Can You Add Money From Apple Pay To Cash App

You know that feeling? You’re ready to send your bestie a little something for that hilarious meme they just sent, or maybe you owe your neighbor for that amazing cup of coffee they brewed. And your money is chilling in Apple Pay, looking all comfortable. But your friend, bless their digital heart, is waiting on Cash App. So, the big question pops into your head: can these two digital wallets, these titans of instant transactions, play nicely together?

Imagine your money as a little digital traveler. It's had a lovely time in its Apple Pay suitcase, maybe for a quick online purchase or a tap-and-go at your favorite coffee shop. Now, it's heard tales of the vibrant community over at Cash App, where you can split bills with ease or even buy a little slice of Bitcoin. Can this traveler pack up its bags and hop over?

The short answer, and we’ll get to the fun part in a sec, is… well, it’s not quite as simple as a drag-and-drop operation. Think of it like trying to directly transfer a song from your brand new digital music player to an old-school cassette tape. They’re both about music, but the technology is a bit different.

So, you can't just hit a button that says "Send to Cash App" directly from your Apple Pay. It's not a built-in feature, like adding a new contact or changing your ringtone. It’s like trying to get your cat to directly deposit its tuna treats into your bank account – adorable to think about, but not how it works in reality.

But don't let that rain on your digital parade! We’re going to explore the delightful detours and creative workarounds that let your money make the journey. It’s all about being a little clever, a little patient, and perhaps a little more tech-savvy than you thought you were.

The Money Shuffle: A Little Bit of Ingenuity

The most common and straightforward way to get your Apple Pay funds over to Cash App involves a small, predictable step: using your bank account as a go-between. It’s like a friendly intermediary, a digital ferryman helping your money cross the river.

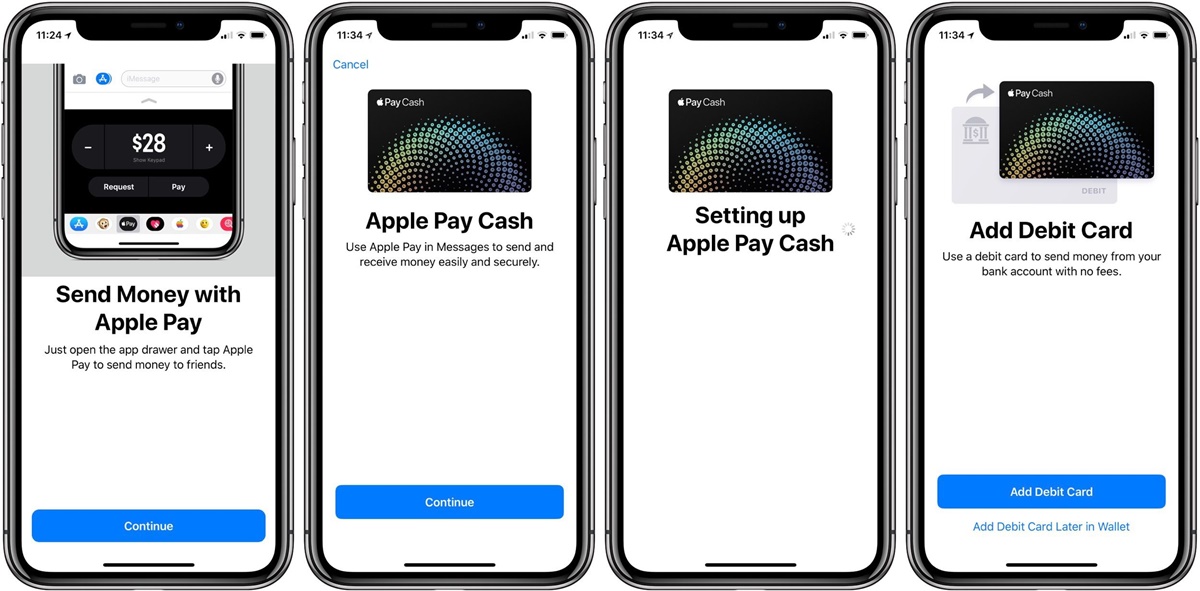

First things first, your Apple Pay is usually linked to a debit card or a bank account. If it’s a debit card, that card is directly connected to your bank account. If it’s a direct bank account link, even better! This is the secret sauce.

So, what you’ll do is tell Cash App to link to that same bank account or debit card that’s feeding your Apple Pay. It’s like saying, “Hey, Cash App, meet my bank! They’re old pals with Apple Pay, so you should get along just fine.”

Once that link is established, you can then add funds to your Cash App balance directly from your linked bank account. Voila! Your money, having started its journey in Apple Pay’s embrace, can now be accessed and used within the Cash App ecosystem. It’s a bit of a round-about way, but it gets the job done with a smile.

Think of it like this: you can't directly mail a letter from your mailbox to your friend's mailbox across town. But you can put it in your car, drive to the post office, and have them deliver it. Your bank account is that trusty car and the post office!

This method is fantastic because it keeps your money secure and within the established banking system. It’s the most reliable way to ensure your funds arrive safe and sound, ready for whatever Cash App adventure awaits.

