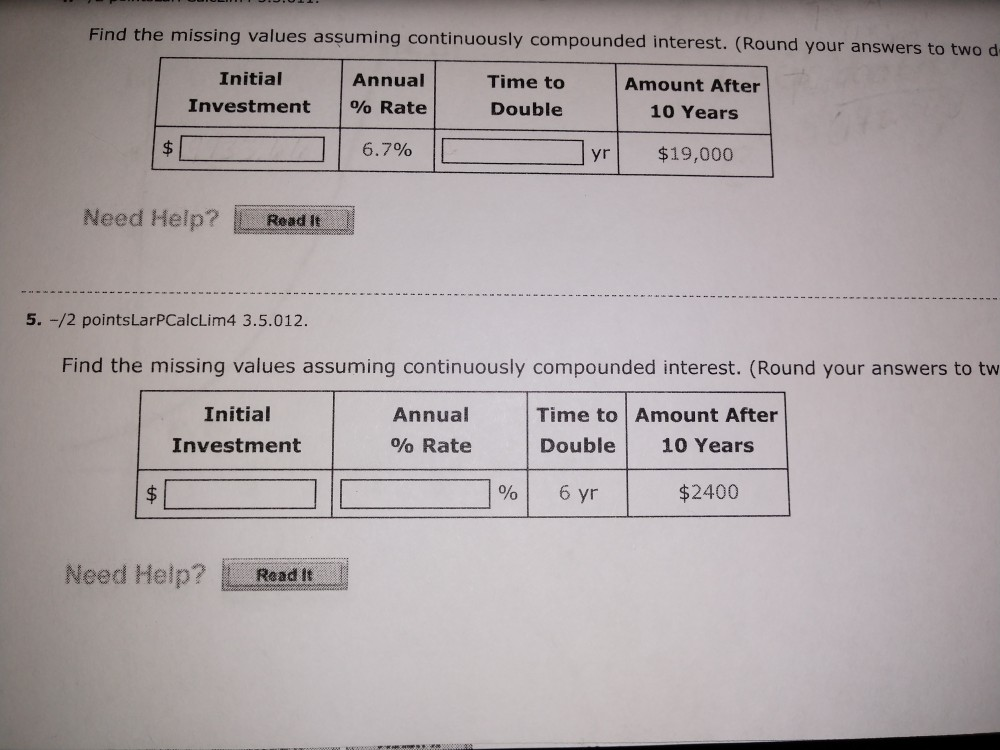

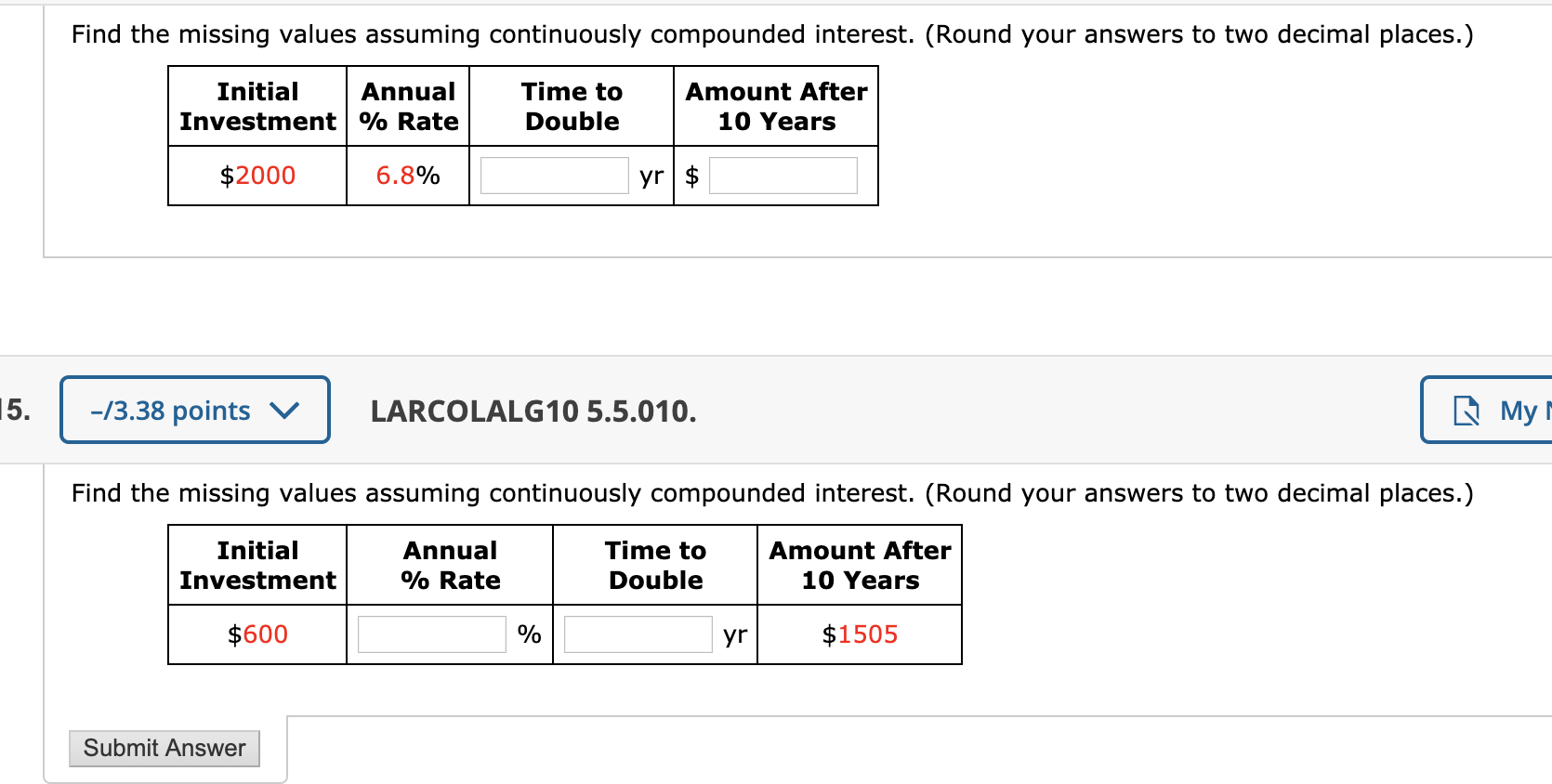

Find The Missing Values Assuming Continuously Compounded Interest

Ever had one of those moments where you swear you put a twenty-dollar bill in your wallet, but then… poof! Gone? It’s like your money has a secret life, a clandestine rendezvous with the couch cushions or a spontaneous vacation to the laundry hamper. Well, when it comes to your hard-earned cash growing in a bank account, especially with that fancy continuously compounded interest, sometimes it feels like a similar magic trick is happening. Except, instead of disappearing, the money is actually growing, but you’re left scratching your head trying to figure out just how much it’s supposed to have grown by.

Think of continuously compounded interest like a really, really enthusiastic barista. You know, the one who keeps pouring that frothy milk, topping off your latte with an extra dollop of whipped cream, and maybe even drawing a little latte art heart on top? Yeah, that’s the vibe. It’s not just a single pour and done; it’s a constant, gentle, and ever-increasing stream of goodness. Your money is getting a tiny, microscopic top-up all the time. It's like a perpetual hug for your bank balance.

Now, sometimes in this magical world of constant growth, we might lose track of a piece of the puzzle. Maybe you forgot to jot down the exact date you opened that savings account. Or perhaps you misremembered the initial deposit amount. Or, and this is a common one, you have absolutely no clue what the final, glorious total ended up being after a few years of your money living its best, continuously compounded life.

This is where we become financial detectives, folks! We’re not talking about shady back-alley deals or deciphering ancient hieroglyphs. We’re just trying to find the missing values in a simple, albeit continuously growing, equation. It’s like putting together a jigsaw puzzle, but instead of a picturesque landscape, you’re building a picture of your burgeoning wealth. And trust me, that’s a much prettier picture.

