Can You Sell A Car On Pcp? What To Know

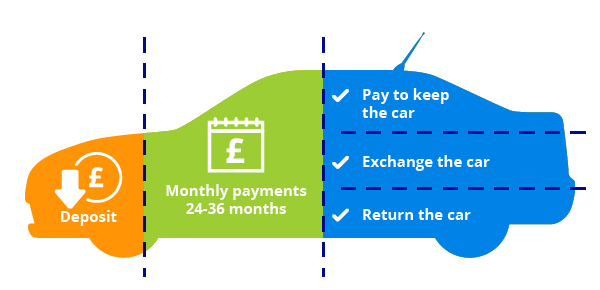

So, picture this: I'm staring at my beloved, slightly battered hatchback. She's been a trusty steed, ferrying me to countless coffee dates, emergency grocery runs, and that one epic road trip where we almost ran out of gas. The thing is, she's on a PCP deal. You know, that thing where you have monthly payments, then a big balloon payment at the end? Yeah, that one. And suddenly, life's thrown a curveball, and I'm thinking, "Can I, or rather, should I, sell this car on PCP?" It’s a question that's probably pinged around in your own head at some point, hasn’t it?

Because let's be honest, PCP can feel a bit like a mystery box. You’ve got your monthly payments, and then there’s this mysterious final figure. Selling a car on PCP? It sounds like trying to untangle a particularly stubborn knot. But fear not, fellow car enthusiasts (or just people who need to offload a vehicle)! We’re going to dive headfirst into this, no jargon overload, just straight talk. Think of this as your friendly neighbourhood guide to navigating the somewhat murky waters of selling a PCP car.

So, The Big Question: Can You Actually Sell A Car On PCP?

The short, sweet, and slightly anticlimactic answer is: yes, you can. But it’s not quite as simple as listing it on Gumtree and walking away with a wad of cash. There are a few hoops to jump through, and understanding them is key to not ending up in a pickle. It's like trying to sell a borrowed book – technically possible, but you need to get the original owner (in this case, the finance company) involved.

The main thing to remember is that you don’t actually own the car until you’ve paid off that final balloon payment. The finance company does. This is probably the most crucial piece of information to hold onto throughout this whole process. It explains a lot of the extra steps involved, and why you can't just treat it like any other car you own outright.

Understanding Your PCP Agreement: Your Secret Weapon

Before you even think about listing your car, you need to get intimate with your PCP agreement. Pull it out, dust it off, and have a good read. Look for the section that details your early settlement figure. This is the magic number that tells you exactly how much you need to pay the finance company to release the car from their grasp.

This figure will include any remaining monthly payments, interest, and the guaranteed future value (GFV) – also known as the balloon payment. It’s important to know that this figure can fluctuate. Sometimes, it’s more beneficial to settle early, and sometimes it's less. The more you understand your contract, the better equipped you'll be to make informed decisions.

Pro tip: If your agreement is buried under a mountain of old receipts, don’t panic! Most finance companies will be able to provide you with a clear breakdown of your settlement figure upon request. Just give them a ring or check their online portal.

The "Equity" Conundrum: Are You In Or Out Of Pocket?

This is where things can get a little tricky, and where the "selling on PCP" concept really comes into play. We’re talking about equity. Think of equity as the difference between what your car is worth on the open market and what you owe on your PCP agreement. It’s essentially your stake in the car.

If your car is worth more than your settlement figure, congratulations! You’ve got positive equity. This means you could potentially make a profit when you sell the car. Isn’t that a nice thought? Imagine selling your car and actually having some money left over. That’s the dream, right?

On the flip side, if your car is worth less than your settlement figure, you’ve got negative equity. This means you owe more than the car is worth. This is the scenario that can make selling a PCP car a bit more complicated. You’ll have to cover that shortfall yourself. Ouch. This is why knowing your car's market value before you commit to selling is super important. Don’t just guess; do your research!

How to Figure Out Your Car's Worth

So, how do you get a realistic idea of what your car is worth? There are a few ways to go about this:

- Online Valuation Tools: Websites like Auto Trader, Parkers, and What Car? offer free car valuation tools. Just pop in your car’s registration number, mileage, and condition, and they'll give you an estimated value.

- Dealership Offers: Many dealerships will happily give you a valuation for your car, especially if you’re looking to buy a new one from them. This can be a good benchmark, but remember they're looking to make a profit, so their offer might be lower than what you could achieve selling privately.

- Private Sale Comparisons: Browse online marketplaces like eBay Motors and Gumtree. See what similar cars to yours are actually selling for. This is probably the most accurate way to gauge your car's true market value.

Remember: Be realistic! Those pristine, low-mileage examples might be fetching top dollar, but if your car has a few more miles on the clock and a couple of minor scuffs, you'll need to adjust your expectations accordingly.

