How Do I Find My Sort Code? Simple Steps That Work

Hey there! So, you're on a quest, a noble quest indeed, to locate your elusive bank sort code. Don't worry, you're not alone in this adventure. It's one of those things that pops up when you least expect it, like finding a rogue sock in the laundry. But fear not, my friend, for this guide is here to equip you with the simple steps to triumph over your sort code search. Let's dive in!

First off, what is a sort code, anyway? Think of it as your bank's postcode, but for money transfers. It's a six-digit number that identifies your specific bank and branch. It's super important for things like getting paid, sending money to pals, or setting up direct debits. Without it, your money might end up on a wild goose chase, and nobody wants that, right? We're talking about making sure your hard-earned cash lands precisely where it's supposed to. It’s like giving your mail carrier a super-specific address – no room for error!

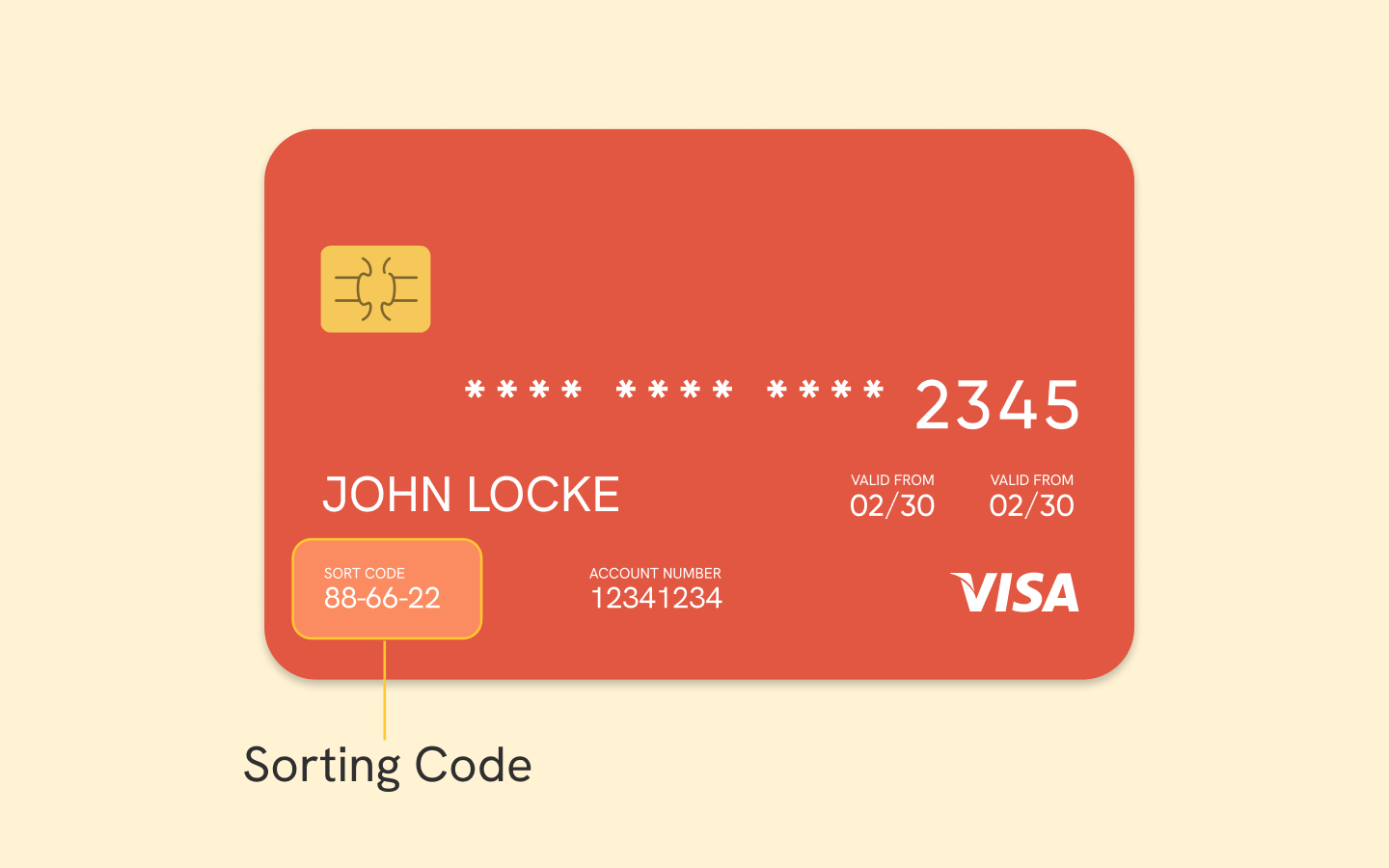

Your Sort Code: The Mighty Six Digits

So, this magical six-digit number. It’s not exactly a secret handshake, but it is essential. You'll often see it grouped into three pairs, like 12-34-56. This little detail is helpful for spotting it on official documents. And remember, it's usually different from your account number, which is generally longer. Think of your sort code as the neighborhood your account lives in, and your account number as the specific house number. Both crucial, but serving different purposes!

Where in the World is My Sort Code Hiding?

Now for the exciting part – the treasure hunt! There are several reliable places your sort code is probably chilling, just waiting to be found. Let's go through them one by one, with a sprinkle of humour and a dash of practicality.

1. Your Chequebook: The Classic Hiding Spot

Ah, the humble chequebook. In this age of digital everything, you might think chequebooks are as rare as a unicorn riding a unicycle. But! If you happen to have one lying around (perhaps it’s a relic from a bygone era, or you actually still write cheques – no judgment here!), your sort code is almost always printed on the bottom. It'll be right there, usually alongside your account number. Look for those three pairs of digits. It’s like finding buried treasure, but instead of gold, you get financial peace of mind. Plus, if you find an old cheque, you might even find a forgotten birthday cheque from your Aunt Mildred!

2. Your Bank Statement: The Official Record Keeper

