Chase Bank Checking Account Minimum Balance

Hey there! So, let's chat about something that might seem a little… well, boring to some, but it's actually pretty important when you're juggling your finances: that whole Chase Bank checking account minimum balance thing. You know, the amount you're supposed to keep in your account so you don't get hit with a fee? Yeah, that one. It’s like the bank’s way of saying, "Hey, don't forget about me!"

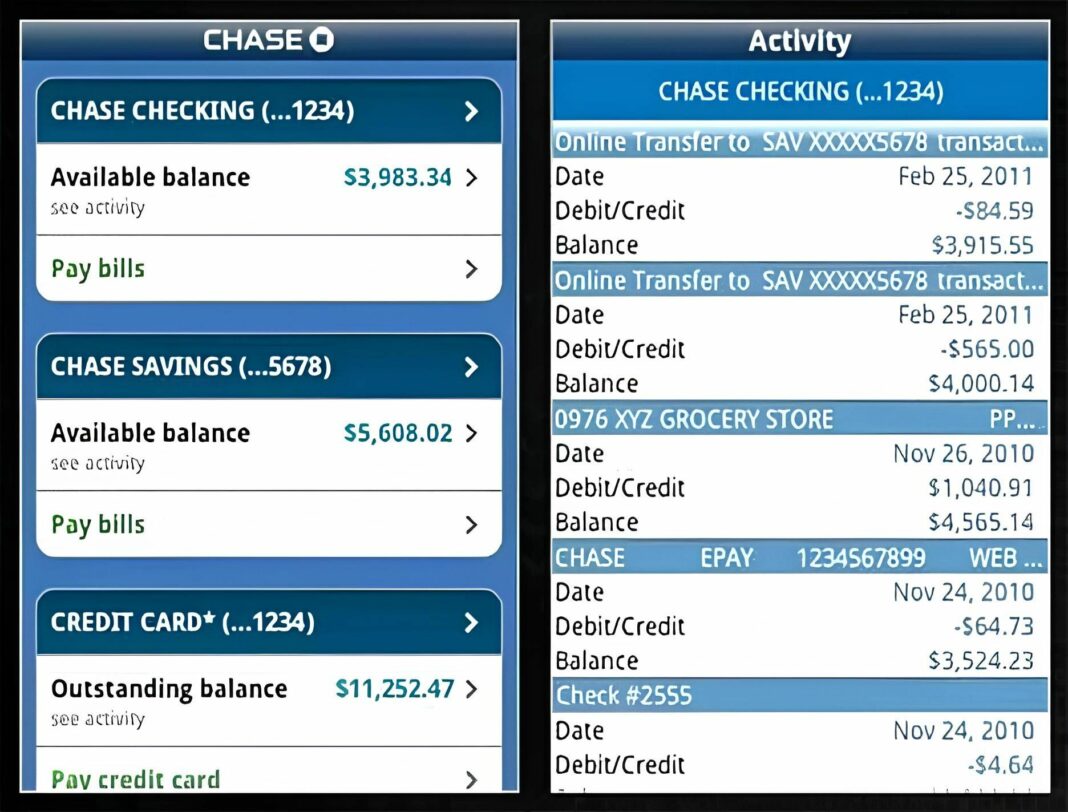

Seriously though, it’s one of those things that can sneak up on you if you’re not paying attention. You’re just living your life, buying coffee, maybe that impulse online purchase (we’ve all been there!), and suddenly you see a little notification from Chase. Ugh. Or worse, you get your statement and there’s a charge you weren’t expecting. Talk about a buzzkill, right?

So, what’s the deal with these minimum balances? Is it some secret handshake you need to know to get the good coffee at the bank? Not quite. It's mostly about making sure you’re a somewhat active customer. And, let’s be honest, it’s how they make a little bit of money too. Banks gotta eat, right?

Now, Chase, being one of the big players, has a few different checking account options. And each one has its own little set of rules. It’s not like a one-size-fits-all situation. Imagine trying to fit into a pair of pants that aren't your size – it just doesn't feel right! So, depending on which Chase checking account you actually have, that minimum balance requirement can be different. Shocking, I know!

