Does Direct Primary Care Count As Insurance

Alright, gather ‘round, folks, because we’re about to dive into a topic that might sound a little… well, insurance-y. But trust me, we’re going to make this as fun and easy as finding a perfectly ripe avocado.

We’re talking about something called Direct Primary Care, or DPC for short. Think of it as your doctor’s office giving you a big, warm hug instead of a confusing bill.

So, does this magical thing called DPC count as insurance? Let’s unpack this, shall we?

The Insurance Shenanigans We’re Used To

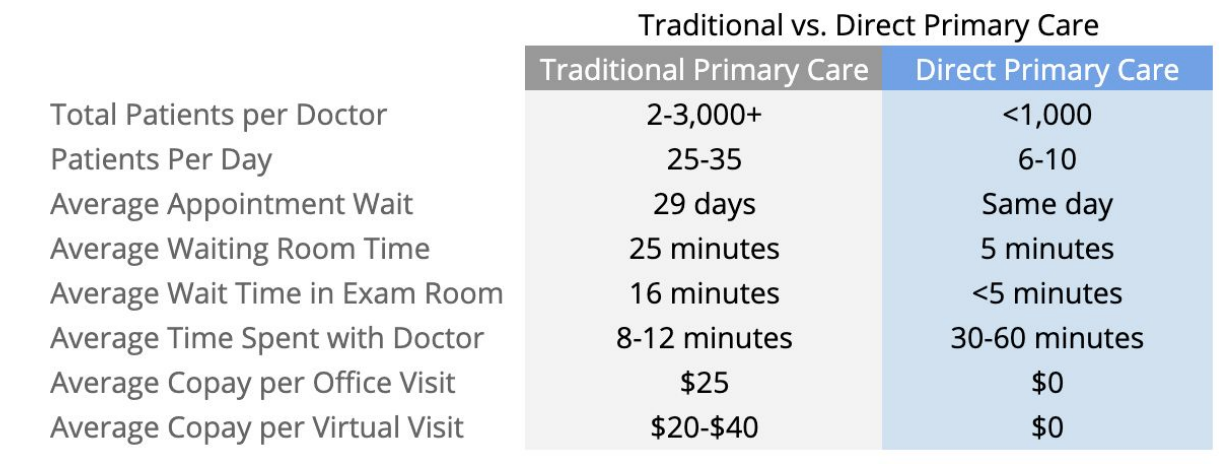

Let’s be honest, traditional health insurance can sometimes feel like navigating a maze blindfolded. You’ve got deductibles higher than a kite, copays that sneak up on you like ninjas, and surprise bills that make you want to hide under your covers.

It’s like trying to get a simple question answered by a robot that only speaks in jargon. You know you need help, but the process is… exhausting.

And don’t even get me started on waiting weeks for an appointment with your actual doctor, only to have a rushed, 10-minute chat that leaves you with more questions than answers. It’s enough to make you want to self-diagnose with WebMD (which, let’s be real, is a whole other adventure).

Enter the DPC Superhero!

Now, imagine a world where your doctor’s office is less about paperwork and more about, you know, doctors and patients. That’s where Direct Primary Care swoops in, cape flapping heroically.

