Can You Transfer Points Between Chase Cards

Okay, so picture this: I’m staring at my Chase Ultimate Rewards dashboard, a digital landscape of points that shimmer like digital gold. I’ve got a healthy chunk in my Chase Sapphire Preferred, earned from, let’s be honest, way too many grocery runs and a couple of slightly impulsive Amazon purchases. Then, I remembered my Chase Freedom Flex. That card, bless its rotating categories, has been quietly racking up points on…well, whatever the 5% category happened to be that quarter. Right now, it’s likely racking up points on something totally mundane like streaming services or transit. Fascinating, right?

The problem? These points are like two separate piggy banks. They’re mine, both of them, but they’re not exactly playing nicely together. It’s like having a bunch of cool LEGO bricks scattered across two different toy boxes. You know you could build something epic if they were all in one place, but for now, they're just…separate. This got me thinking, and I bet it’s gotten you thinking too. If you’ve got more than one Chase card, you've probably had that moment of "Wait a minute..."

So, the big question, the one that keeps loyalty program nerds like me up at night (okay, maybe not that late), is this: Can you actually transfer points between Chase cards? It's a question that gets asked a lot, and the answer, my friends, is a resounding and beautiful YES! And not just a timid "yes," but a confident, high-fiving, confetti-dropping YES.

The Magic of Moving Your Points Around

This is where things get really interesting. Chase has this brilliant system, and it’s probably one of the biggest perks of their rewards program. You don't have to be stuck with points siloed away in individual accounts. Think of it like this: your Chase Ultimate Rewards points, regardless of which card earned them, can be pooled together. It’s like a central vault for your travel dreams.

However, there’s a slight nuance to this magic, and it’s super important to understand. It’s not like you can just log into any old Chase card and pull points from another. The ability to transfer depends on the type of Chase card you have.

The Gatekeepers: Which Cards Let You Play Ball?

This is where the rubber meets the road, or the points meet the transfer portal. Chase has broadly categorized its Ultimate Rewards earning cards into two camps: those that can receive and transfer points, and those that can only receive points. And let me tell you, you want to be in the first camp.

The premium travel cards, like the Chase Sapphire Preferred® Card and the Chase Sapphire Reserve®, are your golden tickets. These are the “chef’s kiss” cards of the Chase UR family. If you have one of these, you have the power to move your points to other Chase accounts linked to your name, and crucially, you can move points from other Chase cards to your Sapphire card. This is key!

Now, what about the other guys? The cards like the Chase Freedom®, Chase Freedom FlexSM, and the Chase Freedom Unlimited®. These are fantastic cards in their own right, offering great earning potential on everyday spending. They earn Chase Ultimate Rewards points, absolutely. But they can’t independently transfer those points to airline or hotel partners. Their superpower is being able to funnel their earned points into a Chase Sapphire account that you also own.

So, if you have a Sapphire card and a Freedom card, you can consolidate all those points into your Sapphire account. This is where the real power of Chase Ultimate Rewards lies. You're not just earning points on one card; you're building a larger, more valuable pool of points that you can then leverage for maximum redemption value.

How Does This Point-Moving Magic Actually Work?

It’s surprisingly straightforward, which is always a relief in the world of credit card rewards, right? You’re not going to need a degree in rocket science.

Here’s the typical process:

- Log in to your Chase online account. This is your command center for all things Chase.

- Navigate to the Ultimate Rewards section. You’ll usually find this prominently displayed once you’re logged in.

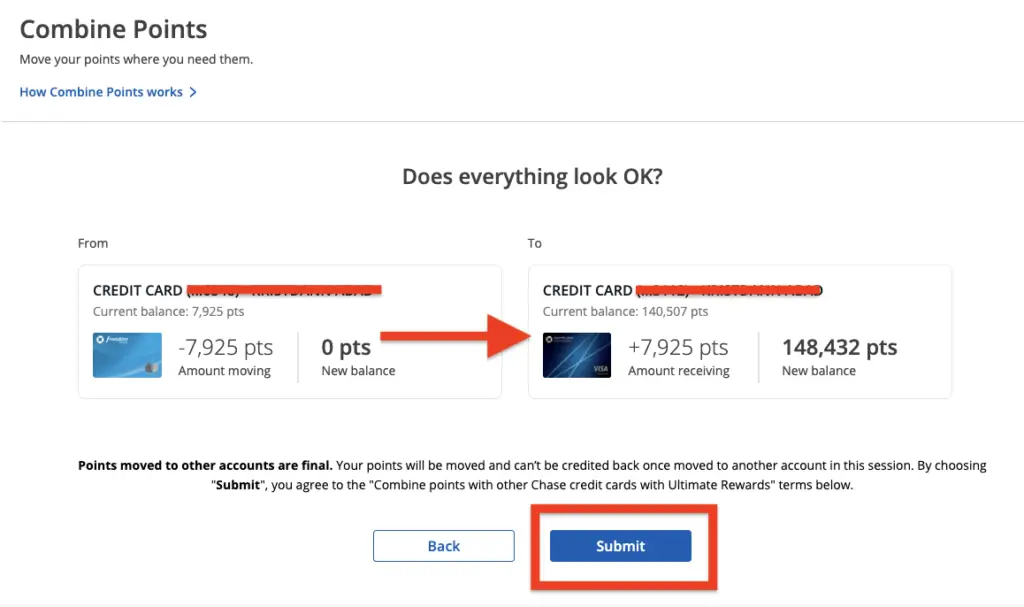

- Look for the option to "Combine Points" or "Transfer Points." The wording might vary slightly, but the intent is the same.

