Can My Parents See My Credit Card Purchases

Hey there, savvy spender! Ever get that little twinge of… well, let’s call it curiosity, when you’re swiping your plastic? You know, that fleeting thought, “Could Mom and Dad actually see this?” It’s a question that pops into our heads, usually when we’re about to embark on a particularly exciting, or perhaps slightly questionable (in the grand scheme of things, of course!), shopping spree. And honestly, it’s a question that can add a whole layer of fun to the whole credit card experience, don’t you think? Let’s dive in and demystify this whole “parental credit card surveillance” thing!

First off, let’s get this straight: generally speaking, your parents cannot magically see every single purchase you make on your own credit card. Phew, right? That’s a big one. When you’re an adult, and you have your own credit card in your own name, with your own social security number and your own billing address, those transactions are pretty much your private business. The credit card company is bound by privacy laws, and they’re not exactly handing over your detailed spending reports to just anyone who asks – not even your dear old mom and dad, unless there are some very specific and unusual circumstances.

So, What’s the Real Deal Then?

Think of it like this: your credit card is like your personal financial diary. It’s filled with your adventures, your splurges, and your everyday necessities. The credit card company keeps that diary safe and sound, and they’re not sharing its contents without your explicit permission. So, that new pair of ridiculously comfortable slippers you just ordered? Or that book that’s been on your wishlist for ages? Totally yours.

However, there are a couple of tiny exceptions that might have sparked this question in the first place. These are the scenarios where, perhaps, a parent might have some insight, but it’s usually by design or by circumstance, not by some secret credit card superpower. And understanding these nuances can actually be quite empowering, giving you even more control over your financial narrative!

The “Authorized User” Shenanigans

This is probably the most common reason why someone might think their parents can see their purchases. If you’re listed as an authorized user on your parent’s credit card, then yes, they absolutely can see your transactions. In this scenario, you’re essentially borrowing their credit line, and they’re responsible for the payments. So, it’s only fair that they have visibility into how that credit is being used. Think of it like being allowed to borrow a fancy car; the owner needs to know where it’s been!

This can be a great stepping stone for younger adults building credit, or for someone who needs a bit of a financial boost. But if you’re rocking your own card, and your parents are not an authorized user on it, then this exception doesn’t apply to you. Your spending is your secret agent mission.

The Joint Account Jive

Another, less common, scenario is if you have a joint credit card account with your parents. In this case, you’re both equally responsible for the account, and both have full access to the statements. This is usually set up for shared expenses or for very specific family financial planning. If this is your situation, then yes, they’ll see what you’re buying. It’s like sharing a bank account; you both know what’s coming in and going out.

But for most of us who have our own individual credit cards, this is a non-issue. You’re the captain of your own financial ship, navigating the seas of commerce all by your lonesome (or with your chosen friends, if you’re splitting costs, but that’s a different story!).

The “I Paid for It” Predicament

Okay, this one is a bit more about practicality than actual credit card access. Have you ever bought something with your own card, and then your parents offered to pay you back? Or maybe they’re just generally involved in your financial life and happen to see a statement lying around? In these cases, they might see a specific purchase because you’ve discussed it or shown them. This isn’t about them having access to your online banking or secret purchase alerts. It’s just… life happening!

And you know what? Sometimes, that’s a good thing! Having a supportive family who is invested in your well-being can be a wonderful thing. It doesn’t mean they’re judging your impulse buys (though, let’s be honest, we’ve all had a few of those we’d rather keep under wraps, right?). It’s more about open communication and mutual support.

Making Your Credit Card Life More Fun!

So, now that we’ve established that your independent credit card purchases are generally private, let’s talk about how this knowledge can actually make your life more… sparkly! Knowing that your spending is your own can free you up to be a little more adventurous with your choices (within your budget, of course!).

