Economics Worksheet Monetary Policy And The Federal Reserve Answer Key

Hey there! So, you’re staring down a pile of economics homework, huh? And guess what’s on the menu? Monetary Policy and the Federal Reserve. Oof. Sounds like a mouthful, right? But don't sweat it! We’re gonna dive into this like we’re grabbing an extra shot of espresso – with enthusiasm and maybe a little bit of a “what am I even doing?” vibe. You know the drill.

And the real kicker? You’re probably hunting for that magical answer key. We’ve all been there, right? Staring at a question that feels like it was written in ancient hieroglyphics, wishing for a cheat sheet. It’s okay, confess it! Who needs sleep when you can have… well, understanding this stuff? Or at least faking it convincingly.

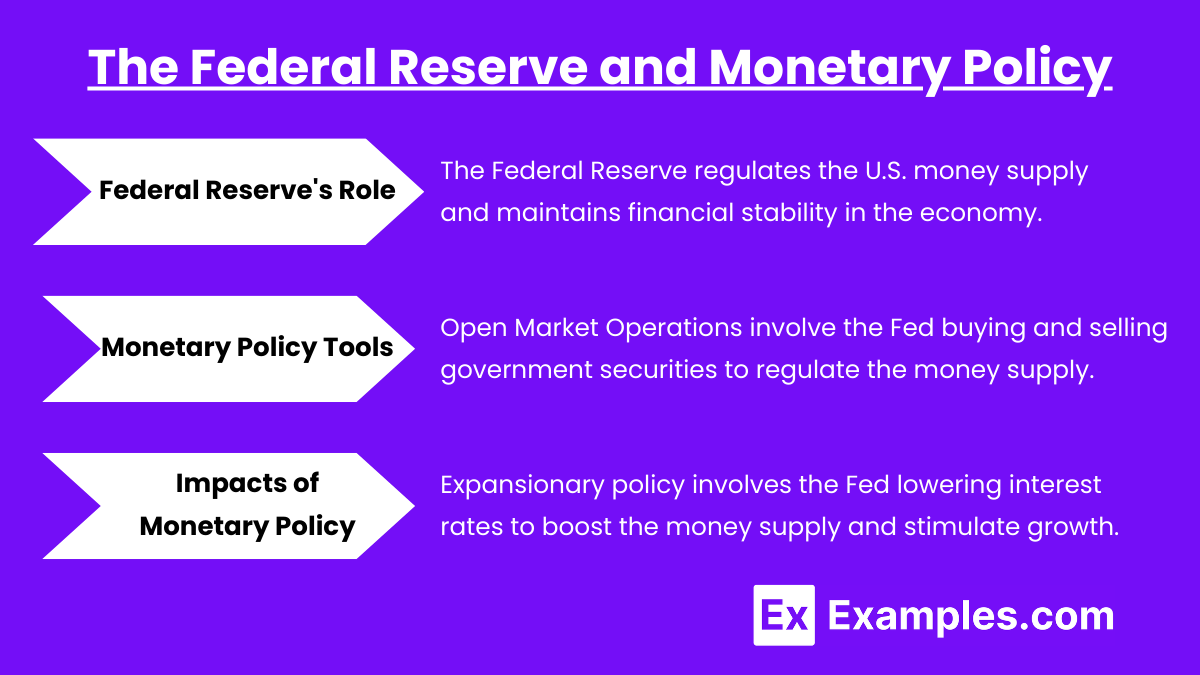

So, let’s break down this whole “Federal Reserve” thing. Think of them as the big kahunas of the American economy. Not like, a royal family, but more like the ultimate money managers. They’re the ones who decide how much green stuff is floating around. Pretty important, wouldn’t you say? It’s like they have their finger on the economic pulse, trying to keep things from going all wobbly.

Now, what is this “monetary policy” they keep yammering about? It’s basically the Fed’s toolkit. Their magic wand, if you will, for influencing how much money banks have to lend and, by extension, how easy or hard it is for you and me to borrow cash. Think of it as the gas pedal and brake for the economy. Gotta be careful not to floor it and crash, or slam on the brakes and get stuck in a ditch, you know?

One of the main tools in their arsenal? The federal funds rate. Sounds super official, right? What it really means is the interest rate that banks charge each other for overnight loans. Yeah, banks borrow from other banks. It’s a whole thing. And when the Fed fiddles with this rate, it sends ripples through the entire financial system. Like a pebble dropped in a pond, but the pond is, like, the entire global economy. No pressure!

If the Fed wants to cool things down – maybe inflation is getting a little too spicy, like when you accidentally grab the ghost pepper instead of the jalapeño – they’ll raise this rate. Higher rates mean it’s more expensive for banks to borrow, so they’ll charge you more for mortgages, car loans, credit cards. Everything gets a bit pricier. You might start rethinking that impulse purchase of a solid gold toaster. Just saying.

Conversely, if the economy is feeling sluggish, like it just can't get out of bed on a Monday morning, the Fed might lower the federal funds rate. Cheaper borrowing means people and businesses are more likely to take out loans, spend money, and hopefully, get things humming again. It’s like a financial wake-up call. “Hey economy, get up and go!”