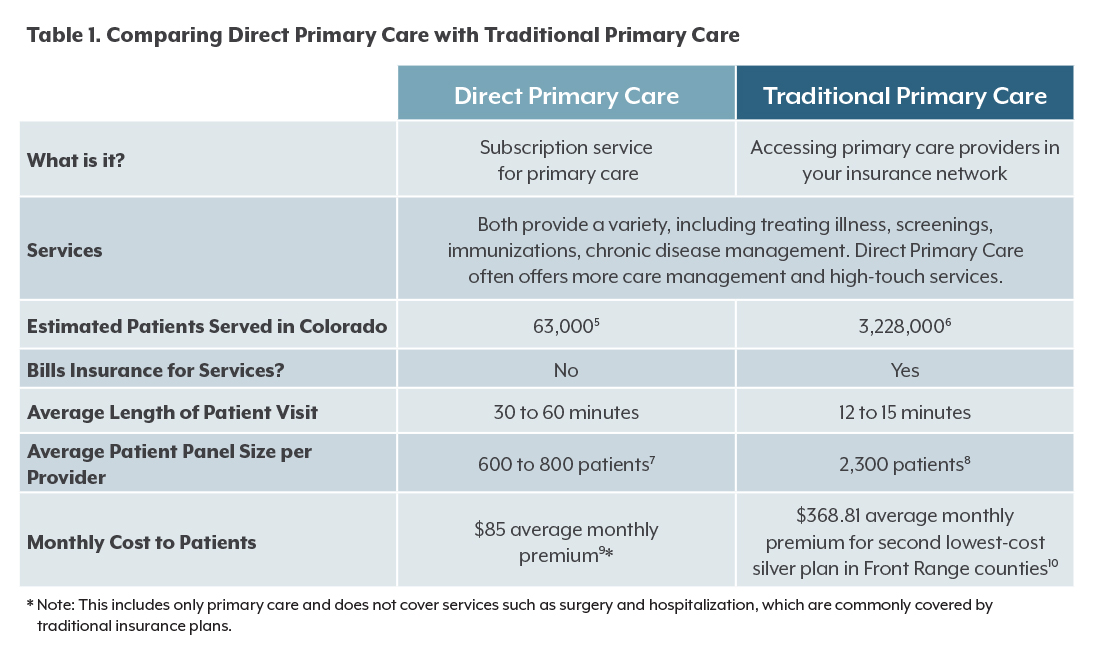

With DPC, you typically pay a flat monthly fee directly to your doctor’s office. No insurance companies acting as gatekeepers, no confusing claim forms, just a clear, predictable cost.

It’s like having a personal stylist for your health, but instead of clothes, they’re helping you look and feel your best!

So, Is It Insurance? The Big Question!

Here’s the kicker, and it’s a good one: Direct Primary Care is not traditional health insurance. Think of it this way: insurance is designed to protect you from massive, unexpected medical expenses, like a house fire or a catastrophic car accident.

DPC, on the other hand, is focused on your *routine and preventative care. It’s about building a strong relationship with your doctor so they can keep you healthy in the first place.

It’s the difference between having a giant emergency fund for a hurricane and having a monthly subscription for excellent Wi-Fi. Both are important, but they serve different purposes!

What Does That Monthly Fee Get You in DPC?

Prepare to be amazed! That DPC membership often covers unlimited visits with your primary care physician. Yes, you read that right: unlimited.

Need to pop in because you’re feeling a bit under the weather? Go for it! Have a burning question about a weird rash? Swing by!

Your doctor gets to know you, your history, and your lifestyle. They become your partner in health, not just a transaction.

This means they have more time for you during appointments. Forget feeling rushed! Your doctor can actually listen to you, dive deep into your concerns, and develop a personalized health plan.

It’s like finally having a conversation with someone who actually cares about what you’re saying, instead of someone ticking boxes on a spreadsheet.

DPC: The Power of Direct Connection

The beauty of DPC is the direct connection. You’re not dealing with insurance company red tape or pre-authorization nightmares.

Your doctor can order tests, prescribe medications, and refer you to specialists without needing a permission slip from a faceless entity. It cuts out a lot of the frustration and delays that can plague traditional healthcare.

This can lead to faster diagnoses, more efficient treatment, and a much smoother healthcare experience overall. It’s like having a fast-pass at an amusement park for your health!

What About Big Stuff?

Now, you might be thinking, “Okay, so DPC handles my check-ups and colds, but what about a serious illness or a surgery?” This is where the distinction is crucial!

Since DPC isn't insurance, it doesn't cover those massive hospital bills or complex surgical procedures. That’s the territory of, you guessed it, actual health insurance.

Many people who use DPC still carry a separate, more affordable insurance plan to cover these catastrophic events. Think of it as your DPC membership being your all-access pass to your doctor’s office, and your insurance being your safety net for the big, unexpected curveballs.

It’s a powerful one-two punch for your health and your wallet!

The “Why” Behind the DPC Revolution

Doctors are choosing DPC because it allows them to practice medicine the way they intended: by focusing on patients, not paperwork. They can spend more time building relationships and less time battling insurance companies.

Patients love DPC because it’s affordable, transparent, and makes accessing quality primary care incredibly easy. It’s a win-win that’s revolutionizing how we think about healthcare.

Imagine a doctor’s office that feels less like a sterile waiting room and more like a trusted friend’s cozy living room, ready to help you navigate your well-being.

So, Does it Count as Insurance?

To put it simply, no, Direct Primary Care does not count as insurance. But that’s precisely what makes it so brilliant!

It’s a different type of healthcare service that focuses on building a strong, ongoing relationship with your primary care doctor, making you healthier and happier in the long run. It’s about proactive care, personalized attention, and a straightforward, affordable monthly fee.

It’s the exciting new frontier in primary care, and it’s designed to make your life easier and your health journey smoother. So, while it’s not insurance, it’s definitely a game-changer you should know about!