Classify Each Action As Expansionary Or Contractionary Monetary Policy

Ever wonder what makes the economy go "whoosh" or "whoa"? It's all about the money magic that central banks perform. They're like the conductors of our economic orchestra, making sure everything plays in harmony.

Today, we're diving into the exciting world of monetary policy. Think of it as the central bank's toolkit. They have some nifty ways to nudge the economy in the direction they want it to go.

It's not just about numbers and charts, though. It's about how these decisions affect your wallet, your job, and even the price of your morning coffee! It’s like a thrilling game of economic chess, and we’re all playing along.

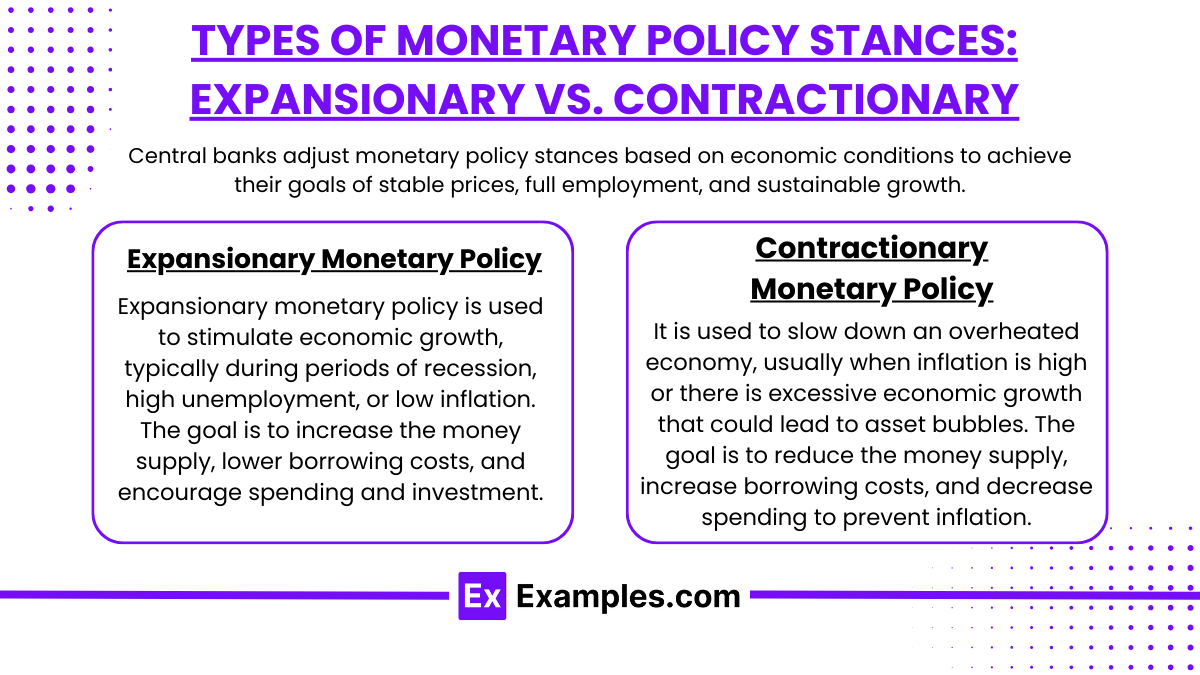

The two main moves in this game are expansionary policy and contractionary policy. They sound a bit serious, but they’re really just about speeding things up or slowing them down. Let’s break down what each one means and see if we can spot them in action!

Expansionary Moves: Let's Get This Party Started!

Imagine the economy is a car that’s a little sluggish. It needs a boost to get going! That's where expansionary policy comes in. It's like pressing the accelerator.

The main goal here is to make money easier to get. When money is flowing freely, people and businesses tend to spend more. This can lead to more jobs and a happier economy. It’s all about encouraging that economic bounce!

So, what are some of the secret weapons in the expansionary playbook? We're about to find out! These are the moves that get the economic engines revving.

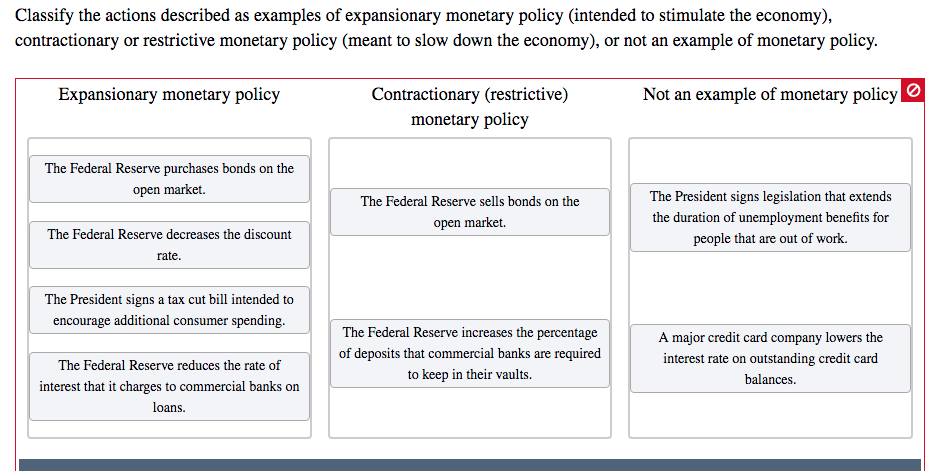

Lowering Interest Rates

This is one of the most common expansionary tactics. Think of interest rates like the "rent" you pay to borrow money. When the central bank lowers these rates, borrowing becomes cheaper.

