Can You Get An Extension To File Taxes

Alright, let's talk about taxes. I know, I know. The very word can send shivers down your spine, right? It's like that awkward family reunion you've been dreading, or the moment you realize you've forgotten your partner's birthday. But hey, we've all been there, staring at that looming tax deadline with a mixture of dread and a sudden, inexplicable urge to reorganize your sock drawer. So, the big question on everyone's lips, the one whispered in hushed tones over lukewarm coffee and stale donuts: "Can you get an extension to file your taxes?"

The short and sweet answer, folks, is a resounding "YES!" You absolutely can. Think of it as the universe giving you a tiny little breather, a cosmic "you got this, but maybe later" note. It’s not a free pass to ignore your financial responsibilities entirely, mind you. It’s more like asking for a rain check on that mountain of paperwork.

The Anatomy of a Tax Extension: It's Not as Scary as it Sounds

So, how does this magical tax extension work? It’s surprisingly straightforward. In the United States, the IRS (that's the Internal Revenue Service, for those who prefer their acronyms with a side of mystery) offers a standard extension. You typically file a form, either electronically or on paper, and poof! You’ve bought yourself an extra six months. Six months! That’s practically an eternity in tax-filing time. It’s enough time to finally learn to play the ukulele, write that novel you’ve been dreaming about, or at least think about starting that home renovation project.

Now, before you start planning that extended vacation to Tahiti, there's a little catch. This extension is for filing your taxes, not for paying them. Big difference, much like the difference between getting an extension on your homework and actually doing the homework. If you owe money, you're still expected to fork over a good estimate of what you owe by the original deadline. Failing to do so can lead to interest and penalties, which are about as welcome as a surprise root canal.

Why Would Anyone Need an Extension? Let's Be Honest.

Life, my friends, is a beautifully chaotic mess. And sometimes, that chaos makes it incredibly difficult to wrangle all your financial documents into submission by the April deadline. Think about it:

- The Great Document Scramble: You know that feeling? You're pretty sure you put that important W-2 somewhere safe, but "somewhere safe" has now morphed into a black hole of forgotten receipts, miscellaneous mail, and that single sock that’s been eluding its mate for months. It’s like trying to find a specific LEGO piece in a bin the size of a small car.

- Life Happens: Maybe you’ve been busy. Like, really busy. Perhaps you were dealing with a new baby, a demanding career change, a family emergency, or even just a particularly intense Netflix binge-watching marathon. (No judgment here, we’ve all been there.) When life throws you a curveball, or a whole pitching machine of curveballs, tax forms can fall to the bottom of the priority list faster than you can say "procrastination."

- Complex Tax Situations: Some tax returns are more intricate than a spiderweb in a hurricane. If you’ve got investments, rental properties, a side hustle that’s finally taking off, or a particularly adventurous approach to your charitable donations, you might genuinely need more time to ensure everything is reported accurately. It’s not about laziness; it’s about accuracy. Like trying to assemble IKEA furniture without the instructions – you could wing it, but the end result might be a lopsided bookshelf and a serious existential crisis.

- The "I'll Get to It Later" Syndrome: This is the most common one, isn’t it? We all have that little voice in our head that whispers, "You've got plenty of time!" until suddenly, you don't. It’s the same voice that tells you one more cookie won't hurt, or that it’s perfectly fine to go to bed with wet hair.

Honestly, sometimes the reason is simply that you’re just not feeling it. The thought of poring over tax documents feels about as appealing as voluntarily attending a Tupperware party. And that’s okay! An extension acknowledges that sometimes, you just need a little more runway.

How to Actually Get That Extension: It's Easier Than You Think

So, you’ve decided you need a tax extension. Excellent! Now, how do you secure this precious gift of time? The primary way is by filing Form 4868, Application for Automatic Extension of Time to File U.S. Individual Income Tax Return. Yes, it sounds official and a little intimidating, but it’s basically a "get out of jail free" card for filing deadlines.

You can do this in a few ways:

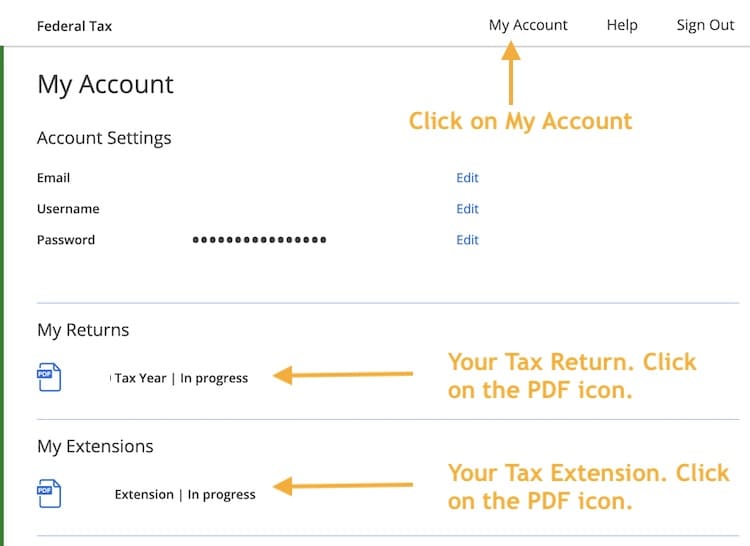

- Electronically: This is the fastest and most recommended method. You can file Form 4868 through tax software, or directly via the IRS website. It’s like sending an email – quick, efficient, and you get a confirmation receipt.

