Can You Declare Bankruptcy On Student Loans

So, you've got these student loans. They feel like a friendly ghost, always lurking in the background, right? Maybe they whisper sweet nothings about your future, or perhaps they hum a more ominous tune. Either way, they're part of your financial soundtrack.

Now, you might be wondering, "Can these loan-monsters be banished, like, forever?" This is where things get a little bit like a treasure hunt, or maybe a slightly confusing maze. The answer, in a nutshell, is a bit of a plot twist.

The Great Student Loan Escape (or Not!)

Imagine this: you've gathered all your courage, you're ready to face your financial dragons, and you think, "Bankruptcy! That's the magic word!" You picture yourself, triumphant, riding off into the sunset with your student loans nowhere in sight.

Well, hold your horses, noble knight! While bankruptcy is a powerful tool for wiping away many kinds of debt – think credit cards and old medical bills – student loans are a bit more... stubborn.

They're like that one relative who just won't leave your party. They've got a special VIP pass, and it's not easy to get them to RSVP "no" to your financial future.

The "Undue Hardship" Hurdle

Here's where the adventure gets interesting. To discharge (that's fancy talk for "get rid of") student loans in bankruptcy, you usually have to prove something called "undue hardship". This isn't just a bad hair day or a temporary ramen noodle diet.

The courts want to see that keeping up with these loans would pretty much sink your ship. We're talking about a situation where you're struggling to meet your basic needs, like food, shelter, and, you know, not living in a cardboard box.

Think of it like this: if you were trying to get a superhero cape off a grumpy, but very strong, badger, it would be quite a feat. Proving undue hardship for student loans can feel a lot like that.

It's not just about being a little tight on cash. It’s about a genuine, long-term struggle that would prevent you from ever getting back on your feet financially, even with a reasonable effort.

This "undue hardship" test is where many people discover their student loans are more like a very well-protected treasure chest than a leaky old boat.

The "Special" Case of Federal Loans

Now, let's talk about the most common type of student loan: federal loans. These guys have some special protections, which, depending on your situation, can be a good thing or a bit of a roadblock.

Because the government wants to make sure people can repay these loans (after all, they helped fund your education!), they've made it extra tricky to discharge them in bankruptcy.

It's almost as if the loans come with their own tiny, but very stern, security guards.

The good news? If you do manage to prove undue hardship, those federal loans can be wiped clean. It’s a rare victory, but a victory nonetheless!

What About Private Loans?

What about those loans from banks or other private lenders? Are they any easier to get rid of? Well, sometimes they are, but it's still not a walk in the park.

Before October 2005, private student loans were treated more like other debts in bankruptcy. You could often discharge them without needing to prove undue hardship.

But then, the rules changed. Now, for private loans taken out after October 2005, you generally also need to prove undue hardship. So, the badger is still there, just maybe wearing a slightly different hat.

This change was a big deal for many people, making the path to debt relief a bit more winding.