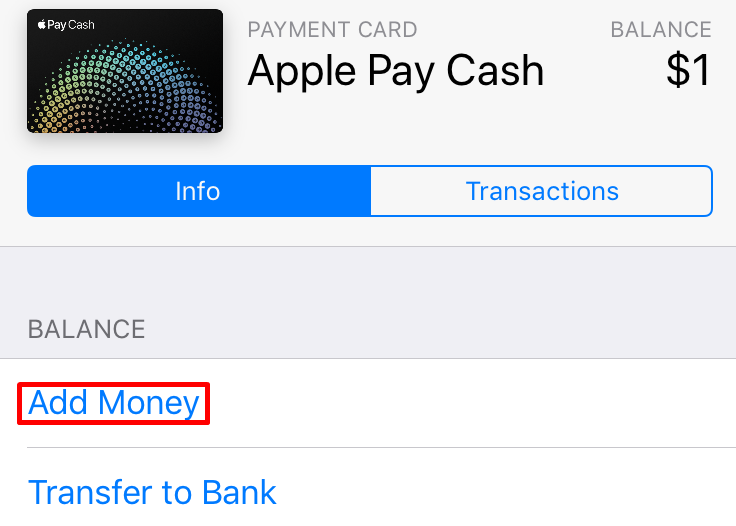

The "Add Cash" Adventure: A More Hands-On Approach

Sometimes, you might want to see your money move with a bit more… tangible presence. This is where the "Add Cash" feature on Cash App comes into play, and it can be a surprisingly fun way to feel in control.

With Cash App, you have the option to add cash to your account at participating retailers. Imagine walking into your local convenience store, not just to grab a snack, but to make a deposit into your digital wallet! It’s a modern twist on an old-school banking errand.

How does your Apple Pay money get involved here? Well, you can use your Apple Pay to pay for that purchase at the convenience store. If you’re buying something, you can simultaneously ask to add a certain amount to your Cash App balance. It’s a bit of a double-duty errand!

For instance, you might be picking up groceries, and you can use your Apple Pay for the transaction. Then, as part of that same trip, you can tell the cashier, "And please add $50 to my Cash App balance." They’ll scan a code, you hand over the cash (which you just spent using Apple Pay, a bit of a financial origami), and boom – your money is in Cash App.

This method can feel quite empowering. It’s a physical manifestation of your digital funds moving between platforms. Plus, it might even get you to interact with a friendly cashier, a little human connection in our increasingly virtual world.

It’s not the fastest way, mind you. You have to physically go to a store. But for those who enjoy a bit of an errand or want to avoid too many direct digital links, this is a perfectly viable and quite unique solution.

The "Virtual Card" Trick: A Bit of a Sneaky Move

Now, let's talk about a slightly more advanced, but still wonderfully accessible, technique. This one involves those digital cards that Apple Pay often uses. It's a little like having a secret identity for your money.

When you add a debit card to Apple Pay, it often creates a “tokenized” version of that card. This means that the actual card number isn’t directly transmitted during transactions. It’s a security feature, but it also gives us some interesting possibilities.

Here’s the clever part: sometimes, you can use the details of that tokenized card (or more accurately, the underlying card that Apple Pay is using) as a payment method within Cash App. It’s not a direct transfer, but it’s getting closer.

You might need to go into your Apple Pay settings to find the card details that Apple Pay is referencing. Then, you can try adding that card information as a linked card within your Cash App. If it works, you can then initiate transfers from your bank account (via that card) into Cash App.

It’s important to note that this can be a bit hit-or-miss depending on your bank and how they’ve set up their integration with Apple Pay and other financial services. It’s not a guaranteed, foolproof method for everyone.

But when it works, it’s like discovering a secret passageway. You’ve bypassed the usual steps and found a more direct, albeit slightly unconventional, route for your funds. It’s a testament to the ingenuity of users who want their digital lives to be as seamless as possible.

Why the Detour? A Little About Digital Wallets

So, why isn't it as simple as hitting a button? Think of Apple Pay and Cash App as two different clubs. Both are awesome, and both deal with money, but they have their own membership rules and ways of doing things.

Apple Pay is designed to be a secure way to pay for things online and in stores, using your existing cards. It's like a fancy digital wallet that holds your cards securely. It’s focused on the payment aspect.

Cash App, on the other hand, is more of a peer-to-peer payment service, a digital bank account, and even an investment platform. It’s built for sending money between individuals, receiving paychecks, and managing a balance within its own app. It’s focused on money management and transfer within its ecosystem.

Because they have different primary functions, direct integration for money transfers between them isn't a core feature. It’s like asking your toaster to also function as a washing machine – it’s just not what it was designed to do.

However, the beauty of the digital world is that we’re not limited by design alone. We can find clever workarounds, like using our bank account as a bridge, or even the more adventurous "add cash" method.

It’s a testament to our adaptability and our desire to have our digital tools work for us, not the other way around. So, the next time you’re pondering that money move, remember the little detours are just part of the adventure!

The Heartwarming Bit: Connecting People

Ultimately, why do we even care about moving money between Apple Pay and Cash App? It’s not just about the technicalities, is it?

It’s about sending your niece a birthday gift, even if you can't be there in person. It's about quickly repaying your roommate for that pizza you just inhaled. It's about supporting that small online artist you discovered.

These digital tools, with all their little quirks and workarounds, are ultimately about connection. They allow us to show care, to be helpful, and to participate in each other’s lives, even when we’re miles apart.

So, the next time you’re navigating the digital transfer, have a little chuckle about the journey your money is taking. It might not be a direct flight, but it’s a journey with a purpose: to strengthen bonds and make life just a little bit easier, and perhaps a little more fun.