Can You Get A Mortgage With Derogatory Mark

So, you've got a bit of a... let's call it a "blip" on your credit report. Maybe a late payment here, a missed bill there. We've all been there, right? Life happens! But then the dream of owning a home pops into your head, and a little voice whispers, "Can I even get a mortgage with these derogatory marks?" It's a question that can feel like a real stumbling block. But hold on to your hats, because the answer might be more interesting – and more hopeful – than you think!

Think of your credit report as your financial report card. Lenders, those folks who hold the purse strings for mortgages, peek at this report card to see how you've handled money in the past. And those derogatory marks? They're like the red ink scribbled all over your grades. A foreclosure, a bankruptcy, a significant number of late payments – these are the big ones. They tell a story, and sometimes that story says, "This person might be a risk."

But here’s where the plot thickens and things get really intriguing. It’s not always a straight-up "no." It’s more like a "let’s talk about it." Lenders aren't just looking at the marks themselves. They're also trying to understand the story behind the marks. Did you have a sudden job loss? Were you dealing with a serious health crisis? Sometimes, lenders have a heart, believe it or not!

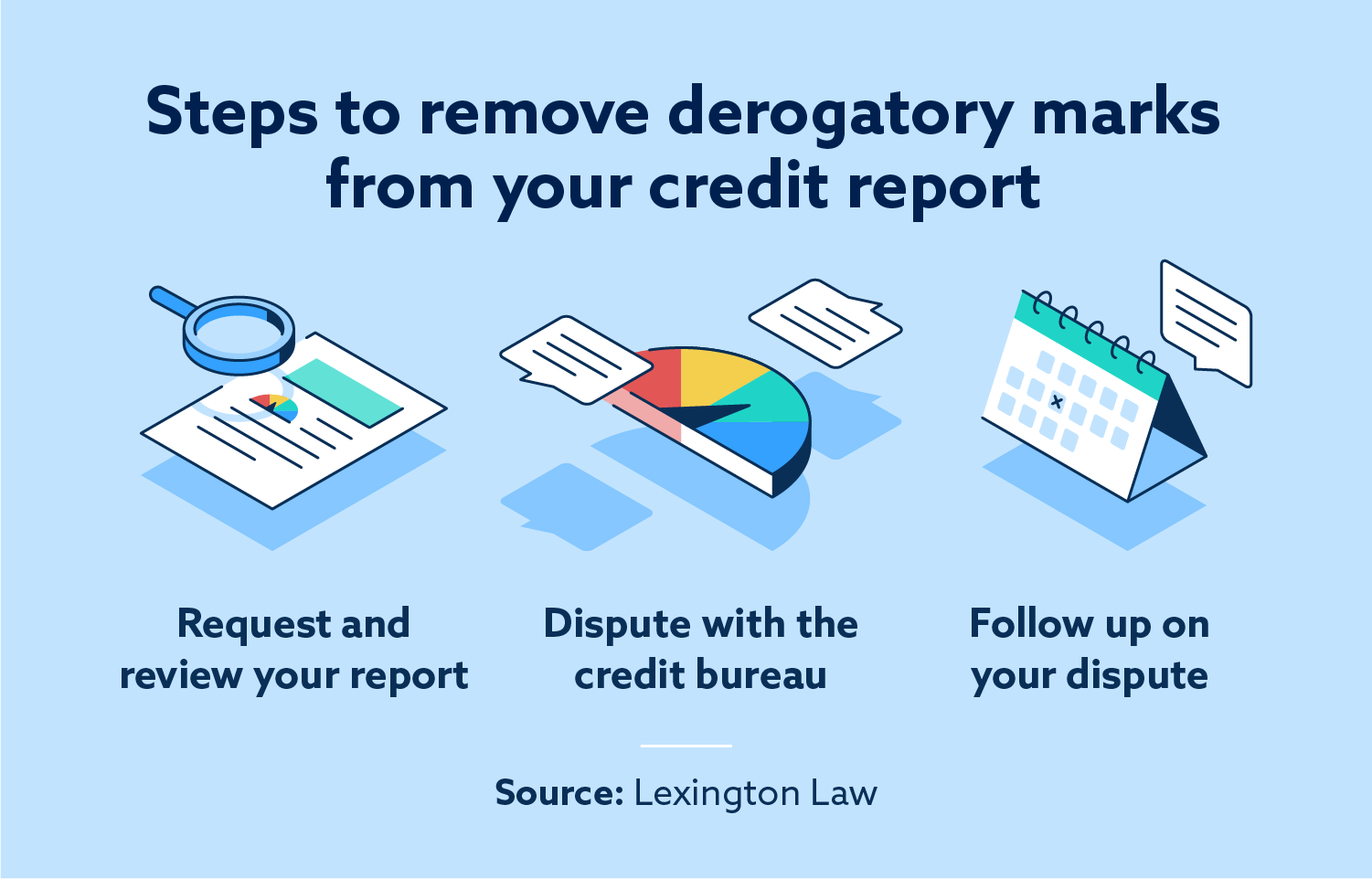

This is where the whole journey becomes a bit of a detective story. You’ve got to dig into your credit report. Sites like Experian, Equifax, and TransUnion are your investigative tools. You need to see exactly what’s on there. Are there errors? Sometimes, mistakes happen, and if you can get them corrected, that's a quick win! It’s like finding a typo in your teacher’s grading book – suddenly, your grade goes up!

Now, if those marks are legit, the next chapter is all about building a case for yourself. This is where you become the star of your own financial comeback story. Think about how you’ve improved your financial habits since those blips occurred. Are you paying all your bills on time now? Have you reduced your debt significantly? These are the acts of redemption that lenders love to see!

One of the most fascinating parts of this whole process is exploring different types of mortgages. Not all mortgages are created equal. Some are more flexible than others. You might have heard of FHA loans. These are often a great option for people with less-than-perfect credit. The government insures these loans, which means the lender takes on less risk. It's like having a safety net woven by Uncle Sam!

