Does Homeowners Insurance Go Up After Claim

Hey there, home hero! Ever had a little oopsie happen at your place? Maybe a rogue squirrel decided your attic was the new luxury condo, or a rogue sprinkler decided to redecorate your living room? Whatever the drama, you probably had to file a homeowners insurance claim. And then, the big question pops into your head, right? "Does my insurance premium suddenly go all 'Cha-ching!' upwards?" Let's dish!

It's a question that hangs in the air, like that lingering smell of burnt toast after a kitchen mishap. Will filing that claim, even for something totally out of your control, turn your friendly insurance policy into a money-hungry monster? The short answer? Sometimes. But hold your horses! It’s not as simple as a universal "yes" or "no." Think of it more like a quirky, unpredictable game of insurance bingo.

Here's the deal: your insurance company looks at claims like a detective at a crime scene. They're piecing together the puzzle of risk. If you've had a few "incidents" that required their help, they might see you as a slightly riskier bet. And when you're a riskier bet, well, the price of admission can go up.

The "It Depends" Factor: It's More Like a Mad Libs

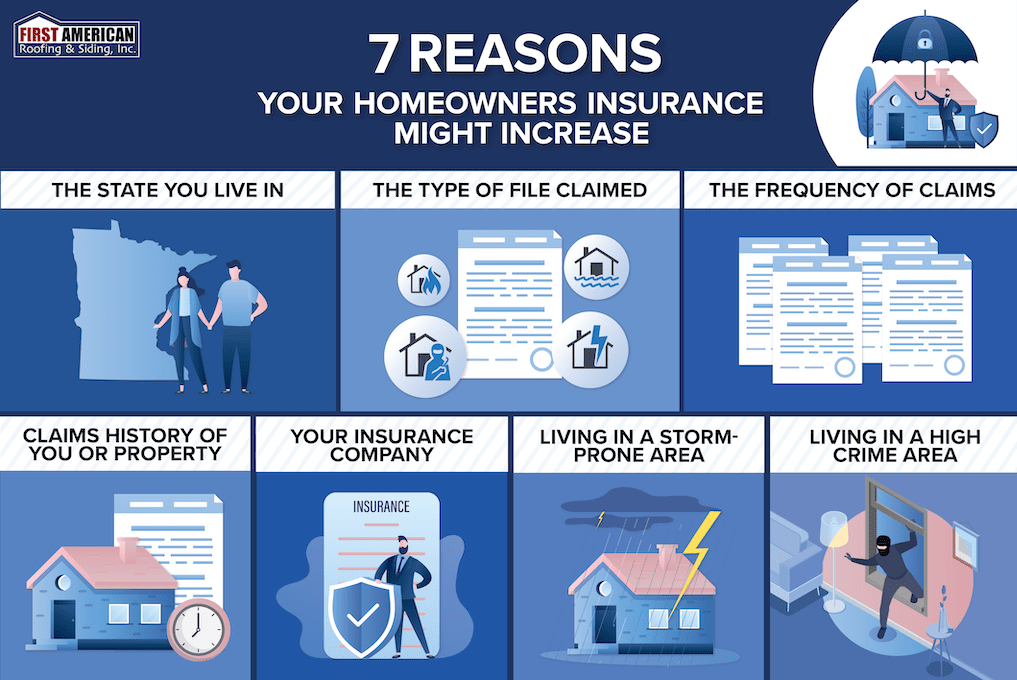

So, what makes it a "depends" situation? It's like filling in the blanks in a hilarious Mad Libs story. A lot of factors play a part. Did you have a tiny fender-bender with your mailbox, or did a meteor decide your roof looked lonely? The severity of the claim is a HUGE player. A small, easily fixed leak might barely tickle your premium. A full-blown house fire? Yeah, that's going to make them sit up and take notice.

Then there's the frequency of claims. One claim in a decade? Probably no biggie. Three claims in two years? The insurance gods might start looking at you with a raised eyebrow. It's not about punishing you; it's about them managing their own risk. They're not running a charity, after all!

And let's not forget the type of claim. Was it a natural disaster that ravaged the whole neighborhood? Your insurer might be more understanding, especially if everyone around you is in the same boat. Did you accidentally leave the garden hose running and flood your basement? That might be viewed a little differently, as it could be seen as something more preventable.

