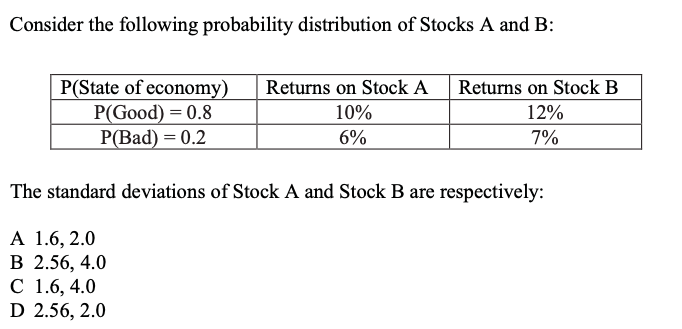

Consider The Following Probability Distribution For Stocks A And B

Alright, settle in, grab your overpriced artisanal coffee, and let's talk about something that sounds drier than a dad joke at a silent retreat: probability distributions. Specifically, for two imaginary stocks, let's call them Stock A and Stock B. Now, before you start picturing dusty textbooks and professors who speak only in complex equations, let me tell you, this is actually more like picking between your favorite flavors of ice cream, but with way more potential to either make you a millionaire or have you eating instant ramen for a month.

So, picture this. We've got Stock A. Now, Stock A is, let's say, a steady Eddie. It's the kind of stock that you could probably explain to your grandma, and she'd nod along without her eyes glazing over completely. Its probability distribution is like a nice, predictable bell curve. You know, that classic humpty-dumpty shape? Most of the time, it's going to do its thing, hang out around the average, maybe wiggle a little. Think of it as a… well, a stock that’s just fine. It’s not going to set the world on fire, but it's also unlikely to spontaneously combust and take your life savings with it. It’s the vanilla of the stock market, reliable and generally accepted.

The best part about Stock A? Its variance, which is fancy talk for how spread out the possibilities are, is pretty darn low. This means most of the time, Stock A is going to give you results that are pretty close to its average return. It’s like if you're at a buffet, and you always go for the mashed potatoes. You know what you're getting, and it’s usually pretty consistent. No wild surprises, no rogue Jell-O mold. Just… mashed potatoes.

Now, let's meet Stock B. Oh boy, Stock B. Stock B is the daredevil. It's the one with the mohawk and the tattoos, the one who bungee jumped off that bridge just because. Its probability distribution? It's not a neat little bell curve, no sir. It's more like a… a wobbly spaghetti monster. It's got a few big spikes, meaning there are some highly likely outcomes, but then it's got these long, spooky tails stretching out into the unknown. It's like the stock market's equivalent of that friend who texts you at 3 AM with a "brilliant" business idea that involves selling artisanal cat sweaters made from recycled dryer lint.

Stock B has a much higher variance. This means its returns can be all over the place. One day, it's soaring like an eagle, and you're planning your yacht purchase. The next day, it's plummeted like a lead balloon in a zero-gravity chamber, and you're contemplating the economic viability of selling your socks for spare change. It's the thrill-seeker's choice, the gamble that could lead to a penthouse or a cardboard box under a bridge.

Let's break down these distributions a bit more, just to make sure we’re all on the same page. For Stock A, imagine we’re looking at its potential returns over a year. We might find that 70% of the time, it’ll give us a return of somewhere between 5% and 10%. Pretty sweet, right? It’s like knowing you’re going to get a B- on that history paper, no matter how much you procrastinate. It’s a decent, expected outcome.

But Stock B? Oh, Stock B is a wild card. For Stock B, that same 70% probability might be split between, say, a 30% chance of a 40% gain (hello, retirement!) and a 40% chance of a 15% loss (hello, financial ruin!). And then there’s that other 30% of the time? That’s where the real fun – or terror – lies. That’s the 10% chance it skyrockets by 100% and you become the proud owner of a small island, and the other 20% chance it tanks by 80% and you're suddenly fluent in the language of pawn shop negotiations.

Think about it like this: if you were to pick one of these stocks based purely on the average expected return, they might look pretty similar. Let's say both have an average expected return of, oh, 8%. Sounds great, right? But that's like saying both a fluffy kitten and a rabid badger are "mammals." Technically true, but the experience is… vastly different.

The key here, my friends, is risk. Stock A, with its tight little bell curve, has low risk. It’s the sensible shoe of the investment world. Stock B, with its sprawling, unpredictable spaghetti monster distribution, has high risk. It’s the stiletto heel that might give you blisters but looks fabulous doing it (until it doesn't).

So, what does this mean for us mere mortals trying to make our money do more than just sit there and collect dust? It means we need to understand what kind of risk we're comfortable with. Are you someone who likes the security of knowing you're probably not going to lose your shirt? Then Stock A is your jam. You're looking for steady growth, like a well-maintained bonsai tree. It's not exciting, but it's beautiful and dependable.

Or are you an adrenaline junkie? Do you get a rush from the possibility of a massive payday, even if it means the occasional stomach-churning drop? Then Stock B might be calling your name. You're playing the lottery with slightly better odds, hoping for that big win, while simultaneously developing a strong relationship with your local stress ball manufacturer.

It’s also worth noting that sometimes, even the most predictable stock can surprise you. Think of a seemingly stable company suddenly hit by a scandal, or a product that was supposed to be revolutionary turning out to be… well, less revolutionary and more like a glorified paperweight. The "tails" of Stock A's distribution, while small, are still there. And sometimes, lightning strikes in unexpected places, both good and bad.

And Stock B? Well, sometimes those wild swings can lead to incredible fortunes. That 10% chance of a 100% gain isn't just a number; it's the dream that fuels a lot of investment decisions. It's the lottery ticket that sits on your desk, whispering sweet nothings of early retirement and a lifetime supply of caviar.

Ultimately, understanding these probability distributions is like having a weather forecast for your money. Stock A tells you it's probably going to be a mild, partly cloudy day. Stock B tells you it's a 50/50 chance of sunshine or a category 5 hurricane. Which one you choose depends on whether you packed an umbrella or a lifeboat.

So, next time you hear about probability distributions, don't glaze over. Think about Stock A, the reliable friend, and Stock B, the wild child. And remember, in the grand, often chaotic, circus of the stock market, knowing the odds, even if they look like a Jackson Pollock painting, can be your greatest superpower. Or at least, it can help you decide whether to pack your sunglasses or your helmet.