Does A Medical Bill Affect Your Credit Score

Hey there, lovely people! Let’s chat about something that can feel as fun as a root canal, but is actually pretty darn important: medical bills and your credit score. I know, I know, the words "medical" and "bill" together can make anyone’s stomach do a little flip. But stick with me, because understanding this is like finding a secret shortcut to financial peace of mind, and who doesn't want that?

Think of your credit score like a report card for how you handle your financial responsibilities. It’s what lenders look at when you want to, say, buy a car (your trusty chariot to the grocery store!) or maybe even rent that cozy apartment you’ve been eyeing. A good score is like a golden ticket, opening doors and making things a little smoother.

So, the burning question:

Imagine you’ve had a bit of a mishap. Maybe you tripped over your enthusiastic dog (we’ve all been there!) and ended up with a sprained ankle and a trip to the doctor. Or perhaps it was something more serious. The bill arrives, and it's a bit of a shock. You might think, "Okay, I'll deal with this later." And that’s where things can get a little tricky.

Generally, medical bills

But here’s where the plot thickens, and why you should care. If that unpaid medical bill gets sold to a debt collector, that’s when it can start to wag its tail and potentially wag down your credit score. Think of it like this: your doctor’s office tries its best to get paid. If they can't, they might sell that debt to a specialist collector who’s really good at chasing down outstanding payments. And that collector will report it.

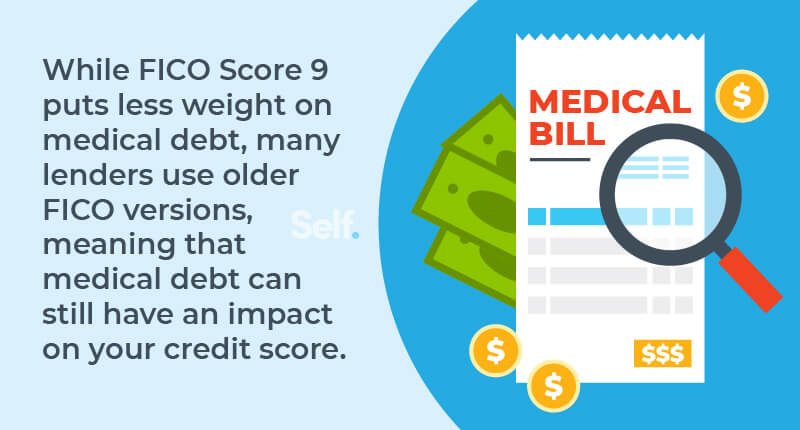

Why does this matter? Well, imagine you’re applying for a mortgage to get that dream home. The bank sees a medical debt on your report, even if it’s old and small. They might think, "Hmm, this person isn't the most reliable with their payments." It’s not fair, especially when it was for something unavoidable like healthcare, but that’s how the system can sometimes work. It could mean a higher interest rate, or worse, a denied application.

It’s kind of like when you leave dirty dishes in the sink. For a little while, it’s just a mild annoyance. But if you keep ignoring it, and then your super tidy friend comes over, they might judge you a little! Your credit score can have a similar reaction to lingering unpaid bills.