Let’s break down the main players in this game. We’ve got the Principal (P), which is your initial investment, the seed money. Then there’s the Interest Rate (r), how enthusiastically your money is being pampered. We also have Time (t), the duration of this financial spa treatment, usually measured in years. And finally, there’s the Future Value (A), the grand total, the glorious outcome, the reason you started this whole adventure in the first place.

The super-secret formula, the wizard’s spell for continuous compounding, is this little beauty: A = Pe^(rt). Don't let the 'e' scare you; it's just a special number, kind of like a mathematical celebrity, approximately 2.71828. It’s involved in all sorts of natural growth phenomena, so it’s perfectly at home with your money growing non-stop.

So, what if you know how much your money grew to (A), you know the interest rate (r), and you know how long it’s been chugging along (t), but you’re fuzzy on the starting point (P)? Well, my friends, that’s our first mission!

Mission 1: The Case of the Missing Starting Principal

Imagine you’re digging through your old bank statements, and you find a note that says, "Hey, that account you opened a few years ago is now worth a cool $5,000! Congrats!" But, oh dear, you have no idea how much you initially put in. It could have been $100, it could have been $1,000, it could have been that loose change you collected for a year. This is where we need to rewind and find that original deposit.

We need to rearrange our magical formula to solve for P. Think of it like unlocking a secret compartment in the formula. We take our equation A = Pe^(rt) and do a little algebraic dance. We divide both sides by e^(rt), and voilà! We get: P = A / e^(rt). Or, if you’re feeling fancy, P = Ae^(-rt). Either way, we’re isolating P.

Let’s say the bank statement said your money grew to $5,000 (A = 5000). You remember it was a 4% annual interest rate (r = 0.04), and you think it’s been about 10 years (t = 10).

So, we plug those numbers in: P = 5000 / e^(0.04 * 10).

First, calculate the exponent: 0.04 * 10 = 0.4.

Then, find e raised to the power of 0.4. You’ll probably need a calculator for this part, unless you’re a math whiz with a photographic memory for exponential constants. Let’s say e^0.4 is roughly 1.4918.

Now, divide the future value by that number: P = 5000 / 1.4918.

And there you have it! Your estimated initial deposit was around $3,351.61. See? You didn’t accidentally stash it in a forgotten sock drawer; it just grew from a smaller, but still significant, starting point. It's like realizing that slightly deflated balloon at the party actually started as a perfectly good, round balloon. You just needed to figure out its original size.

