Crude Oil Price Today Per Barrel In Usd

You know, I was filling up my car the other day, humming along to some questionable 80s ballad, when I noticed the numbers on the pump just… kept climbing. Like a teenager hitting a growth spurt on fast-forward. It got me thinking, not just about my rapidly depleting bank account, but about the invisible hand that dictates those numbers. The one that, with a flick of its wrist, can make my wallet feel significantly lighter. I’m talking, of course, about the ever-elusive, the perpetually talked-about, the utterly fundamental crude oil price today per barrel in USD.

It’s one of those things, isn’t it? We all feel the ripple effect, whether we’re driving a gas-guzzler or zipping around in an electric marvel (though even those batteries have their own oil-related supply chain stories, but I digress!). It’s a global dance, a high-stakes poker game played on a stage that stretches from the deserts of the Middle East to the icy depths of the Arctic. And today, right now, someone, somewhere, is asking: “What’s the crude oil price today per barrel in USD?”

And honestly, it’s a question that can feel like trying to catch smoke. It shifts. It jiggles. It sometimes does a little jig that makes economists sweat. But there are people who actually track this stuff. Analysts, traders, even folks in government who probably have entire rooms dedicated to screens displaying charts that look like a seismograph during an earthquake. Pretty fascinating, when you stop to think about it. They’re not just looking at numbers; they’re looking at the pulse of the global economy.

So, let’s dive in, shall we? Grab your favorite beverage – maybe a latte, which, let’s be honest, has its own oil-tinged journey from bean to cup – and let’s try to make sense of this whole crude oil price today per barrel in USD thing. No fancy jargon, just a friendly chat about what’s making those pump prices tick. Because, let’s face it, knowing why your money is disappearing is at least a little bit empowering, right?

The Wild Ride of Black Gold

The price of crude oil. It’s more than just a number on a screen; it’s a story. A story of supply and demand, of political wrangling, of technological advancements, and, occasionally, of pure, unadulterated market madness. Think of it like this: imagine a giant pie. That’s the world’s energy needs. Now, how much of that pie is made of oil? A whole lot, historically speaking. And the price of that slice? Well, that’s what we’re all trying to pin down when we ask about the crude oil price today per barrel in USD.

It’s not like there’s just one kind of oil, either. Nope. We’ve got your Brent Crude, your West Texas Intermediate (WTI), and a whole host of others. They’re like different vintages of wine, each with its own characteristics and, consequently, its own price. WTI, for example, is generally lighter and sweeter (less sulfur, which makes it easier to refine), so it often fetches a slightly higher price. Brent, on the other hand, is the global benchmark, traded all over the world. So, when you hear about the oil price, it’s usually one of these two leading the charge.

And the “per barrel” part? That’s just the standard unit of measurement. A barrel of oil is, you guessed it, 42 US gallons. Imagine trying to track it in liters or pints – it would be a logistical nightmare, and frankly, a bit too much math for my liking before my first coffee. So, we stick with the barrel. It’s iconic, almost like the little black dress of commodities. Always there, always relevant.

What’s Pushing the Price Today?

So, what influences the crude oil price today per barrel in USD? Oh, you know, just a little something called the entire global geopolitical landscape. Casual, right? It's a constant tug-of-war between the folks who have the oil and the folks who need it. And in that tug-of-war, a million things can give you whiplash.

Let’s start with the big players. You’ve got OPEC+, the Organization of the Petroleum Exporting Countries and its allies. These guys have a massive chunk of the world’s oil production. When they decide to pump more oil, prices tend to… well, go down. Surprise, surprise! When they decide to cut back production to keep prices artificially high (and let’s be honest, that’s often the strategy), prices tend to… you guessed it, go up.

Then you have the non-OPEC producers. The United States, with its shale oil revolution, has become a significant force. Think of it as a really enthusiastic newcomer crashing the established party. Their ability to ramp up or slow down production can also throw a wrench into the OPEC+ plans and influence the crude oil price today per barrel in USD.

But it’s not just about how much oil is being pumped. Demand plays a huge role. Is the global economy booming? Are factories churning out goods? Are people traveling more? If the answer is yes to all of those, then demand for oil goes up, and prices usually follow suit. Conversely, if there’s a recession looming, or if people are suddenly glued to their home offices, demand dips, and the price can feel the pinch.

