Head Of Household Vs Married Filing Jointly

Hey there, sunshine seekers and financial adventurers! Ever find yourself staring at tax forms, wondering if it’s all just a big, confusing riddle designed to make your brain do a little jig? You’re not alone! Today, we’re diving into something that might sound a tad dry, but trust me, it can actually be a source of some surprisingly fun strategic thinking: the classic showdown between being a Head of Household and Married Filing Jointly.

Now, before you groan and imagine endless spreadsheets, let’s reframe this. Think of it as a little financial game. It’s about making smart choices that can potentially put more money back in your pocket, which, let's be honest, can lead to more fun money for that weekend getaway, a new hobby, or just a really good cup of coffee. Who doesn’t love a good coffee? 😉

The "Head of Household" Hero: More Than Just a Title

So, what’s the deal with being a Head of Household? This filing status is like a superhero cape for certain individuals. It’s for those who are unmarried (or considered unmarried for tax purposes) and have a qualifying child living with them for more than half the year. Think of yourself as the captain of your own ship, steering your family’s financial destiny.

Being a Head of Household often comes with some sweet perks. Generally, you get more favorable tax brackets compared to being single. That means a bigger chunk of your income might be taxed at lower rates. Pretty neat, right? It's like finding a hidden bonus level in your favorite game!

You also get a higher standard deduction than single filers. More money you don't have to report as taxable income? Yes, please! This status acknowledges the extra responsibilities and costs that come with being the primary caregiver and provider for a child. It’s a little nod from Uncle Sam saying, "We see you, and we appreciate you!"

But here’s the catch, and it’s an important one: you need to meet specific criteria. You’ve got to be paying more than half the cost of keeping up your home, and a qualifying child needs to actually reside with you for a significant portion of the year. So, while it’s a fantastic status if you qualify, it’s not a one-size-fits-all situation.

The "Married Filing Jointly" Dream Team: Two Heads Are Better Than One

Now, let’s talk about the power couple! When you’re married, you often have the option to file as Married Filing Jointly (MFJ). This is where you and your spouse combine all your income, deductions, and credits into one big, beautiful tax return. It's like forming an ultimate team-up!

Why would you do this? Well, MFJ often leads to some of the lowest overall tax liabilities for married couples. The tax brackets for joint filers are typically wider than for single or Head of Household filers. This can mean that more of your combined income falls into those lower tax rate zones.

Think of it like this: if one spouse earns significantly more than the other, filing jointly can help "income-split" the earnings, potentially lowering the tax burden on the higher earner. It’s a brilliant strategy that can save you a pretty penny. Imagine those savings translating into that dream vacation you’ve been eyeing!

Plus, MFJ opens the door to certain tax credits and deductions that might not be available or as beneficial if you filed separately. We’re talking about things like the Earned Income Tax Credit, education credits, and even the credit for the elderly or disabled. It's a package deal of potential financial wins!

So, Which One Reigns Supreme? It's a Strategy Game!

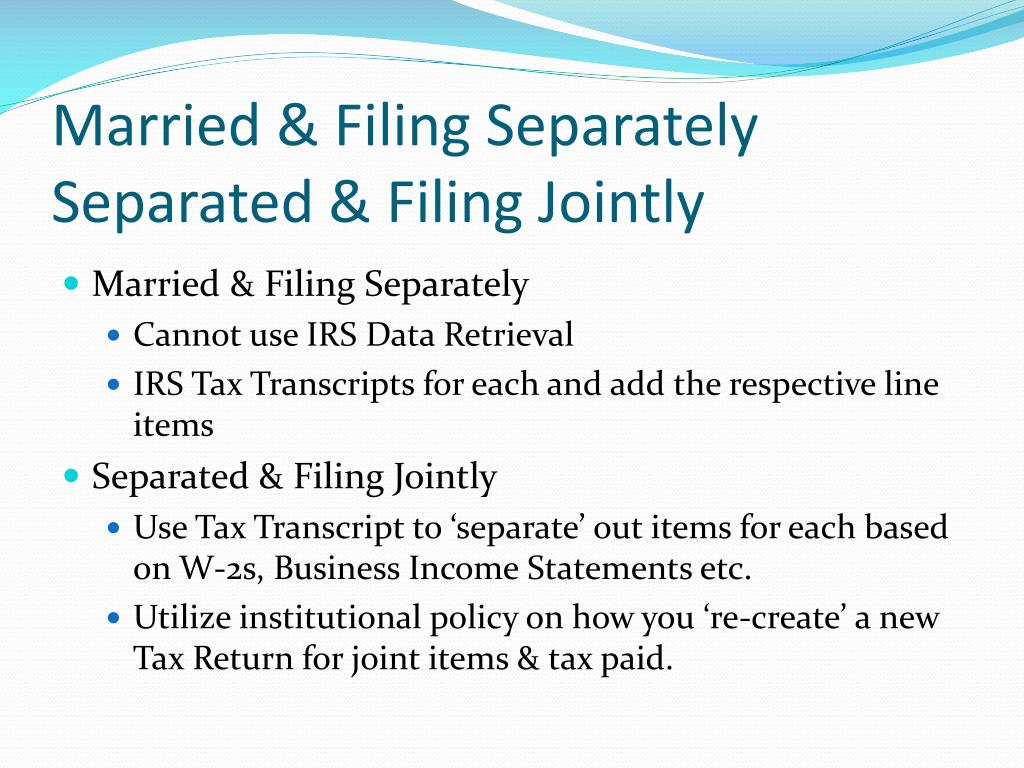

Here’s where the fun truly begins. It’s not always a straightforward answer. Sometimes, for married couples, filing separately might actually result in a lower tax bill. This can happen in specific situations, such as when one spouse has significant itemized deductions (like high medical expenses) that are limited by their Adjusted Gross Income (AGI). If they file separately, their individual AGI is lower, potentially allowing them to deduct more of those expenses.

This is why we call it a financial game! You have to play the field, run the numbers, and see which strategy gives you the best outcome. Many tax software programs will automatically calculate both scenarios (Married Filing Separately and Married Filing Jointly) and tell you which one is the most beneficial. It’s like having a little financial cheat sheet!

For those who are single and have a qualifying child, Head of Household is usually the best route. It’s designed for your situation and provides those crucial tax advantages. But if you’re married, the decision between filing jointly or separately is where the real strategic thinking comes in. Don't be afraid to explore all the options!

Making Tax Time a Little Less Terrifying (and More Empowering!)

The key takeaway here, my friends, is that understanding your filing status isn't just about filling out forms; it's about empowerment. It’s about knowing the rules of the game and using them to your advantage. It’s about making informed decisions that can positively impact your financial well-being.

Don’t let the jargon scare you. Think of it as learning a new skill, like mastering a recipe or figuring out a new board game. The more you understand, the more confident you’ll feel. And when you feel confident, you’re more likely to make smart choices that lead to better outcomes.

So, the next time tax season rolls around, don't just sigh and accept whatever comes your way. Take a moment. Explore. See if Head of Household is your power move, or if you and your partner can conquer the tax world together with a joint filing strategy. You might just surprise yourself with how much you can save, and how much fun you can have optimizing your financial life!

Go forth and conquer your taxes with curiosity and a smile! Your future, financially savvy self will thank you. Keep learning, keep exploring, and remember, every little bit of financial knowledge is a step towards a brighter, more prosperous future!