Cheapest Car Insurance In The United States

You know, the other day, I was staring at my car insurance bill. It felt like a tiny, paper-thin guilt trip disguised as a financial statement. And I thought, "Seriously? After all these years of being a model driver – never a ticket, barely a fender bender, and my car is older than some of the influencers on TikTok – why does this still feel like such a burden?" It's like the universe's way of saying, "Here's a little something to remind you that you're alive and therefore, statistically, a walking hazard."

It got me thinking, though. What if there was a secret handshake, a hidden portal, a magic word that could unlock ridiculously cheap car insurance? We’re all out here hustling, trying to make ends meet, and sometimes, those monthly bills just pile up, right? Car insurance, in particular, can feel like that one friend who always asks for money and never pays you back. So, today, let's dive into the fascinating, and sometimes slightly frustrating, world of finding the cheapest car insurance in the United States. Because who doesn't love saving money? Am I right?

Let's be clear from the get-go: there's no single "cheapest" insurer for everyone. It's like trying to find the "best" pizza. Your favorite might be someone else's "meh." It totally depends on a gazillion factors. But, and this is a big BUT, there are definitely strategies and companies that tend to offer more competitive rates. We're going to explore those!

The Quest for the Elusive "Cheapest"

So, how do you even begin this quest? It's not like you can just walk into an insurance store and demand the cheapest policy. (Though, imagine that! "Excuse me, do you have the 'barely legal' insurance plan?") The reality is, it's a personalized puzzle. And the companies are the ones holding all the pieces, deciding how much your personal puzzle is worth… to them.

Think of it this way: they're assessing your risk. Are you a thrill-seeker who races down country roads at midnight? Or are you a homebody who only ventures out for artisanal cheese and to walk your perfectly behaved poodle? Your driving habits, your car, where you live, even your credit score (more on that later, brace yourselves!) all play a massive role. It's like a cosmic lottery, but instead of winning a million bucks, you might just win a slightly less soul-crushing monthly payment.

The first, and arguably the most crucial, step is comparison shopping. I know, I know, it sounds like a chore. It’s about as exciting as watching paint dry. But trust me, this is where the real savings lie. You absolutely must get quotes from multiple insurance companies. Don't just stick with the same company year after year because "that's what Mom always did." Your loyalty might be costing you a small fortune.

The Big Kahunas: Who Usually Offers Better Deals?

While it’s impossible to name one definitive "cheapest" company, some insurers consistently pop up in the lower price brackets. These are often the:

- Large, national insurers: Companies like Progressive, Geico, and State Farm often have massive customer bases, which can sometimes translate to economies of scale and more competitive pricing. They also tend to have extensive online tools and apps, making the quoting process a bit less painful.

- Direct insurers: These are the companies you typically interact with online or over the phone, like Esurance (owned by Allstate, but operates differently) and Allstate itself. They often have lower overhead costs than traditional brick-and-mortar agencies, and these savings can be passed on to you.

- Regional players: Sometimes, a smaller, regional insurer might offer incredibly competitive rates in specific states or areas. These can be trickier to find but are definitely worth looking into if you're dedicated to finding the absolute cheapest.

It's also worth noting that online-only insurers can sometimes be cheaper because they don't have the same overhead costs as companies with physical branches. Think of them as the digital natives of the insurance world. They're built for speed and efficiency, and that can benefit your wallet.

However, don't just blindly go for the cheapest quote you find online. Sometimes, the cheapest policy might have a very high deductible or limited coverage options. You need to make sure the policy actually covers what you need it to. It’s like buying a super-cheap umbrella that instantly flips inside out in the first gust of wind. Not very useful, is it?

Factors That Make Your Insurance Go Up (Or Down!)

Let's get real here. What are the things that insurance companies look at when they're deciding your fate (and your premium)? Understanding these can help you strategically make choices to lower your costs. It’s like knowing the cheat codes to the insurance game.

Your Driving Record: The Unsung Hero (or Villain)

This is the big one. If you've got a clean driving record – no accidents, no tickets, no DUIs – you're already ahead of the game. Insurance companies see you as less of a risk, and that translates directly to lower premiums. On the flip side, a history of violations will send your rates soaring. It’s a tough love situation, but it’s true.