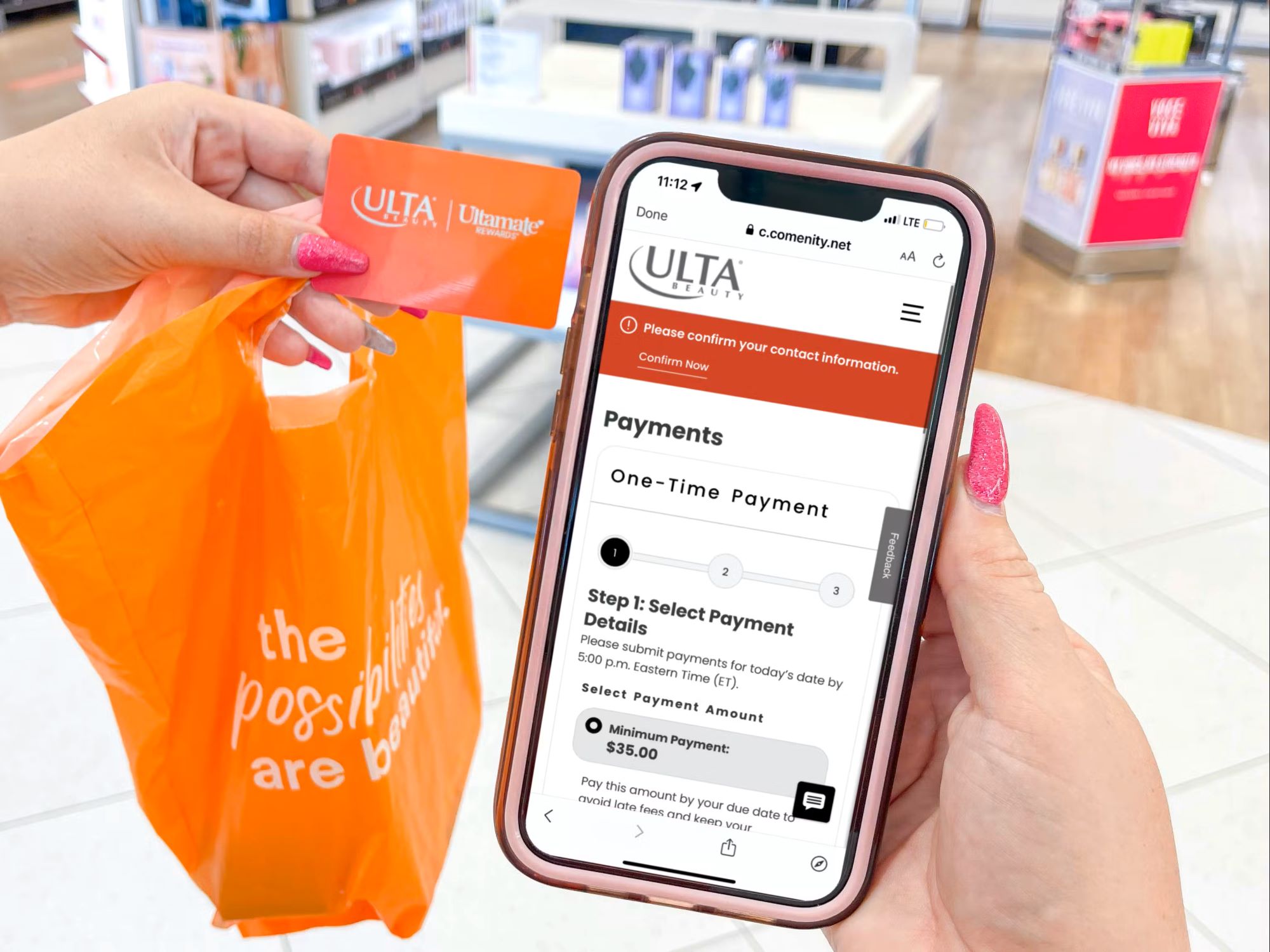

Want to try that quirky new restaurant that just opened? Go for it! See a limited-edition item you absolutely must have? This is your moment! It’s not about being reckless, but about embracing your individuality and treating yourself to the things that bring you joy. Your credit card can be a tool for experiencing the world, learning new things, and creating lasting memories.

Think of the possibilities! You can treat yourself to that online course that will boost your career, or that art supply set to finally unleash your inner Picasso. Maybe it’s that plane ticket for a spontaneous weekend getaway that will recharge your soul. These are the purchases that enrich your life, and they’re yours to discover and enjoy without needing to explain them to anyone. Your financial journey is a personal adventure!

And here’s a little secret: understanding your credit card statements, and the privacy that comes with them, is also a fantastic way to build your financial literacy. The more you understand how your credit works, the more confidently you can manage your money. It’s not just about spending; it’s about smart spending, responsible borrowing, and building a solid financial future.

So, the next time you reach for your credit card, take a moment to appreciate the power and freedom you hold. Your parents might be your biggest cheerleaders, but your credit card purchases are your own personal story. Embrace the fun, be smart, and enjoy the journey!

Ready to become a credit card wizard? There’s a whole world of financial knowledge out there waiting for you. Explore different types of credit cards, learn about rewards programs, and discover how to use credit to your advantage. The more you learn, the more empowered you'll become, and that, my friend, is truly inspiring!