Can I Withdraw From My 401k To Pay Off Debt

Ah, the 401k. That magical little retirement nest egg, chugging along, silently growing for a future you hope will involve less stress and maybe a poolside beverage. But then, life happens, doesn't it? It's like that rogue grocery cart in the parking lot – you're just minding your own business, and suddenly, BAM! You're staring down a pile of debt that looks suspiciously like a mountain of credit card bills that have multiplied faster than rabbits at a petting zoo.

And then the question pops into your head, the one that’s probably been lurking in the back of your mind, whispering sweet, tempting nothings: "Can I… dare I… dip into the 401k to pay off this debt?" It's a question that often surfaces when your bank account is looking about as healthy as a forgotten piece of fruit in the back of the fridge. You know, that fuzzy, slightly alarming shade of green?

Let's be honest, that 401k feels like a secret stash, a treasure chest you've been diligently filling. And this debt? It feels like a hungry dragon, breathing down your neck and demanding tribute. So, the idea of using your own money, the money you've already paid taxes on (or will pay taxes on later, depending on the type of 401k), to slay this dragon seems… well, it seems logical, right? It's like thinking, "If I have a leaky faucet, why wouldn't I use the water from my own well to fix it?"

The Siren Song of Debt-Free Living

The appeal is undeniable. Imagine: no more minimum payments staring you down on the first of the month. No more that little pang of guilt when you see that credit card balance. It's the dream! It's like ditching those uncomfortable shoes for slippers – pure, unadulterated comfort. The thought of wiping those balances clean is as satisfying as finally finding that matching sock you thought was lost to the sock dimension forever.

And the interest! Oh, the interest. That's the real villain here, isn't it? It's like a tiny, invisible gremlin that keeps adding more and more to your bill, even when you've paid down a chunk. It's the ultimate "are you kidding me?" moment when you realize you've paid more in interest than you actually borrowed. It makes you want to shake your fist at the financial gods and ask, "What did I do to deserve this?"

So, when that 401k balance pops up on your statement, looking all plump and ready, it’s like seeing a knight in shining armor. "Hey," you might think, "isn't this money meant to save me? Well, here's a crisis! Save me, 401k!"

So, Can You Actually Do It?

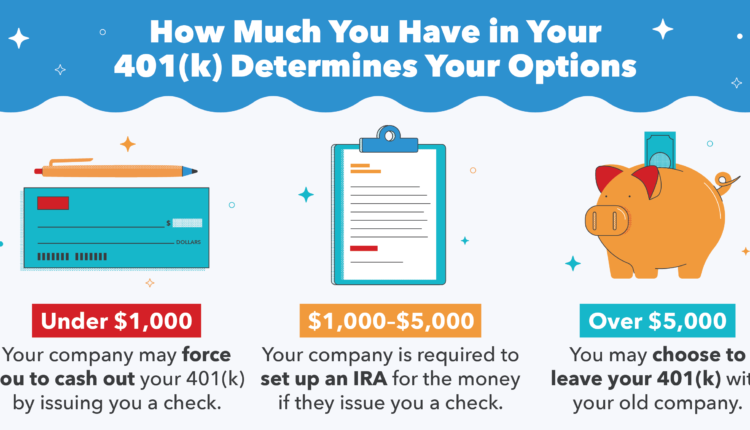

The short, slightly anticlimactic answer is: yes, in many cases, you can withdraw from your 401k to pay off debt. But, like most things in life that seem too good to be true, there's a whole lot of "buts" and "howevers" that come along for the ride. It's not as simple as just walking into the bank with a fishing net and scooping out some retirement funds.

Think of it like borrowing a fancy tool from a neighbor. They might let you use it, but they'll probably want it back in good condition, and maybe with a little thank-you note. Your 401k isn't exactly a neighbor, but your employer and the government have rules, and you gotta play by them.

