Difference In Term And Whole Life Insurance

:max_bytes(150000):strip_icc()/dotdash-term-life-vs-whole-life-5075430-Final-60fb4e8f7bae43e0a65a3fac2431479c.jpg)

So, you're thinking about life insurance. Maybe it sounds a bit serious, a bit… well, insurance-y. But hold on a sec! We're about to dive into something actually pretty cool. Think of it like choosing your adventure!

Life insurance isn't just about “what ifs.” It’s about peace of mind, about making sure your favorite people are taken care of. And guess what? There are different ways to achieve that, each with its own special flavor.

Today, we’re going to chat about two main types: Term Life Insurance and Whole Life Insurance. Don’t let the names scare you. They’re not as complicated as they sound.

Think of Term Life Insurance like renting an apartment. You get all the benefits for a set period of time. It’s super practical and usually comes with a sweet, sweet price tag.

You choose a specific number of years, like 10, 20, or 30. For that chosen time, you’re covered. If something unexpected happens during that term, your loved ones get the payout. It’s like having a safety net for a specific chapter of your life.

The really cool part about Term Life? It’s often way more affordable than its counterpart. This means you can get a substantial amount of coverage without breaking the bank. More bang for your buck, if you will!

Imagine you're buying a house. You need a solid roof over your head, but you're not necessarily looking to buy the entire neighborhood at once. Term Life is that sturdy, reliable roof for the years you need it most.

It’s perfect for when you have big financial commitments, like a mortgage or young kids who depend on your income. You want that protection while those big bills are looming. Once the mortgage is paid off or the kids are out of college, your need for that specific coverage might change.

So, Term Life is your go-to for straightforward, temporary protection. It’s simple, it’s effective, and it’s a smart financial move for many families. It’s like a super useful tool in your financial toolbox.

Now, let’s switch gears and talk about Whole Life Insurance. If Term Life is like renting, Whole Life is like buying a house and owning it forever. It’s a much bigger commitment, but it comes with some pretty unique perks.

The biggest difference? Whole Life Insurance is designed to last your entire lifetime. Seriously, it’s meant to be there from the day you get it until the very end. No more choosing a specific term.

This means that no matter when you pass away, your beneficiaries will receive the death benefit. It’s a guarantee of a payout, a lifelong promise. How’s that for leaving a legacy?

But wait, there’s more! Whole Life Insurance also has a little something extra called cash value. Think of this as a savings account that grows over time, tax-deferred. It's like your insurance policy is also working for you financially.

As you pay your premiums, a portion of that money goes into this cash value. It’s a separate pot of money that you can actually access while you’re still alive. Pretty neat, right?

You can borrow against your cash value or even withdraw from it, though doing so can affect the death benefit. It’s like having a financial safety net that’s attached to your insurance. It adds a whole other layer of flexibility.

This cash value can grow at a guaranteed rate, offering some stability. It’s not as flashy as some investments, but it’s a steady, reliable growth. Like a slow and steady tortoise winning the race.

