Franklin U.s. Large Cap Index 529 Portfolio

Alright, settle in folks, grab your lattes and maybe a croissant, because we’re about to dive headfirst into something that sounds about as exciting as watching paint dry, but trust me, it’s got more sparkle than a disco ball at a tax convention. We’re talking about the Franklin U.S. Large Cap Index 529 Portfolio. I know, I know, the name alone probably makes you want to schedule a nap. But stick with me, because this little gem is actually designed to help your kids, grandkids, or even your incredibly well-read goldfish, conquer higher education without needing to sell a kidney.

Now, what in the Sam Hill is a 529 plan, you ask? Think of it as a magical money box, specifically for education. You shove money in, it hopefully grows, and then, poof, you can use it for tuition, dorm rooms (which, let’s be honest, are just fancy boxes to sleep in), textbooks that cost more than your first car, and even that ramen noodle addiction your teenager is cultivating. The key word here is tax-advantaged. That’s fancy talk for “the government is being surprisingly nice and letting your money grow without snagging it at every turn.” It’s like finding an extra fry at the bottom of the bag, but, you know, for a lot more money.

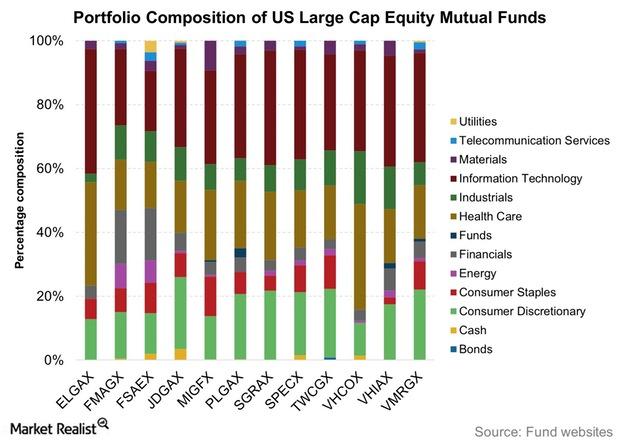

And this particular magic money box, the Franklin U.S. Large Cap Index 529 Portfolio, is basically saying, “Let’s put our eggs in the ‘big, reliable companies’ basket.” Think of it as investing in the giants of the American economy. We’re talking the companies whose logos are probably plastered on every other billboard you see, the ones that make the gadgets you can’t live without, and the ones that have probably been around longer than your grandpa’s favorite pair of socks.

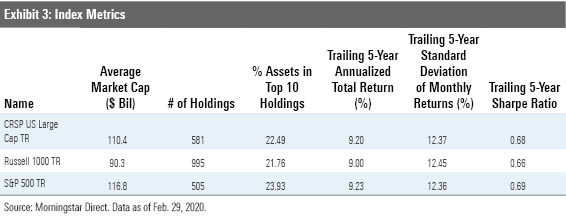

So, what exactly does “U.S. Large Cap Index” mean? It’s not some secret handshake for elite Wall Street types. It means they’re tracking a benchmark index. Imagine an index as a very, very long shopping list of the biggest, most valuable publicly traded companies in the United States. The Franklin portfolio is essentially trying to mimic that list. It’s not about picking the next hot startup that might explode (and take your money with it); it’s about betting on the established players who are, generally speaking, pretty good at staying on their feet. Think of it like choosing a well-worn path in a forest versus bushwhacking through uncharted territory. The well-worn path might not be as thrilling, but you’re less likely to get lost and eaten by a metaphorical bear.

Why large caps? Because these are the companies with the serious clout. They’ve weathered storms, they’ve innovated (sometimes spectacularly, sometimes with a few awkward stumbles), and they’ve got the kind of staying power that makes your average squirrel hoarding nuts for winter look like a novice. These are the companies that likely have a diversified revenue stream, meaning they’re not putting all their acorns in one basket. If one product line goes south, they’ve got ten others to keep them afloat. It’s the financial equivalent of having a really sturdy lifeboat.

Now, the “index” part is crucial. Instead of having some super-smart (and probably very stressed) person at Franklin trying to pick individual stocks, they’re just aiming to mirror the performance of that big, fat index. This is often called passive investing. It’s like saying, “You know what? The market as a whole is pretty darn good at figuring things out. Let’s just tag along for the ride.” This can often lead to lower fees. Because, let’s face it, if you’re not paying a team of stock-picking ninjas, you’re not going to incur ninja-level fees. And lower fees mean more money for, you guessed it, college! Imagine that – less money disappearing into the ether of management costs, and more money for your budding astronaut or future Nobel laureate.