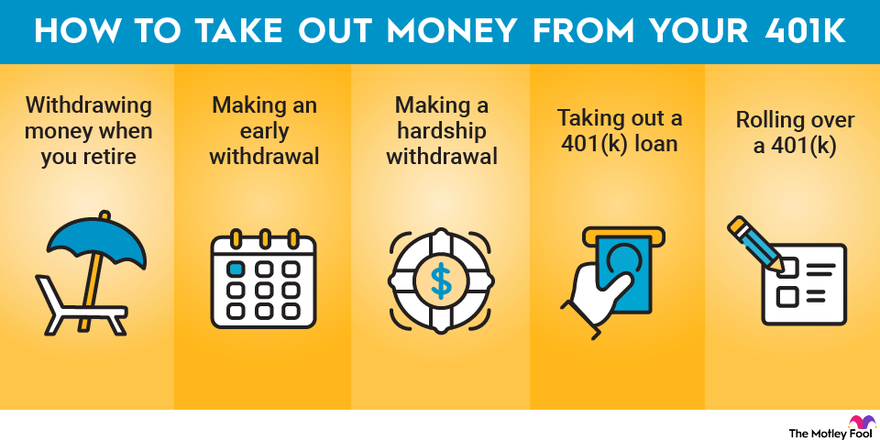

There are generally two main ways people consider tapping into their 401k for debt: hardship withdrawals and loans. Each has its own set of quirks and potential pitfalls, like those tiny, almost invisible speed bumps that jolt you when you're not expecting them.

The Hardship Withdrawal: A Desperate Measure?

A hardship withdrawal is exactly what it sounds like – a withdrawal made out of genuine, pressing need. We're talking about those moments when you're facing a financial emergency that can't be resolved by any other reasonable means. Think of it as the financial equivalent of rummaging through the junk drawer for that one crucial item you need right now.

What constitutes a "hardship" can vary slightly by plan, but generally, it's for things like medical expenses, essential home repairs (like your roof deciding to impersonate a sieve), or, yes, to prevent eviction or foreclosure. Paying off credit card debt can sometimes fall under this umbrella, but it's usually considered less of a priority than those other dire situations. It's like, your car's engine is sputtering and about to give up the ghost – that's a hardship. Your car's paint job is a bit scratched – that's more of a "could use a touch-up" situation.

Here's the kicker with hardship withdrawals: you'll likely have to pay taxes on the money you take out, and there's usually a 10% early withdrawal penalty if you're under age 59½. So, that money you thought was going to save you $1,000 in debt interest might actually cost you more in taxes and penalties. It's like trying to put out a small fire with a bucket of gasoline – you might solve one problem, but you've created a bigger, more explosive one.

And the worst part? This money is gone. Poof. Vanished. It doesn't grow for your retirement anymore. You've essentially short-circuited your future self's ability to relax on that beach with a tiny umbrella drink. It's like eating your Thanksgiving turkey in July – you miss out on the main event when it's supposed to happen.

The 401k Loan: Borrowing From Your Future Self

This is often the more popular option because it feels less permanent. With a 401k loan, you're essentially borrowing money from yourself, from your own retirement account. It's like taking a personal loan from your future self, who, presumably, is doing pretty well and can afford to lend a hand.

The upside is that you don't pay taxes or penalties when you take out the loan, provided you repay it according to the terms. You'll also pay yourself back with interest. So, in a way, you're earning a bit of extra interest on your own money. It's like paying your landlord rent, and then your landlord gives you a discount because you're such a great tenant.

However, there are a few things to keep in mind:

- Repayment is usually mandatory. Most loans have to be repaid within five years, although if you're using the loan to buy your primary residence, you might get longer. It's like a strict babysitter – you gotta stick to the schedule.

- You're missing out on potential investment growth. While you're paying yourself back, that money isn't out there in the market, potentially growing. If the market is booming, you might be missing out on some significant gains. It's like putting your money in a savings account when everyone else is investing in a rocket ship to the moon.

- If you leave your job, things get tricky. This is a big one. If you get laid off, quit, or are terminated from your job, you often have to repay the outstanding loan balance very quickly, usually within 60 days. If you can't, then it's treated as an early withdrawal, and you'll be hit with those dreaded taxes and penalties. It's like having a deadline that appears out of nowhere, like a surprise pop quiz you didn't study for.

- Double Taxation (sort of). You repay the loan with money you've already paid taxes on (from your paycheck). Then, when you eventually withdraw that money in retirement, you'll pay taxes on it again. It's like buying something, paying sales tax, and then somehow having to pay another tax when you use it later.

When is it a "Good" Idea (Relatively Speaking)?

