Can U Insure A Car With A Salvage Title

So, you're eyeing that sweet, sweet ride. The one that whispers tales of daring adventures and maybe, just maybe, a minor mishap or two. But then you see it. That little phrase that makes your wallet do a nervous shimmy: salvage title.

Cue the dramatic music. Or, you know, just a gentle sigh.

Most folks hear "salvage title" and picture a car held together by duct tape and sheer willpower. A mechanical Frankenstein's monster limping its way through life. And hey, sometimes that’s true! But is it the whole story? Absolutely not.

The real question on everyone's lips, the one whispered in hushed tones at car meets and debated over lukewarm coffee, is this: Can you insure a car with a salvage title?

Spoiler alert! The answer is a resounding... it depends.

But wait! Don't click away just yet! This isn't some dry, boring insurance lecture. This is about uncovering the secrets of the automotive underworld. The places where cars go to get a second chance. And yes, where they can actually get some insurance.

The Not-So-Scary Salvage Title

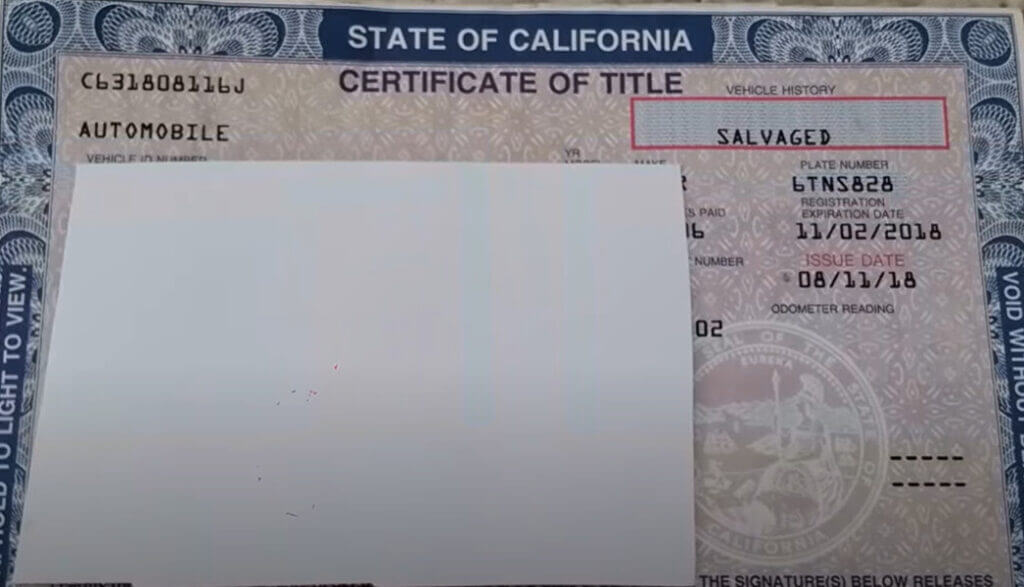

What even is a salvage title? Imagine your car has a really bad day. A fender bender that's more than a fender bender. A flood that decides your car’s interior is the new ocean. Or maybe it got stolen and stripped for parts like a delicious chicken at a picnic.

When the repair costs to fix that poor, unfortunate vehicle exceed a certain percentage of its pre-damaged value (this magic percentage varies by state, by the way – isn't that fun?!), the insurance company declares it a "total loss." And BAM! It gets branded with a salvage title.

This doesn't necessarily mean it's a rust bucket destined for the scrap heap. It just means it was damaged significantly. It’s like a superhero who’s been through a brutal fight. They might have some scars, but they're still capable of saving the day. Or, you know, driving you to the grocery store.

From Wreckage to Wheels: The Rebirth

Here's where things get interesting. That salvage-titled car can be repaired. And not just with chewing gum and hope. Reputable mechanics can bring these beauties back from the brink. After they're fixed up good and proper, they can get what's called a "rebuilt title" or a "reconstructed title."