For you and me, it means mortgages, car loans, and credit cards might have lower payments. For businesses, it means it's cheaper to take out loans to expand, hire more people, or invest in new projects. It’s like a big discount on borrowing!

This encourages everyone to borrow and spend more, which injects more money into the economy. It’s a direct way to get the economic wheels turning faster.

Buying Government Bonds (Open Market Operations)

This is a bit more technical, but super important. The central bank can buy government bonds from banks. Bonds are basically loans made to the government.

When the central bank buys these bonds, they pay the banks with new money. This floods the banking system with more cash. Now, banks have more money to lend out to you and me, and to businesses.

It’s like topping up the economy’s bank account. More money in the banks means more money available for loans, making it easier for everyone to get their hands on some cash.

Reducing Reserve Requirements

Banks are required to keep a certain percentage of their deposits as reserves. They can't lend this money out. But if the central bank lowers this requirement, banks have more money available to lend.

This is like telling the banks, "Hey, you don't need to keep quite as much cash on hand. You can lend out more of it!" This directly increases the amount of money circulating in the economy.

It’s a powerful way to unlock more lending capacity. Suddenly, there’s more fuel for the economic engine, and it’s easier to get it.

Contractionary Moves: Let's Take a Breath

Now, sometimes the economy can get a little too revved up. It might be overheating, leading to things like soaring prices. That's when the central bank needs to tap the brakes. This is where contractionary policy comes in.

The goal here is to slow down the economy. It's about making money a bit harder to get, which can curb excessive spending and prevent prices from rising too fast. It’s like applying a gentle brake to a runaway train.

Think of it as a necessary cooldown. It’s not about stopping the economy, but about keeping it healthy and stable.

Raising Interest Rates

This is the flip side of lowering interest rates. When the central bank raises interest rates, borrowing money becomes more expensive.

For individuals, this means higher payments on loans, making people less likely to take out new ones. For businesses, it becomes more costly to borrow for expansion, so they might hold back on spending. This naturally cools down demand.

![[FREE] Drag each label to the correct location. Classify each action as](https://media.brainly.com/image/rs:fill/w:2048/q:75/plain/https://us-static.z-dn.net/files/d98/98f9067db6432893f04cd2c044f29706.jpg)

It’s like putting up a “pay more to borrow” sign. This encourages saving and discourages spending, which can help stabilize prices.

Selling Government Bonds (Open Market Operations)

This is the opposite of buying bonds. The central bank can sell government bonds to banks. When banks buy these bonds, they use their existing money.

This takes money out of the banking system. With less money on hand, banks have less to lend. This tightens the money supply.

It’s like the central bank is sucking some of the excess cash out of the economy. This makes money scarcer and, therefore, a bit more valuable and harder to get.

Increasing Reserve Requirements

If the central bank raises the percentage of deposits that banks must hold as reserves, banks have less money available to lend.

This means they can’t issue as many loans. It’s like telling banks, “Hold onto more of your cash, and lend out less.” This reduces the amount of money circulating in the economy.

This move makes credit tighter. It’s a way to ensure that lending slows down, which can help control inflation.

Putting It All Together: The Economic Jigsaw Puzzle

So, there you have it! Expansionary policy is about making money easier to get and encouraging spending to boost the economy. Contractionary policy is about making money harder to get to slow down spending and control prices.

Central banks use these tools constantly, like skilled gardeners tending to their plants. They water when things are dry (expansionary) and prune when things are growing too wild (contractionary). It’s a delicate balancing act!

Understanding these concepts isn’t just for economists. It helps us understand why interest rates change, why jobs might be plentiful, or why prices might be going up. It’s a peek behind the curtain of how our economy works!

The next time you hear about the central bank making a move, you’ll know whether they’re trying to give the economy a pep talk or a calming cup of tea. It’s quite fascinating, isn’t it? The world of monetary policy is a constant dance of stimulation and restraint.

It’s a bit like having two different sets of controls for a giant economic machine. One set revs it up, and the other gently eases it back. And the best part is, you’re part of this grand economic ballet!

So, go forth and impress your friends with your newfound knowledge of expansionary and contractionary policies. You’re now an insider in the world of money! Isn't that exciting? Keep an eye out for these actions; they're happening all the time!