Can You Take Money From 401k To Buy A House

Okay, so picture this: Sarah, bless her heart, was eyeing this adorable fixer-upper. It had "character," which, let's be honest, usually means "needs a new roof and a plumbing overhaul." Her down payment fund was looking… well, it was looking a lot like a few stray pennies and a crumpled lottery ticket. Frustration was mounting. Then, a thought, a little whisper in the back of her brain: "What about my 401k?"

Sound familiar? That little voice that pops up when you're staring down a massive financial hurdle, and your retirement savings suddenly seem like a giant, untapped piggy bank? It's a common fantasy, this idea of just… borrowing from your future self to snag your dream home today. But is it a fairy tale, or is there actually a way to make this happen? Let's dive in, shall we?

The 401k House-Buying Dream: Is It Reality or Just a Really Expensive Wish?

So, can you actually dip into that retirement nest egg to buy a house? The short answer, my friends, is a resounding… it depends. And that "it depends" is going to be the theme of our little chat today. It's not a simple yes or no, and frankly, if anyone tells you it is, maybe ask them if they also believe in unicorns. Because while it's possible, it's also a decision that comes with a big ol' side of "uh oh."

Unlocking the Vault: Loans vs. Withdrawals

When we talk about accessing your 401k for a down payment, there are generally two main routes you might consider: a 401k loan or an early withdrawal. These sound similar, right? Like two different flavors of ice cream? Well, they are not the same, and the consequences are wildly different. Think of it like choosing between a gentle nudge and a full-on shove off a cliff. You really want to understand the difference.

The 401k Loan: Borrowing from Your Future Self (With Interest!)

Let's start with the 401k loan. This is the slightly less terrifying option, relatively speaking. It’s basically like asking your retirement plan for a loan. You can usually borrow up to 50% of your vested balance, or a maximum of $50,000, whichever is less. So, if you've got a hefty chunk saved, you might be able to snag a decent amount for that down payment. Pretty neat, huh?

The catch? You have to pay it back, usually within five years (though some plans allow longer terms for home purchases). And get this: you pay yourself back with interest! This means you’re essentially paying interest on your own money. It’s like lending your car to your neighbor, and they pay you back with a little extra for gas. It's a bit of a circular money flow, but at least the interest goes back into your account. Some people see this as a win-win. Some people.

The Homebuyer's Exception: A Little Breathing Room

Now, here's where it gets a little more interesting for the aspiring homeowners. Most 401k loans have a five-year repayment period. However, if you’re taking out the loan to buy a primary residence, your plan might offer a longer repayment term. This is the "homebuyer's exception." It's designed to make it a little more feasible to use this method for your down payment. The exact terms will depend on your specific 401k plan, so you'll need to check those documents with a magnifying glass.

What Happens if You Can't Pay It Back? The Grim Reality

This is where the "uh oh" really kicks in with 401k loans. If you leave your job, voluntarily or involuntarily, for any reason – you get fired, you quit, you get laid off – the remaining balance of your loan is usually due immediately. Like, within 60 days. Yikes.

And if you can't repay it? That unpaid loan balance is treated as an early withdrawal. This means it’s subject to income taxes and a 10% early withdrawal penalty if you’re under age 59 ½. So, that $30,000 you borrowed? Suddenly, it’s a lot less because a chunk of it is going to Uncle Sam. This is the part that makes people sweat. Imagine needing that money for a down payment and then losing a significant chunk of it because you changed jobs. Ouch.

The Early Withdrawal: The Nuclear Option

Then there's the early withdrawal. This is like hitting the self-destruct button on your retirement savings. You're literally taking money out of your 401k, and it's not coming back. For a house purchase, you can withdraw funds before age 59 ½. However, there are specific rules and, as you might have guessed, significant downsides.

The biggest hurdle? The 10% early withdrawal penalty on top of regular income taxes. So, if you withdraw $20,000, and your tax rate is 22%, you're looking at $2,000 in taxes and $2,000 in penalties. That’s $4,000 gone, just like that. Poof. This is why people often refer to it as the "nuclear option." It’s a last resort, and usually, there are better ways to get there. Seriously, think long and hard before you go down this road.

Hardship Withdrawals: For Real Emergencies (Usually Not a House)

Now, sometimes you hear about "hardship withdrawals." These are typically for dire circumstances like medical emergencies, preventing eviction, or funeral expenses. While buying a house is a big life event, it’s generally not considered a hardship withdrawal under most 401k plans. So, don't get your hopes up that you can claim your desire for a bigger kitchen as a hardship. The IRS and your plan administrator are usually pretty strict on this.

The Tax Implications: A Friend or Foe?

Let's talk taxes, because who doesn't love a good tax discussion? As we’ve touched on, both loans and withdrawals have tax implications. With a loan, the interest you pay goes back into your account, so you're not losing that money to taxes directly. However, you’re repaying it with after-tax dollars, and then when you eventually withdraw it in retirement, it will be taxed again as ordinary income. It’s a bit of a double-taxation situation, though less severe than a direct withdrawal.

