How Do I Find Out My Tax Id? Simple Steps That Work

Hey there, future tax-savvy superstar! Ever feel like your Tax ID is hiding somewhere, a little like that one sock that always disappears in the laundry? Don't worry, we've all been there! Finding it might sound like a treasure hunt, but it's actually way easier and less dusty than digging through an attic.

Think of your Tax ID as your personal secret handshake with Uncle Sam. It's that special number that helps the government know it's really you when you're talking about your hard-earned cash. No, it's not your social security number, though it's just as important!

So, why is this even fun? Well, picture yourself confidently filling out forms, not with a big question mark hovering over your head, but with a knowing smile. It's the thrill of accomplishment, like finally beating that tricky level in your favorite game! Plus, knowing this stuff makes you feel a little bit like a financial wizard.

The best part? You probably already have it! It's not some mythical creature you need to track down with a spyglass. For most of us, it's already tucked away in a place you might not even think about. Let's uncover this gem, shall we?

The Great Tax ID Expedition!

Alright, adventurers, let's dive into the exciting world of discovering your Tax Identification Number. It's not about battling dragons, but it might feel like a victory when you nail it!

For the Wonderful Individuals: Your Social Security Number (SSN)

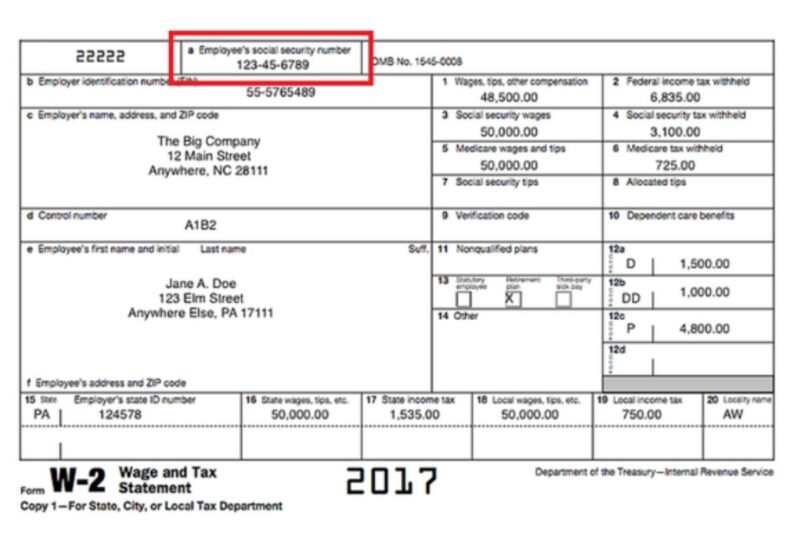

If you're an individual, guess what? Your most common Tax ID is probably something you already know by heart. That's right, your trusty Social Security Number (SSN) is often the magic key. It’s a 9-digit number that's pretty unique to you.

You were likely issued this when you were very young, or perhaps when you started working. It's your official identifier for many things, especially tax-related ones. So, if you're working for someone, your employer uses it. If you're filing your own taxes, it's the main player.

Where might you find this elusive number if you don't have it memorized? Think back to your early financial adventures. Was there a Social Security card that came in the mail? It’s printed right there, bold as brass!

If that card has gone on a vacation to the land of lost items, don't panic! You can usually find your SSN on old tax returns. Remember those papers you filed (or maybe your parents filed for you)? They’re treasure maps!

You can also find it on other official documents. Think about bank statements, pay stubs, or even some health insurance cards. It's like a scavenger hunt, but with important paperwork instead of dusty bones.

If all else fails, and you really can't find it, the Social Security Administration (SSA) is your ultimate quest giver. You can contact them directly to request a replacement card or verification of your number. They are the keepers of the sacred SSN scrolls!

For the Business Bosses: EIN Awesomeness!

Now, if you’re running a business, whether it's a lemonade stand that’s become a global empire or a cool startup, you’ll need a different kind of magic number. This is where the Employer Identification Number (EIN) swoops in like a superhero. It’s also known as a Federal Tax Identification Number (TIN).

This number is like your business’s official name tag for the IRS. It’s a 9-digit number, just like an SSN, but it's specifically for your business entity. It’s essential for hiring employees, opening a business bank account, and filing business taxes.

So, how do you get your hands on this business badge? The most straightforward and absolutely free way is to apply directly with the Internal Revenue Service (IRS). Yes, the IRS themselves! It's like getting your VIP pass straight from the source.

You can apply online, which is super speedy. The IRS website has a dedicated section for applying for an EIN. It’s a short application, and once you’re approved, you’ll get your EIN right away. Talk about efficient!

If you’re a business owner who has already been operating, where would this number be hiding? Check your business bank statements! Most banks require an EIN to open a business account, so it’s likely printed there.

Your business tax returns are also a fantastic place to look. If you've filed taxes for your business before, your EIN will be all over those documents. It’s like a recurring character in your business's financial saga.

Another spot could be any legal documents related to your business formation. Think articles of incorporation or partnership agreements. These official papers usually include your EIN.

What if you got your business started with the help of an accountant or tax professional? They probably have your EIN on file! A quick call to them can often solve the mystery. They're the wise guides on your business journey.

Individual Taxpayer Identification Number (ITIN): For Our International Friends

We also have a special number for those who aren't eligible for an SSN but still need to pay taxes in the U.S. This is the Individual Taxpayer Identification Number (ITIN). It's a lifeline for individuals who are non-resident aliens, resident aliens, or foreign nationals who have U.S. tax reporting or filing requirements.

The ITIN is also a 9-digit number, formatted like an SSN and EIN, but it starts with the number '9'. This tells you it's a different kind of identifier. It’s specifically for tax purposes.

Getting an ITIN is a bit more involved than just asking for one. You have to apply for it using Form W-7, Application for IRS Individual Taxpayer Identification Number. It's a detailed form, and you'll need to provide supporting documentation to prove your identity and foreign status.

Where do you find your ITIN once you have it? It will be on your tax return. You apply for it in conjunction with filing a tax return. So, if you've filed taxes using an ITIN, it will be on those returns.

If you're unsure if you have one or where it might be, you can contact the IRS directly. They have specific resources for ITIN applicants and holders. It’s important to have this number if you have U.S. tax obligations.

The Thrill of the Find!

Finding your Tax ID is like finding a hidden gem. It’s empowering! Knowing this number makes navigating the world of taxes much less daunting. It turns confusion into confidence.

Think of it this way: you're not just finding a number; you're unlocking a tool that helps you manage your finances effectively. It’s about taking control and being informed. And honestly, isn't there a little thrill in knowing you've got this all figured out?

So go on, embark on your Tax ID adventure! Whether it’s a quick peek at a pay stub or a more formal application, the reward is a clearer path forward. Happy hunting! Your inner financial guru awaits!