The "Why Do They Do This?" Mystery (Spoiler: It's Not About Gloating)

Okay, so why the potential price hike? It boils down to this: insurance companies are in the business of probabilities. They use a ton of data to figure out who is likely to have what kind of problem. When you file a claim, you're essentially adding data to your personal risk profile. It's like getting a new sticker on your "risk report card."

Think about it this way: if a car insurance company sees you've had multiple speeding tickets, they're gonna charge you more, right? Same principle, just with more shingles and less rubber on the road. They're trying to predict future payouts. It’s not personal; it’s just… business. Still, it can feel a little like your insurance company is saying, "Oh, you had a problem? Well, that'll be extra, thanks!"

When Your Premium Might Not Skyrocket (The Silver Linings!)

But wait! Don't start hoarding granola bars and preparing for the apocalypse just yet. There are plenty of scenarios where your homeowners insurance premium might remain as steady as your grandpa's favorite armchair.

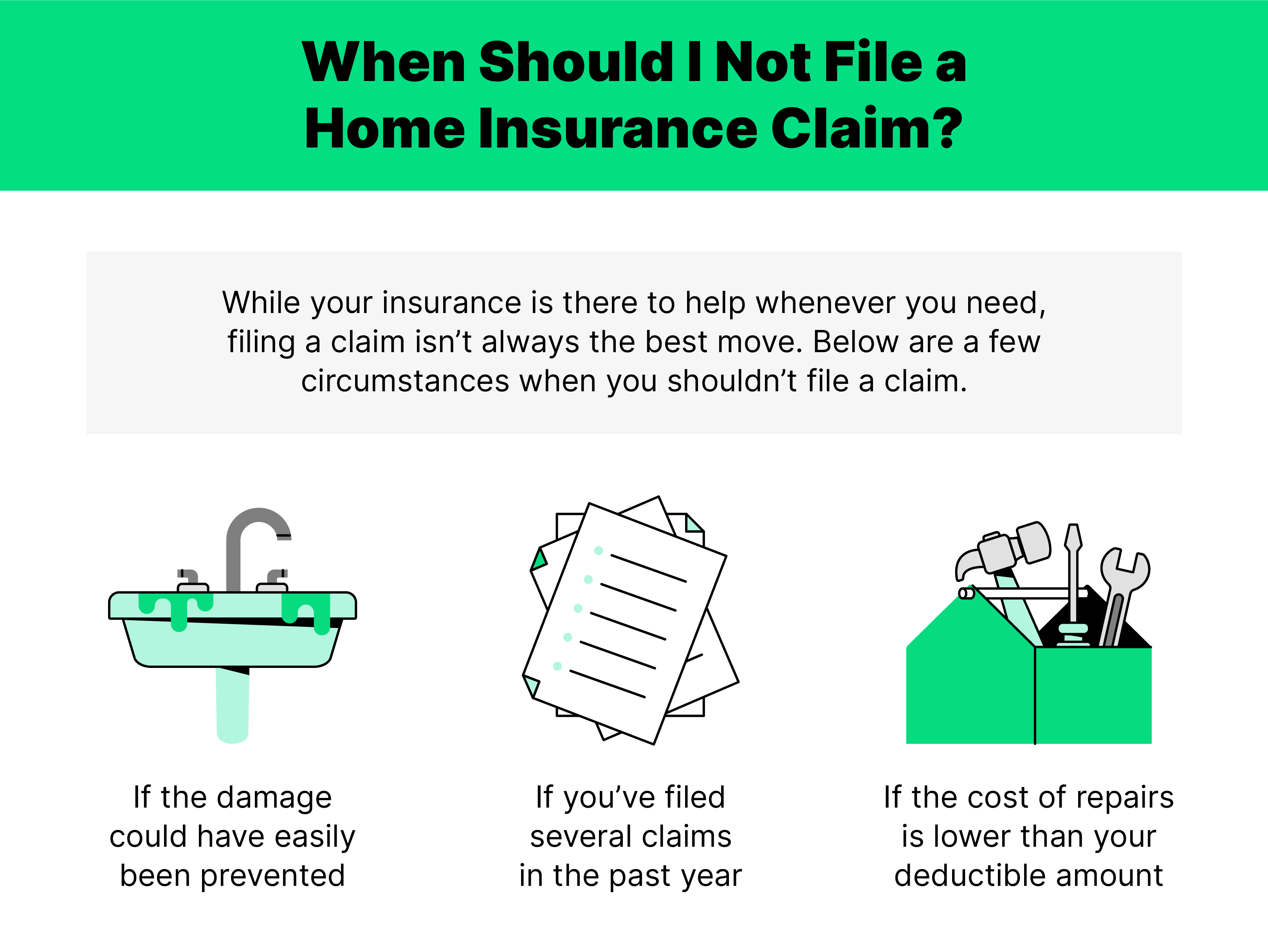

For starters, if it was a very small claim, the kind where you barely had to fill out any paperwork and the repair cost was less than your deductible, your insurer might just shrug it off. It’s like a tiny sneeze; they don't necessarily need to call in the whole medical team.

Also, if your claim was due to a major disaster affecting a wide area, like a hurricane or a widespread hail storm, your insurer might offer some grace. They know that the entire neighborhood experienced the same woes. They’re not going to single you out for an act of Mother Nature that hit everyone. Plus, they have re-insurance for these big events, which is like insurance for insurance companies. Fancy, right?

Some policies also have a "claims forgiveness" clause. This is like a secret handshake with your insurance company. If you've been claim-free for a certain period, they might waive the premium increase for your first claim. It’s their way of saying, "You've been good, have a cookie!"

The Deductible: Your First Line of Defense (and Cost Control!)

Let's talk about the deductible. This is the amount YOU pay out of pocket before your insurance kicks in. Choosing a higher deductible can sometimes lead to lower monthly premiums. It's a trade-off! If you have a high deductible, you're essentially telling your insurer, "I'm willing to take on a bit more risk myself, so give me a break on the regular payments."