Even a single speeding ticket can impact your rates. So, maybe ease up on the pedal when you see that blue and red flashing in your rearview mirror. Just saying. Some companies also offer accident forgiveness programs, which can be a lifesaver if you have a minor mishap. Do your research on these!

Your Car: The Metal Box That Holds Your Fate

What you drive matters. A lot.

- Make and Model: Sports cars are generally more expensive to insure than sedans. Why? Because they're more likely to be driven fast, and parts can be pricier to replace if you get into an accident. Think about it: a flashy red convertible versus a sensible family minivan. The insurance company sees a different kind of driver.

- Safety Features: Cars with advanced safety features like anti-lock brakes, airbags, and anti-theft devices can actually lower your premiums. It’s like your car is doing the work for you to keep you safe!

- Value of the Car: If you have a newer, more expensive car, your comprehensive and collision coverage will likely be higher, leading to a higher premium. If you have an older car that’s paid off, you might even consider dropping comprehensive and collision coverage altogether if the cost of the coverage outweighs the value of the car. This is a big decision, though, so weigh it carefully.

My neighbor, bless her heart, drives a classic Mustang. It’s a beauty. But her insurance? Let’s just say she’s probably paying enough to buy a small used car every year just to cover that one. Sometimes, the coolest cars aren't the cheapest to keep on the road.