Another biggie: reserve requirements. This is the percentage of deposits that banks are legally required to keep on hand, not lending out. Think of it as their rainy day fund, but mandated by the government. If the Fed wants banks to lend out more money, they can lower the reserve requirement. More money available to lend, woohoo! If they want to tighten things up, they can raise it. Less money sloshing around.

But here’s the funny part: they don’t mess with reserve requirements that often. It’s kind of like that really old, dusty tool in your toolbox you know is there, but you rarely reach for it. They prefer to use their other tricks.

And what are those other tricks? Enter open market operations. This is where the Fed becomes a buyer or seller of government securities, like Treasury bonds. If they want to pump more money into the economy, they buy these securities from banks. When they buy, they’re handing over cash, increasing the money supply. It’s like they’re just printing money and handing it out (okay, not exactly, but you get the idea).

If they want to take money out of circulation, they sell these securities to banks. Banks pay the Fed, and poof! That money is temporarily out of the economy. It’s like a giant economic vacuum cleaner. Nifty, right?

So, why does the Fed even do all this? What’s their grand mission? They have two main goals, and they’re pretty important: maximum employment and stable prices. Basically, they want as many people employed as possible without causing prices to go bananas. It’s a delicate dance, a tightrope walk over a pit of economic woes. They’re trying to hit that sweet spot, that Goldilocks economy – not too hot, not too cold, just right.

And when it comes to your worksheets, you’ll likely see questions about how these policies affect things like inflation, unemployment, and interest rates. For example, if the Fed buys government bonds (open market operations), what happens to the money supply? (It increases, duh!). What happens to interest rates? (They tend to go down because there’s more money available to lend). What happens to employment? (Hopefully, it goes up because borrowing is cheaper and businesses can expand). See? You’re already getting it!

Now, let’s talk about the Federal Reserve’s structure. It’s not just one guy in a suit making all the decisions. It’s a whole system! There’s the Board of Governors in Washington D.C. – think of them as the top brass, the strategists. Then there are the 12 Federal Reserve Banks spread across the country. These guys are more on the ground, the operational folks.

And the really important decision-making body? The Federal Open Market Committee (FOMC). This is where the magic (or the madness, depending on your perspective) really happens. It’s made up of the Board of Governors and five of the Reserve Bank presidents. They meet regularly, usually eight times a year, to discuss the economic outlook and decide on monetary policy actions. Imagine a bunch of really smart people in a room, intensely debating the fate of your next paycheck. Intense, right?

Sometimes, even with all their tools and all their meetings, things don’t go exactly as planned. The economy is a fickle beast, after all! Think of it like trying to herd cats. You’ve got your best intentions, your little laser pointers, and still… chaos. Monetary policy can have time lags, meaning the effects of a decision made today might not be felt for months. So, they’re always trying to predict the future, which is, you know, impossible. But they try!

And what about when things go really wrong? Like a massive recession or a financial crisis? That’s when you hear about unconventional monetary policy. Things like quantitative easing (QE). This is basically the Fed buying lots of longer-term assets, not just short-term government bonds, to inject even more money into the system and lower long-term interest rates. It’s like saying, “Okay, the usual tricks aren’t working, let’s bring out the heavy artillery!” It’s a bit controversial, and some people worry it can lead to inflation down the road, but hey, desperate times, right?

Let’s circle back to those worksheets. You’re probably going to see scenarios where you have to predict the Fed’s response. If unemployment is rising and inflation is low, what will they likely do? (Probably lower rates and increase the money supply – stimulate the economy!). If inflation is sky-high and the economy is booming, what’s their move? (Raise rates and decrease the money supply – cool things down!). It’s like a puzzle, and the Fed’s actions are the pieces you need to place.

And sometimes, the questions might get a little more nuanced. They might ask about the goals vs. tools. Remember, the goals are employment and stable prices. The tools are the federal funds rate, reserve requirements, and open market operations. Make sure you can connect them! It’s not just memorizing definitions; it’s understanding the cause and effect.

Think about the difference between expansionary and contractionary policy. Expansionary is like giving the economy a pep talk and a good stretch. It aims to increase the money supply and lower interest rates to boost economic activity. Contractionary is like putting the brakes on, tightening the money supply and raising interest rates to curb inflation. You want to be able to identify which is which and what triggers them.

And don’t forget the concept of money neutrality. This is the idea that in the long run, changes in the money supply only affect nominal variables (like prices) but not real variables (like output or employment). It’s a bit of an academic concept, but you might see it pop up. Basically, the Fed can’t magically make everyone richer forever just by printing more money. Eventually, it just leads to higher prices.

So, when you’re staring at that answer key (or, you know, trying to figure it out for yourself, which is way cooler, obviously), remember these core ideas. The Fed is the money maestro. Monetary policy is their orchestra. And their goal is a harmonious economic symphony, not a cacophony of inflation and unemployment. It’s a tough gig, and they’re always improvising a little, but understanding their basic moves is half the battle.

Don’t be afraid to draw little diagrams, jot down notes, or even explain it out loud to your pet rock. Whatever helps it stick! Because once you get this down, you’ll feel like a total economic whiz. Or at least, you’ll be able to nod knowingly when people talk about interest rates on the news. And honestly, that’s half the fun, right? You got this!