Can You Sell Term Life Insurance Policy

Okay, so you're chilling, maybe scrolling through TikTok, and a thought pops into your head. Like a tiny, brilliant spark. It hits you: "Can I... sell my term life insurance policy?" Sounds wild, right? Like, you're holding onto this future payout thing, and suddenly you're thinking about flipping it like a vintage comic book.

And you know what? That's the kind of question that makes us lean in. It’s got that delicious whiff of the unexpected. It’s not your everyday conversation, is it? Most people are just trying to figure out if they remembered to pay their electric bill. You, my friend, are pondering the exotic world of life settlements.

Let's get this out of the way: The short answer is: sometimes, but not always, and definitely not in the way you might be thinking. It's not like popping down to the pawn shop with your policy. This is a whole different ball game. A much, much more… financially sophisticated ball game.

Think of it like this. Your term life insurance policy is, well, a term. It has an end date. Like a limited edition sticker. Once that date hits, poof! Gone. No more coverage. So, selling it is all about what happens before that magical expiration date.

Now, the real juicy bit. Who in their right mind would buy your life insurance policy? It’s not like they’re going to get a kick out of your death. That’s a bit dark, even for us. No, they're buying it for the potential death benefit. And they're usually betting on a few things.

For starters, they’re likely looking at folks who are a bit older. Why? Because time, my friends, is a crucial factor. The longer it takes for the policy to pay out, the better for the buyer. It’s like a fine wine. Or a really good cheese. The wait can be worth it.

The Secret World of Life Settlements

This whole thing is called a life settlement. Fancy name, right? It sounds like something you'd read about in a spy novel. "Agent, we've acquired the asset. The life settlement is secure." Okay, maybe not that dramatic, but you get the idea.

So, how does it actually work? You've got a policy. You decide you want some cash now. You contact a company that specializes in this. They’ll do their homework. A LOT of homework.

They'll want to know everything. Your age. Your health. Your lifestyle choices. Are you a bungee jumper? Do you enjoy extreme gardening? They're essentially assessing your life expectancy. It's like a very intense, very personal actuarial study.

And here’s where it gets interesting. They’re not just looking at a calendar. They’re looking at your individual timeline. Think of it like a really specific predictor. They're trying to estimate when, statistically speaking, the policy is most likely to pay out.

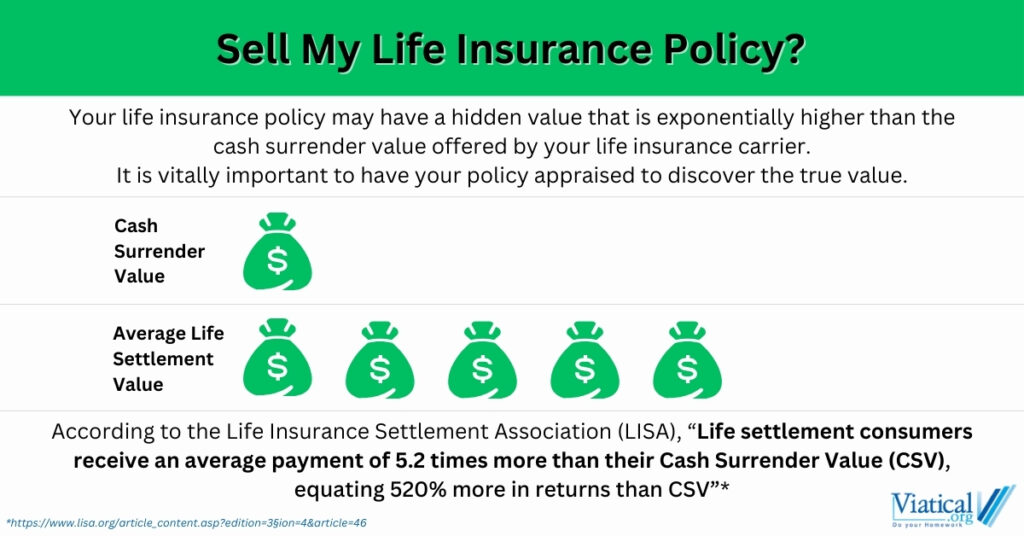

If they decide to make an offer, it's usually a portion of the death benefit. So, you won't get the full million dollars your policy is worth. But you'll get a lump sum of cash right now. Which, for some people, is exactly what they need.

Why Would You Even Consider This?

This isn't for everyone. Let's be super clear on that. But imagine this: you took out a hefty life insurance policy years ago. Life happened. Your financial situation changed. Maybe the kids are grown and gone. Maybe you've got some unexpected medical bills. Or maybe, just maybe, you want to travel the world in a gilded hot air balloon. We're not judging!

In those situations, a lump sum of cash could be a game-changer. It's like finding a forgotten twenty-dollar bill in your old jeans, but multiplied by… well, a lot.

It’s a way to unlock the value that's currently locked up in your policy. It’s turning a future promise into present-day reality. And that can be incredibly powerful.

Who Buys These Things, Anyway?