And if your claim is less than your deductible? Then, my friend, you're footing the whole bill. This is where the "no premium increase" party really kicks off, because technically, your insurance company didn't pay a dime!

The Quirky Insurance World: A Tale of Two Premiums

Here’s a fun quirk: sometimes, your premium doesn’t go up after a claim, but your renewal offer might have different terms or a higher deductible. It’s like they’re saying, "We still love you, but maybe we should talk about our future together a little more seriously."

Another funny detail? Some insurers have different tiers or "scorecards" for claims. A water damage claim from a burst pipe might be treated differently than a liability claim where someone tripped on your garden gnome. It’s a whole complex system, and honestly, sometimes it feels like they’re reading tea leaves to predict your future insurance needs.

The whole point is, don't automatically assume the worst. Filing a claim is what insurance is FOR! It’s like having a superhero cape for your house. But like any superhero, they sometimes need to adjust their powers (and their prices) based on past battles.

What To Do When Your Premium Tries to Run Away

So, what’s your game plan if your premium does decide to do a disappearing act and reappear at a higher price? First, talk to your insurance agent. They are your allies in this often confusing world. Ask them why your premium increased. Understanding the reasoning is key.

Next, shop around! This is the golden rule of insurance. Get quotes from other companies. You might be surprised to find someone who offers you a better deal, even after your claim. The insurance market is competitive, and they want your business!

Consider increasing your deductible. If you have a healthy emergency fund, you might be able to absorb a slightly higher out-of-pocket cost in case of a future claim in exchange for lower monthly premiums. It’s a calculated move!

And finally, maintain your home! This sounds obvious, but preventing future issues is the best way to avoid claims and keep your premiums happy. Fix that leaky faucet, trim those overgrown trees, and maybe give that squirrel a stern talking-to. A well-maintained home is a happy home, and a happy home often means a happier insurance premium.

So, the next time you have to file a claim, take a deep breath. It’s not the end of the world. It's just part of the grand, slightly quirky adventure of owning a home. And who knows, maybe your insurance premium will surprise you with its resilience. Or, if not, you’ll know exactly how to navigate the wild world of insurance pricing. Happy home owning!