Your Location: Where You Park Matters

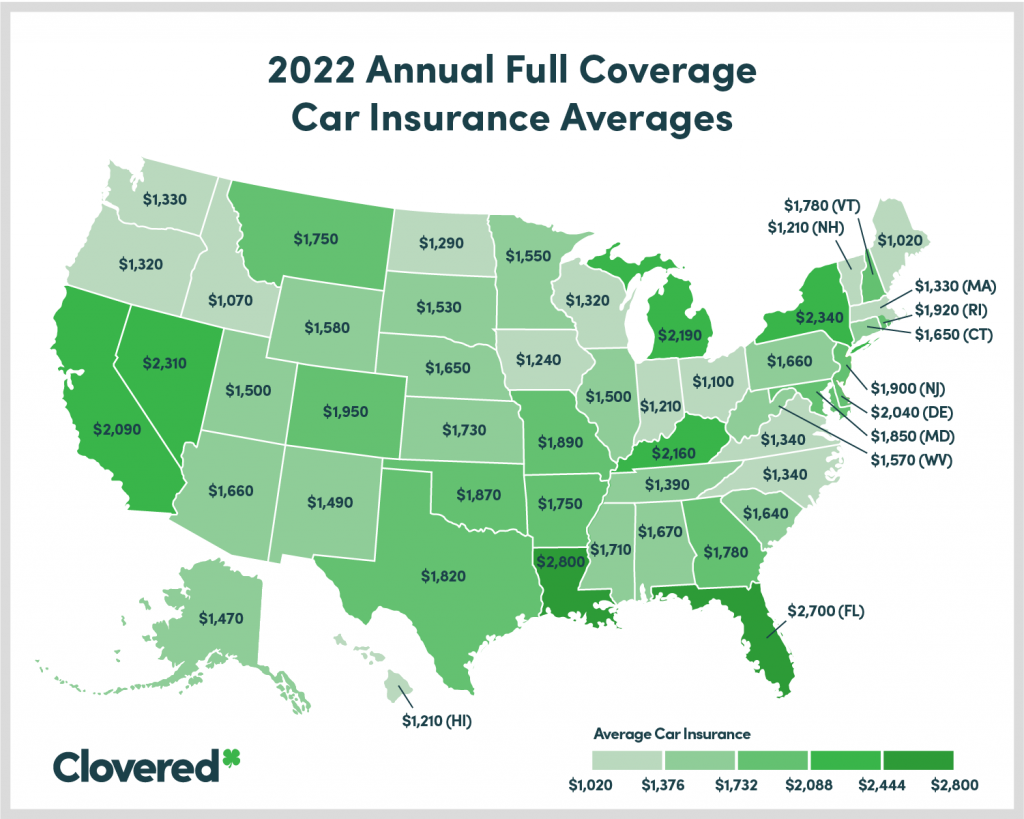

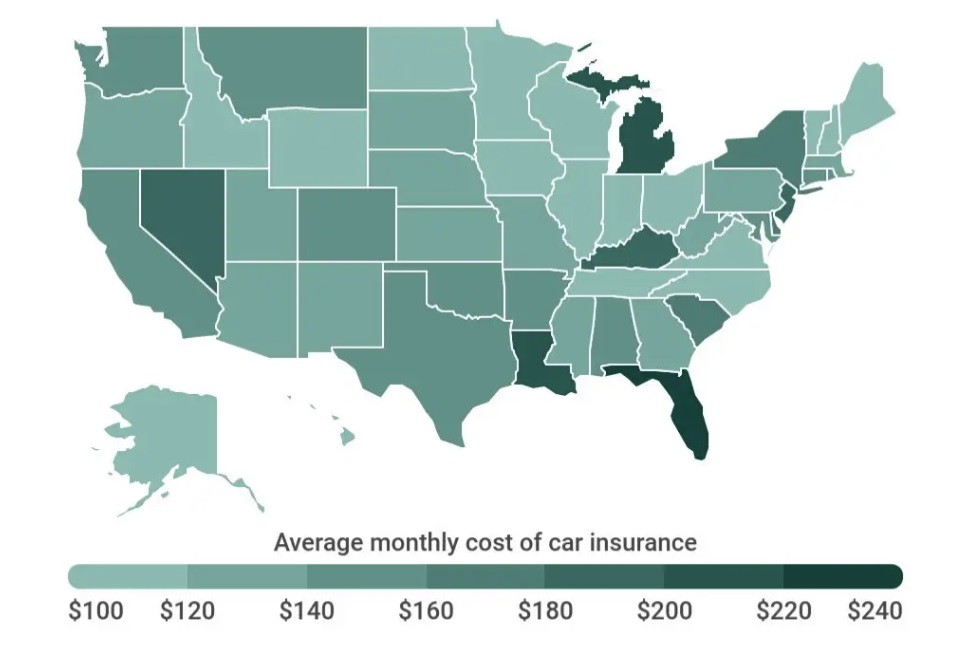

Believe it or not, where you live can significantly impact your car insurance rates. Insurance companies analyze data for specific ZIP codes. Areas with higher rates of accidents, theft, or vandalism will naturally have higher insurance premiums. So, if you live in a bustling city center versus a quiet rural town, you might see a difference.

It's not just about crime, either. Traffic density, road conditions, and even the likelihood of severe weather can play a role. So, that peaceful little town you dream of retiring to might just be a hidden insurance bargain!

Your Age and Gender: The Unfair (but Real) Metrics

This is where it gets a bit controversial, but it's a reality of insurance pricing. Statistically, younger, less experienced drivers tend to have more accidents. Therefore, their premiums are often higher. Similarly, historically, younger men have been seen as a higher risk than younger women, although this is changing in some states.

If you're over 25 and have a good driving record, you're likely to see lower rates. It’s just the way the cookie crumbles, or rather, the insurance numbers add up. As you get older and gain more experience (and hopefully don't accumulate too many tickets), your premiums should gradually decrease.

Your Credit Score: The Controversial Link

This is a big one and often a point of contention. In most states (not all!), insurance companies use your credit-based insurance score to help determine your premiums. The theory is that people with better credit scores are more responsible and less likely to file claims. It sounds a bit… arbitrary, doesn't it? Like your ability to pay bills on time directly correlates to how safely you drive your car.

If you have excellent credit, you're likely to get better rates. If your credit score isn't the best, this is definitely an area to focus on improving. It's not just about getting a loan or a credit card; it can affect your car insurance, too!

Your Coverage Levels: More Protection, More Cost

This one is pretty straightforward. The more coverage you opt for, the higher your premium will be. Basic liability coverage is the cheapest, but it only covers damages to others. If you want comprehensive and collision coverage (which covers damage to your own car), your rates will go up.

Liability coverage is what most states require. It includes bodily injury liability and property damage liability. Comprehensive coverage helps pay for damage to your car from things like theft, vandalism, fire, or falling objects. Collision coverage helps pay to repair or replace your car if it's damaged in an accident, regardless of who is at fault.

You also have options for uninsured/underinsured motorist coverage, which is crucial. It protects you if you're hit by a driver who doesn't have insurance or doesn't have enough insurance. Given the number of uninsured drivers out there, this is a really important one to consider, even if it bumps up your premium a bit.