Let’s dive into some of the popular ones. First up, we’ve got the good old Chase Total Checking®. This is probably the most common one. It's like the reliable sedan of checking accounts – gets you where you need to go, no frills, but does the job. And for this one, to avoid that pesky monthly service fee, you generally need to keep a certain amount of money floating around in there. How much, you ask? Well, it’s usually around $1,500. Yep, fifteen hundred bucks. That’s a good chunk of change, especially if you’re like me and sometimes feel like your bank account is playing a game of peek-a-boo with your bills.

Now, $1,500. Is that a lot? It depends on your life, doesn’t it? For some people, that’s like pocket change. For others, it’s the price of a decent used car. So, you gotta think about your own cash flow. Are you someone who has a steady paycheck and likes to have a bit of a buffer? Then maybe $1,500 is totally doable. You can just, you know, set it and forget it. Easy peasy.

But what if you’re not quite there? Don’t panic! Chase, bless their hearts (sometimes!), does give you other ways to waive that fee. So, if keeping $1,500 in your account feels like asking a goldfish to climb a tree, there are other options. For the Chase Total Checking®, one way is to have direct deposits totaling at least $500 or more per statement period. That’s a pretty sweet deal, right? Think about it: your paycheck just lands in your account, and boom! Fee waived. It’s like getting a free pass at a theme park. Who doesn't love a free pass?

So, if your employer offers direct deposit, and you’re bringing home at least $500 (after taxes, usually, so don't freak out if your gross is higher), then that monthly fee just… disappears. Poof! Gone like a magician’s rabbit. This is a lifesaver for people who might not always have that $1,500 sitting there. You're still using your account, making transactions, and they're happy. It’s a win-win. Or at least, a win for you and a "we'll get 'em next time" for Chase's fee department.

Then there’s the Chase Premier Plus Checking®. This one is a step up. It’s like the business class seat of checking accounts. You get a few more perks, maybe a little more attention. And with that, comes a slightly higher minimum balance requirement. For this fancy-pants account, you’re looking at needing to keep around $15,000 in there. Fifteen thousand dollars. Whoa nelly! That’s enough to make my eyes water a little, and I'm just talking about it. I mean, imagine having that much just chillin’ in your checking account. That’s like Scrooge McDuck levels of money. You could probably buy a small island with that!

Okay, maybe not a whole island, but you get the idea. $15,000 is a significant chunk of change. So, if you’re not swimming in dough, this account might not be your go-to. But, if you do have that kind of cash lying around, or you’re strategically saving for something big, this account could be worth it. And just like with Total Checking®, there are ways to avoid the monthly fee. Phew! Always options, right? Keeps things interesting.

For Chase Premier Plus Checking®, you can also waive the fee with direct deposits, but the number is a bit higher, naturally. You’re looking at a total of $5,000 or more in direct deposits per statement period. So, if you're pulling in serious cash, this is definitely an option. It’s like saying, "I’ve got this, Chase. You don't need to nickel and dime me."

Another way to get that fee waved for Premier Plus is by maintaining an average total balance of $75,000 or more across your Chase accounts. Yes, you read that right. Seventy-five thousand dollars. This includes savings accounts, CDs, investment accounts, all of it. So, if you’ve got a substantial financial empire with Chase, they’ll pretty much let you do your thing without charging you a monthly fee. It’s like they’re saying, "You’re too important to us to charge you this tiny fee."

Now, let's talk about the Chase Sapphire Checking®. This is the really, really fancy one. The private jet of banking. It’s for people who demand the best. And with the best comes… you guessed it… the highest minimum balance. For Sapphire Checking®, you need to keep a whopping $75,000 in there. Just in your checking account alone! This isn't a total across all your accounts; this is just for that one account. That's a number that makes me need a lie-down. Seriously, who has that kind of money just sitting in their checking account? I feel like I’d be too scared to even breathe on it.

However, if you do have that kind of liquid capital, the benefits of Sapphire Checking® might be enticing. And guess what? If you meet that $75,000 minimum, the monthly fee is waived. It’s like they’re saying, "Don’t worry about the little things, you've clearly got bigger fish to fry."