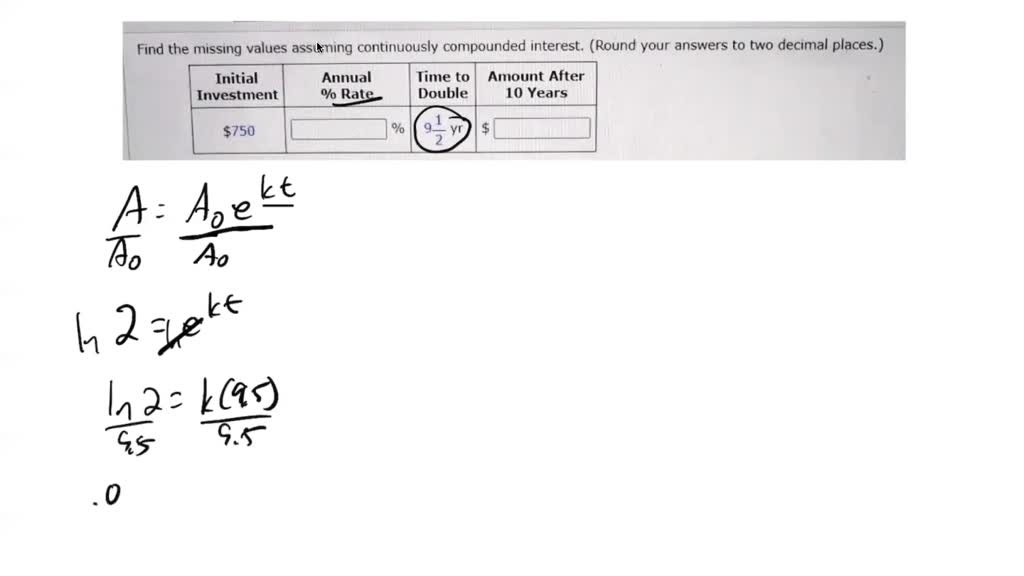

Mission 2: The Mystery of the Elusive Interest Rate

Now, sometimes you know you started with a certain amount, and you know roughly how long it’s been, and you even know the final grand total. But that sneaky interest rate? It’s playing hide-and-seek. Maybe you opened a savings account with, say, $2,000, and after 7 years, it’s blossomed into $3,000. What was that magical percentage that made it happen?

This one’s a bit trickier, like trying to guess your friend's secret password based on their cat’s name and their favorite color. We have to get a little creative with our formula. We start with A = Pe^(rt). This time, we’re solving for 'r'.

First, we isolate the exponential part by dividing both sides by P: A/P = e^(rt).

Now, to get 'rt' out of the exponent’s clutches, we use the natural logarithm (ln), which is basically the inverse operation of 'e'. Think of 'ln' as the key that unlocks the exponent. We take the natural logarithm of both sides:

ln(A/P) = ln(e^(rt)).

Because ln and e are opposites, ln(e^(rt)) just simplifies to rt. So, we have: ln(A/P) = rt.

Finally, to get 'r' by itself, we divide by 't': r = ln(A/P) / t.

Let's plug in our hypothetical numbers. A = $3,000, P = $2,000, and t = 7 years.

First, calculate A/P: 3000 / 2000 = 1.5.

Next, find the natural logarithm of 1.5. Your calculator will be your best friend here: ln(1.5) is approximately 0.4055.

Now, divide that by the time: r = 0.4055 / 7.

And that gives us a rough interest rate of approximately 0.0579, or 5.79%. So, your money wasn't just lounging around; it was actively working for you at a respectable rate. It’s like discovering your slightly quiet neighbor actually has a secret talent for juggling flaming torches. You just didn’t know it until now!

Mission 3: The Enigma of the Vanishing Time

This is perhaps the most common scenario. You know you started with a certain amount of money, and you know what it’s grown to, and you’re pretty sure about the interest rate. But how long did it take for your money to reach that awesome final amount? Did it take 5 years? 10 years? Was it a brief sprint or a marathon?

We’re back to our trusty formula: A = Pe^(rt). This time, we’re hunting for 't'. Just like with finding 'r', we’ll be employing the power of the natural logarithm.

Again, we isolate the exponential part first: A/P = e^(rt).

Then, we apply the natural logarithm to both sides: ln(A/P) = ln(e^(rt)).

This simplifies to: ln(A/P) = rt.

And to get 't' all by its lonesome, we divide by 'r': t = ln(A/P) / r.

Let’s imagine you invested $1,000 (P = 1000), and it grew to $1,800 (A = 1800). You remember the interest rate was around 5% annually (r = 0.05). How long did this financial glow-up take?

First, calculate A/P: 1800 / 1000 = 1.8.

Now, find the natural logarithm of 1.8: ln(1.8) is approximately 0.5878.

Finally, divide that by the interest rate: t = 0.5878 / 0.05.

And the answer is: approximately 11.76 years. So, it wasn’t just overnight magic; your money was patiently and continuously compounding for a little over 11 and a half years to achieve that growth. It’s like waiting for your sourdough starter to bubble and rise; it takes time, patience, and the right environment to get that perfect, delicious result.

So there you have it! Finding the missing pieces in the continuously compounded interest puzzle isn't about complex calculus or needing a degree in advanced finance. It’s about a little bit of logical thinking, a good calculator, and understanding how our money can work smarter, not just harder. It’s about regaining clarity on your financial journey, making sure all those little gains are accounted for, and appreciating the steady, relentless power of compound interest. Now go forth and solve your financial mysteries, you brilliant money detectives!