re busy and can’t pop into a branch during opening hours. It's like ordering your favourite coffee without leaving your sofa – pure bliss!

A Quick Call Can Do the Trick

If you’re not a fan of online interfaces or can’t get to a branch, a phone call is your trusty sidekick. Find the customer service number for your bank (it’s usually on their website or the back of your debit card). When you speak to a representative, clearly state that you wish to order a cheque book for your account. They’ll guide you through the necessary steps, which might involve verifying your personal details over the phone.

Step 3: The Identity Verification Tango

No matter how you choose to order your cheque book, your bank will need to verify your identity. This is a standard security measure to protect your account. What does this usually involve? You'll likely need to provide:

- Your valid government-issued photo ID: Think driver's license, passport, or a national identity card.

- Your account number: Have this readily available.

- Potentially a security question or PIN: This is for phone or online verification.

It’s always a good idea to have these things ready before you start your request to make the process as smooth as a perfectly poured latte. Think of it as collecting your power-ups before a boss battle!

Step 4: The Waiting Game (And What to Do During It!)

Once your request is submitted, there’s a little bit of a waiting game. Cheque books aren't usually printed on demand in the branch like a custom t-shirt. They are typically printed off-site and mailed to you. The timeframe can vary, but it's generally anywhere from 3 to 10 business days. Here’s how to make the waiting period a little more entertaining:

Track Your Mail Like a Detective

If you've ordered online or by phone, you might receive a confirmation email with an estimated delivery date. Keep an eye on your mailbox! It's a satisfying feeling when that official-looking envelope finally arrives.

Learn About Cheque Security

While you're waiting, why not do a little research on cheque security features? You'll notice things like watermarks, microprinting, and security threads. These are all designed to make cheques harder to counterfeit. It’s like learning the secret codes of the financial world!

Practice Your Signature!

This might sound a bit silly, but if it’s been a while since you’ve had a cheque book, consider practicing your signature. You want it to be consistent and legible on your cheques. Think of it as honing your personal brand.

Consider Your Cheque Style

When you order, some banks might offer you choices for your cheque design. You could go for classic and professional, or perhaps something a bit more fun if available. It’s a small way to add a personal touch to your finances.

Fun Fact Alert!

Did you know that the first paper cheques were used in the 17th century? They were essentially written orders to a goldsmith or banker to pay a sum of money from a deposited amount. So, while we see them as a bit retro now, they've actually been around for quite a while, evolving from simple notes to the sophisticated documents they are today!

Step 5: Receiving Your Precious Cheques

And there it is! Your brand-new cheque book arrives in the mail. Open it up and admire your name and address printed neatly on each cheque. You'll also find a deposit slip book, which is equally important for, you guessed it, making deposits!