- Select the account you want to transfer points from. This will be your Freedom card, for example.

- Select the account you want to transfer points to. This should be your Sapphire card.

- Enter the amount of points you wish to transfer. You can transfer any amount, from a single point to your entire balance.

- Confirm the transfer. A quick click, and voila! Your points have moved.

It’s that simple. The points will show up in your designated Sapphire account almost instantly. It’s like a digital swift-moving river of rewards.

But Wait, There’s More! (The Destination of Your Points Matters)

Now, here’s where it gets really strategic. While you can move points between your Chase cards for the sake of consolidation, the real benefit of having a Sapphire card comes when you want to redeem those points.

Remember how I said the Freedom cards can’t independently transfer points to partners? Well, once those points are in your Sapphire account, they gain a new level of flexibility. You can then use the travel portal powered by Expedia (or transfer them directly to airline or hotel partners) from your Sapphire account. And this is where you get the best value for your points, especially if you’re looking to fly in business class or stay in a fancy hotel.

For example, if you have 50,000 points in your Freedom Flex and 50,000 points in your Sapphire Preferred, you can transfer the 50,000 from the Freedom Flex to your Sapphire Preferred. Now you have 100,000 points in your Sapphire account. You can then use these 100,000 points to book a flight through the Chase Travel portal, or, and this is where the magic really happens, transfer them to a partner like United, Hyatt, or Marriott for potentially much higher value.

This is the secret sauce of Chase Ultimate Rewards. It allows you to strategically earn points on cards that offer higher category bonuses (like Freedom cards) and then redeem them for maximum value through the premium Sapphire cards.

What About Transferring to Family or Friends?

This is another common question, and the answer is a bit more nuanced. Generally, you can transfer your Chase Ultimate Rewards points to another Chase Ultimate Rewards member in your household. This means if you and your spouse or partner both have Chase accounts, you can combine your points. This is a fantastic way to save up for a big trip together.

However, Chase has some fairly strict rules about transferring points to people outside of your household. They consider it a violation of their terms and conditions and can potentially claw back points or even close accounts if they suspect abuse. So, while you might see some advice online about sending points to friends, I’d strongly advise against it. It’s just not worth the risk.

Stick to transferring within your household. It’s the safe and sanctioned way to share the rewards of your credit card spending.

The "Why Bother?" Section: Unlocking the True Value

So, why go through the slight hassle of transferring points? It’s all about optimizing your rewards. Let’s break it down:

- Maximizing Redemption Value: As I mentioned, points redeemed through the Chase Travel portal or transferred to travel partners from a Sapphire account are generally worth more than if redeemed at a flat rate. For example, 1,000 UR points might be worth $0.0125 each when redeemed for travel through Sapphire, giving you $12.50, whereas redeeming for cash back might only get you $0.01 each, or $10.00. It’s a significant difference!

- Access to Travel Partners: The ability to transfer to airlines and hotels is a huge perk. You can often find better award availability or more favorable redemption rates this way. Think about snagging a business class flight to Europe or a luxury hotel stay for fewer points than you would otherwise have to spend.

- Consolidation for Big Redemptions: Planning a dream vacation? You might need a larger chunk of points than one card alone can provide. By consolidating points from all your eligible Chase cards, you can reach those aspirational redemption goals much faster.

- Strategic Earning: You can focus on earning with the cards that offer the best bonuses for your spending habits (e.g., using Freedom cards for their 5% categories) and then consolidate them into your Sapphire account for that premium redemption power. It’s the best of both worlds.

It’s like having a toolbox with different specialized tools. A Phillips head screwdriver is great for certain screws, and a flathead is good for others. But if you have a whole set, and you can keep them organized and accessible, you can tackle almost any repair job. Your Chase cards are those tools, and the ability to transfer points is your organizational system.

A Word of Caution (Because Nothing is Completely Perfect)

While transferring points is fantastic, it's worth noting a few things:

- The "Sapphire Rule": As we’ve discussed, you need a Sapphire card (Preferred or Reserve) to unlock the full transfer and redemption potential. If you only have Freedom cards, your points are essentially stuck at a 1 cent per point value for statement credits or cash back. This is why so many people consider the Sapphire cards essential for maximizing Chase Ultimate Rewards.

- Account Linking: Ensure your Chase accounts are properly linked online. This makes the transfer process seamless. If they aren’t, you might need to call Chase customer service to get them connected.

- No Returning Points: Once points are transferred from one Chase card to another, they are pooled. You can’t "un-transfer" them back to the original card in their separate state. So, make sure you’re happy with the destination account before you hit confirm.

- Watch Out for Changes: While this system has been in place for a while, credit card companies can and do change their reward programs. Always check the latest terms and conditions for Chase Ultimate Rewards.

Seriously, though, the ability to transfer points is one of the most powerful features of the Chase Ultimate Rewards program. It’s what elevates it from a good rewards program to a truly exceptional one for savvy travelers and consumers.

The Bottom Line: Pool Those Points!

So, to circle back to my initial predicament with the scattered points, the answer is a resounding YES, you can transfer points between Chase cards! But remember the key: you need at least one of the premium Chase Sapphire cards to truly unlock the magic. If you have one, and you have other Chase cards earning Ultimate Rewards, start moving those points. Combine them, strategize, and get ready to make your points work harder for you.

It’s not just about accumulating points; it’s about strategically managing them to get the most bang for your buck. So go forth, my fellow rewards enthusiasts, and consolidate your Chase points! Your future travel adventures will thank you. And who knows, maybe you’ll even find yourself with enough points for that business class ticket you’ve been dreaming about. Happy redeeming!