Let's be real, no one wants to tap into their retirement funds early. It's like eating your favorite dessert first – you might enjoy it, but you're going to regret it when there's nothing left. But sometimes, the alternative is worse.

If you have high-interest debt, like credit cards with APRs in the 20s or 30s, and you're struggling to make payments, using a 401k loan to pay that off might make sense.

Imagine you have $10,000 in credit card debt at 25% APR. That's a lot of money going down the drain in interest. If you can get a 401k loan at, say, 5% interest, and you repay it over five years, you're saving yourself a significant amount in interest payments. It’s like choosing between a slow, agonizing death by a thousand papercuts, or a quick, painless… well, maybe not painless, but certainly less agonizing, solution.

The key is to look at the numbers. Calculate the interest you're paying on your debt versus the interest you'll pay on the loan (and remember the potential penalties and lost growth on the 401k itself). If the math works out in your favor, and you are absolutely sure you can manage the repayment and won't be in a situation where you lose your job unexpectedly, it might be a viable option.

The "Probably Not" Scenarios

On the flip side, here are some situations where you should probably run screaming in the other direction from your 401k:

- Low-interest debt: If your debt has an interest rate lower than what you'd pay on a 401k loan (or even a regular personal loan), it's generally not worth it. Why pay to borrow money that's effectively costing you less as is? It's like paying extra for express shipping when your package is already on your doorstep.

- No solid repayment plan: If you're not confident you can make those loan payments, or if you have a history of struggling with debt, then borrowing from your future self is a recipe for disaster. You’re setting yourself up for a bigger fall. It's like trying to juggle chainsaws – exciting, but probably not a good idea without a lot of practice and safety gear.

- Impending job change: If you're thinking about leaving your job soon, a 401k loan is a big gamble. The 60-day repayment window can be a cruel mistress.

- Using it for non-essential spending: If you're just trying to free up some cash for a new gadget or a vacation, then absolutely, do not touch your 401k. That's like using your emergency savings to buy lottery tickets. Your future self will not thank you.

The Alternatives: Don't Forget These!

Before you even think about touching that retirement nest egg, let's explore some other options. These might not be as flashy, but they can be just as effective, and they won't jeopardize your golden years.

Balance Transfers: If you have good credit, you might be able to transfer your high-interest credit card debt to a card with a 0% introductory APR. You'll have a limited time to pay it off, but it can save you a ton on interest. It's like getting a temporary reprieve from the debt dragon, giving you some breathing room.

Debt Consolidation Loans: You can get a personal loan from a bank or credit union with a lower interest rate than your credit cards. This allows you to combine all your debts into one monthly payment. It’s like tidying up a messy room – everything is in one place, and it's easier to manage.

Debt Management Programs: Non-profit credit counseling agencies can help you create a plan to pay off your debt. They often work with creditors to negotiate lower interest rates and monthly payments. Think of them as financial therapists, helping you work through your debt issues.

Negotiating with Creditors: Sometimes, just calling your creditors and explaining your situation can lead to them offering you a more manageable payment plan or even a temporary reduction in interest. They might be more understanding than you think, especially if they know you're genuinely trying to pay them back.

Budgeting and Cutting Expenses: This is the old reliable. Sometimes, the best way to tackle debt is to squeeze every penny you can. Look at your spending. Where can you cut back? That daily fancy coffee? Those streaming subscriptions you never watch? It all adds up. It's like going on a financial diet – you might be a little hungry at first, but you'll feel better in the long run.

The Verdict: Proceed With Caution!

So, can you withdraw from your 401k to pay off debt? Yes, often you can, either through a hardship withdrawal or a loan. But should you? That's the million-dollar question (or maybe just the ten-thousand-dollar question, depending on your debt).

It's a move that should be considered a last resort, after you've thoroughly explored all other avenues and crunched all the numbers. The potential penalties, taxes, and lost growth on your retirement savings are significant. You're essentially borrowing from your future self, and that's a loan with some pretty steep terms.

Think of your 401k as a meticulously built sandcastle. You can certainly dig some holes in it, but each dig means it's a little less stable, a little less grand, and it might not withstand the next tide as well. Make sure the immediate need to pay off debt is worth the long-term consequences for your retirement security. Your future self, sipping that poolside beverage, will likely appreciate you making the most prudent decision possible today.