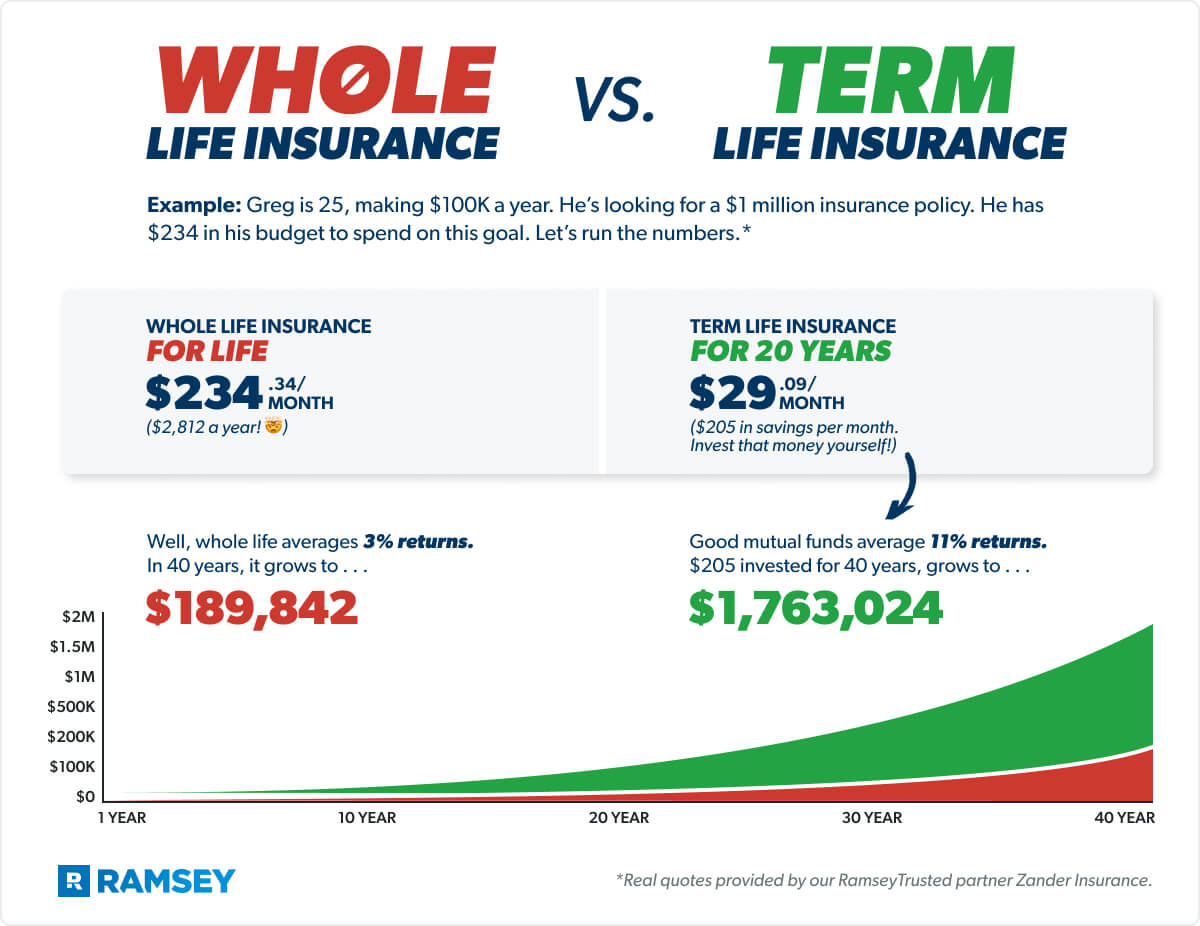

Because Whole Life is designed to cover you forever and includes this cash value feature, it generally comes with higher premiums than Term Life. It's a trade-off for that lifetime coverage and the growing savings.

Think of it this way: Term Life is focused on providing protection for a specific period. Whole Life offers both that lifelong protection *and a way to build wealth over time. It’s a two-in-one deal!

Who is Whole Life great for? It's often a good choice for people who want to ensure their estate is well-provided for, or if they want to leave a significant inheritance. It’s for those who appreciate a lifelong guarantee.

It can also be useful for estate planning, helping to cover estate taxes or provide funds for funeral expenses without dipping into other assets. It’s like having a pre-paid solution for future financial needs.

So, the big question is, which one is right for you? It really depends on your individual needs, your budget, and your long-term goals. There’s no one-size-fits-all answer here.

If you need affordable coverage for a specific period, like while you’re paying off your mortgage or raising young children, Term Life is likely your champion. It’s the practical, budget-friendly choice for targeted protection.

If you’re looking for lifelong coverage and the potential to build cash value over time, and you have the budget for it, then Whole Life might be your perfect match. It’s the comprehensive, long-term solution with added financial benefits.

It’s kind of like choosing between a fantastic vacation rental for your annual trip versus investing in a vacation home. Both have their merits, but they serve different purposes and have different price tags.

Don't feel pressured to pick right away! The best approach is to understand what each option offers. Think about what worries you most, and what you want to achieve financially for your loved ones.

Sometimes, people even combine both! They might get a Term Life policy for a large chunk of coverage during their peak earning years and a smaller Whole Life policy for permanent needs. It's like having your cake and eating it too, with a customized strategy.

The most important thing is to start the conversation. Look into it, get some quotes, and maybe chat with a financial advisor. They can help you decode the jargon and find the best fit for your unique situation.

Think of it as a fun puzzle. You're trying to put together the pieces to create the perfect financial picture for your future and the future of those you care about most. It’s about empowerment and smart planning.

So, whether you’re leaning towards the practicality of Term Life or the lifelong benefits and cash value of Whole Life, know that you’re taking a step towards securing your loved ones’ futures. And that, my friends, is pretty darn special.

It’s not just about policies and premiums; it’s about love, responsibility, and building a lasting sense of security. It’s a tangible way to show you care, even when you’re not around. Pretty powerful stuff, don’t you think?

So go on, explore! The world of life insurance might just surprise you with its practical magic and its ability to offer such profound peace of mind. It's a journey worth taking.

Remember, the goal is not to be scared, but to be prepared. Both Term and Whole Life insurance are fantastic tools to help you do just that.