Bank statements are like your financial diary, and they usually spill all the beans. Whether you receive them by post or view them online, your sort code should be clearly displayed. It's typically at the top of the statement, in the section that details your account information. Look for labels like "Sort Code" or "Bank Details." It's usually a prominent part of the header information. If you get paper statements, it might be printed near your address. If you're going digital, log in to your online banking portal and navigate to your account summary or details page. They've got nothing to hide!

Sometimes, they might even list it on the transaction history page itself, as it's needed for some types of transfers. So, give that statement a good once-over. It’s a much more reliable source than trying to decipher ancient hieroglyphs, I promise.

3. Your Online Banking Portal: The Digital Treasure Trove

If you're a modern human who prefers their banking sleek and digital, your sort code is likely just a few clicks away. Log in to your online banking account. Usually, you'll find your sort code within the "Account Details," "Personal Information," or "My Details" section. It's often displayed alongside your account number, sort code, and sometimes even your IBAN if you have one. Think of it as your digital ID card for your money. It’s all there, neatly presented, no need to dust off any physical paperwork.

Some banks even have a dedicated section for "Bank Details" or "Payment Information" where you can easily find and even copy your sort code. So, if you haven't visited your online banking portal in a while, consider this your official invitation to explore its nooks and crannies. You might even find a new budgeting tool or a helpful savings calculator!

4. Your Banking App: On-the-Go Sort Code Retrieval

Just like the online portal, your bank's mobile app is another prime location for your sort code. Open up the app on your phone, log in securely, and navigate to your account information. Similar to the website, it’ll be in a section detailing your account numbers and personal bank details. It’s super convenient for when you need that code in a pinch, perhaps while you’re on the bus or trying to impress someone with your financial prowess at a coffee shop. “Oh, my sort code? Just a sec…” taps furiously on phone

This is probably the quickest way if you have a smartphone and your banking app is set up. It's like having your bank's entire branch in your pocket, but without the queues! Though, sometimes, the app might be a little too streamlined, and you might have to dig a tiny bit. Don't give up, it's definitely in there somewhere.

