Difference Between A Bull And A Bear Market

Ever find yourself staring at the news, hearing about the stock market going up or down, and feeling like you’re trying to decipher ancient hieroglyphics? You’re not alone! People throw around terms like “bull market” and “bear market” like they’re obvious, but let’s be honest, they’re about as clear as a muddy puddle after a downpour.

Well, fear not, my curious comrades! We’re about to break down this whole bull vs. bear thing in a way that’s as easy as deciding whether to have pizza or tacos for dinner. Think of it like this: the stock market is this giant, unpredictable playground where fortunes can be made and lost, and our two main characters, the bull and the bear, are the spirits that guide its mood.

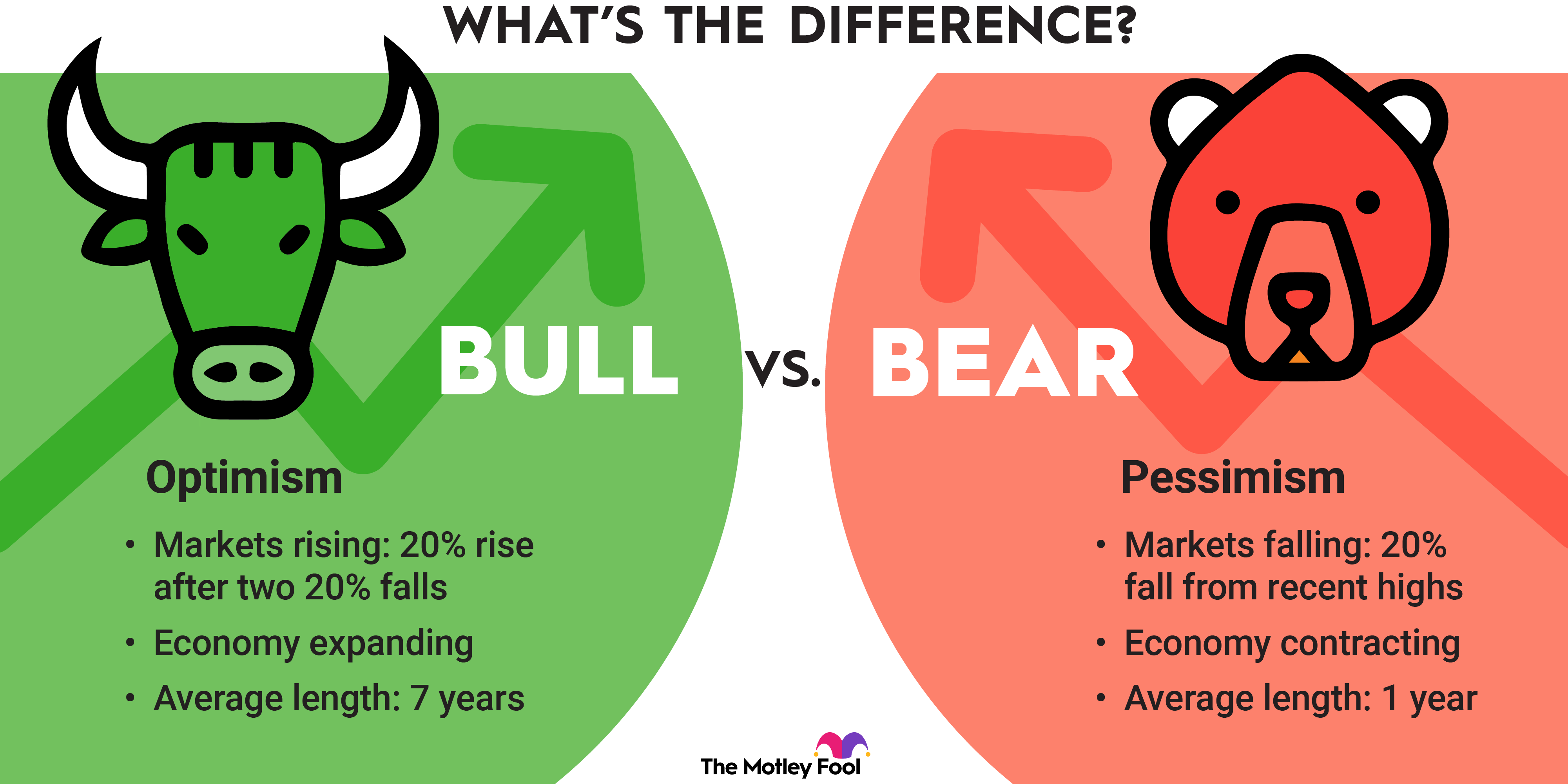

Let’s start with the cheerful chap: the bull! Imagine a bull. What does it do? It charges forward, right? Head down, horns ready, stampeding with gusto! That’s exactly what a bull market feels like. It’s when the stock market is on a magnificent upward climb, practically doing a victory lap. Think of it as a big, happy party where everyone’s invited and the stock prices are getting bigger and better by the day. It’s like finding a twenty-dollar bill in your old jeans – pure joy! Prices are generally rising, people are feeling optimistic, and they’re eager to invest their hard-earned cash because they believe it’s only going to grow.

In a bull market, companies are usually doing well. They’re making profits, expanding, and generally kicking butt. This optimism spreads like wildfire. Imagine everyone you know suddenly getting a raise and deciding to go on an epic vacation – that’s the vibe! People are confident that things will keep getting better, so they’re happy to buy stocks, hoping to ride that wave of prosperity all the way to the bank. It’s like the market is a super-fast roller coaster that’s going straight up, and everyone’s screaming with delight!

Now, let’s switch gears and meet our other star player: the bear. Picture a bear. What’s it doing? Often, it’s hibernating, or maybe it’s got a grumpy look on its face and is swiping at things. That's the mood of a bear market. It’s when the stock market is taking a nosedive, heading south with a definite lack of enthusiasm. It’s like realizing you’ve been buying those fancy coffee pods for years, and suddenly you find out they’re basically just flavored dust. Bummer!