The Bankruptcy Maze: A Guide for the Brave

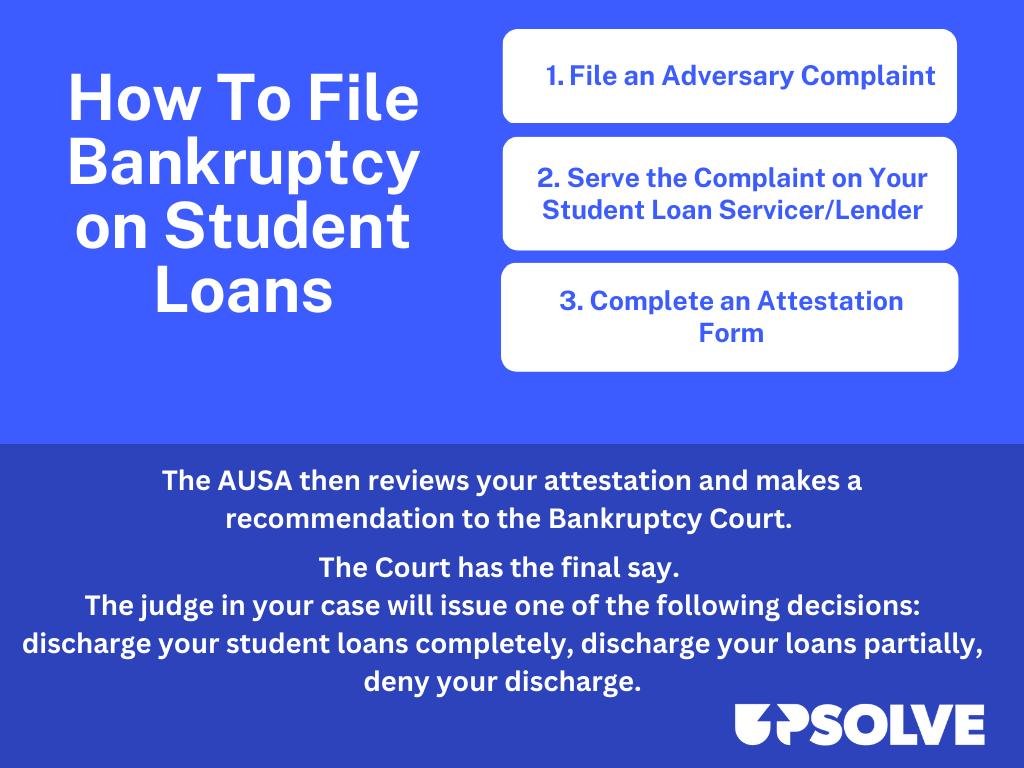

So, if you're considering bankruptcy for your student loans, it’s not as simple as just ticking a box. You’ll likely need to go through a whole separate legal process called an "adversary proceeding".

This is basically a mini-lawsuit within your bankruptcy case, where you present your evidence of undue hardship to a judge.

It’s like embarking on a quest where you have to collect specific magical artifacts (evidence) to prove your case.

You’ll need to show proof of your income, expenses, assets, and how those loans are crushing your ability to live a normal life. This often involves mountains of paperwork and, usually, a lawyer who speaks the ancient language of legal jargon.

Think of your lawyer as your trusty guide through this legal jungle, helping you navigate the tricky paths and avoid any financial quicksand.

When It's Worth the Fight

Is it ever worth it to try and discharge student loans in bankruptcy? For some, absolutely. If you're in a truly dire financial situation, where your student loan payments are preventing you from feeding your kids or keeping a roof over your head, it might be your only hope.

:max_bytes(150000):strip_icc():format(webp)/how-to-file-student-loan-bankruptcy-4772237-v1-03759a3771b741cca682ecd10c61127c.png)

It’s a path for those who are genuinely at the end of their rope, feeling like they’re constantly treading water and never reaching the shore.

However, for most people, there are often other, more accessible, repayment options.

It's a tough road, but for those facing extreme hardship, the possibility of a fresh start is a powerful motivator.

Alternatives to the Bankruptcy Battle

Before you even think about facing that badger of undue hardship, let's look at some other, friendlier options for your student loans. These are often much easier to access and can make a huge difference.

If you have federal loans, you might qualify for income-driven repayment (IDR) plans. These plans adjust your monthly payments based on your income and family size.

Imagine your loan payment shrinking to a size that’s actually manageable. It’s like finding a comfortable pair of shoes instead of having to wear ill-fitting ones all the time!

Some of these plans even offer the possibility of loan forgiveness after a certain number of years. It’s like planting a seed that, with consistent care, will eventually bloom into debt freedom.

Other Friendly Faces in the Debt World

There are also programs like Public Service Loan Forgiveness (PSLF), which can wipe out your remaining federal loan balance after 10 years of qualifying payments if you work in public service.

So, if you're a teacher, a nurse, or a government worker, this could be your golden ticket! It’s a way to get rewarded for serving your community, with the bonus of some serious debt relief.

And for private loans, while they don't have the same safety nets, it's always worth talking to your lender about refinancing or other repayment options. They might be more flexible than you think.

The Takeaway: Knowledge is Power

So, can you declare bankruptcy on student loans? Technically, yes, but it’s a high bar to clear. For most people, it’s not the easiest or most practical solution.

The good news is that there are usually other ways to manage your student loan debt. The key is to understand your options and explore them thoroughly.

It's like having a map to a hidden treasure. You just need to know where to look!

Don't let those loan whispers turn into loud shouts of despair. Instead, turn them into a quiet hum of manageable payments or, even better, a sweet song of freedom through alternative repayment plans. Your financial future is a beautiful melody, and you get to compose it!