- Through Your Tax Preparer: If you use a tax professional, they can usually handle filing the extension for you. Think of them as your trusty sherpa guiding you up the treacherous Mount Tax.

- By Mail: You can also download and print Form 4868 from the IRS website and mail it in. Just make sure you get it postmarked by the original tax deadline. It’s the old-school method, like sending a postcard from your vacation.

The beauty of Form 4868 is that for most people, it grants an automatic six-month extension. This means you don't need a special reason to request it. Simply filling out the form and submitting it is usually all it takes. It's not like applying for a mortgage where you need a solid credit score and a compelling life story. It's more like asking for an extra few minutes to finish your lunch.

The Crucial Caveat: Paying What You Owe

Now, let’s revisit that little detail about paying your taxes. This is where many people get tripped up, and it’s the part that can really sting. An extension to file is not an extension to pay. If you owe money to the IRS, you're still expected to pay an estimated amount by the original tax deadline.

Think of it this way: If you borrow a cup of sugar from your neighbor and promise to return it by Tuesday, but you ask for an extension on telling them you’ve borrowed it until Thursday, that doesn’t mean you get to keep the sugar until Thursday. You still owe them the sugar by Tuesday!

So, how do you estimate what you owe?

- Review Last Year's Return: This is a good starting point.

- Estimate Your Income: Think about your earnings so far and what you expect to earn.

- Consider Deductions and Credits: Make an educated guess about what you might be eligible for.

- When in Doubt, Overestimate: It's generally better to pay a little more than you owe and get a refund, than to underpay and face penalties. It’s like packing an extra snack for a long road trip – you might not need it, but you’ll be really glad you have it if you do.

You can pay your estimated tax liability when you file your extension. This can also be done electronically through the IRS website or tax software. If you've paid enough throughout the year via withholding or estimated tax payments, you might not owe anything at all, which is the dream scenario!

What Happens if You Don't Get an Extension? (The "Oops" Scenario)

Let’s say you totally missed the deadline, didn’t file an extension, and now you’re staring at your tax return with the same panic you feel when you see your bank account balance after a weekend of fun. What happens?

Well, the IRS isn't going to send out tax-collecting ninjas (though that would make for an interesting movie). However, there are consequences:

- Failure to File Penalty: If you owe taxes and don't file on time, you’ll likely face a penalty. This penalty is usually a percentage of the unpaid taxes for each month or part of a month that your return is late, up to a maximum percentage.

- Failure to Pay Penalty: This penalty is for not paying the tax you owe by the deadline, even if you filed an extension. It’s also calculated as a percentage of the unpaid taxes.

- Interest: On top of penalties, the IRS also charges interest on underpayments and unpaid taxes. This interest accrues daily.

The good news is that these penalties and interest are often waived if you can show "reasonable cause" for not filing or paying on time. Think of it as explaining to your boss why you were late – "my cat ate my homework" might not fly, but a genuine medical emergency or a natural disaster usually will. You'll need to submit a written statement explaining the situation.

The Benefits of a Little Extra Time

Beyond the obvious relief of not having to rush, a tax extension offers several advantages:

- Reduced Stress: This is probably the biggest one. Knowing you have more time can significantly lower your stress levels. You can approach your taxes with a clearer head.

- Accuracy: More time means more opportunity to double-check your numbers, gather all necessary documents, and ensure you're claiming all eligible deductions and credits. This can actually save you money in the long run.

- Avoiding Mistakes: Rushing can lead to errors, which can cause more headaches down the line. An extension helps you avoid those costly slip-ups.

- Peace of Mind: Instead of feeling that constant nagging guilt, you can tackle your taxes at your own pace, when you’re feeling most productive.

Think of it like this: Would you rather cram for a major exam the night before, fueled by energy drinks and panic, or study steadily over a few weeks, feeling confident and prepared? The tax extension is your "steady study" approach to your finances.

Who Should Not Worry About Extensions

Now, let’s be real. Not everyone needs an extension. If you’re getting a big tax refund, you actually want to file as soon as possible to get your money back! It's like finding a twenty-dollar bill in an old coat pocket – the sooner you find it, the sooner you can spend it (responsibly, of course).

Also, if your tax situation is super simple – a single W-2 job, no major life changes – you might be able to whip it out quickly. But even then, if life is just too darn hectic, there’s no shame in asking for a little more time.

In Conclusion: Don't Sweat the Small Stuff (Especially Tax Deadlines)

So, there you have it. The tax deadline doesn't have to be a source of sleepless nights and existential dread. The IRS understands that life happens, and they've provided a safety net in the form of a tax extension. It’s a simple, automatic process for most individuals, giving you that much-needed extra breathing room.

Just remember that all-important distinction: an extension to file is not an extension to pay. Make your best estimate and pay what you owe to avoid those pesky penalties and interest. Otherwise, go ahead and embrace that extra six months. Use it wisely, use it to get organized, and use it to finally tackle that pile of receipts that’s been staring at you with judgment. Because at the end of the day, a little bit of extra time can make all the difference between a stressful scramble and a calm, collected tax season. Now go forth and file (or extend!) with confidence!