In a bear market, things are generally going the other way. Stock prices are falling, and people are starting to get a bit… well, bearish. They’re feeling cautious, maybe even a little scared. It’s like the market has hit a giant pothole, and everyone’s getting jolted. Companies might be struggling, profits might be down, and the general mood is one of uncertainty. People are less eager to buy stocks because they’re worried that the price will keep dropping, and they might lose money. Imagine if your favorite ice cream shop suddenly doubled its prices – you’d probably think twice before heading in, right? That’s the sentiment in a bear market.

So, what’s the key difference, you ask? It’s all about the direction and the feeling. A bull market is about growth, optimism, and upward movement. Think of it as a sunny day with a gentle breeze, perfect for flying a kite. A bear market, on the other hand, is about decline, caution, and downward movement. Imagine a cloudy day where you’re not quite sure if it’s going to rain.

Think about it this way: If you’re walking and you see a sign that says, “Free Ice Cream Tomorrow!” you’re probably going to be pretty happy and maybe even tell all your friends. That’s the bull market optimism! But if you see a sign that says, “Warning: Giant sinkhole ahead!” you’re going to slow down, look around nervously, and maybe even turn back. That’s the bear market caution!

It’s also important to remember that these aren’t just random occurrences. They’re driven by a whole bunch of factors, from how well companies are doing to how confident people feel about the economy. Sometimes, a bull market can go on for years, making investors feel like kings and queens of the financial world. And then, sometimes, a bear market can strike, making everyone clutch their wallets a little tighter.

But here’s the good news, my friends: neither a bull nor a bear lasts forever. The market is constantly shifting and changing, like the tides. After a long, glorious bull run, a bear market might eventually show up. And after a period of grumbling and falling prices in a bear market, the bull is bound to peek its head out again, ready to charge. It’s a natural cycle, like the changing seasons.

So, the next time you hear someone talking about a bull or a bear, you can nod wisely and think, “Ah, yes! The market is either charging ahead with a smile, or it’s got its paws crossed and is looking a bit grumpy!” It’s not so scary when you break it down, right? Now go forth and impress your friends with your newfound financial vocabulary!