The Two Main Paths to Selling Your PCP Car

Now that you’ve got a handle on your settlement figure and your car's potential value, let's look at the actual selling process. There are two main avenues you can explore:

1. Settling the Finance Yourself and Selling Privately

This is often the most lucrative option if you have positive equity or are comfortable covering a small shortfall. Here’s how it generally works:

- Get Your Settlement Figure: Contact your finance company and request your early settlement figure.

- Secure the Funds: You’ll need to have the cash or be able to arrange a loan to cover this figure.

- Pay Off the Finance: Make the payment to your finance company. They will then send you the V5C (logbook) and confirm that the finance is settled. This is the moment you officially become the owner!

- Sell the Car: Once you have full ownership, you can advertise and sell your car privately. You set the price and deal directly with buyers.

Pros: You’ll likely get the best price for your car, and you have full control over the sale. You might even make a profit!

Cons: It requires upfront cash to settle the finance, and it can take more time and effort to find a buyer. You also have to deal with all the negotiations and paperwork yourself. If you have negative equity, this route means you'll have to find the extra money to cover it.

2. Selling to a Dealership or Part-Exchanging

This is usually the quicker and simpler route, especially if you’re looking to upgrade to another car. Here’s the gist:

- Get Your Settlement Figure: Again, this is your starting point.

- Approach Dealerships: You can approach dealerships to buy your car outright or to part-exchange it for a new vehicle.

- The Dealership Settles the Finance: The dealership will typically handle settling the finance with your PCP provider directly. They’ll deduct the settlement figure from the agreed sale price of your car.

If you have positive equity: The dealership will pay you the difference between the agreed sale price and the settlement figure. This might be a lump sum or a deduction from the price of your new car.

If you have negative equity: This is where it gets a bit more involved. The dealership will deduct the settlement figure from the agreed sale price. If the settlement figure is higher than the agreed sale price, you will owe the dealership the difference. You’ll either need to pay this difference upfront, or it will be added to the finance of your new car (which can increase your monthly payments).

Pros: It’s usually much faster and more convenient. Dealerships handle the paperwork and the finance settlement. It’s a good option if you’re upgrading and want a smooth transition.

Cons: You will almost certainly get less money for your car than if you sold it privately. Dealerships need to make a profit, after all. If you have negative equity, it can be more expensive.

What About Voluntary Termination? Is That an Option?

Ah, voluntary termination. This is a legal right that most PCP agreements have, usually after you've paid 50% of the total amount payable. It's essentially a way to hand the car back and walk away, with no further payments (provided you haven't exceeded the mileage allowance or caused excessive damage).

While not strictly "selling," it's a way to exit your PCP agreement. If your car is worth significantly less than you owe and you're struggling to cover the settlement, voluntary termination might be a way to avoid further debt. However, you won't get any money back if your car is worth more than what you owe at the 50% mark. It's a way to get out, not to make money.

Crucial point: Make sure you've read your contract carefully regarding the 50% rule and any conditions attached. Don't assume it's always a simple "hand back the keys" situation.

Navigating the "Trader" World: What if You're a Car Dealer?

Now, if you're a car dealer, the process is a little different, and frankly, you'll have a lot more experience with this! Dealers have specific procedures for settling finance on cars they acquire. They’ll have accounts with finance companies and are well-versed in the necessary paperwork. If you're a dealer looking to sell a car that's still on PCP, you'll need to follow your established protocols for settling outstanding finance and ensuring clear title.

For the average punter (like me and likely you): This isn't really your concern. Focus on the two main paths outlined above.

The Paperwork Trail: Don't Get Lost!

Regardless of how you choose to sell, there will be paperwork. It’s inevitable. Here’s what you need to be aware of:

- Settlement Quote: As we’ve said, this is your starting point.

- Proof of Ownership (Once Settled): The V5C (logbook) is your golden ticket.

- Sales Contract/Agreement: Whether it’s with a private buyer or a dealership, you’ll need some form of agreement.

- HPI Check (for private buyers): If you’re selling privately, it’s a good idea to get an HPI check done to prove the car is free from outstanding finance. Buyers will often ask for this.

My advice? Keep copies of everything. It’s better to have too much documentation than not enough, especially when dealing with finance agreements.

Final Thoughts: Is Selling Your PCP Car Worth the Hassle?

Selling a car on PCP can feel a bit daunting, like trying to perform a magic trick without knowing the incantations. But once you understand the core principles – that you don't own it until it's paid off, and the importance of the settlement figure – it becomes much more manageable.

If you have positive equity, selling privately can be very rewarding. If you’re looking for speed and convenience, a dealership might be your best bet, even if it means a slightly lower return. And if you’re facing negative equity, you’ll need to carefully weigh the costs and benefits of each route.

Ultimately, the decision to sell is a personal one, driven by your circumstances. But with a bit of research, a clear understanding of your agreement, and a healthy dose of realism, you can navigate the world of selling a PCP car with confidence. And who knows, you might even come out with a little extra cash in your pocket. Now, if you’ll excuse me, I’ve got some valuations to check!