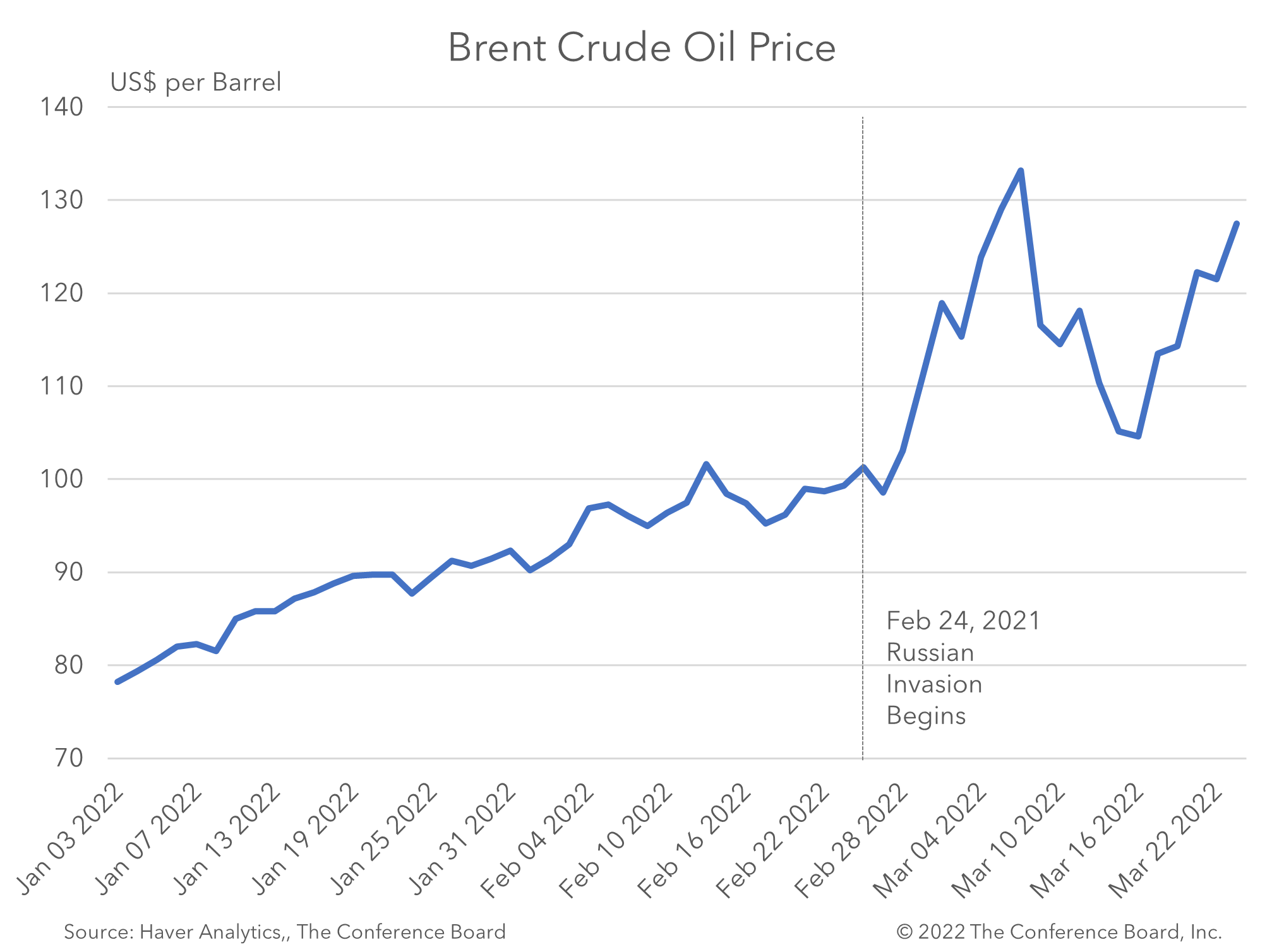

And then, my friends, there are the wildcards. Hurricanes in the Gulf of Mexico can shut down offshore production, causing prices to spike. Geopolitical tensions in oil-producing regions – think the Middle East, for crying out loud – can send jitters through the market. A conflict here, a political shake-up there, and suddenly everyone’s wondering if the oil supply will be disrupted. It’s enough to make you want to hoard candles and canned beans, isn’t it? (Just kidding… mostly.)

Even the weather can play a role. Extreme cold snaps can increase demand for heating oil, while scorching heatwaves can boost demand for electricity, which, in many places, is still generated with fossil fuels. It’s a complex web, and trying to predict the exact crude oil price today per barrel in USD can feel like predicting the winning lottery numbers. Only with much higher stakes and significantly more suits involved.

The Dollar Connection: Why USD Matters

Now, here’s a little nugget of information that often gets overlooked, but it’s super important when we talk about the crude oil price today per barrel in USD. Why USD? Why not euros or yen? Well, crude oil is predominantly traded in US dollars. This is largely due to historical reasons and the US dollar’s status as the world’s primary reserve currency.

So, what does this mean for us, the everyday observer of the oil market? It means that the strength of the US dollar directly impacts the price of oil for countries using other currencies. If the dollar strengthens, oil becomes more expensive for buyers using weaker currencies. Conversely, if the dollar weakens, oil becomes cheaper for them. It’s like a seesaw, with the dollar on one end and the purchasing power of other nations on the other.

Think about it: if you’re a country in Europe, and the euro is weak against the dollar, you’re going to need more euros to buy the same amount of oil, even if the dollar price of oil hasn’t changed at all. This can then cascade into higher prices for gasoline in your country, even if the barrel price in USD appears stable. It’s a subtle but significant factor that adds another layer of complexity to understanding the crude oil price today per barrel in USD.