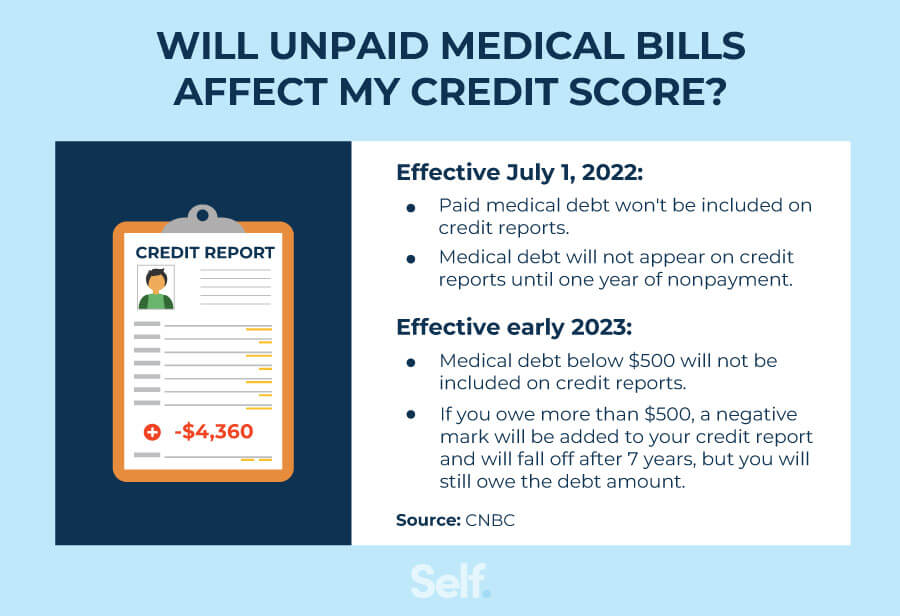

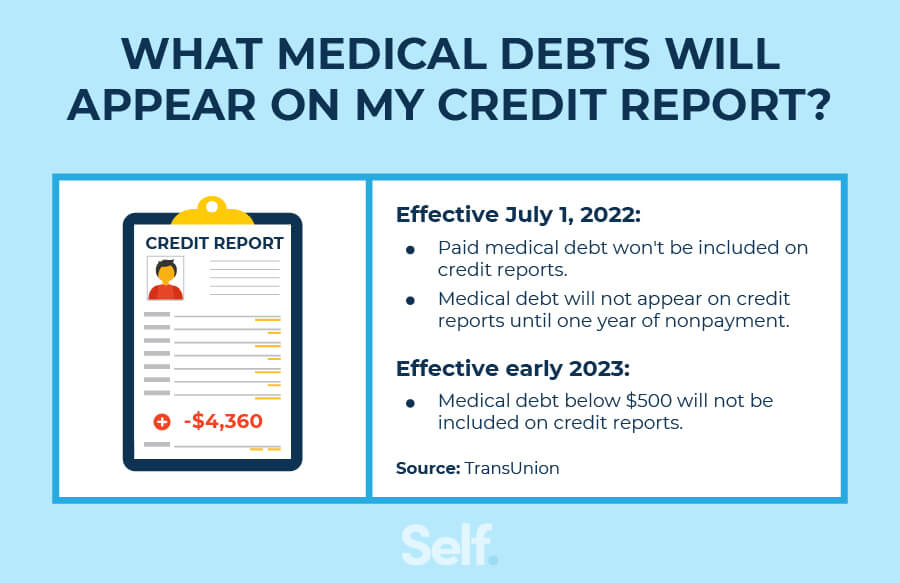

There have been some positive changes recently, which is fantastic news! Thanks to advocacy, unpaid medical debts that are less than $500 won’t be reported to credit bureaus at all. This is a huge relief for many people who might have faced unexpected, smaller medical expenses. Plus, if a medical debt is paid off, it will be removed from your credit report within seven years, even if it was previously sent to collections.

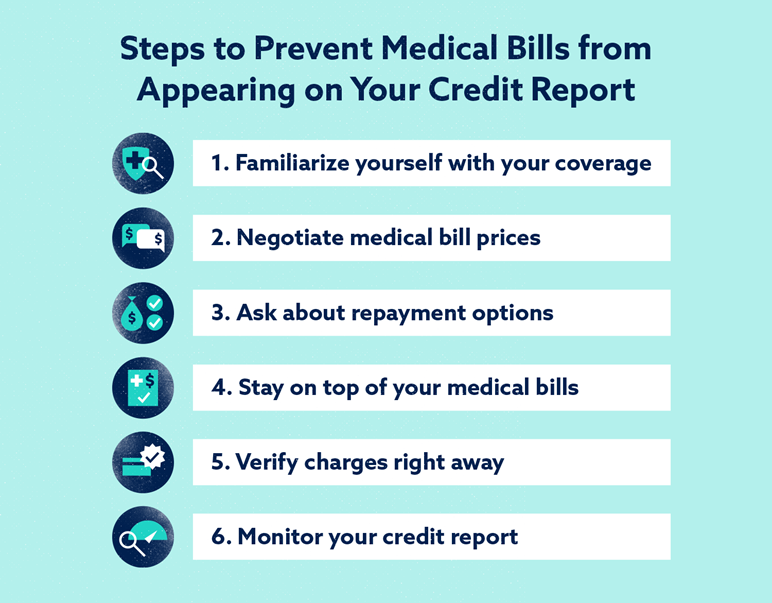

So, what’s the takeaway? The most important thing is to be proactive. When you get that medical bill, don't just shove it in a drawer and hope it disappears. Instead, take a moment to:

1. Read it Carefully

Make sure the charges are correct. Sometimes mistakes happen, and you don't want to pay for something you didn't receive! It's like double-checking your grocery receipt to make sure they didn't accidentally scan two cartons of your favorite ice cream.

2. Contact Your Insurance Company

If you have insurance, this is your first line of defense. See what they’re covering and what your responsibility is. Sometimes there's confusion, and a quick call can clear it all up.

3. Talk to the Provider

If the bill seems high or you're struggling to pay, don't be afraid to talk to the hospital or clinic's billing department. They often have payment plans or financial assistance programs that can make things much more manageable. They'd rather work something out with you than have the debt go unpaid. It's like negotiating with your favorite barista to get an extra shot of espresso for free – okay, maybe not that easy, but you get the idea!

Here’s a little story for you. My friend Sarah had an unexpected ER visit for her son. The bill was more than she could handle in one go. Instead of panicking, she called the hospital. They worked out a low monthly payment plan, spread over several months, that she could comfortably afford. She kept up with the payments, and it never even came close to affecting her credit score. She felt so relieved and in control.

If you find yourself with an old, unpaid medical bill that you didn't realize was impacting your credit, and it’s still within that 180-day window before it’s reported to bureaus (or if it's been paid off but is still lingering), you can dispute it with the credit bureaus. They have processes for this, and it's worth looking into. Think of it as being a good financial detective!

The bottom line is, while medical bills are a part of life, they don't have to be a source of constant financial dread. By being aware, communicating, and taking small, proactive steps, you can keep your credit score healthy and your peace of mind intact. It's all about managing those unexpected bumps in the road with a little bit of savvy and a whole lot of "don't worry, we've got this!"

So, next time a medical bill arrives, take a deep breath, tackle it head-on, and remember that taking care of your financial health is just as important as taking care of your physical health. And hey, a good credit score can certainly make life a little less stressful, leaving you more energy to enjoy those fun moments, like chasing your enthusiastic dog (responsibly, of course!).