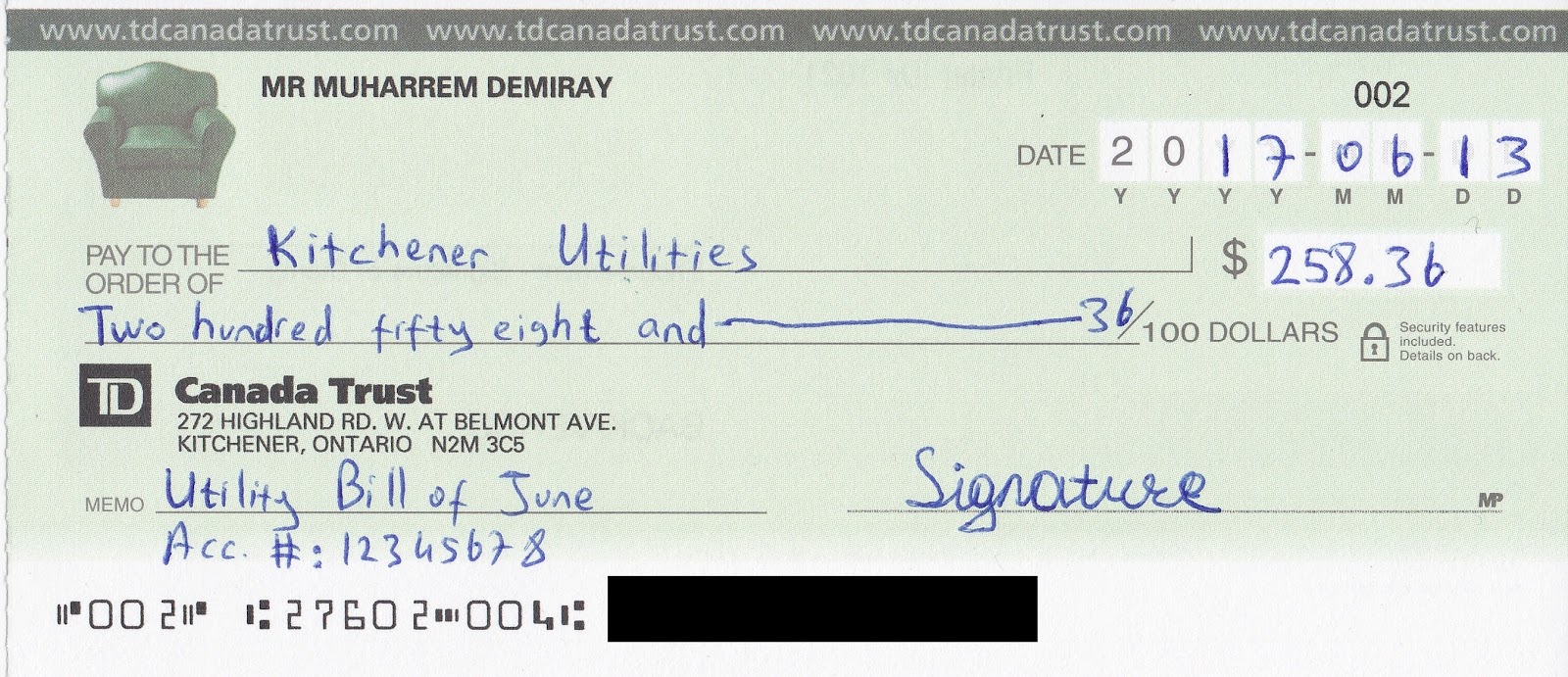

Filling Them Out: The Art of the Cheque

Now for the actual writing part. It’s not rocket science, but there are a few key fields you need to fill in correctly:

- Date: Always put the current date.

- Pay to the order of: Write the full name of the person or company you are paying.

- The amount in figures: Write the numerical value of the payment (e.g., $100.50).

- The amount in words: Write out the amount in words (e.g., One Hundred and Fifty only/ dollars and 50 cents). This is crucial as the written amount usually takes precedence if there's a discrepancy.

- Your signature: Sign your name in the designated spot. This is the legal authorization for the payment.

- Memo (Optional): This is a small space for you to note what the payment is for (e.g., "Rent - March," "Gift for Sarah"). It's helpful for your own record-keeping.

Pro Tip: Use a pen that doesn’t smudge easily. A good quality ballpoint is usually best. And always double-check the payee name and the amount before signing!

Fees and Costs: The Nitty-Gritty

Let's talk about money. While getting a cheque book might seem like a freebie, many banks do charge a fee for them. This can be a flat fee per cheque book order, or it might be included as part of a monthly account maintenance fee. Some higher-tier accounts might offer free cheque books as a perk. It’s always wise to check your bank's fee schedule or ask them directly. Transparency is key, and knowing the cost upfront means no surprises!

What If My Bank Doesn't Offer Them?

This is becoming less common, but if your bank genuinely doesn't offer cheque books for your account type, don't despair. You have a couple of options:

Explore Other Banks

If having a cheque book is a must-have for you, you might consider opening an account with a different bank that does offer them as standard. Do a little research and compare accounts – you might even find a bank with better features or lower fees overall.

Third-Party Cheque Printing Services

There are companies that specialize in printing cheques. You can order personalised cheques from them, which you can then use with your bank account. However, this usually requires you to have blank cheque stock provided by your bank for printing. It's a bit more complex and generally less common for everyday use, so always check with your bank first if this is a route you're considering.

A Quick Cultural Snapshot

In some cultures, especially in North America, the cheque book was for a long time a symbol of financial stability and a key tool for managing household expenses. Think of the iconic scenes in movies where characters pull out their cheque books for grand purchases or to settle accounts with a confident flick of the wrist. While the digital age has democratized many financial actions, the cheque still carries a certain historical weight and a sense of established procedure.

The Reflection: Cheques in Our Modern Lives

So, there you have it. Getting a cheque book is remarkably straightforward when you know the steps. It’s a simple process that connects you to a more traditional way of handling money, one that still has its place in our fast-paced world. In a time where everything feels instant, there’s a unique satisfaction in the deliberate act of writing a cheque. It’s a small ritual, a moment of pause in the digital stream. Whether it’s a necessity for a particular transaction or simply a preference for a tangible record, the cheque book remains a handy tool in our financial toolkit. It reminds us that even with all the futuristic advancements, sometimes, the enduring power of a simple piece of paper, signed with intent, is exactly what we need to navigate our daily lives with confidence and control.