With an early withdrawal, it’s much more straightforwardly bad. You pay income tax on the amount withdrawn, and the 10% penalty. This is money you will never get back, and it directly reduces the amount you have for retirement. Think of it as paying a hefty fee to access your own money early. Not exactly a great deal, is it?

The Opportunity Cost: What Else Could That Money Be Doing?

Beyond the immediate taxes and penalties, there's the concept of opportunity cost. That money sitting in your 401k is supposed to be growing, compounding over decades. When you take it out, you lose out on all that potential future growth. Imagine that $20,000 you withdrew. If it had stayed invested and grown at, say, 7% annually for 30 years, it could be worth a substantial amount more by the time you retire. That's money that could have funded a comfortable retirement, paid for travel, or even helped your grandkids. By taking it out early, you’re essentially sacrificing future wealth for present needs. It’s a tough trade-off, and one that needs serious consideration.

Are There Any Loopholes? (Spoiler: Not Really)

You might be thinking, "Is there some clever way around all of this?" Sadly, for the most part, no. The rules are there for a reason – to protect your retirement security. Trying to find a magical loophole is often more trouble than it's worth, and can lead to unexpected penalties and interest. The IRS is pretty good at catching people who try to game the system.

The "Best" Way to Use Your 401k for a Home (If You Absolutely Must)

If, after all this talk of doom and gloom, you’re still determined to use your 401k for a down payment, a 401k loan for a primary residence is generally the least damaging option compared to an early withdrawal. The repayment terms can be more favorable, and you avoid the immediate 10% penalty. However, the risks associated with job loss are still very real and should not be underestimated.

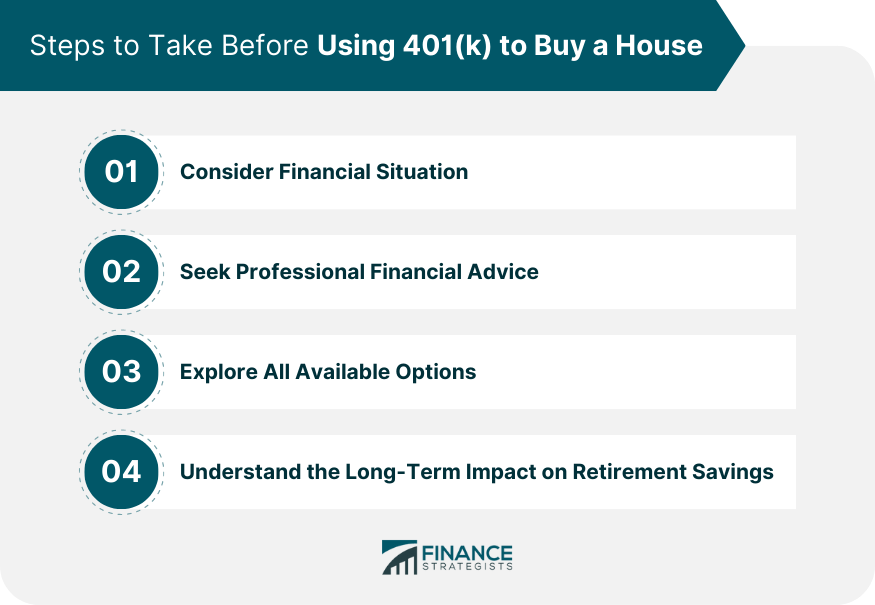

Before you even think about it, you need to have a rock-solid plan for repayment. What happens if you lose your job? Do you have an emergency fund that can cover the loan payments? Are you absolutely sure this is the best use of your retirement funds?

Alternatives to Consider: Don't Burn Your Bridges (or Your 401k)!

This is where we pivot to the more optimistic side. Before you even consider touching that 401k, have you explored ALL the other options? Seriously, exhaust these first.

- Saving diligently: The old-fashioned way. It takes time, but it’s the safest.

- Down payment assistance programs: Many states and local governments offer programs to help first-time homebuyers with down payments and closing costs. These are often grants that you don't have to repay!

- First-time homebuyer loans: Some lenders offer loans with lower down payment requirements.

- Borrowing from family: If you have family members who are willing and able to lend you money, this can be an option, though it comes with its own set of relationship dynamics to navigate. Just make sure it's all documented properly.

- Selling other assets: Do you have stocks, bonds, or other investments that aren't earmarked for retirement?

- Negotiating with the seller: Sometimes, you can negotiate for seller concessions to help with closing costs.

The Bottom Line: A Calculated Risk, Not a Default Option

Look, buying a house is a huge milestone, and it’s completely understandable to want to access any funds you have to make it happen. But your 401k is designed for your future security. Taking money out of it for a down payment is a big decision with significant long-term consequences. It's not a free pass to homeownership; it's a calculated risk that can jeopardize your retirement if not handled with extreme caution and foresight.

So, can you take money from your 401k to buy a house? Yes, technically. But should you? That's a question only you, with a deep understanding of the risks and a thorough exploration of all alternatives, can answer. Tread carefully, my friends, and always prioritize your long-term financial well-being.