Think of it as a phoenix rising from the ashes. Or a caterpillar transforming into a butterfly. A slightly dented, possibly still smelling faintly of old socks, but undeniably flying butterfly.

Now, this is the crucial part. Having a rebuilt title is different from having a salvage title. Most insurance companies are perfectly happy to insure a car with a rebuilt title. It’s like saying, "Okay, you had a rough patch, but you're back in action!"

So, Can You Insure a Salvage-Titled Car DIRECTLY?

This is where we get a bit philosophical. Can you insure the car while it still carries the official "salvage" brand? Generally speaking, most major insurance companies will NOT offer comprehensive or collision coverage on a car with a pure salvage title.

Why? Well, imagine you’re an insurance company. Your job is to assess risk. A car that's officially deemed "salvage" is a big, flashing neon sign that says, "HIGH RISK." It's harder to predict its future reliability. It might have hidden issues. It's a bit of a gamble, and insurance companies aren't usually big gamblers. They prefer sure things. Or at least, less risky things.

Think of it like trying to get a loan for a house that's literally floating away. It's just... a tougher sell.

But Wait, There's More! (There Always Is!)

This is where the fun really begins. Because the insurance world, like a good mechanic, is full of clever workarounds and specialized solutions.

You might not get the standard, all-singing, all-dancing insurance policy. But you can definitely get some kind of coverage.

Liability Insurance: This is usually the bare minimum required by law. And guess what? Most insurance companies will offer liability coverage on a salvage-titled car. This covers you if you cause an accident that injures someone else or damages their property. It's the essential safety net. You know, just in case your rebuilt superhero decides to trip over its cape.