5. Your Bank Card: Sometimes, But Not Always

This one is a bit of a gamble, and it's becoming less common. Historically, some bank cards (especially debit cards) had the sort code printed on them. However, for security reasons, many banks have stopped doing this. It’s generally considered safer for your sort code not to be printed on something you carry around everywhere, as it's part of your sensitive bank details. So, while it’s worth a quick peek at your card – especially if it’s an older one – don’t be too surprised if it’s not there. Think of it as a lucky find, not a guaranteed one.

If you do find it, remember to treat it with the same care you’d give your account number. It’s all part of the secret code to your financial kingdom!

6. Contact Your Bank Directly: The Last Resort (But Still a Good One!)

If you've scoured your chequebook, statement, and digital platforms and your sort code is still playing hide-and-seek, it's time to call in the professionals: your bank! You can do this in a few ways.

Phone Banking: Give your bank a call. They'll ask you some security questions to verify your identity (because they don't want to give out your financial details to just anyone, which is a good thing!). Once they're satisfied, they'll happily tell you your sort code. Just have your account number and some personal details ready.

Visit a Branch: If you’re old-school or just prefer face-to-face interaction, head down to your local bank branch. Bring some identification, and they’ll be able to assist you. It’s also a great opportunity to have a chat with a human, maybe even ask them for the secret password to infinite money (they won’t tell you, but it’s worth a shot).

Live Chat/Email: Many banks now offer live chat or email support. You can initiate a chat online or send an email explaining your situation. They'll guide you through the process of getting your sort code. This can be a good option if you can't always get to a phone or a branch.

Don't feel embarrassed about asking your bank for help. They're there to assist you! Think of it as them doing their job. They’ve heard it all before, believe me. Someone’s always looking for their sort code.

A Quick Word on Security

While we're on the topic of your sort code, a little reminder about security. Your sort code, combined with your account number, is a key piece of information for making payments. Never share your sort code and account number with anyone you don't trust. Be wary of unsolicited emails or calls asking for your bank details. If in doubt, always contact your bank directly using official channels. It’s better to be safe than sorry, as they say. Think of it as protecting your digital fortress!

Troubleshooting Your Sort Code Search

Sometimes, even with the best intentions, things can get a bit tricky. Here are a few common hiccups and how to sidestep them:

- You've Moved Banks: If you’ve recently switched banks, your old sort code won't be valid for your new account. Make sure you’re looking at details for your current bank.

- Forgotten Which Bank You Use: This might sound silly, but it happens! If you’re unsure which bank you have an account with, check your direct debit mandates on other bills, or look at old statements from any bank you might have used in the past. Sometimes, a forgotten online account might be the culprit.

- International Accounts: If you have an account with an international bank, the sort code might be different or referred to by another name, like an IBAN or SWIFT code. For most UK domestic transfers, you’ll need the standard sort code.

Don't get discouraged if it takes a little digging. The important thing is that you will find it. It's a bit like solving a very simple, very useful puzzle.

The Grand Finale: You’ve Got Your Sort Code!

And there you have it! You’ve navigated the labyrinth, conquered the quest, and emerged victorious with your sort code in hand. Whether it was hiding in plain sight on a cheque, nestled within your online banking, or revealed after a friendly chat with your bank, you’ve done it! You’ve armed yourself with the knowledge to handle your finances like a pro. Now you can confidently receive that salary, send that gift to a friend, or set up that direct debit without a moment's hesitation.

So, take a moment to pat yourself on the back. You’ve tackled a common financial task with ease and a touch of humor. The world of money transfers is now a little less mysterious, and a lot more accessible. Go forth and transfer with confidence, knowing you're a sort code-finding superstar! Your financial journey just got a little smoother, and that's definitely something to smile about. Happy banking!