It also means that traders and analysts are constantly monitoring not just the oil market itself, but also the currency markets. It’s a two-for-one special of economic indicators! Sometimes, a strong dollar can even be a reason for oil prices to dip, as it makes dollar-denominated commodities more expensive for international buyers. It’s a fascinating interplay, and one that often flies under the radar for many of us just trying to navigate our daily commutes.

Futures and Speculation: The Crystal Ball of Oil

When you hear about the daily fluctuations in the crude oil price today per barrel in USD, a big part of what you're seeing is the result of trading in futures markets. Now, this can sound a bit like advanced wizardry, but stick with me. Futures contracts are essentially agreements to buy or sell a commodity (like oil) at a predetermined price on a specific future date.

Why do people do this? Well, producers might use futures to lock in a price for their future output, ensuring they get a certain return. Consumers might use them to hedge against future price increases. But then you have the speculators. These are folks who are essentially betting on the future direction of oil prices. They’re not necessarily intending to take physical delivery of the oil; they’re just trying to profit from price movements.

And let me tell you, these speculators can have a pretty significant impact. Their collective buying and selling can move the market, sometimes creating self-fulfilling prophecies. If enough traders believe oil prices are going to go up, they’ll start buying futures contracts, which then pushes prices up, reinforcing their initial belief. It’s a bit like a crowd at a concert all thinking the band is going to come out, so they start cheering, and that cheer actually makes the band more likely to appear. Weird, right?

This is why the crude oil price today per barrel in USD can sometimes feel so volatile. It’s not just about the current supply and demand; it’s also about what traders think the supply and demand will be in the future. They’re looking at economic data, geopolitical events, weather forecasts, and a whole host of other indicators to try and predict the future. It’s a constant stream of analysis and decision-making, happening in milliseconds.

So, the price you see quoted for “today” is often a reflection of these futures markets, especially the front-month contracts (the ones closest to expiring). It’s a forward-looking indicator, trying to capture the collective wisdom (and sometimes, the collective panic) of market participants. It’s a high-octane environment, that’s for sure!

Beyond the Pump: The Wider Impact

So, we’ve talked about how the crude oil price today per barrel in USD affects your gas tank, but the ripple effects go so much further. Think about literally everything that’s made of plastic. Yep, that’s oil. From your toothbrush to your computer keyboard, from the packaging on your groceries to the tires on your car – oil is a fundamental building block.

When oil prices spike, the cost of producing these everyday items increases. This means manufacturers face higher costs, and those costs are inevitably passed on to us, the consumers. So, even if you’re driving an electric car and feel insulated from gas prices, you’re still likely to see the impact in the price of your new phone or the plastic container your yogurt comes in. It’s like a really, really pervasive form of inflation.

Transportation costs are another massive factor. Shipping goods across the globe relies heavily on oil-powered vessels and trucks. When fuel costs go up, so does the cost of transporting everything. This affects everything from the price of imported goods to the cost of local produce that’s been trucked in from a few states away. It’s a fundamental part of the global supply chain, and any disruption or increase in oil prices has a domino effect.

And let’s not forget about the energy sector itself. While there’s a massive push towards renewables, many power plants still rely on oil, especially for peak demand. Increased oil prices can lead to higher electricity bills for households and businesses, adding another layer of financial pressure. It’s a constant reminder of how intertwined our modern lives are with fossil fuels, even as we strive for a cleaner future.

The crude oil price today per barrel in USD isn’t just a number; it’s a barometer of global economic health, a geopolitical indicator, and a fundamental driver of countless industries. It influences your daily commute, the cost of your groceries, and the very materials that make up the objects you use every day. Pretty wild to think about, isn’t it?

So, What's the "Today" Price?

Alright, so you’ve endured my rambling and are probably wondering, “Okay, wise guy, what is the darn price right now?” And as I’ve hinted, this is where it gets tricky. The crude oil price today per barrel in USD is a moving target. It changes throughout the day, even minute by minute, as markets open and close and news breaks.

If you want the most up-to-the-minute figures, you’d typically look at financial news websites, commodity trading platforms, or specialized energy news outlets. They will usually quote prices for WTI and Brent crude futures. For instance, you might see something like: “WTI crude futures for [next delivery month] trading at $X.XX per barrel,” and then a similar quote for Brent.

It’s important to remember that the "spot" price (the price for immediate delivery) can sometimes differ slightly from the futures price, but futures are what most people refer to when they talk about the daily oil price. Think of it as the publicly traded score of the oil market.

So, if you’re checking this article at precisely the moment I’m writing it, the price might be one thing. If you’re reading it a few hours from now, or tomorrow, it will likely be something else. That’s the nature of this beast – always evolving, always responding to the latest developments. It’s a constant reminder that in the world of commodities, especially something as vital and complex as crude oil, “today” is a very fluid concept.

But the quest for that number, the understanding of what influences it, and the awareness of its far-reaching consequences? That’s a constant. And I hope this little chat has given you a bit more insight into that ever-fascinating, and sometimes bewildering, world of the crude oil price today per barrel in USD. Now, if you’ll excuse me, I think my car is silently judging me for how much I just spent on its last fill-up. Time for a walk!