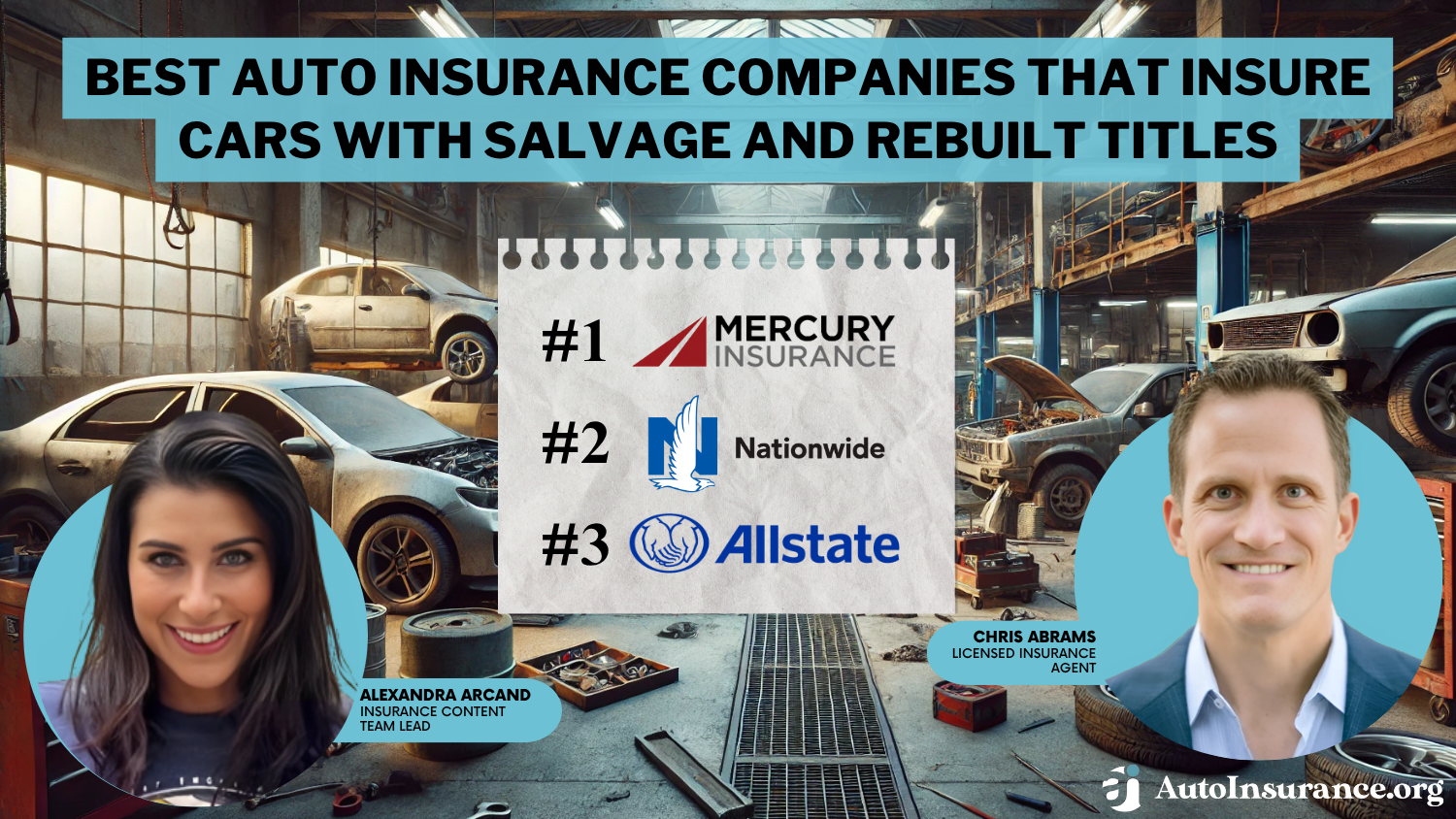

Specialty Insurers: This is your secret weapon! There are insurance companies out there that specialize in "hard-to-insure" vehicles. They understand the salvage and rebuilt title market. They're the knights in shining armor for your slightly scuffed chariot.

These companies might have different requirements. They might ask for more detailed inspections of the car. They might charge a bit more. But they exist. And they're willing to take on that unique challenge.

The Rebuilt Title is Your Golden Ticket

Let's reiterate. If your salvage-titled car has been repaired, inspected, and officially given a rebuilt title, your insurance options open up dramatically. Many standard insurance providers will then be willing to offer a full range of coverage, including comprehensive and collision.

This is because the rebuilt title signifies that the car has passed safety inspections and is deemed roadworthy again. It's like your car went through rehab and is now officially sober and ready to rejoin society!

The key is the inspection and the certification process. It's the proof that the car is no longer a question mark, but a verifiable vehicle.

Why is This So Fascinating?

Honestly? Because it’s about second chances! It’s about the ingenuity of humans fixing what’s broken. It’s about finding value where others see only damage.

And let’s be real, sometimes salvage cars are absolute bargains. You can get a fantastic car for a fraction of the price, if you know what you're doing. It's like finding a designer dress with a tiny, unnoticeable stain. Still fabulous, just more affordable!

Plus, think of the stories these cars could tell! Was it a daring escape from a rogue squirrel migration? A dramatic encounter with a rogue shopping cart? The possibilities are endless and hilarious!

The Quirky Facts You Didn't Know You Needed

Did you know that the definition of "total loss" can vary wildly by state? Some states are more forgiving than others. It's like a secret club with different rules for entry!

And then there are the inspection processes. Some require a thorough mechanical review. Others are more about ensuring the vehicle's identity is intact. It’s a car detective story, and you’re the Watson.

Ultimately, insuring a car with a salvage title isn't a black-and-white issue. It's a spectrum. It’s a journey. It’s about finding the right people who understand that a little bit of history doesn't mean a car isn't still a fantastic companion.

So, next time you see that salvage title, don't just think "nope." Think "hmm, interesting." Because with a little research, a good mechanic, and the right insurance provider, that once-damaged car might just be your next awesome adventure mobile.

And who knows? It might even have a funny story to tell.