And then there are the add-ons: rental car reimbursement, towing and labor, roadside assistance. While these can be super handy, they all add to your overall cost. You need to weigh the cost of these extras against the potential out-of-pocket expenses if you needed them.

Strategies to Slash Your Insurance Premiums

Okay, so we’ve looked at what makes insurance expensive. Now, let’s get to the good stuff: how to make it cheaper! These are the real money-saving hacks.

1. The Power of Comparison Shopping (Again!)

I cannot stress this enough. Get online. Use comparison websites. Call different companies. Don’t be afraid to get multiple quotes. The difference in price for the exact same coverage can be staggering. It might take an hour or two of your time, but that could save you hundreds, if not thousands, of dollars a year. Seriously, make this your first and last step every year when your policy is up for renewal.

2. Bundle Your Policies

Many insurance companies offer discounts if you bundle your car insurance with other policies, like your homeowner’s or renter’s insurance. This is often called a multi-policy discount. It’s a win-win: you simplify your billing and often save money. Check with your current insurer and any other companies you’re considering.

3. Ask About Discounts!

This is where you become an insurance detective. Insurers have a TON of discounts, and they’re not always advertised. You have to ask!

- Good Student Discount: If you have a teen driver with good grades.

- Defensive Driving Course: Completing an approved course can sometimes earn you a discount.

- Low Mileage Discount: If you don't drive much, let them know!

- Safe Driver Discount: If you have a clean record.

- New Car Discount: For newer vehicles with safety features.

- Paperless Billing/Auto-Pay Discount: For going digital.

- Military/Veteran Discount: If applicable.

- Professional/Affinity Group Discounts: Sometimes membership in certain organizations can qualify you.

Seriously, ask your insurance agent or representative about every single possible discount they offer. You might be surprised at what you qualify for.

4. Increase Your Deductible

Your deductible is the amount you pay out-of-pocket before your insurance kicks in. Raising your deductible (for comprehensive and collision coverage) will generally lower your monthly premium. However, make sure you can comfortably afford to pay that higher deductible if you ever need to file a claim. It’s a trade-off between lower monthly payments and a higher potential out-of-pocket expense.

Think of it as self-insuring for a larger chunk. If you have a healthy emergency fund, you might be able to swing a higher deductible without too much stress. If your emergency fund is a bit… theoretical, maybe stick with a lower deductible. Safety first, folks!

5. Drive Less (If Possible)

If you work from home, or your commute is short, or you just don’t use your car much, let your insurer know. You might qualify for a low mileage discount. Some insurers even offer usage-based insurance (UBI) programs that track your driving habits (speed, braking, mileage) via an app or device and offer discounts based on safe driving. It’s a bit Big Brother-ish, but if it saves you money, maybe it's worth considering. Just try not to take any unexpected detours to the nearest ice cream shop!

6. Improve Your Credit Score

As we mentioned, credit scores can impact your insurance rates. Working on improving your credit score by paying bills on time, reducing debt, and avoiding opening too many new credit accounts can lead to lower insurance premiums over time. It’s a long-term play, but a good one for your overall financial health.

7. Re-evaluate Your Coverage Needs

As your life changes, so should your insurance. Do you still need comprehensive and collision on that old clunker you’ve been driving for 15 years? If the car is paid off and its market value is low, it might make financial sense to drop those coverages and save money on premiums. Conversely, if you’ve recently bought a new car, you’ll obviously want to ensure you have adequate coverage.

It’s easy to just let your policy renew year after year without a second thought. But take a moment to think about what you actually need. Are you still carrying rental car reimbursement when you haven’t rented a car in a decade? Probably not necessary!

The Bottom Line: Be Proactive!

Finding the cheapest car insurance in the US isn't about finding a magic bullet or a secret handshake. It’s about being informed, proactive, and diligent. It’s about understanding how the system works, what factors influence your rates, and then actively taking steps to lower them.

So, don't just accept that high premium. Do your homework. Shop around. Ask for discounts. Re-evaluate your coverage. Your wallet will thank you. And who knows, maybe that extra money you save can go towards something fun. Like, you know, a slightly less guilt-inducing car insurance bill. Or, dare I say it, that artisanal cheese you've been eyeing.

Remember, insurance is there to protect you, but it doesn’t have to break the bank. Go forth and conquer those quotes! You’ve got this.