The Franklin U.S. Large Cap Index 529 Portfolio is essentially a buffet of American corporate giants, served up in a tax-friendly package. You’re getting exposure to the big names, the established brands, the companies that are, by and large, the backbone of the economy. It’s a strategy that favors stability and broad market participation over the dizzying highs and terrifying lows of trying to be a stock market guru. This is for the parent who says, “I want my kid to go to college, and I don’t want to have to sell my liver to pay for it.”

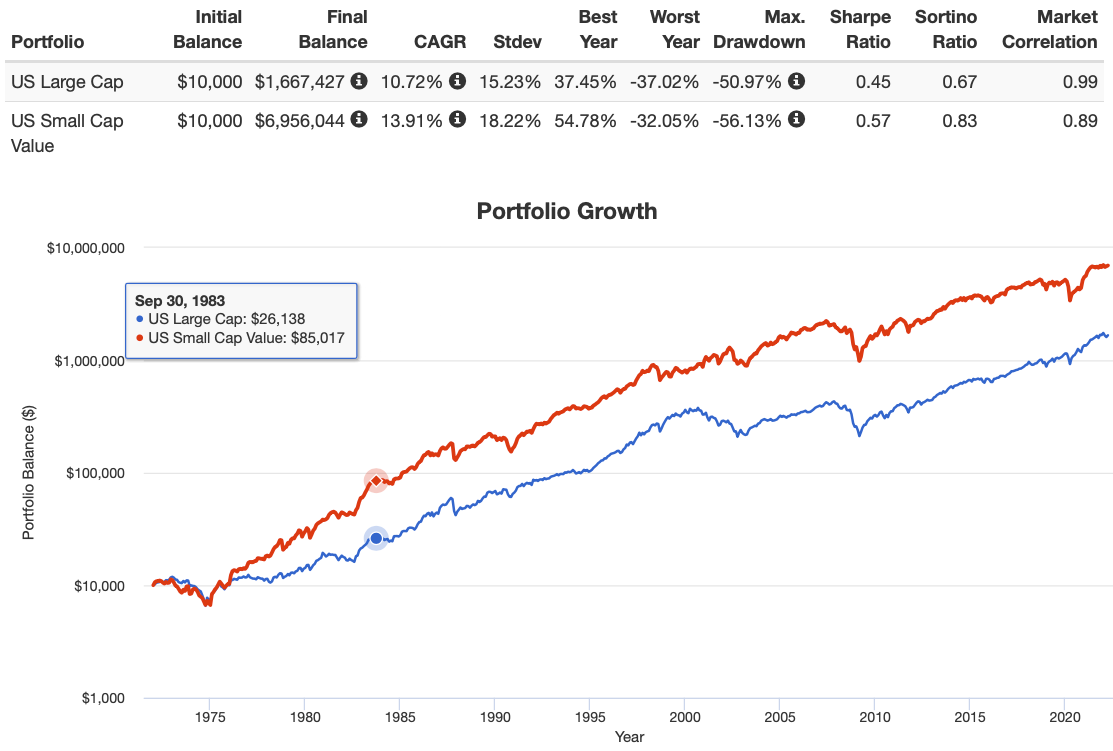

Think of it as a sensible, well-trodden path to funding education. It’s not going to make you a millionaire overnight (unless you’ve already got a fortune to start with, you lucky dog). But what it can do is provide a steady, consistent growth potential over the long term, all while being shielded from Uncle Sam’s prying eyes. It’s the financial equivalent of a reliable old friend – not the flashiest, but always there when you need them. And when it comes to funding college, reliability is golden. It’s like having a secret weapon in your arsenal, a quiet but powerful force working to ensure that when little Timmy or Susie decides to pursue their dreams of becoming a professional cat groomer or a competitive eater, you’ll have the funds ready.

So, next time you hear “Franklin U.S. Large Cap Index 529 Portfolio,” don’t groan. Think of it as a sturdy ship sailing towards a brighter educational future. It’s a way to harness the power of the biggest companies in America to build a nest egg for the next generation. And who knows, maybe that nest egg will even cover the exorbitant cost of those tiny, designer dorm room refrigerators. Now, that’s a future worth investing in, wouldn’t you agree?