So, to recap the minimums for the popular ones:

- Chase Total Checking®: Keep $1,500 to avoid the fee, OR have $500+ in direct deposits.

- Chase Premier Plus Checking®: Keep $15,000 to avoid the fee, OR have $5,000+ in direct deposits, OR $75,000+ total in Chase accounts.

- Chase Sapphire Checking®: Keep $75,000 to avoid the fee. (No other direct deposit options to waive the fee here, it's all about that balance!)

It’s important to remember that these numbers can sometimes change. Banks aren’t exactly known for their static policies, are they? So, it’s always a good idea to check the official Chase website or chat with a banker to get the most up-to-date information. Don't just take my word for it, although I do give pretty good advice, if I do say so myself.

What if you don’t meet the minimum balance? Well, then you’ll likely get hit with a monthly service fee. For Chase Total Checking®, this fee is usually around $12 per month. Twelve dollars. It might not seem like a ton, but let’s do some quick math. If you pay $12 a month for a year, that’s $144! That’s enough for a nice dinner out, or a few new books, or… well, you get the idea. It adds up! And that’s just for the basic account. The fees for the higher-tier accounts are even more substantial.

For Premier Plus, that fee is around $25 a month. And for Sapphire Checking®, it’s a cool $40 a month. Ouch. That’s like paying rent on your own money. Who wants to do that?

So, the big question is: do you need to worry about these minimums? Honestly, it depends on your banking habits and your financial situation. If you’re someone who likes to keep a healthy buffer in your checking account anyway, then meeting the minimum might be second nature. You might already be doing it without even thinking about it!

But if you’re more of a “just-enough-to-pay-the-bills” kind of person, or you prefer to invest your money rather than let it sit in a checking account earning next to nothing, then these minimums can be a real pain. You might find yourself constantly checking your balance, trying to avoid that fee. It can be a little stressful, can’t it? Like a mini game of financial Tetris.

That’s where those direct deposit options come in handy. If you can swing it, setting up direct deposit is often the easiest way to waive the fee without having to drastically change your spending or saving habits. It’s a set-it-and-forget-it solution. Just make sure your employer is set up for it, and that the amount you’re getting deposited is enough to qualify.

Another thing to consider is whether a Chase checking account is even the right fit for you if you're struggling with these minimums. There are tons of other banks out there, including online banks and credit unions, that offer accounts with no monthly fees and no minimum balance requirements whatsoever. They might not have the same branch network as Chase, but if you're primarily an online banking person, it might be a much simpler and more cost-effective option.

Think about it. Do you really need to go to a physical branch every week? Or do you mostly do your banking online or through an app? If it’s the latter, then paying a fee to maintain a minimum balance at a traditional bank might be like paying for a fancy gym membership when you only ever use the free weights. It just doesn’t make sense!

But hey, if you like Chase, and you like the convenience of their branches, and their app is your jam, then it’s worth exploring how to meet those requirements. Maybe it means adjusting your budget slightly, or being a little more mindful of your spending before payday. It’s all about finding what works best for your life.

One of the things I personally try to do is to have a separate savings account with a little cushion. That way, if my checking account gets a bit low, I can easily transfer money over without dipping into my main spending funds. And sometimes, that cushion in savings can help contribute to meeting a total balance requirement if you're aiming for those higher-tier accounts. It’s like having a secret stash of emergency cash, but for avoiding bank fees!

And don't forget about the power of automatic transfers! You can set up your bank to automatically transfer a certain amount from your savings to your checking account on a regular basis. This can help you maintain that minimum balance without having to constantly remember to do it yourself. It’s like having a tiny, invisible banking assistant. Pretty neat, huh?

Ultimately, the Chase Bank checking account minimum balance is a factor to be aware of. It's not the end of the world if you can't meet it, but it's definitely something to consider when choosing a bank and an account. Do your research, understand the options, and pick the path that makes the most sense for your wallet and your peace of mind. Because honestly, who needs extra stress when it comes to managing their money? Let’s keep it simple, keep it smart, and maybe, just maybe, keep a little extra cash in our pockets instead of giving it to the bank as a fee. Cheers to that!