Current Mortgage Rate For 15 Year Fixed

Hey there, future homeowners and savvy savers! Let’s talk about something that sounds super serious, but is actually way more exciting than you might think: 15-year fixed mortgages! Imagine this: you’re sailing on a calm sea, the sun is shining, and you know exactly how much your monthly payment is going to be. No stormy weather, no surprise squalls – just smooth sailing towards your dream home! That’s the magic of a 15-year fixed mortgage.

Now, I know what you might be thinking. “Mortgages? Rates? Sounds like rocket science!” But trust me, it’s more like baking a delicious cake. You’ve got your ingredients (the loan amount), your oven temperature (the interest rate), and your bake time (the loan term). And with a 15-year fixed rate, the recipe is beautifully simple: you pay it off faster, and your interest rate stays put, like a loyal guard dog, guarding your budget from unexpected leaps and bounds!

Think of it this way: you’re signing up for a shorter marathon. Instead of a 30-year slog where you might be tempted to pack it in halfway and move to a desert island (tempting, I know!), a 15-year fixed mortgage is more like a brisk, invigorating 5K. You get to the finish line quicker, you feel amazing, and you’ve got more years left to, you know, actually enjoy your house without that mortgage hanging over your head like a slightly grumpy ghost.

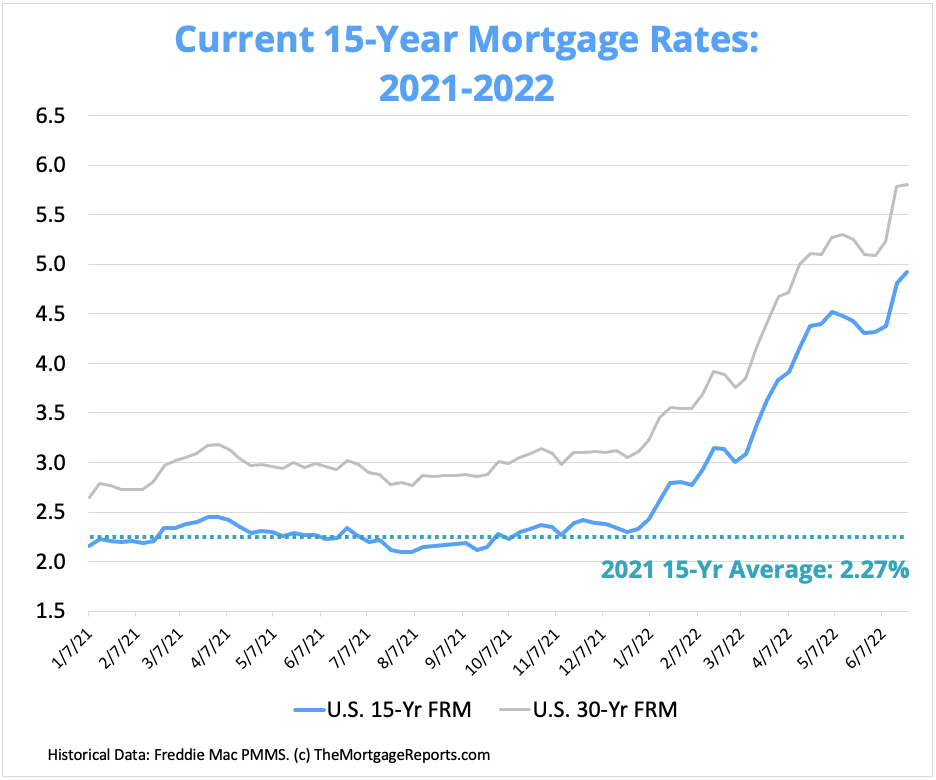

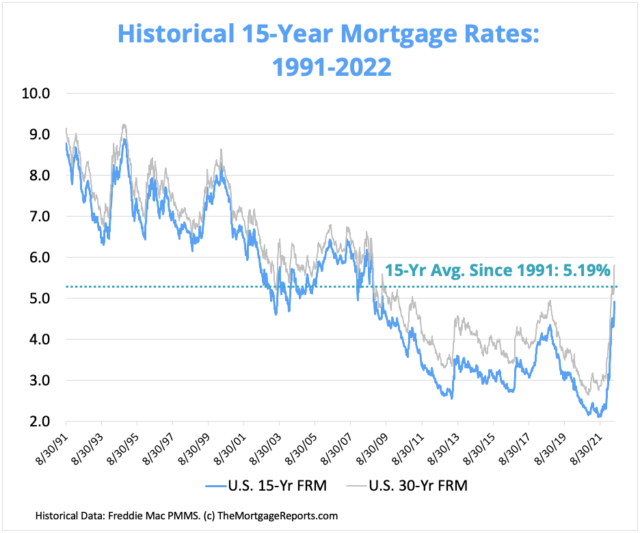

And the best part? The current mortgage rates for a 15-year fixed are often like finding a perfectly ripe avocado on sale – a delightful surprise that makes everything better! While the exact numbers are always doing a little dance (they're called "rates" for a reason, right?), they’ve been looking pretty darn attractive lately. We’re talking about numbers that can make your wallet do a little happy jig.

Let’s get a little playful with this. Imagine you’re at a buffet, and there are two options: Option A, where you’re served a massive plate of food that you’ll be picking at for three days straight, and Option B, a perfectly portioned, utterly delicious gourmet meal that you finish in one sitting, leaving you satisfied and with plenty of room for dessert! The 15-year fixed mortgage is definitely Option B. You might pay a little more each month compared to its 30-year cousin, but oh boy, is it worth it! You slash down the total interest you pay over the life of the loan. We’re talking about saving potentially tens of thousands of dollars. That’s enough for a truly epic vacation, a super-fancy new kitchen appliance, or maybe even a solid gold bathtub (hey, we can dream!).

So, why is it called "fixed"? Because it’s fixed! Like that one friend who always knows the best pizza place. No matter what happens in the wild world of economics, your interest rate stays the same for the entire 15 years. This means your principal and interest payment is as predictable as the sunrise. You can budget with the confidence of a seasoned accountant, planning your future without the nagging worry that your mortgage payment will suddenly decide to go on a bungee jump.

Consider this: you’re building a magnificent sandcastle. With a 15-year fixed mortgage, you’re using really strong, quick-drying cement. It’s solid, it’s stable, and it’s going to be standing tall in no time. If you went with a 30-year fixed, it’s more like using a slightly less robust, slower-setting glue. It’ll hold, sure, but it’ll take a whole lot longer to feel truly secure.

Now, let’s talk about those current mortgage rates for a 15-year fixed. They’re often significantly lower than their 30-year counterparts. Think of it like getting a premium seat at the concert for a slightly better price because you committed to a shorter show. Lenders love this because it means they get their money back (and their profit!) faster. And guess who benefits from that? You do! Lower interest rates mean more of your hard-earned cash goes towards actually owning your home, and less goes into the abyss of interest payments.

So, if you’re looking to buy a home, or even refinance an existing one, and you’ve got a bit of financial pep in your step, the 15-year fixed mortgage is absolutely worth a serious look. It’s the smart choice for those who want to build equity quickly, save a bundle on interest, and enjoy the peace of mind that comes with a predictable, manageable mortgage payment. It’s about taking control of your financial future, one happy, fixed payment at a time. Don’t let those numbers scare you; see them as an opportunity to make your homeownership dreams a vibrant, debt-free reality sooner than you think! It’s time to get excited!