The buyers are typically investors. Think of them as sophisticated gamblers. They’re buying these policies and holding them. They pay the premiums. And they wait. They are betting on the policyholder living for a certain amount of time, but not too long.

It's a business. A rather niche business, but a business nonetheless. They’re looking for a return on their investment. And they’re willing to take on the risk associated with the policyholder’s lifespan.

It’s a bit like owning a rare collectible. You buy it, you hold onto it, and you hope its value increases. In this case, the "value" is the death benefit, and the "increase" is the time the policyholder lives.

Is Your Term Policy Even Sellable?

This is where it gets a little… picky. Not all term life insurance policies are eligible for life settlements. There are a few key reasons why.

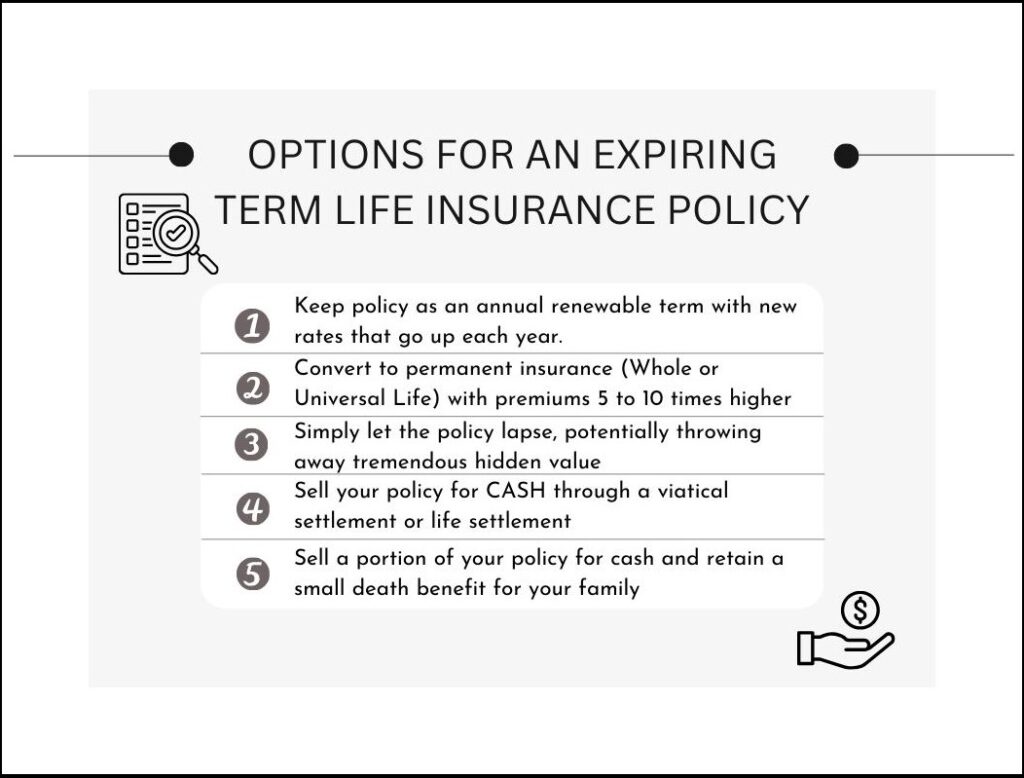

First off, term policies have an expiration date. Remember our sticker analogy? Once the sticker's gone, it's gone. Buyers are usually looking for policies that are permanent. Things like whole life or universal life insurance. These policies stick around for your entire life.

Why? Because a term policy that's about to expire is a bad investment for a buyer. They're not going to get their money back, let alone a profit. They need time for their investment to mature. So, if your policy is on its last legs, it's probably not a candidate.

Also, there are usually minimum death benefit amounts. You're unlikely to sell a policy with a $10,000 death benefit. The transaction costs and the investor's potential profit just won't justify it.

The Quirky Details

Here’s a fun little fact: The life settlement market has grown quite a bit over the years. What used to be a very obscure transaction is now a more established industry. It’s not exactly mainstream news, but it’s definitely not a ghost story anymore.

And the folks who do go through with it? They’re often looking for liquidity. That's a fancy word for ready cash. They need it for something specific. A down payment on a new home? Funding a business idea? Helping out family?

It’s a decision that requires a lot of thought. It’s not a spur-of-the-moment thing. You're essentially trading a future death benefit for immediate funds. That’s a big trade-off.

So, Should You?

The question of whether you can sell your term life insurance policy is a complex one. The answer is often no, if it's a standard term policy nearing its end. But if you have a permanent policy, and you’re facing a situation where immediate cash would be a lifesaver, then exploring a life settlement might be worth your time.

It’s about understanding your options. It’s about knowing that there are sometimes surprising ways to leverage assets you thought were just… there. It’s a little bit of financial magic, if you will.

Just remember, this isn't financial advice. It's just a peek behind the curtain of a really interesting, slightly quirky corner of the financial world. So, next time you're pondering the universe, maybe ponder life settlements too. It’s more fun than you think!