Then there are VA loans for our amazing veterans and active-duty military. These are often incredibly generous and can have very lenient credit requirements. If you served, this is a secret weapon you absolutely want to investigate. It’s a thank you from the nation for your service, and it can open doors that might otherwise seem locked shut.

Another key player in this drama is the loan officer. These are your guides through the mortgage wilderness. A good loan officer won't just look at your credit score and say "next!" They'll listen to your story, understand your situation, and help you find the best path forward. Finding the right one is like finding a wise mentor who knows all the shortcuts and secret passages.

It's important to understand that getting a mortgage with derogatory marks usually means you'll be looking at a higher interest rate. Think of it as a premium for the extra risk the lender is taking. It's not ideal, but it's often the price of admission to homeownership when your credit isn't pristine. But even with a slightly higher rate, owning a home can still be a fantastic investment and a huge step forward!

The most important takeaway from this whole adventure is that you shouldn't give up before you even start. The mortgage world can seem daunting, especially with a few bumps in your financial road. But there are ways. There are people who want to help. And with a little effort, research, and perhaps a bit of patience, that dream of owning your own place could be closer than you think. It’s a story of resilience, of learning from mistakes, and of finding the right key to unlock your future. So, go on, start digging. Your homeownership adventure might just be waiting for you to uncover it!

Remember, your financial journey isn't always a straight line. Sometimes, the most rewarding paths are the ones with a few unexpected twists and turns!

So, can you get a mortgage with derogatory marks? The answer is a resounding maybe, and that 'maybe' is packed with possibilities! It’s an exciting challenge, a chance to prove your financial resilience. Don't let past missteps define your future. Explore your options, talk to the right people, and get ready to write your own happy ending. Your dream home might just be a credit report away from becoming a reality. It’s a tale of perseverance, and honestly, those are the best kinds of stories, aren’t they?